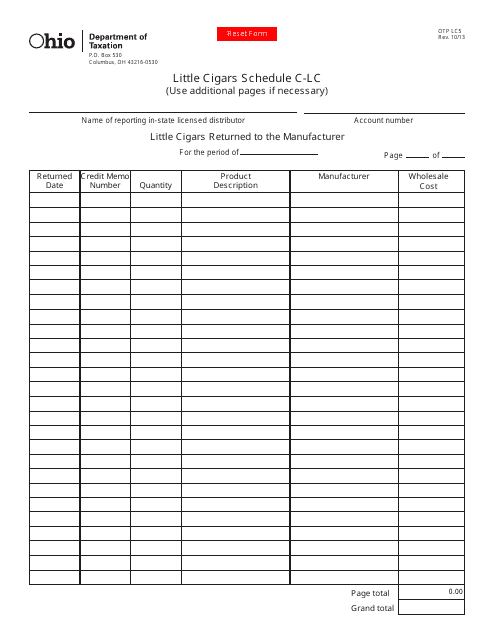

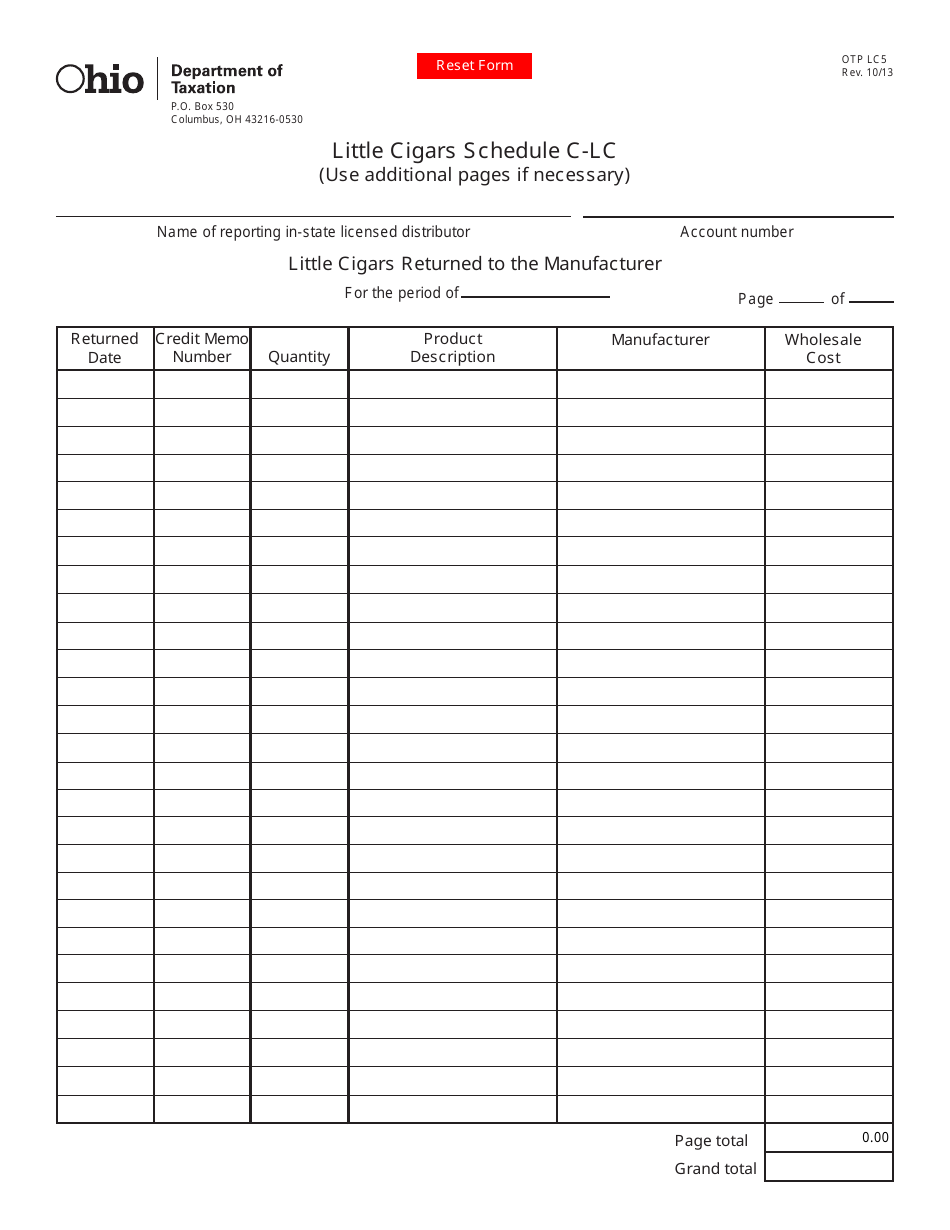

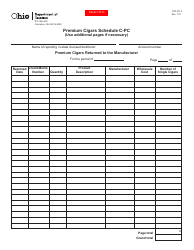

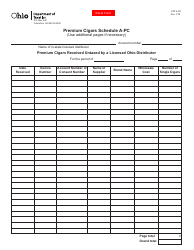

Form OTP LC5 Little Cigars Schedule C-Lc - Little Cigars Returned to the Manufacturer - Ohio

What Is Form OTP LC5?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTP LC5?

A: OTP LC5 is a brand of little cigars.

Q: What is Schedule C-LC?

A: Schedule C-LC refers to the specific tax schedule for little cigars in Ohio.

Q: What does 'Little Cigars Returned to the Manufacturer' mean?

A: 'Little Cigars Returned to the Manufacturer' refers to the process of sending back unused or unsold little cigars to the manufacturer.

Q: Is Schedule C-LC specific to Ohio?

A: Yes, Schedule C-LC is specific to Ohio.

Q: What are little cigars?

A: Little cigars are small-sized cigars that are similar in size and shape to cigarettes.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP LC5 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.