This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8949

for the current year.

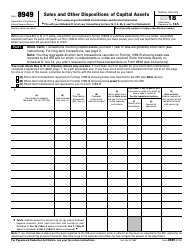

Instructions for IRS Form 8949 Sales and Other Dispositions of Capital Assets

This document contains official instructions for IRS Form 8949 , Sales and Other Dispositions of Capital Assets - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8949?

A: IRS Form 8949 is used to report sales and other dispositions of capital assets.

Q: When is IRS Form 8949 required?

A: IRS Form 8949 is required when you have sold or disposed of capital assets during the tax year.

Q: What information is needed for IRS Form 8949?

A: You'll need to provide details of each sale or disposition, including the date acquired, date sold, proceeds, cost basis, and gain or loss.

Q: Can I e-file IRS Form 8949?

A: Yes, you can e-file IRS Form 8949 along with your tax return.

Q: What are capital assets?

A: Capital assets are items such as stocks, bonds, real estate, and other investments that are subject to capital gains tax when sold or disposed of.

Q: Do I need to report every sale on IRS Form 8949?

A: Yes, you need to report every sale or disposition of capital assets on IRS Form 8949.

Q: What is the deadline for filing IRS Form 8949?

A: IRS Form 8949 is usually filed along with your annual tax return, which is typically due on April 15th.

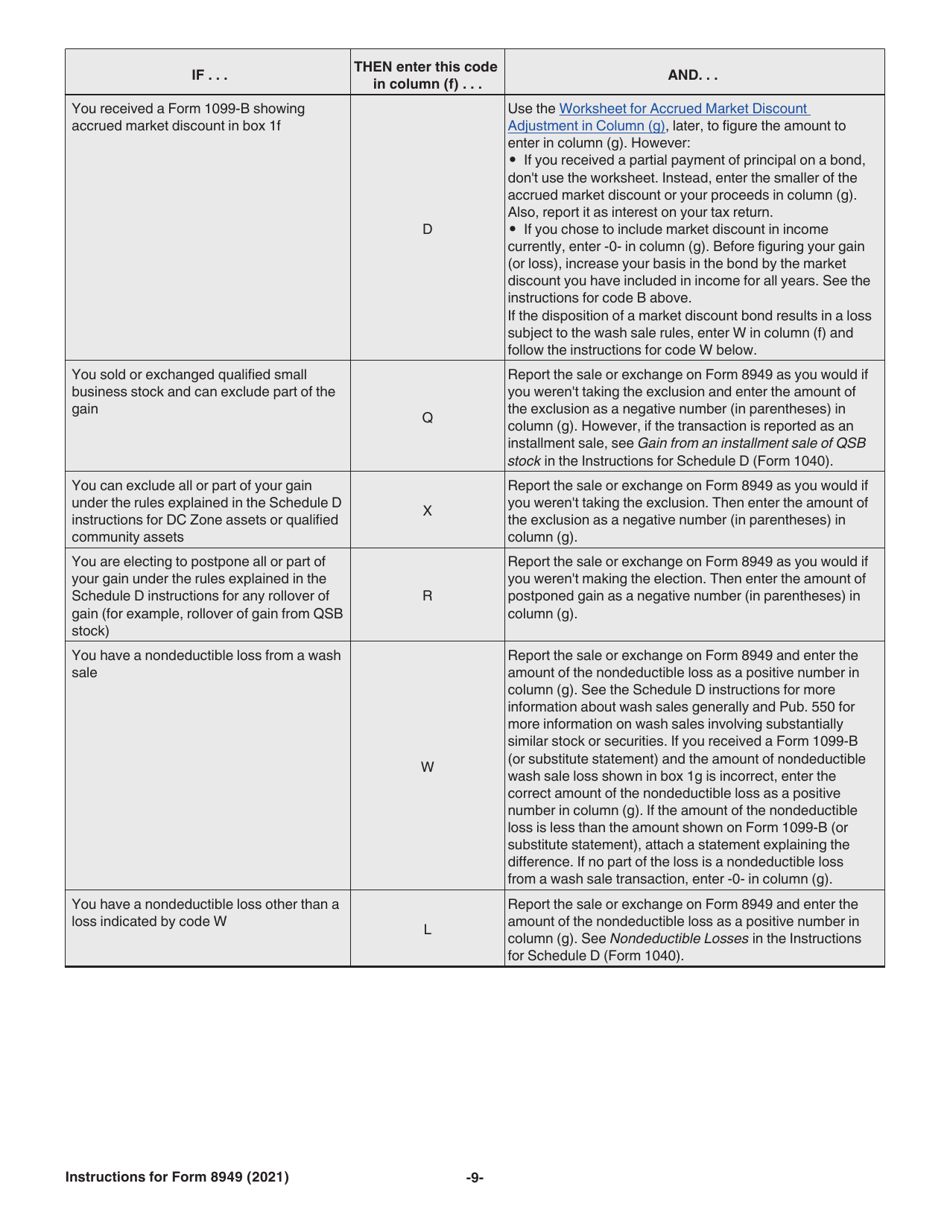

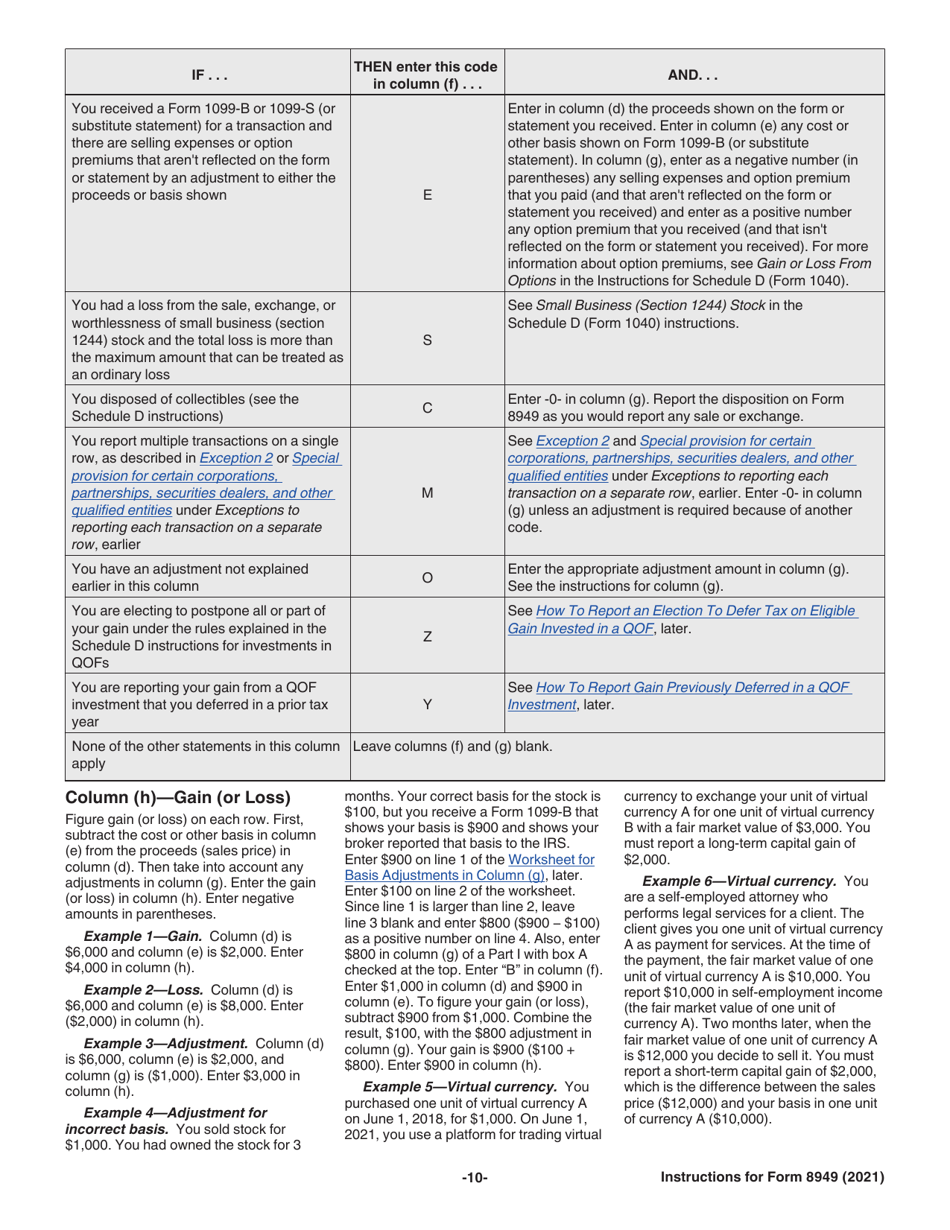

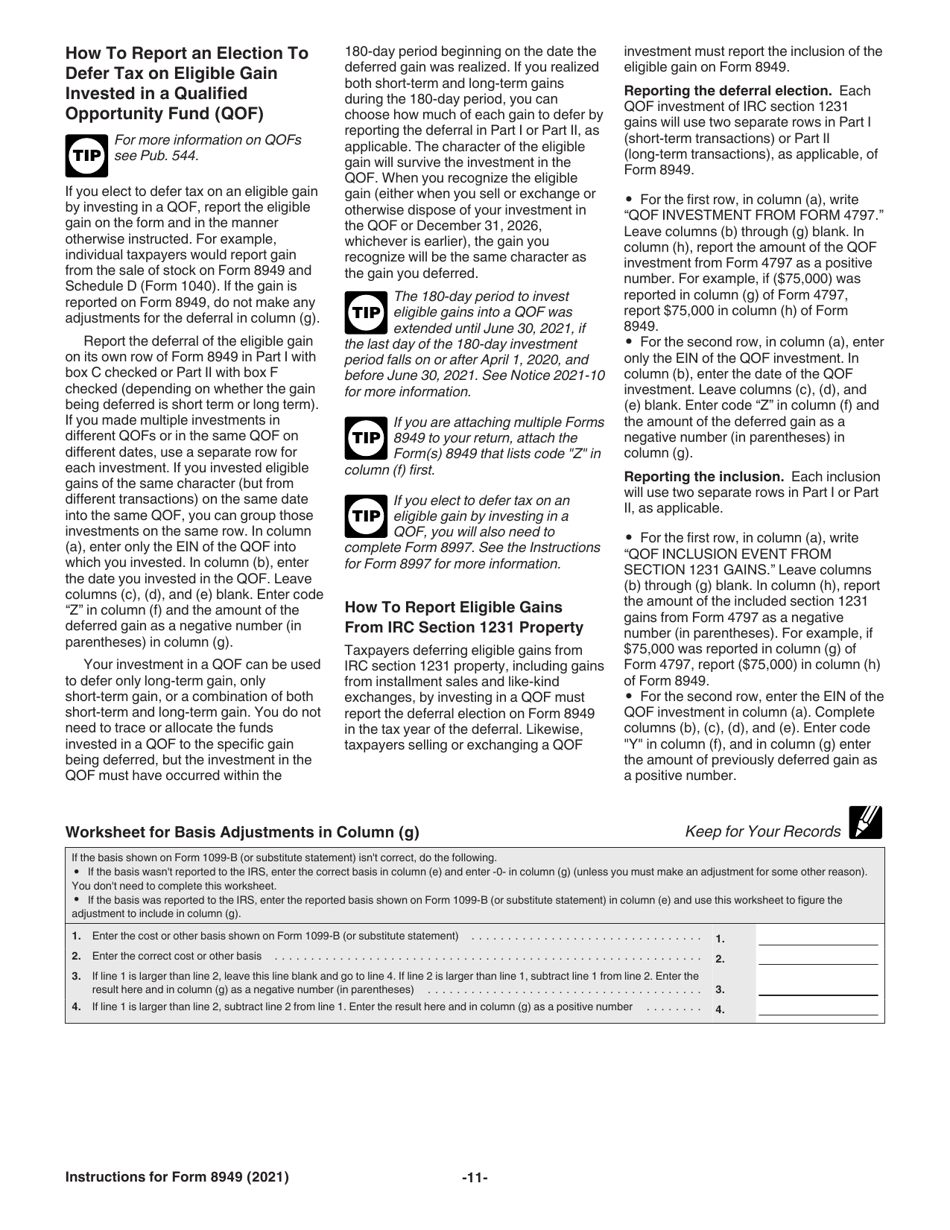

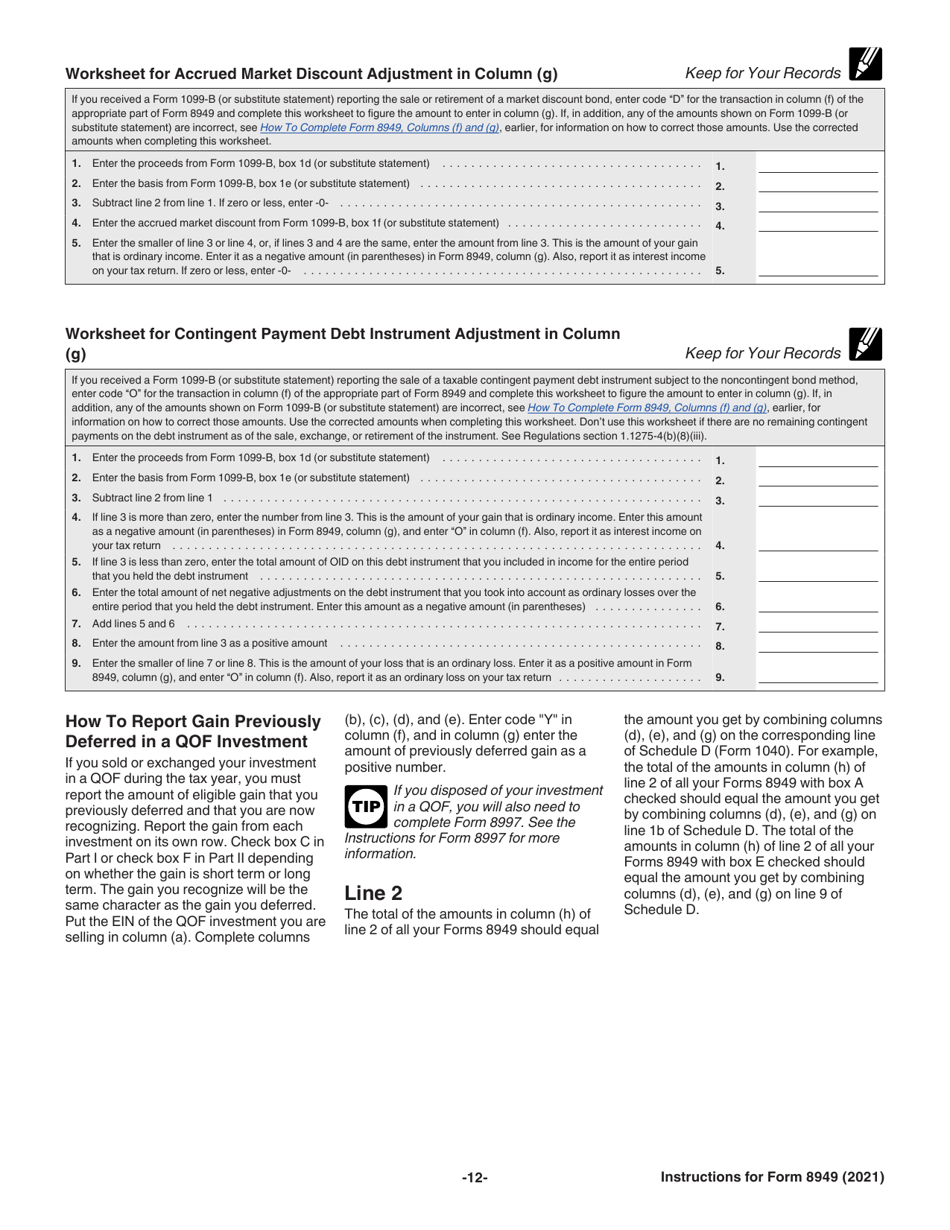

Q: Are there any exceptions or special rules for IRS Form 8949?

A: Yes, there are exceptions and special rules for certain types of transactions, such as wash sales or like-kind exchanges. Consult the instructions for Form 8949 for more information.

Q: What happens if I make a mistake on IRS Form 8949?

A: If you make a mistake on IRS Form 8949, you may need to file an amended tax return using Form 1040X to correct the error.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.