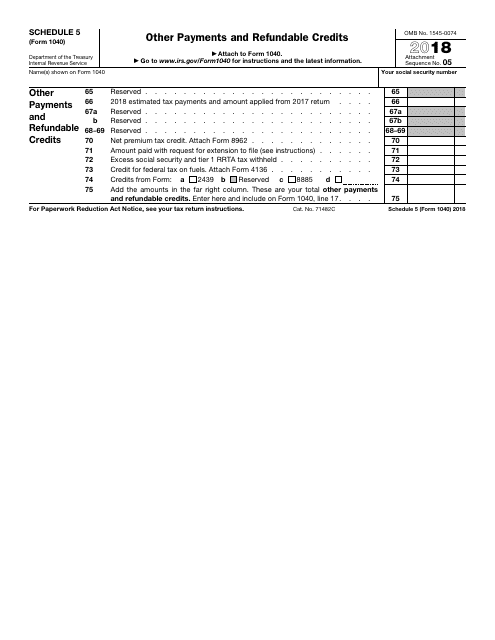

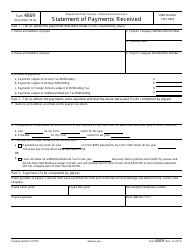

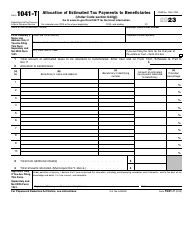

IRS Form 1040 Schedule 5 Other Payments and Refundable Credits

What Is IRS Form 1040 Schedule 5?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule 5?

A: IRS Form 1040 Schedule 5 is a form used to report other payments and refundable credits on your federal income tax return.

Q: What are other payments?

A: Other payments refer to any income tax payments or credits that do not fall under the standard categories.

Q: What are refundable credits?

A: Refundable credits are tax credits that can result in a refund if the amount of the credit exceeds the taxpayer's tax liability.

Q: When do I need to use Schedule 5?

A: You need to use Schedule 5 if you have other payments or refundable credits to report on your tax return.

Q: How do I fill out Schedule 5?

A: You will need to enter the appropriate information regarding your other payments and refundable credits on the form.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 5 through the link below or browse more documents in our library of IRS Forms.