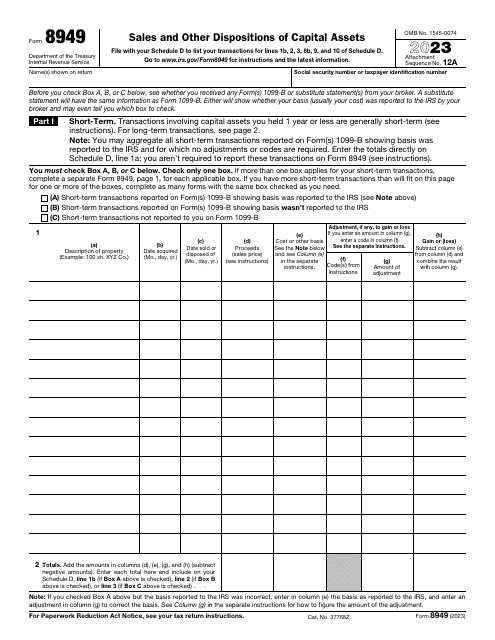

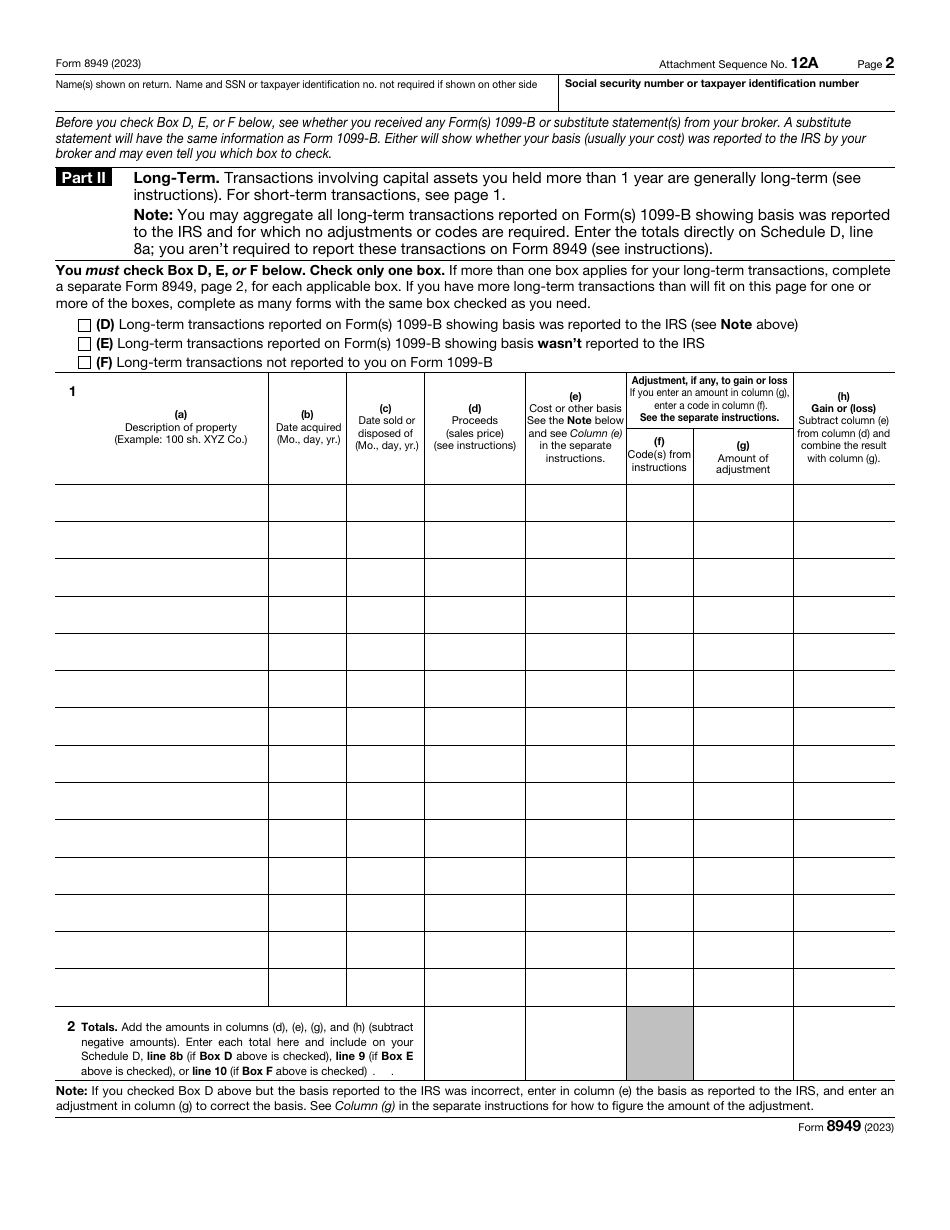

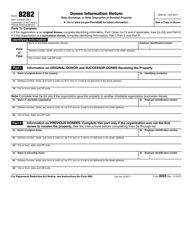

IRS Form 8949 Sales and Other Dispositions of Capital Assets

What Is IRS Form 8949?

IRS Form 8949, Sales and Other Dispositions of Capital Assets, is a fiscal instrument used by taxpayers to compute and report gains and losses associated with their capital.

Alternate Names:

- Tax Form 8949;

- Federal Form 8949.

Utilize this statement to allow tax organizations to evaluate your tax liability and confirm all the transactions you were a part of are transparent and in line with the current legislation.

This document was issued by the Internal Revenue Service (IRS) in 2023, rendering older editions of the form outdated. An IRS Form 8949 fillable version can be found via the link below.

This document allows a taxpayer to reconcile amounts reported on IRS Form 1099-B, Proceeds from Broker and Barter Exchange Transactions, and IRS Form 1099-S, Proceeds from Real Estate Transactions, with the amounts you report on your return.

What Is Form 8949 Used For?

Prepare and submit IRS Form 8949 in case you sold your capital assets or exchanged them during the year. If you represent your own interests or act on behalf of the corporation, estate, or trust and you participated in the transaction selling bonds, stocks, or real property, you need to let the IRS know about the details of the deal so that your taxable income and the amount of tax are calculated without an error. Some taxpayers do not know they are required to report the transactions by filling out Form 8949 in addition to Schedule D yet it is their duty to complete the form to inform the government about all transactions whether they had a short-term gain or a long-term loss connected to their capital.

Who Must File Form 8949?

You must submit IRS Form 8949 if you participated in the transaction that ended in a sale or exchange of capital assets you are not describing using other forms and schedules or generated gains from forced payments for assets that were damaged or destroyed.

The details you disclose in the form are not affected by your taxpayer status - both individual taxpayers and entities are obliged to identify themselves and list relevant information about every transaction they were a part of. Additionally, if you and your spouse are filing a joint tax return, you will be expected to list all the transactions either of you have been involved in over the course of the tax period.

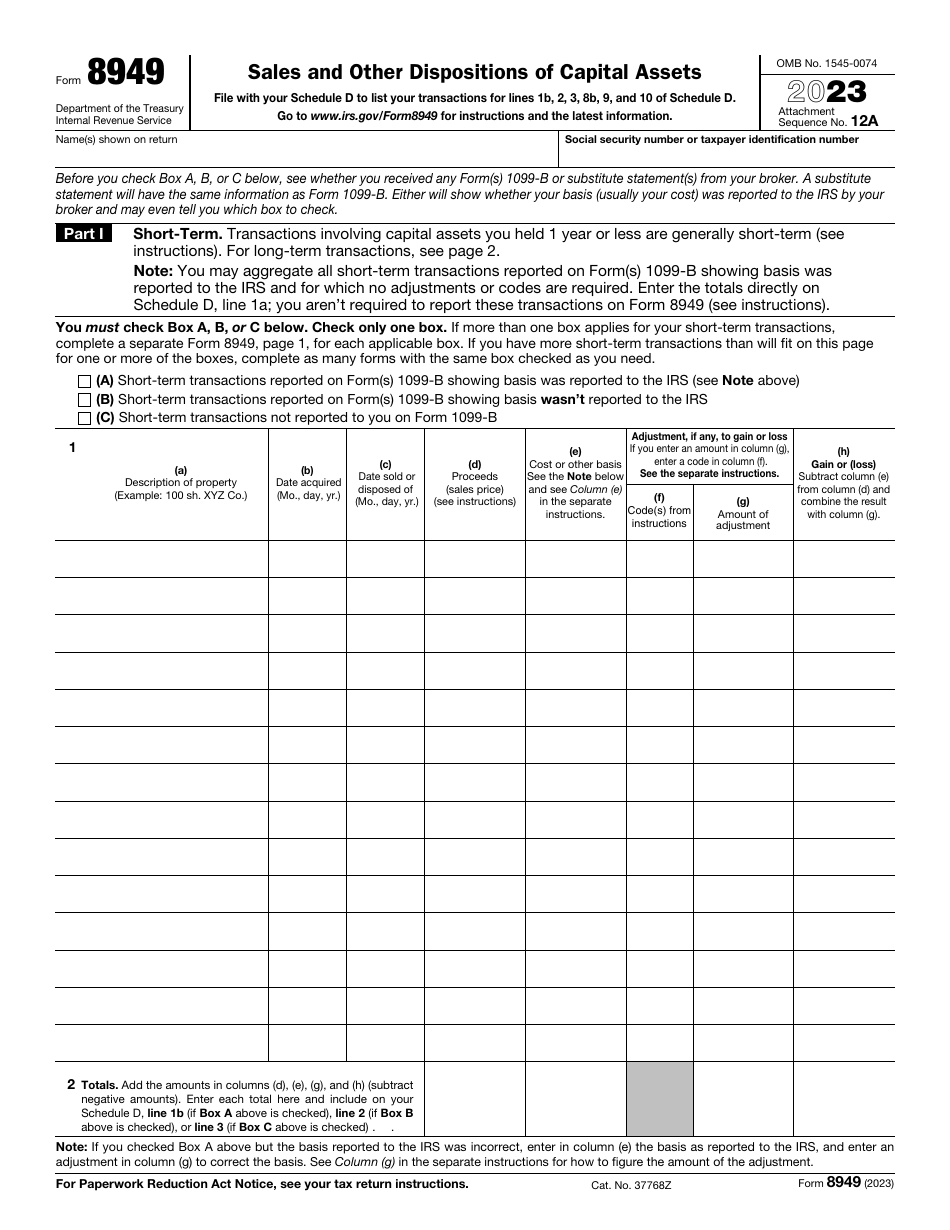

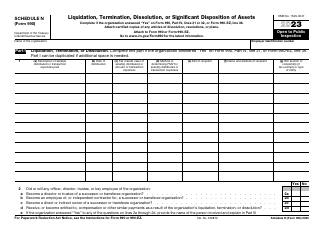

Form 8949 Instructions

Follow these IRS Form 8949 Instructions to inform fiscal authorities about the transactions with investments that led to capital gains or losses:

-

Write down your full name and taxpayer identification number. Note that the information you include in the document has to match the details you submit on your regular tax return. Check the appropriate box to confirm specific transactions were reported to you with the help of IRS Form 1099-B, and specify whether tax organizations received relevant information about those short-term transactions or not.

-

Provide information about every transaction separately. You need to briefly describe the property (for instance, if you are informing the IRS about stock, the number of shares in question is enough to include in the form), state the date you acquired those assets and the date you disposed of them, and indicate the proceeds from the sale and the cost of the property including extra expenses. Refer to the official instructions for the 8949 Tax Form to enter the code that properly describes your transaction and point out the amount of adjustment to either gain or loss. Using formulas in the instrument, calculate the precise amount of gain or loss based on the numbers you have already recorded in the form.

-

After you subtract negative amounts listed in several columns, state the total gain or loss for every transaction and replicate the results in Schedule D - note that you are supposed to write them down in different fields depending on the box you checked when you started filling out the documentation.

-

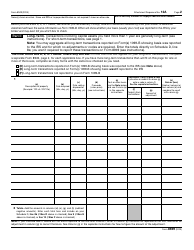

Disclose the same information related to long-term transactions - you may skip the second section of the form if you had no capital assets in your possession for more than a year. Once again, you need to let the IRS know about the Form 1099-B you received from your broker whose duty it is to remind you about the transactions with various securities, list the transactions with a comprehensive description, and compute the total amounts you later report on Schedule D.

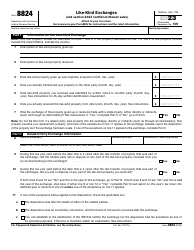

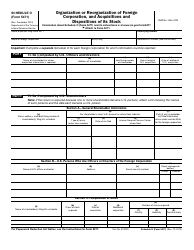

How to Fill Out Form 8949 for Cryptocurrency?

Not all taxpayers are aware that transactions involving cryptocurrency must be reported to the IRS - it is the duty of the individual or entity to retain a detailed record of their cryptocurrency sales and let fiscal authorities know the particulars of every disposal whether you swapped cryptocurrency or spent it and had a capital gain or loss using Tax Form 8949. To notify the government about these transactions, you have to describe the assets you sold (for instance, confirm you sold two Bitcoins), state their value at the moment the deal was formalized, and figure out your total gain or loss.

Remember to separate your short-term disposals from long-term ones so that you complete the section of Form 8949 that applies in your case - it is essential since the latter category means better tax rates for the taxpayer. When you are filling out the table on the first or second page of the form, you may skip the fields that would otherwise contain codes and adjustments. Do not forget to certify you received a copy of Form 1099-B from the cryptocurrency marketplace - reach out to the platform in advance to learn if you will get this document before preparing your tax paperwork.

Where to Mail Form 8949?

Send Tax Form 8949 as well as Schedule D attached to the annual IRS Form 1040, U.S. Individual Income Tax Return, or a similar instrument you are filing on behalf of your partnership, corporation, trust, or estate - the mailing address depends on your current residence or location of the principal place of business. This means the filing deadline is the same one you are expected to comply with when submitting your annual income statement to fiscal authorities.

IRS 8949 Related Forms:

- Form 1040, Individual Income Tax Return;

- Form 1040-SR, U.S. Tax Return for Seniors;

- Form 1041, U.S. Income Tax Return for Estates and Trusts;

- Form 1065, U.S. Return of Partnership Income;

- Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships;

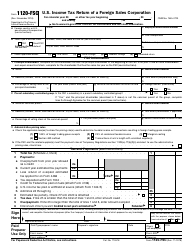

- Form 1120, U.S. Corporation Income Tax Return;

- Form 1120-S, U.S. Income Tax Return for an S Corporation;

- Form 1120-C, U.S. Income Tax Return for Cooperative Associations;

- Form 1120-F, U.S. Income Tax Return of a Foreign Corporation;

- Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation;

- Form 1120-H, U.S. Income Tax Return for Homeowners Associations;

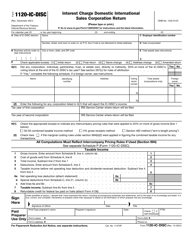

- Form 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return;

- Form 1120-L, U.S. Life Insurance Company Income Tax Return;

- Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons;

- Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return;

- Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations;

- Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts;

- Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies;

- Form 1120-SF, U.S. Income Tax Return for Settlement Funds (Under Section 468B);

- Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)).