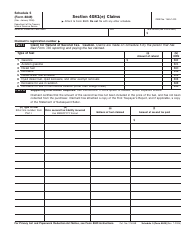

Instructions for IRS Form 8849 Schedule 6 Other Claims

This document contains official instructions for IRS Form 8849 Schedule 6, Other Claims - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8849 Schedule 6 is available for download through this link.

FAQ

Q: What is IRS Form 8849 Schedule 6?

A: IRS Form 8849 Schedule 6 is a tax form used to claim refunds or credits for certain fuel taxes.

Q: What is the purpose of IRS Form 8849 Schedule 6?

A: The purpose of IRS Form 8849 Schedule 6 is to allow taxpayers to claim refunds or credits for fuel taxes paid on certain activities or fuels.

Q: Who should use IRS Form 8849 Schedule 6?

A: Individuals, businesses, and organizations that have paid fuel taxes and are eligible for refunds or credits can use IRS Form 8849 Schedule 6.

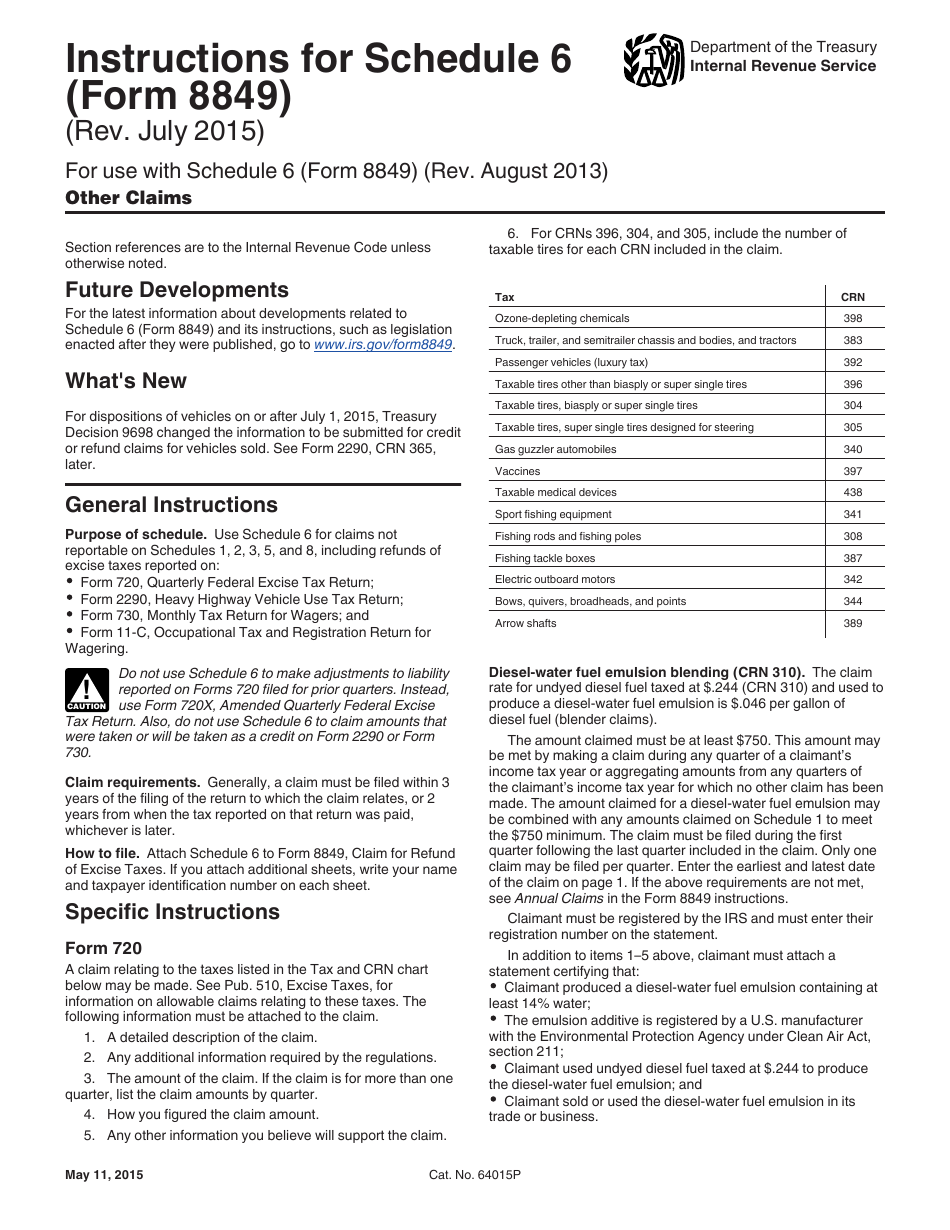

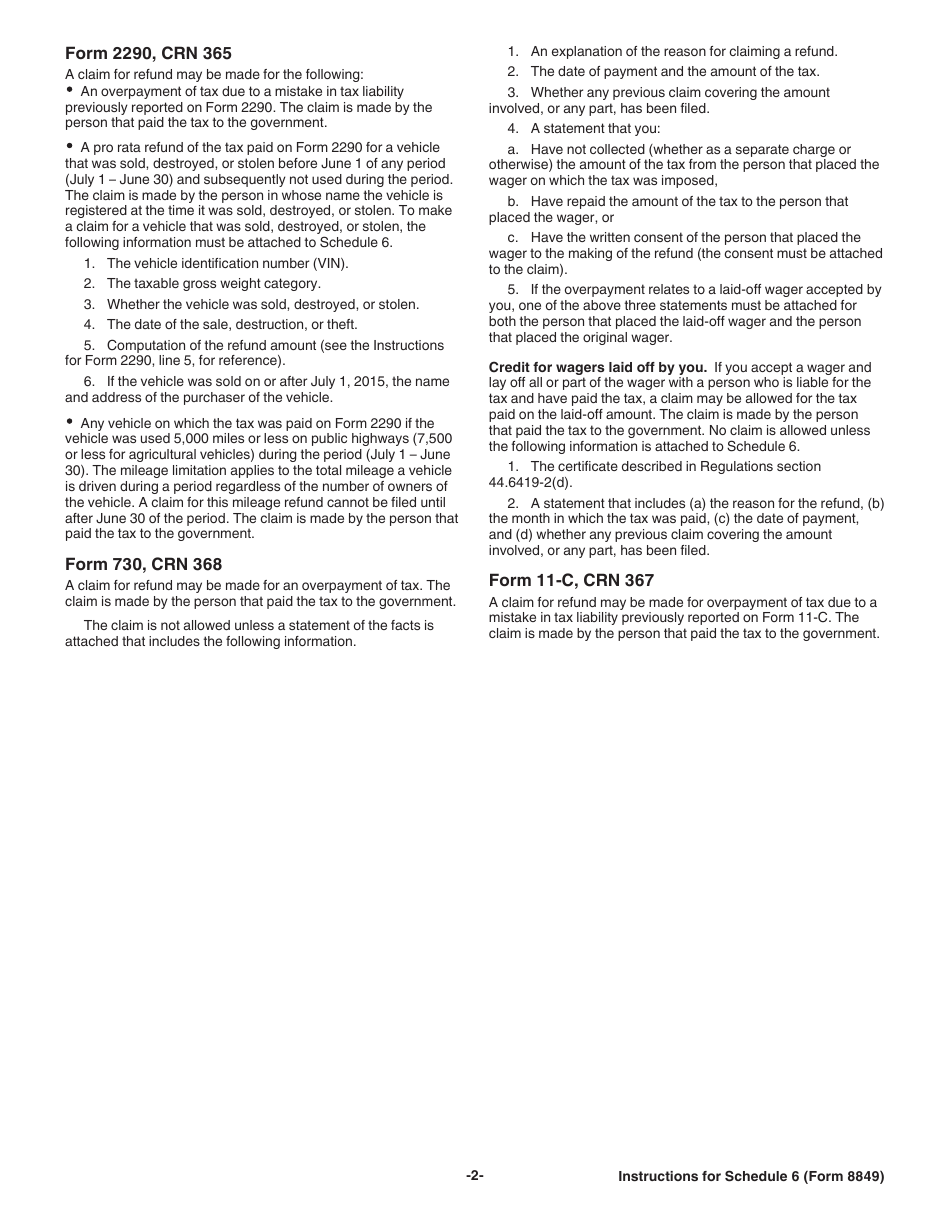

Q: What types of claims can be made on IRS Form 8849 Schedule 6?

A: IRS Form 8849 Schedule 6 allows for claims related to certain fuel taxes, including the alternative fuel credit, biodiesel and renewable diesel fuels credit, and the second-generation biofuel producer credit.

Q: When is the deadline for filing IRS Form 8849 Schedule 6?

A: The deadline for filing IRS Form 8849 Schedule 6 depends on the specific claim being made. It is important to check the instructions for the form or consult with a tax professional.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.