This version of the form is not currently in use and is provided for reference only. Download this version of

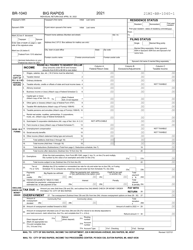

Instructions for Form BR-1040

for the current year.

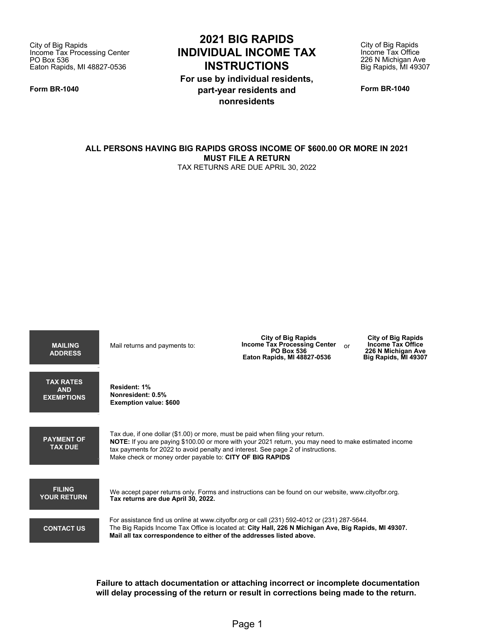

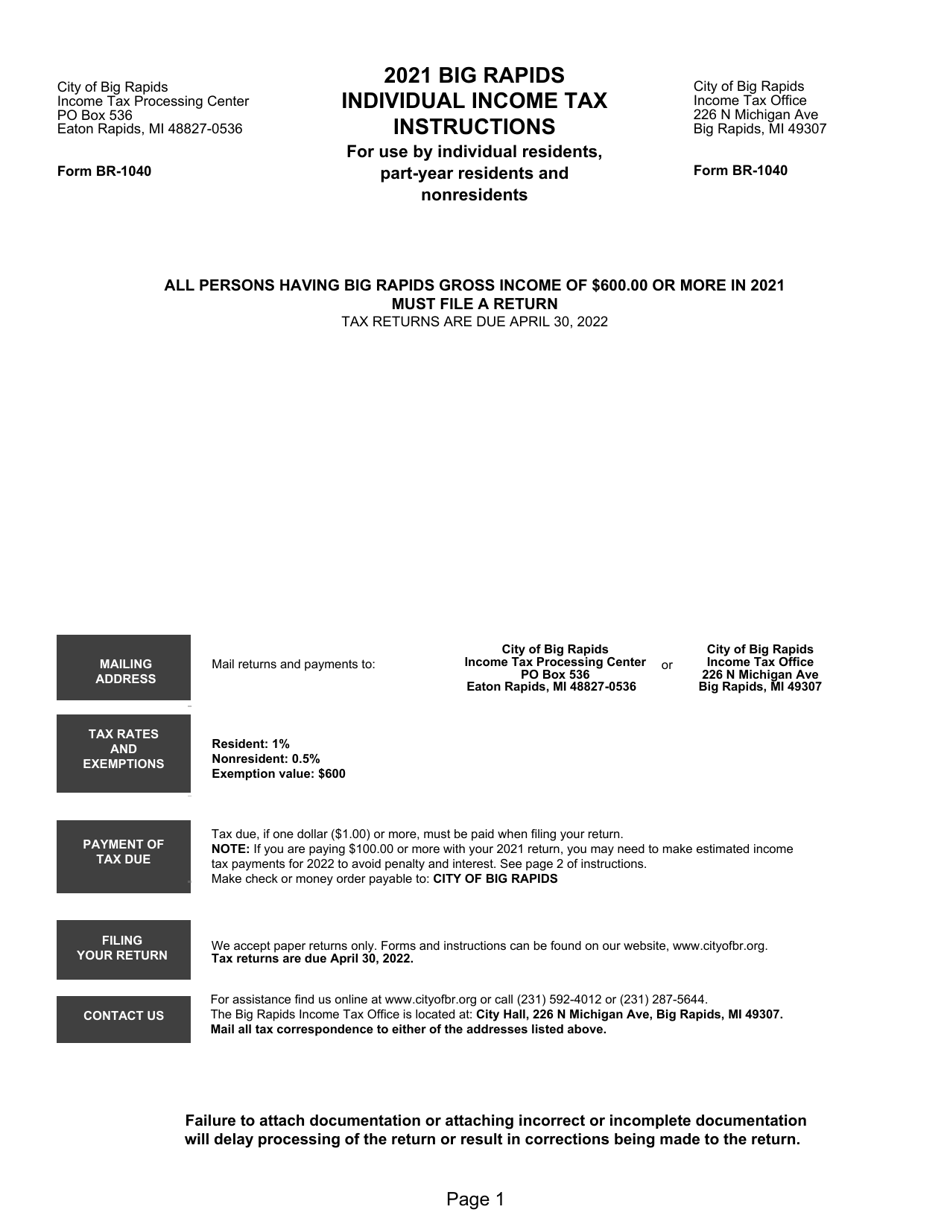

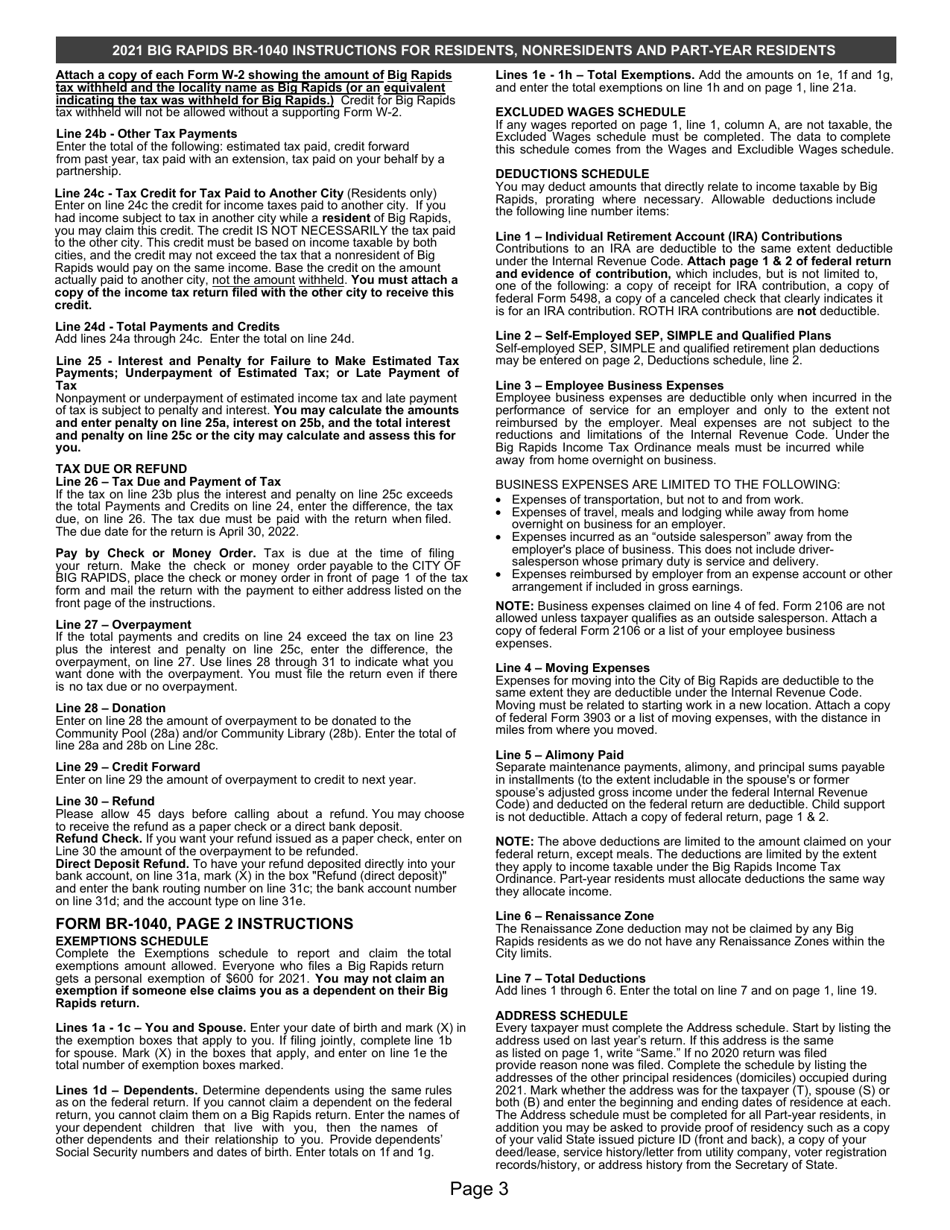

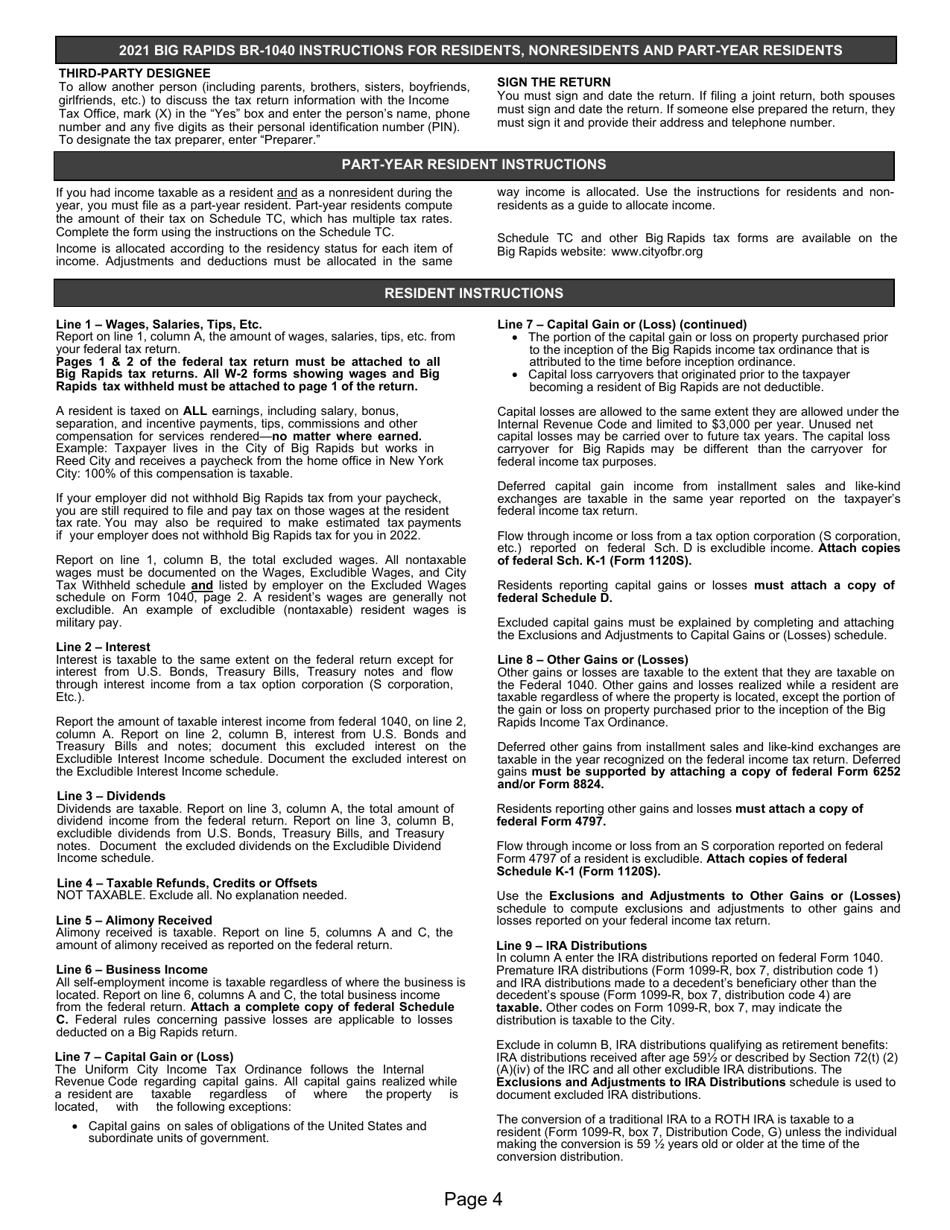

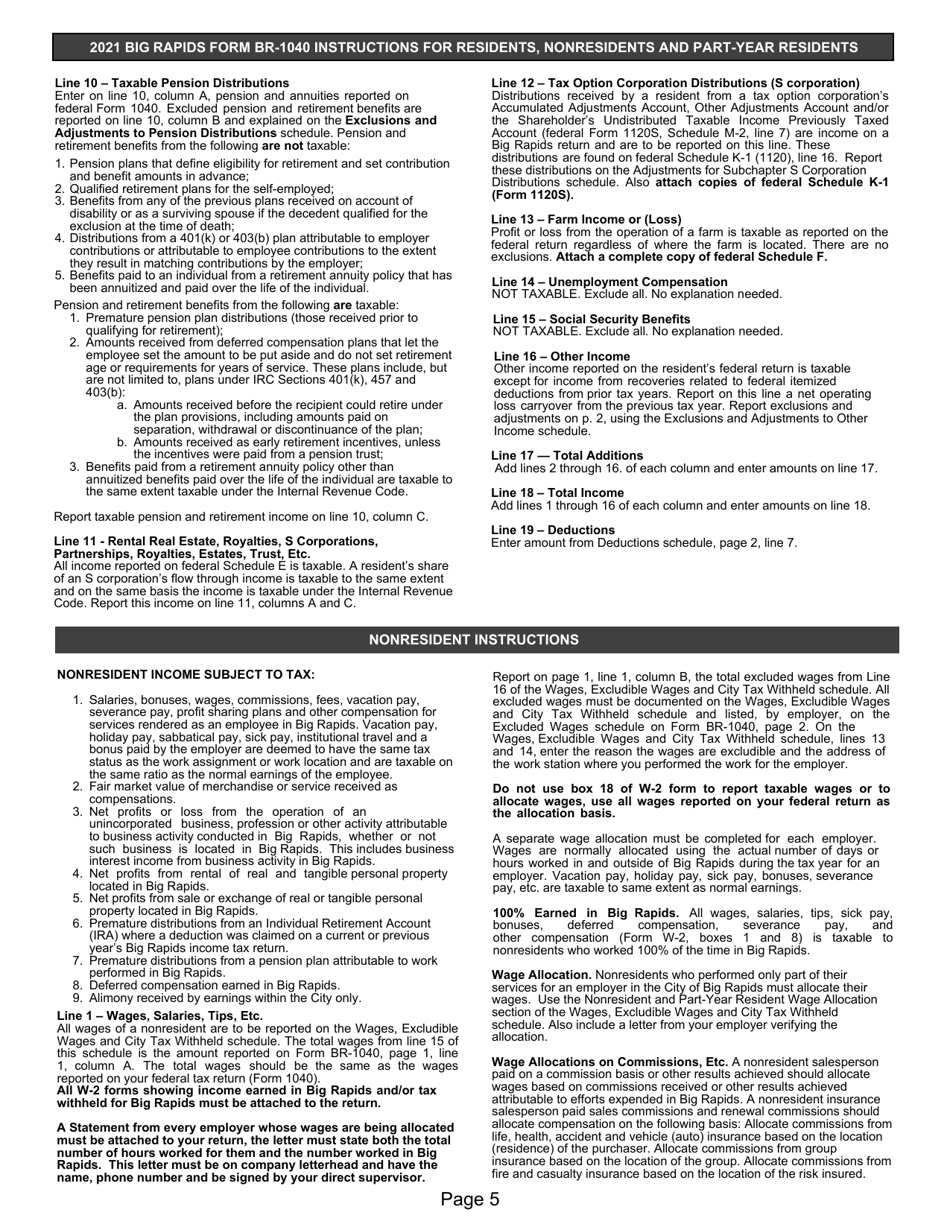

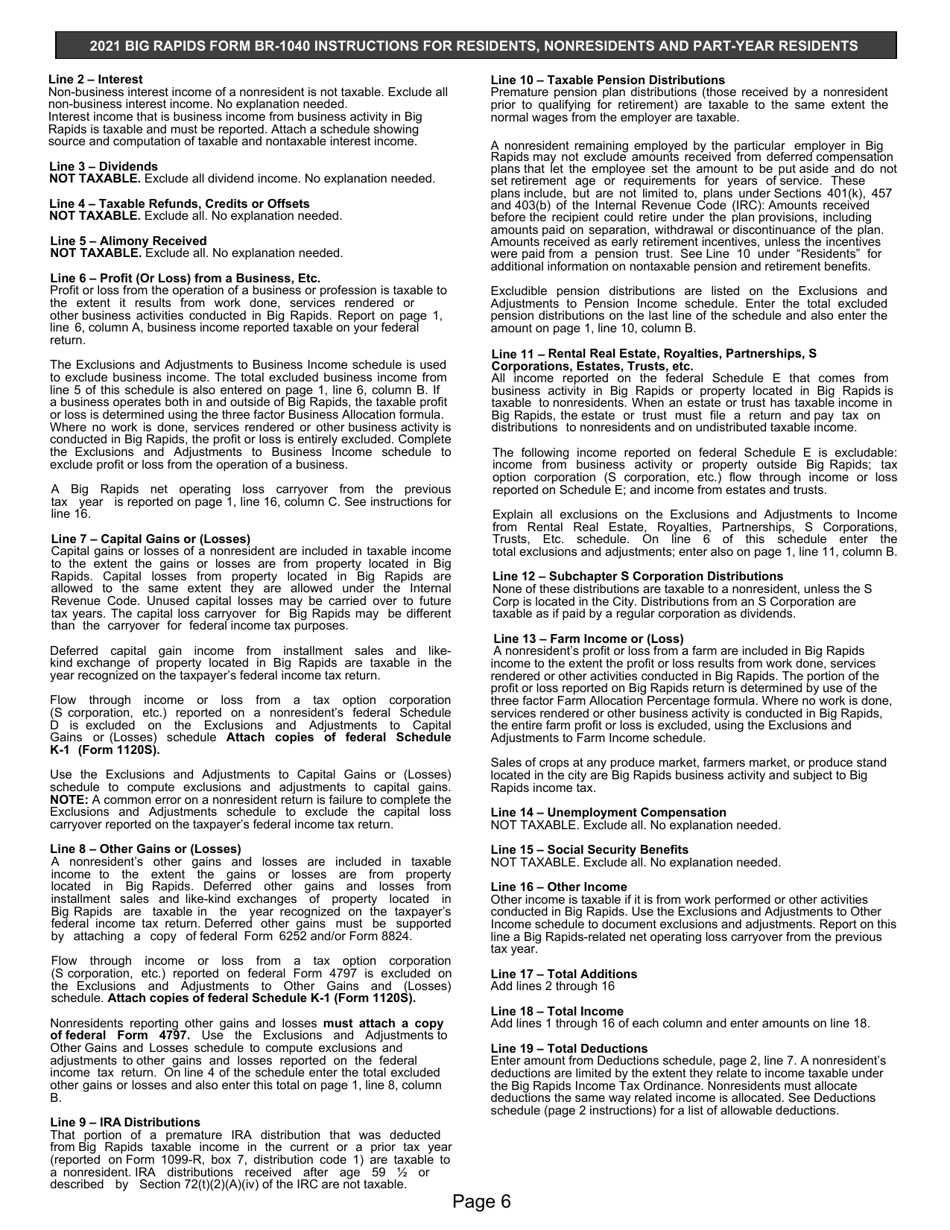

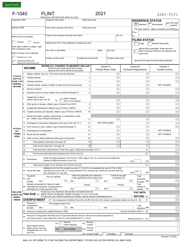

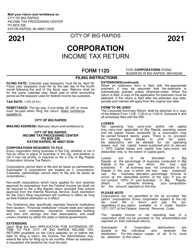

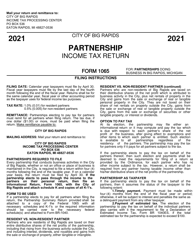

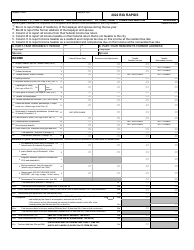

Instructions for Form BR-1040 Individual Return - City of Big Rapids, Michigan

This document contains official instructions for Form BR-1040 , Individual Return - a form released and collected by the Income Tax Department - City of Big Rapids, Michigan.

FAQ

Q: What is Form BR-1040?

A: Form BR-1040 is an individual return form for taxpayers in the City of Big Rapids, Michigan.

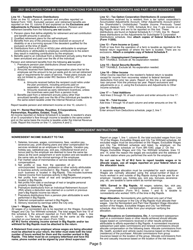

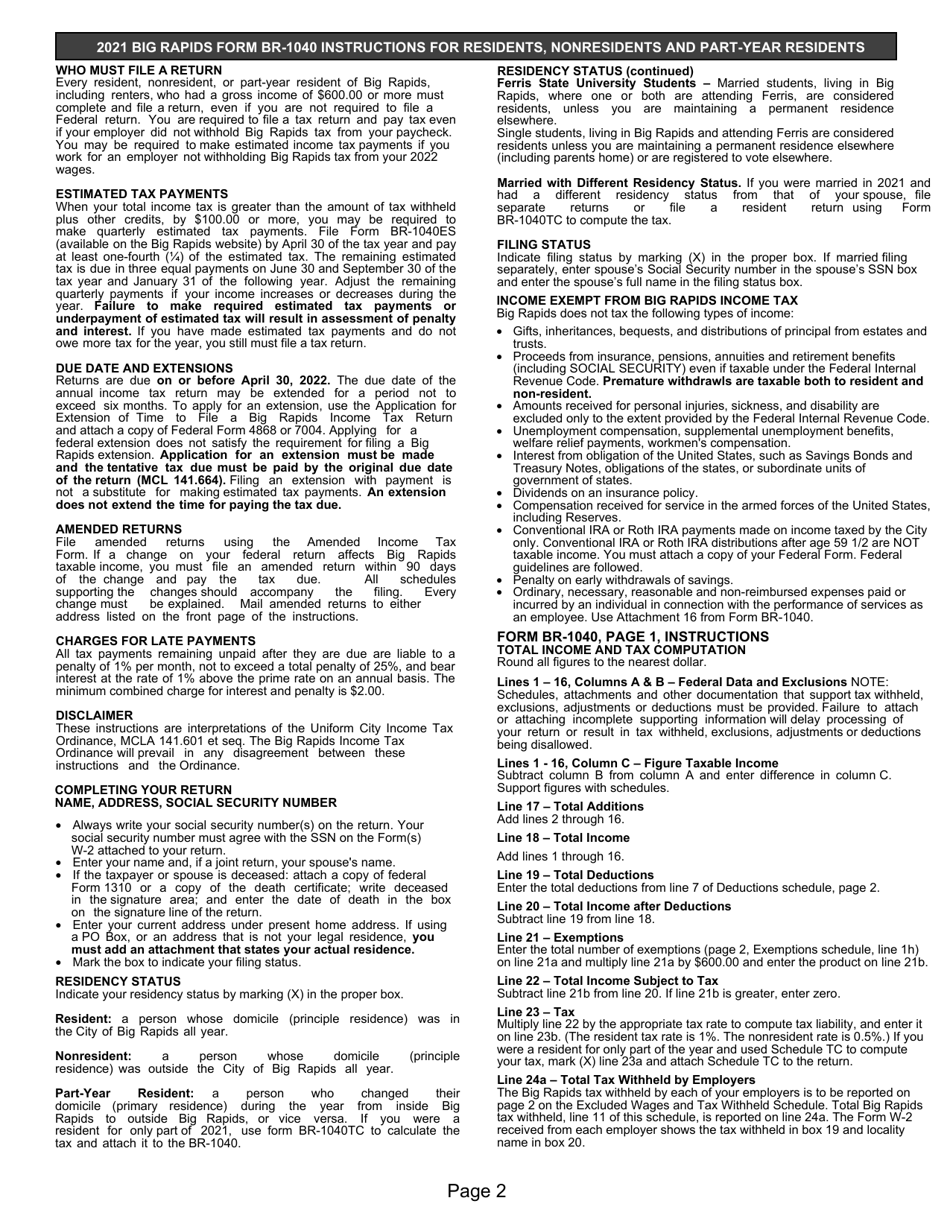

Q: Who needs to file Form BR-1040?

A: Residents of the City of Big Rapids, Michigan who have taxable income need to file Form BR-1040.

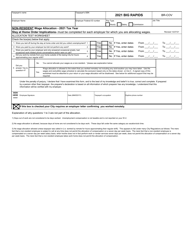

Q: What information do I need to complete Form BR-1040?

A: You will need information about your income, deductions, and credits for the tax year.

Q: When is the deadline to file Form BR-1040?

A: The deadline to file Form BR-1040 is usually April 30th of each year.

Q: Can I file Form BR-1040 electronically?

A: Yes, you can file Form BR-1040 electronically if you choose to do so.

Q: What if I need an extension to file Form BR-1040?

A: You can request an extension to file Form BR-1040 by submitting Form BR-1040EXT.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there may be penalties for late filing or non-compliance, so it's important to file your return on time and accurately.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Income Tax Department - City of Big Rapids, Michigan.