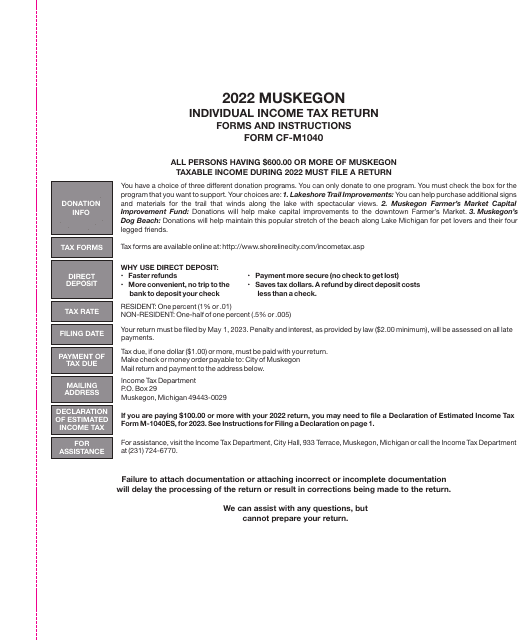

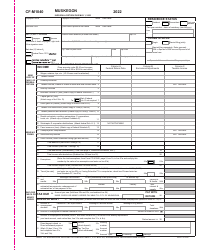

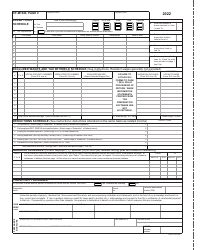

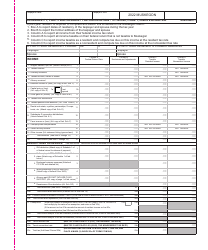

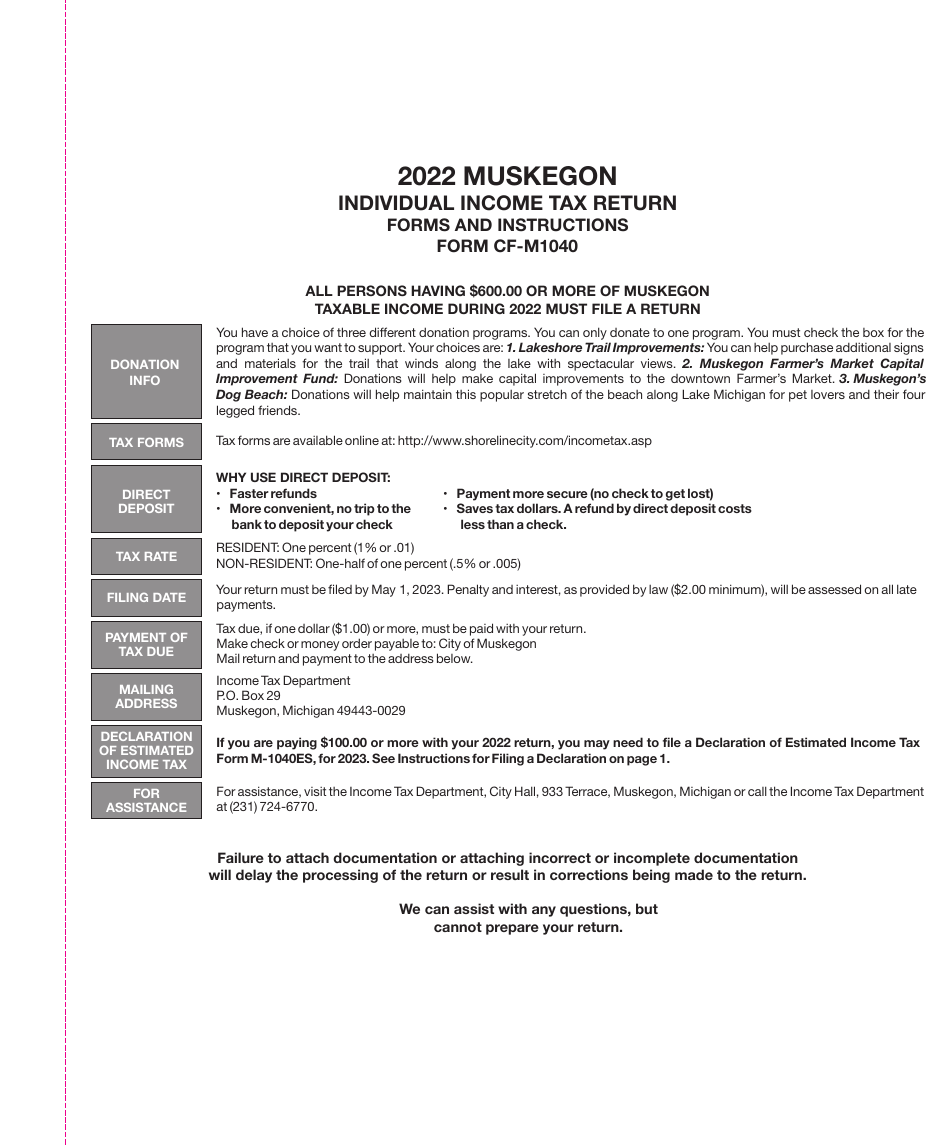

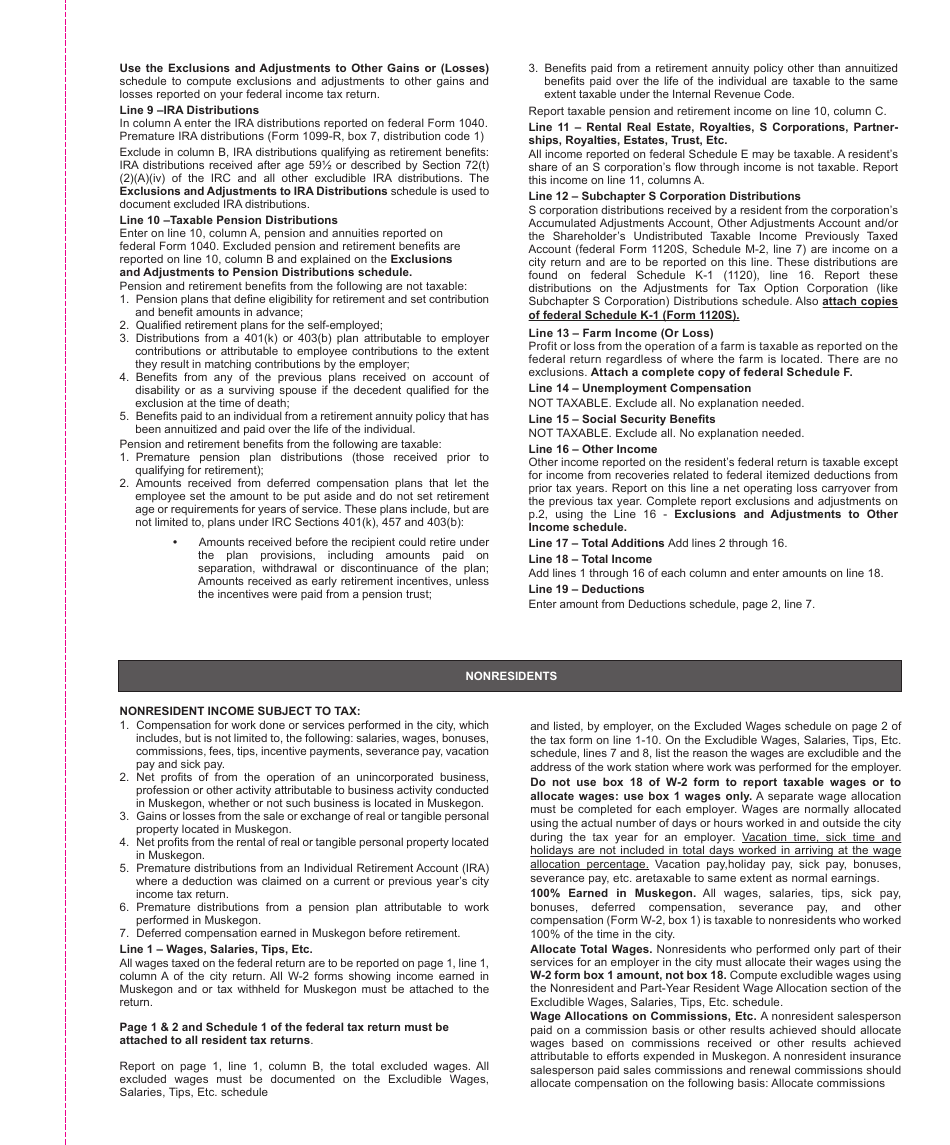

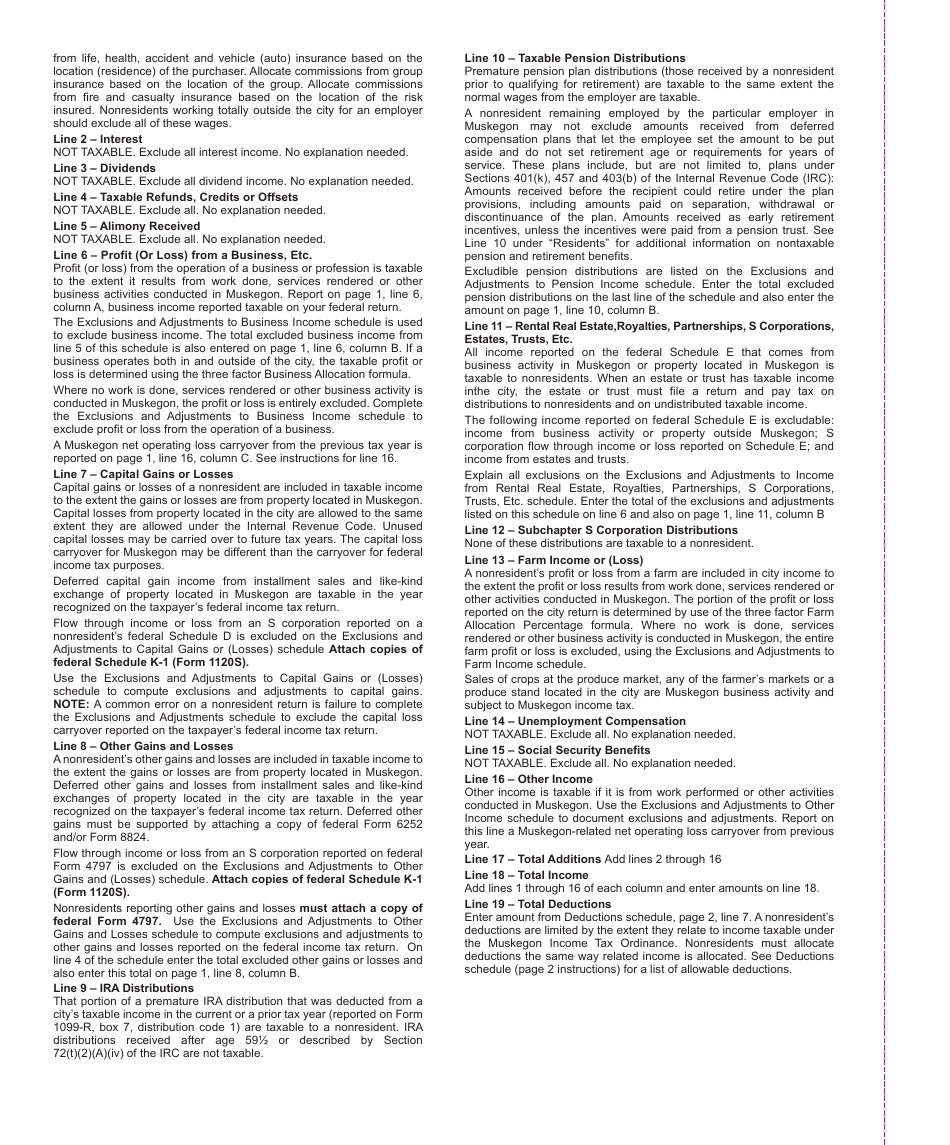

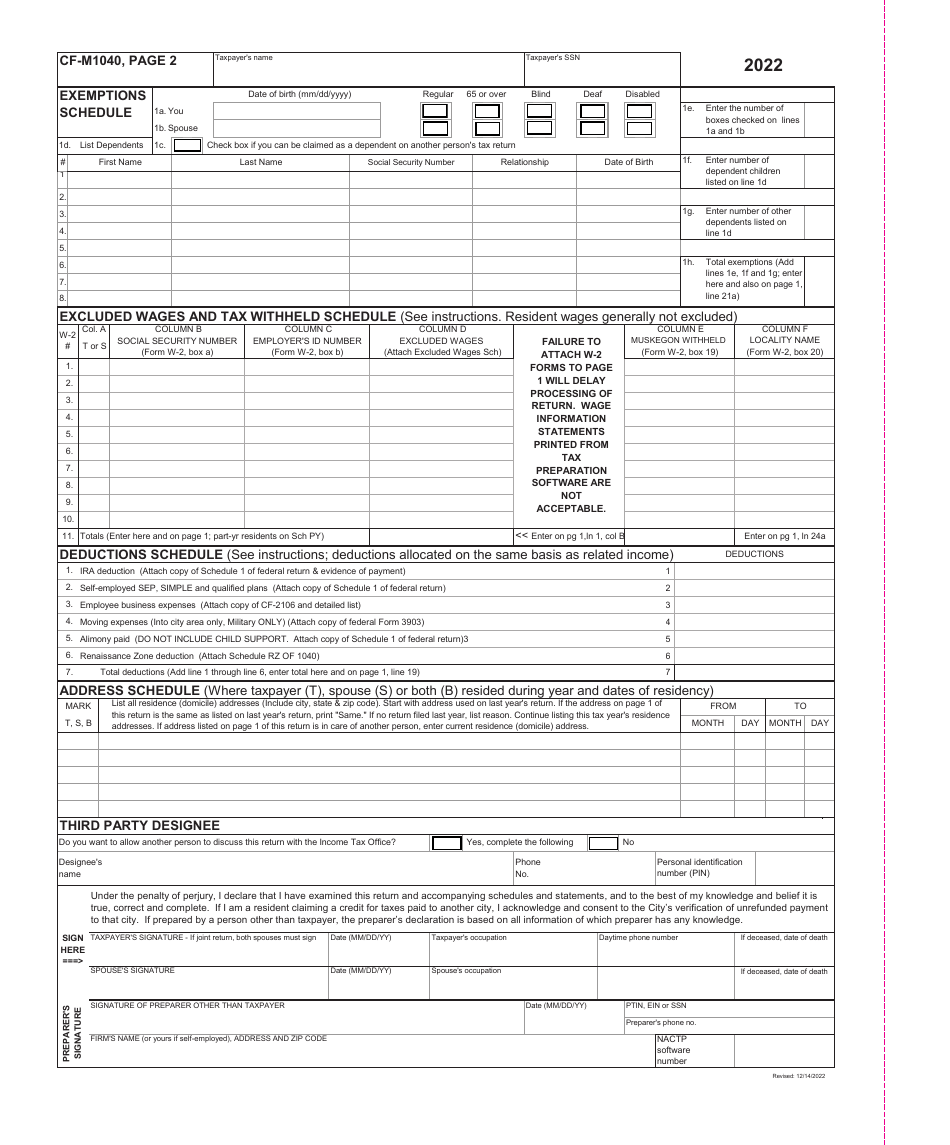

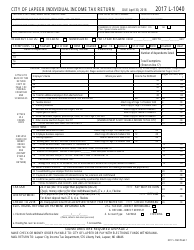

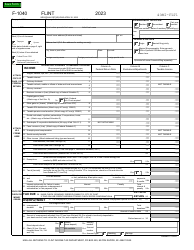

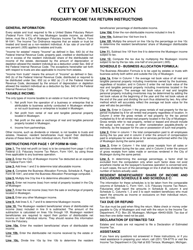

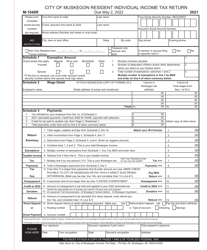

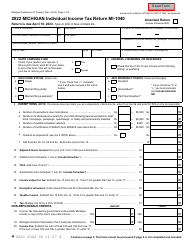

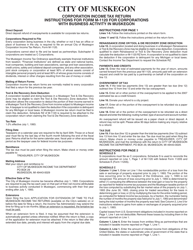

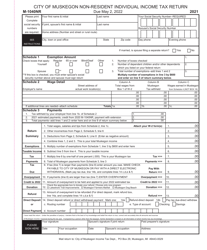

Form M-1040 Individual Income Tax Return - City of Muskegon, Michigan

What Is Form M-1040?

This is a legal form that was released by the Income Tax Department - City of Muskegon, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Muskegon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-1040?

A: Form M-1040 is the Individual Income Tax Return specifically for residents of the City of Muskegon, Michigan.

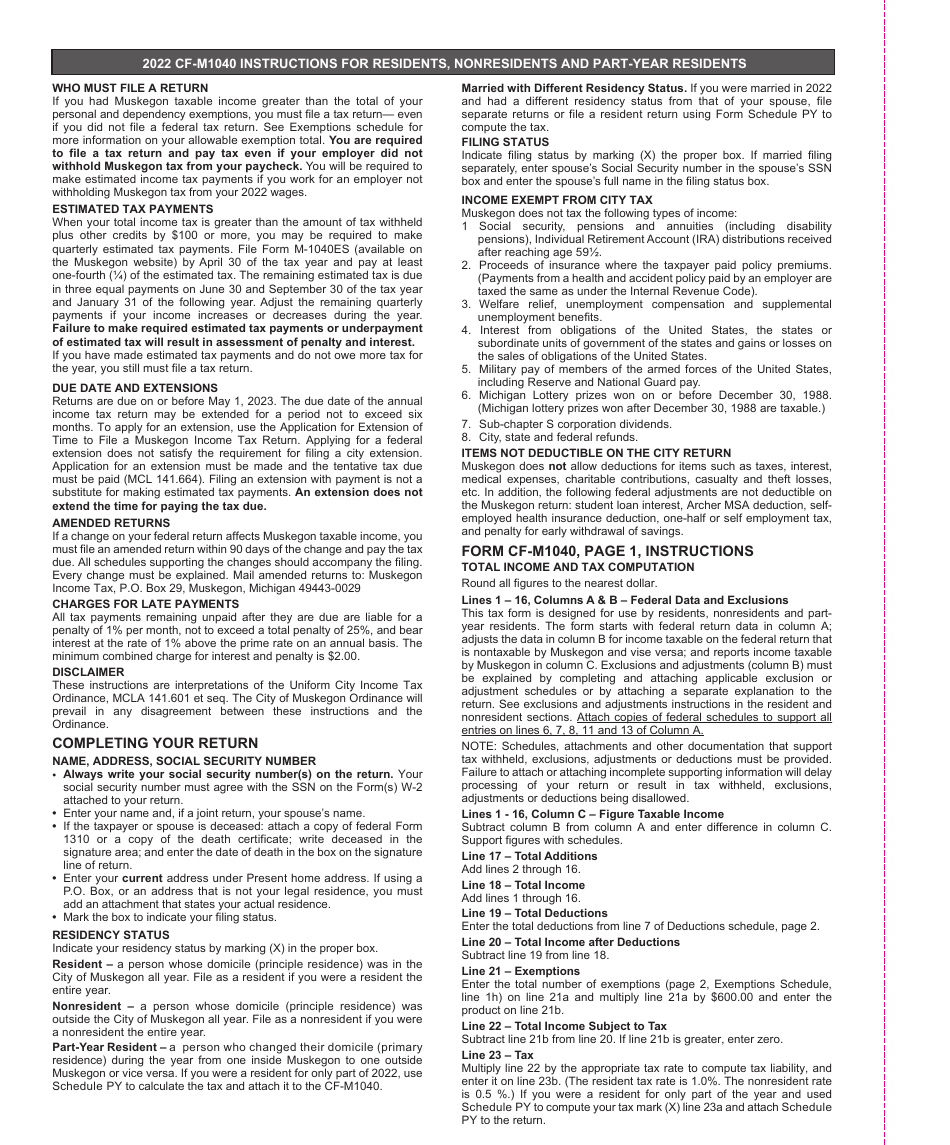

Q: Who needs to file Form M-1040?

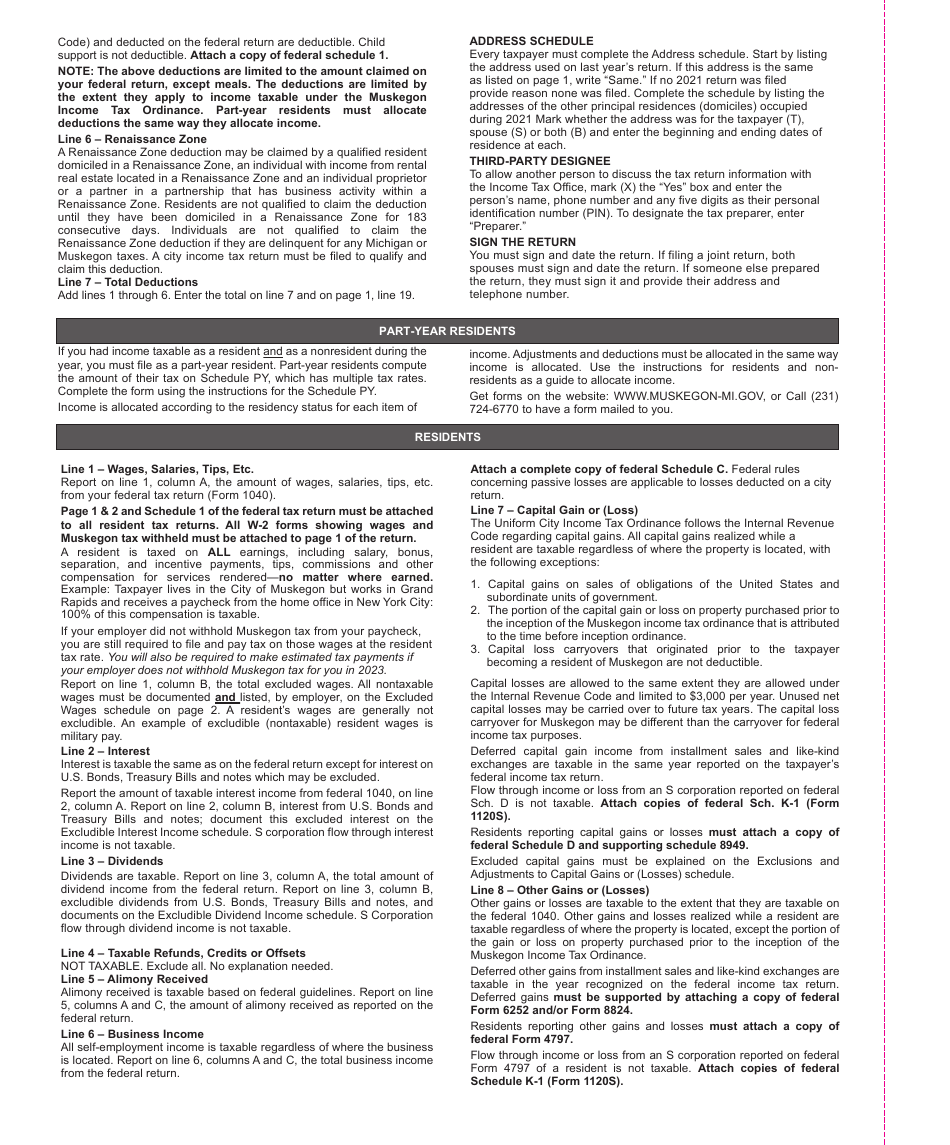

A: Residents of the City of Muskegon, Michigan who have taxable income must file Form M-1040.

Q: What is taxable income?

A: Taxable income is the total income on which you owe taxes after deducting any eligible deductions and exemptions.

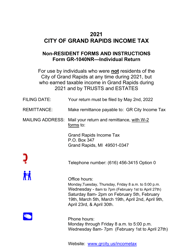

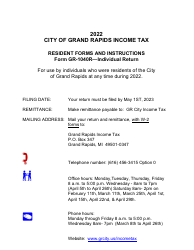

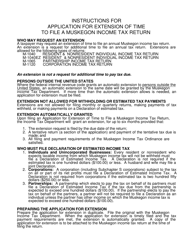

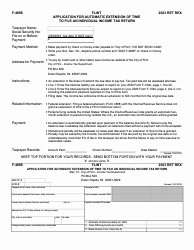

Q: What are the important deadlines for filing Form M-1040?

A: The deadline to file Form M-1040 is usually April 15th of the following year.

Q: What if I can't file my Form M-1040 by the deadline?

A: If you cannot file your Form M-1040 by the deadline, you may be able to request an extension or face penalties for late filing.

Q: How do I calculate my tax liability on Form M-1040?

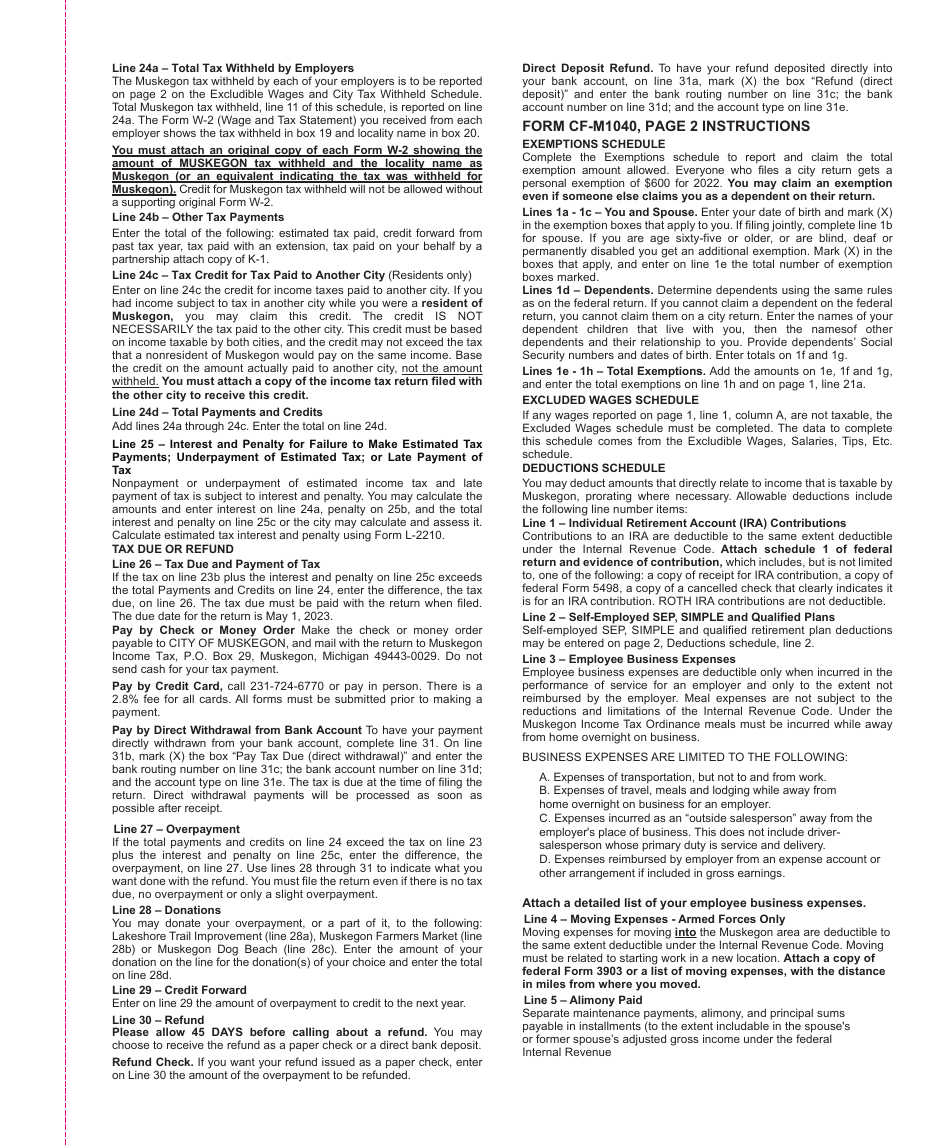

A: Tax liability is calculated by applying the relevant tax rates to your taxable income after deducting any eligible deductions.

Q: Can I e-file Form M-1040?

A: Yes, you can e-file Form M-1040 if you meet the requirements and use an authorized e-file provider.

Q: What are some common deductions I can take on Form M-1040?

A: Common deductions include mortgage interest, property taxes, and medical expenses, among others.

Q: Is there any additional information I need to provide with Form M-1040?

A: You may need to attach additional schedules or forms depending on your specific tax situation, such as Schedule A for itemized deductions.

Form Details:

- Released on December 14, 2022;

- The latest edition provided by the Income Tax Department - City of Muskegon, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-1040 by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Muskegon, Michigan.