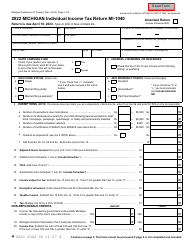

This version of the form is not currently in use and is provided for reference only. Download this version of

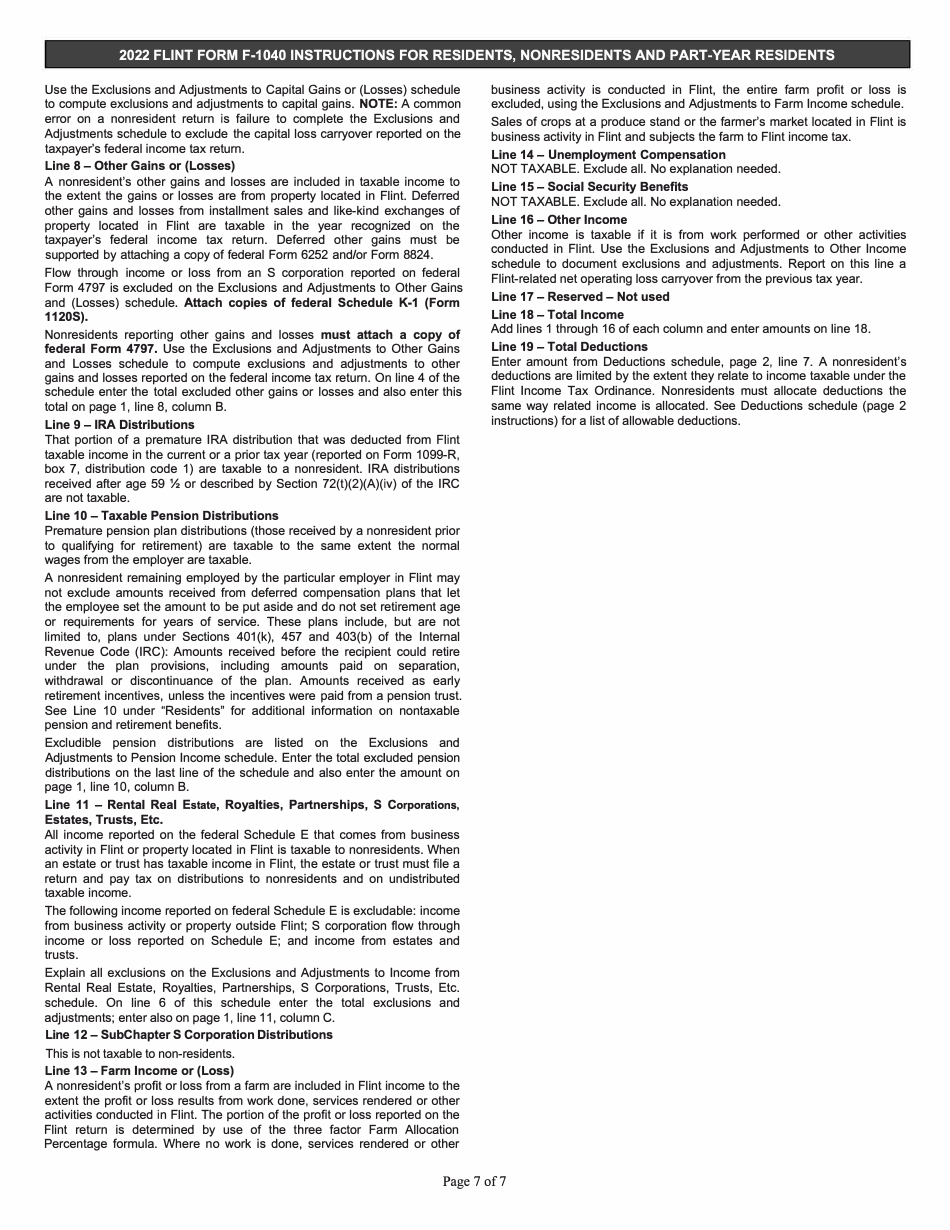

Instructions for Form F-1040

for the current year.

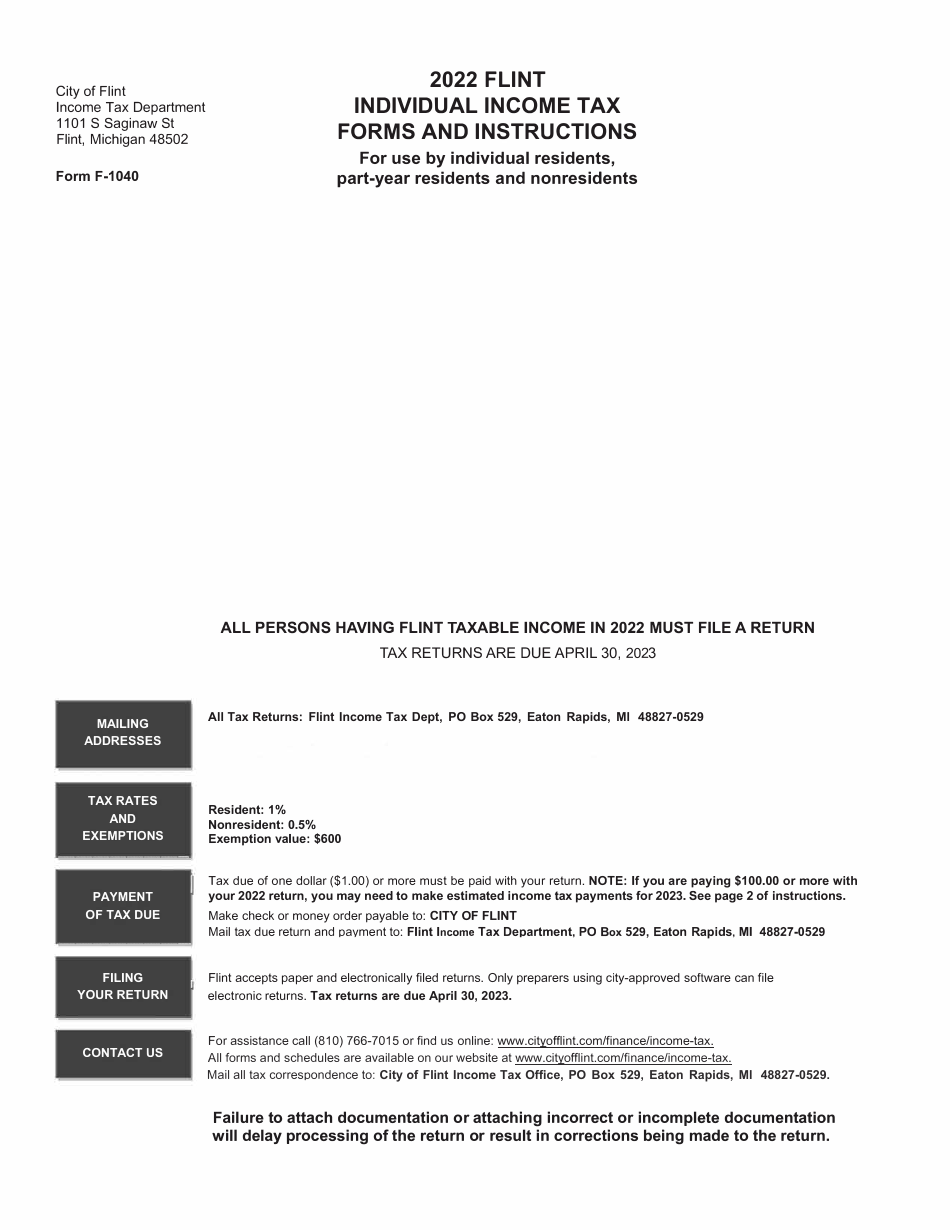

Instructions for Form F-1040 Individual Income Tax Return - City of Flint, Michigan

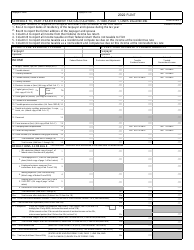

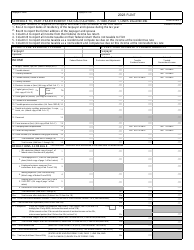

This document contains official instructions for Form F-1040 , Individual Income Tax Return - a form released and collected by the Income Tax Department - City of Flint, Michigan. An up-to-date fillable Form F-1040 Schedule TC is available for download through this link.

FAQ

Q: What is Form F-1040?

A: Form F-1040 is the Individual Income Tax Return form used by residents of Flint, Michigan to report their annual income.

Q: What is the City of Flint, Michigan?

A: The City of Flint is a city located in the state of Michigan, known for its water crisis in recent years.

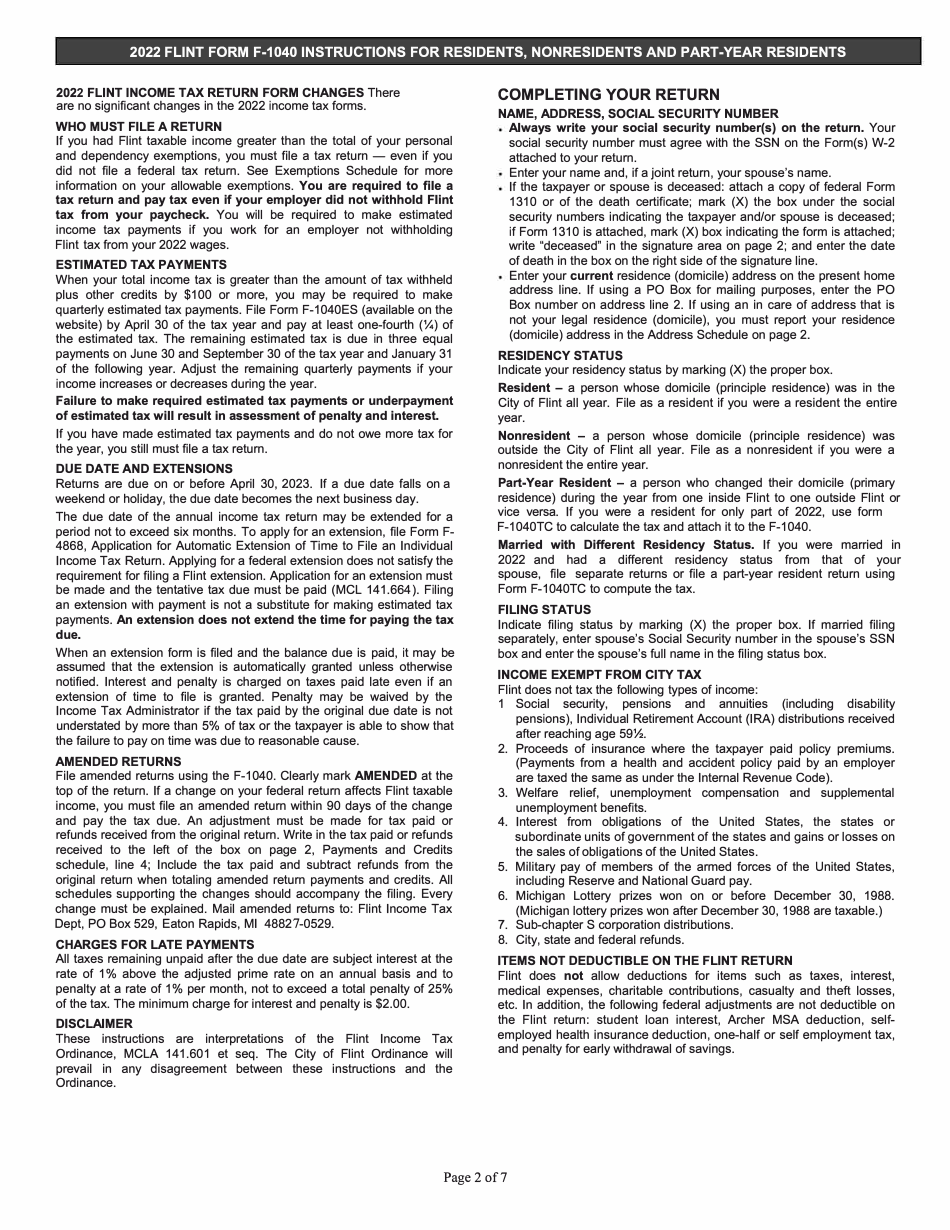

Q: Who needs to file Form F-1040?

A: Residents of Flint, Michigan who have earned income in the previous tax year need to file Form F-1040 to report their income.

Q: What information do I need to complete Form F-1040?

A: You will need information about your income, deductions, and credits to complete Form F-1040.

Q: When is the deadline to file Form F-1040?

A: The deadline to file Form F-1040 for residents of Flint, Michigan is generally April 15th of each year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Form F-1040, including interest charges and late payment penalties.

Q: Can I file Form F-1040 electronically?

A: Yes, you can file Form F-1040 electronically if you meet the requirements set by the IRS.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Income Tax Department - City of Flint, Michigan.