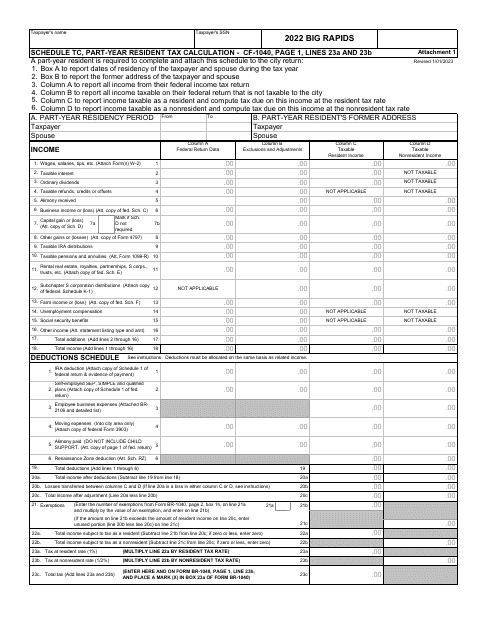

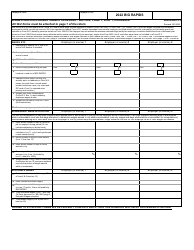

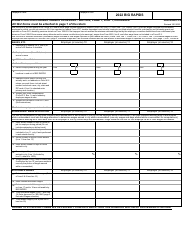

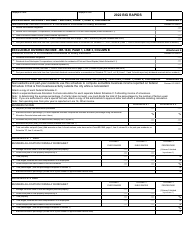

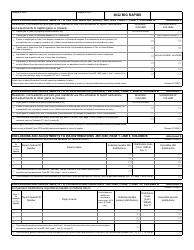

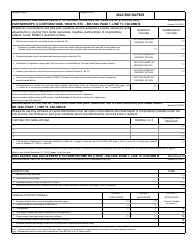

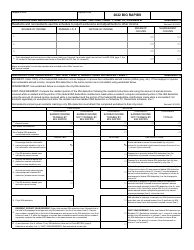

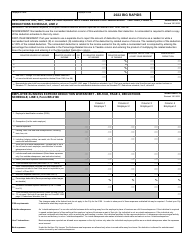

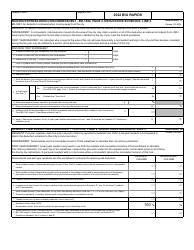

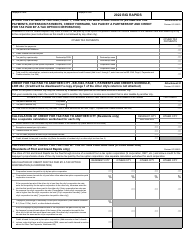

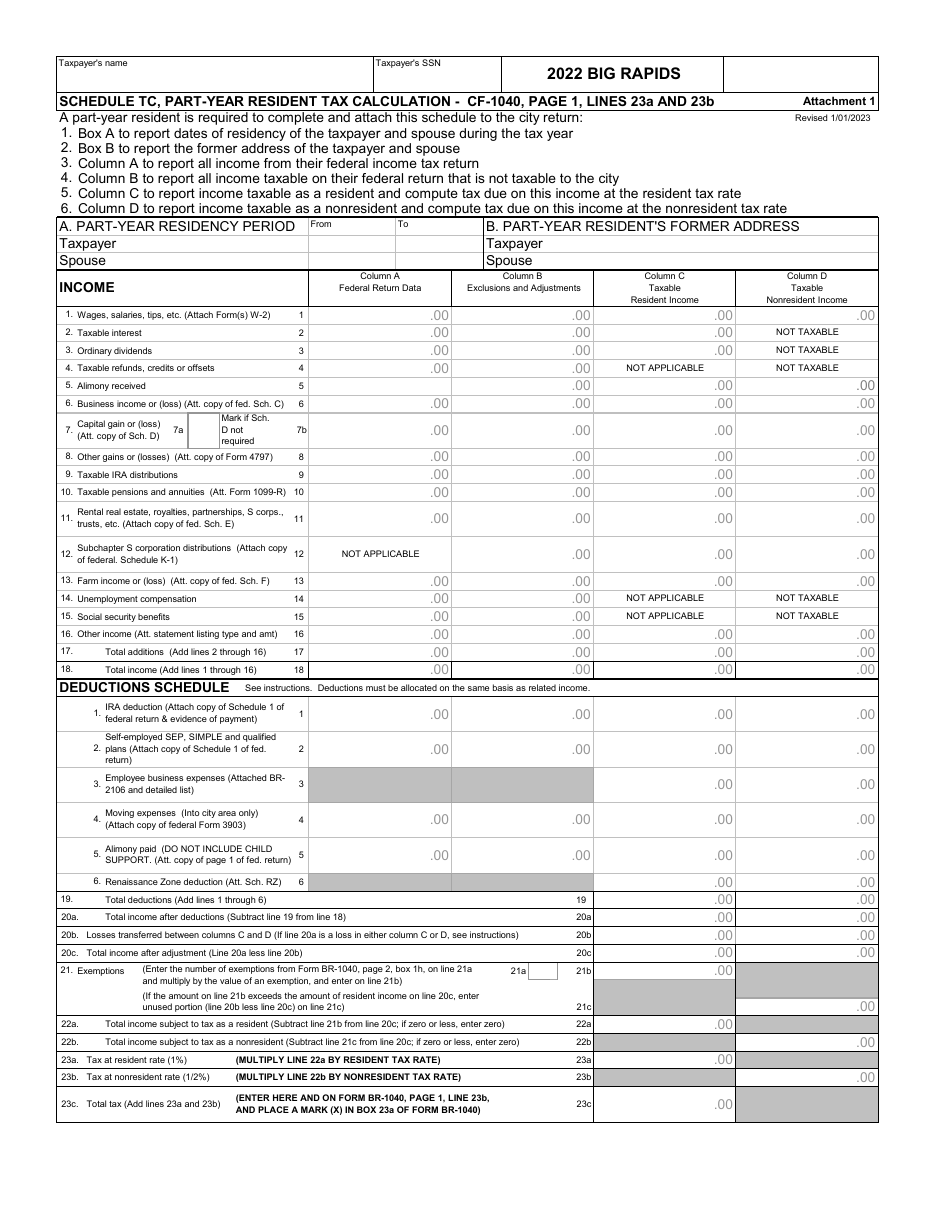

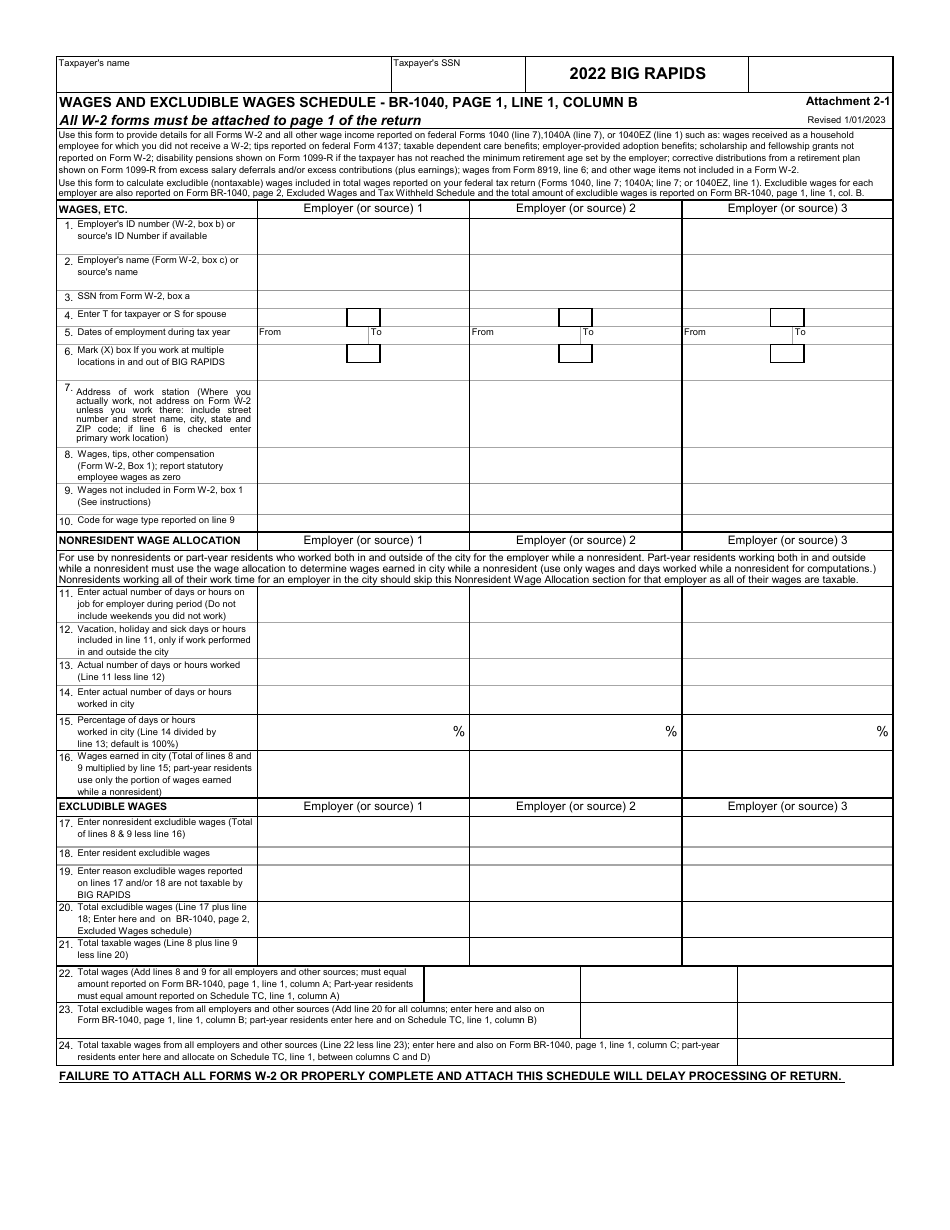

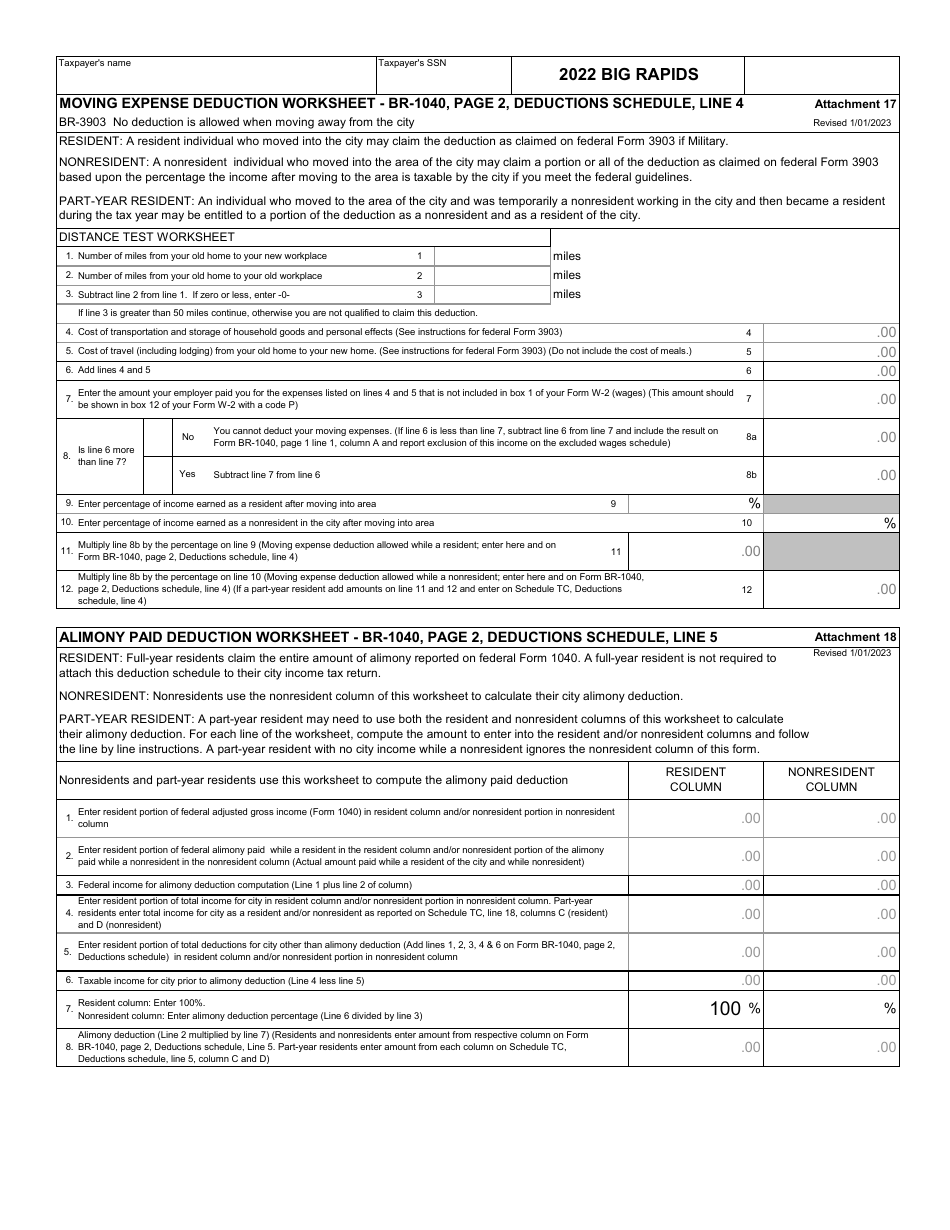

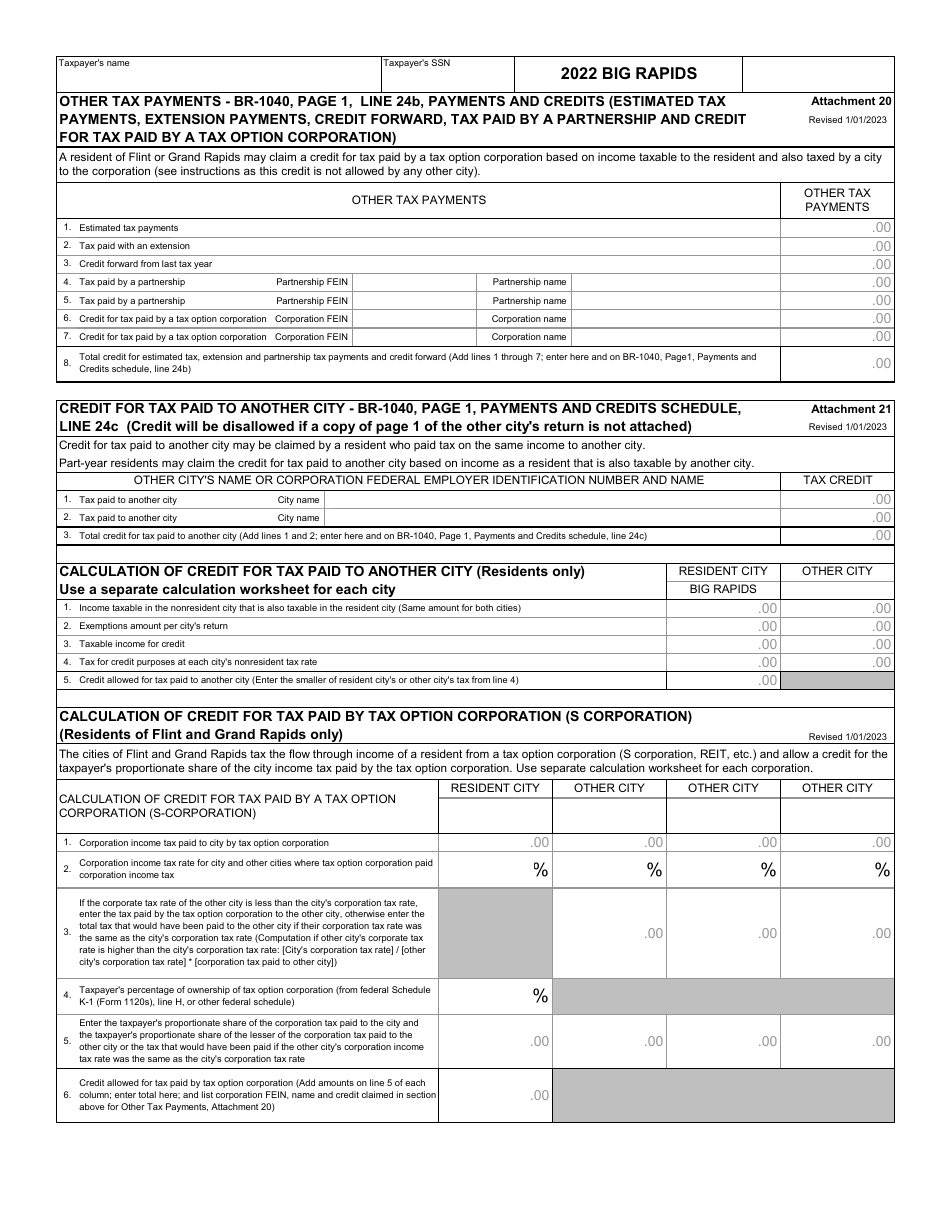

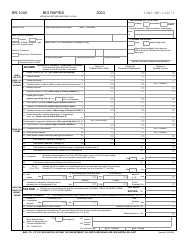

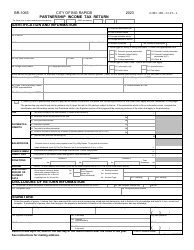

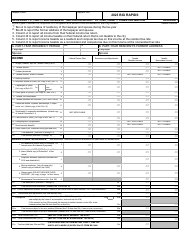

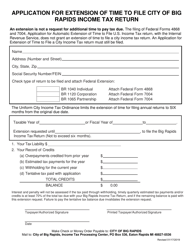

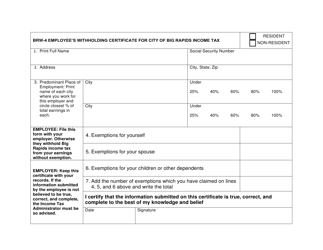

Form BR-1040 Schedule TC - City of Big Rapids, Michigan

What Is Form BR-1040 Schedule TC?

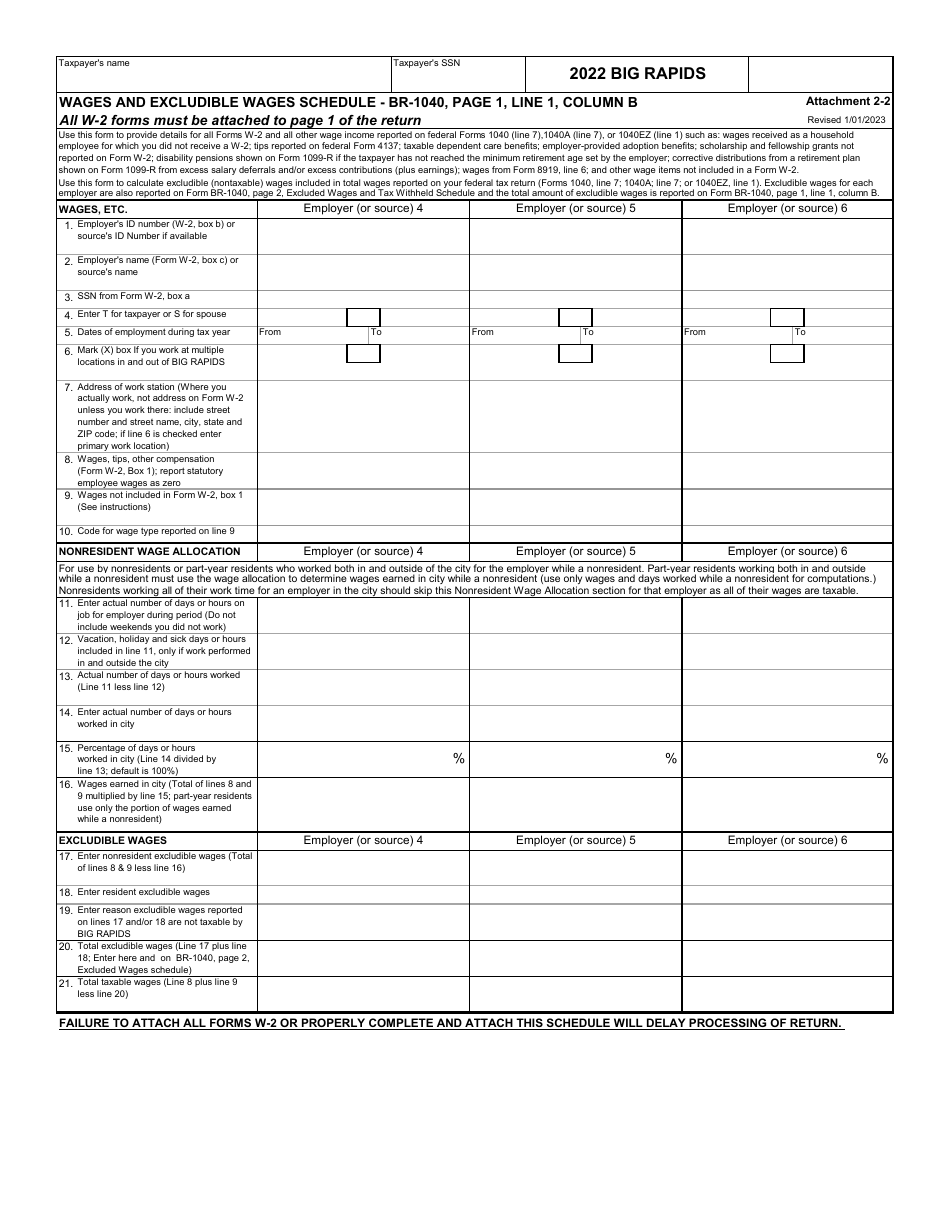

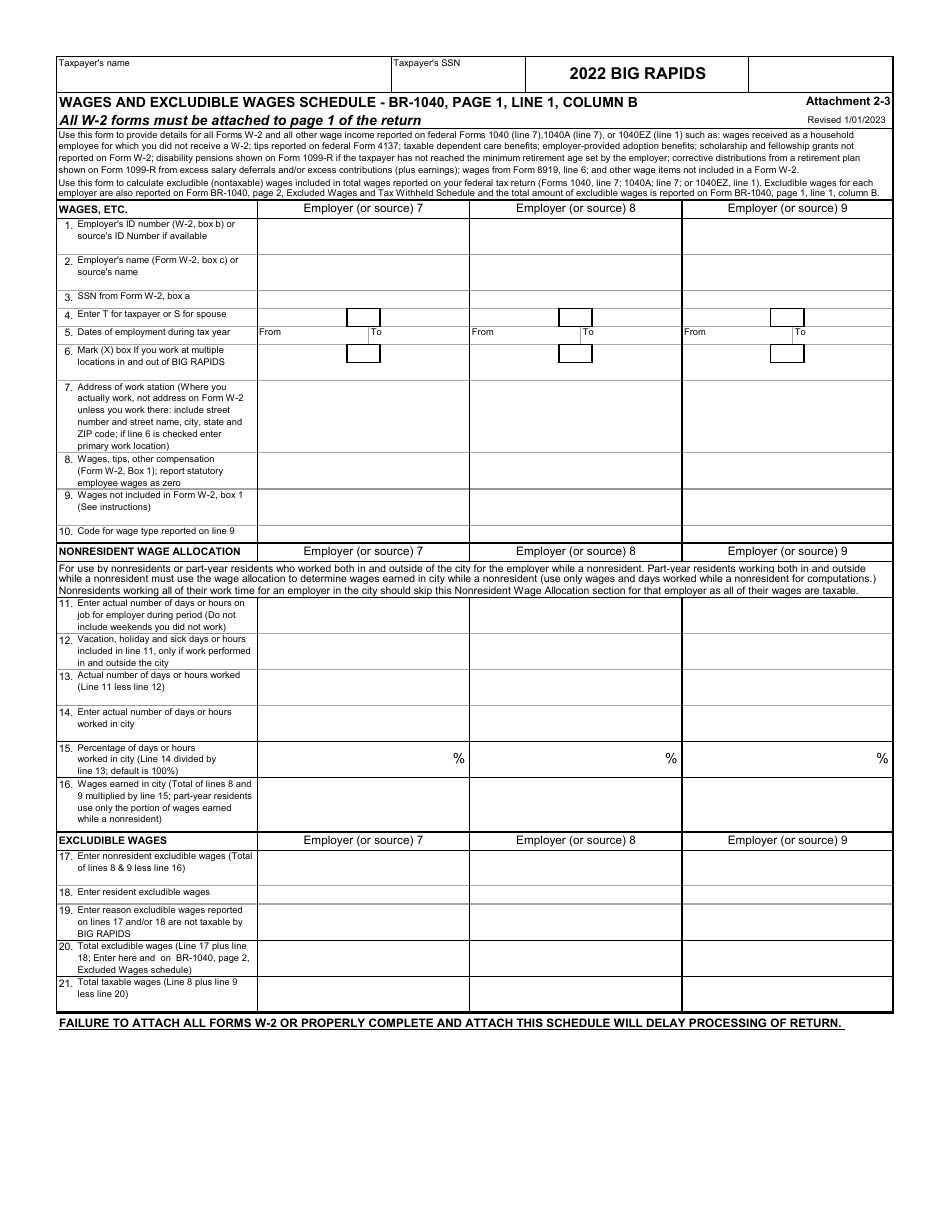

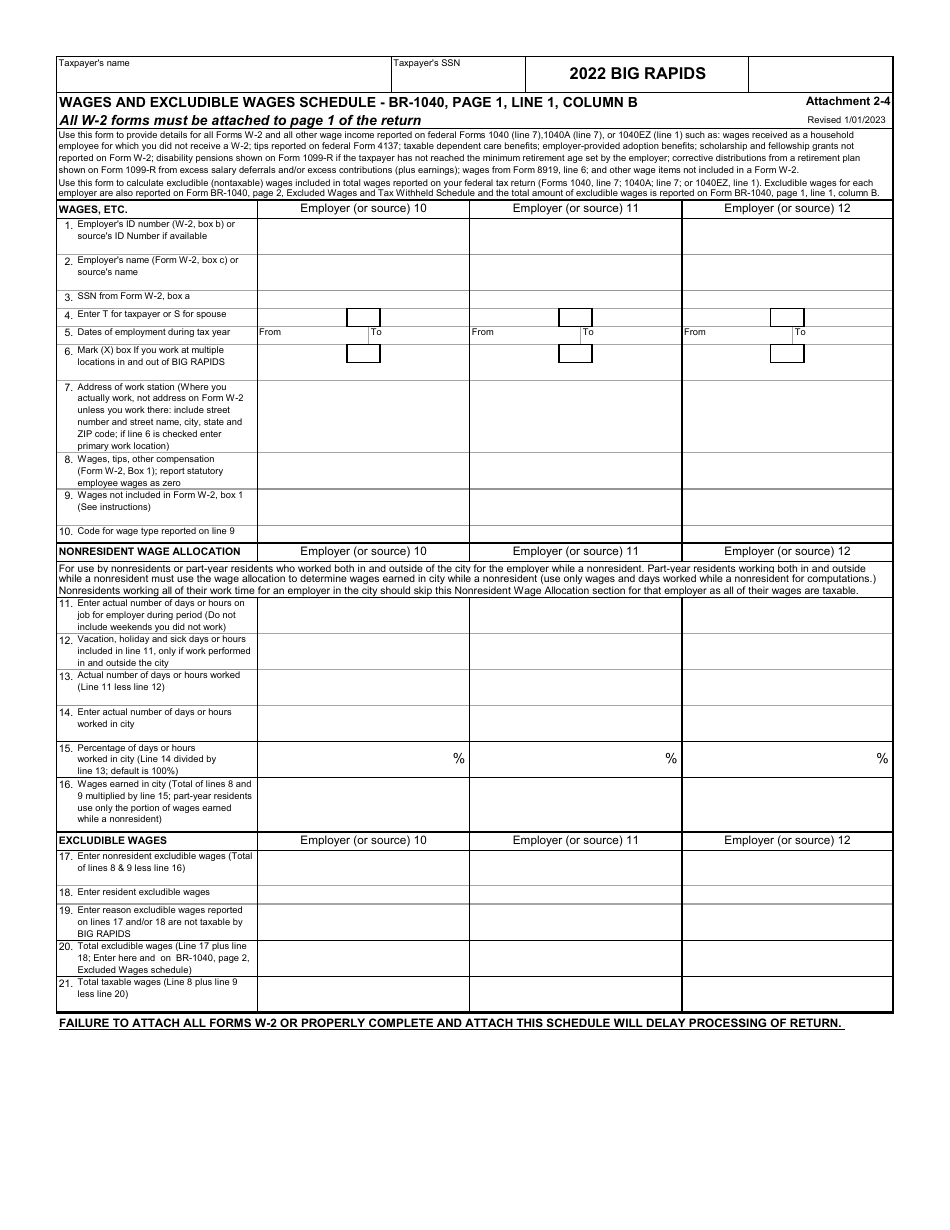

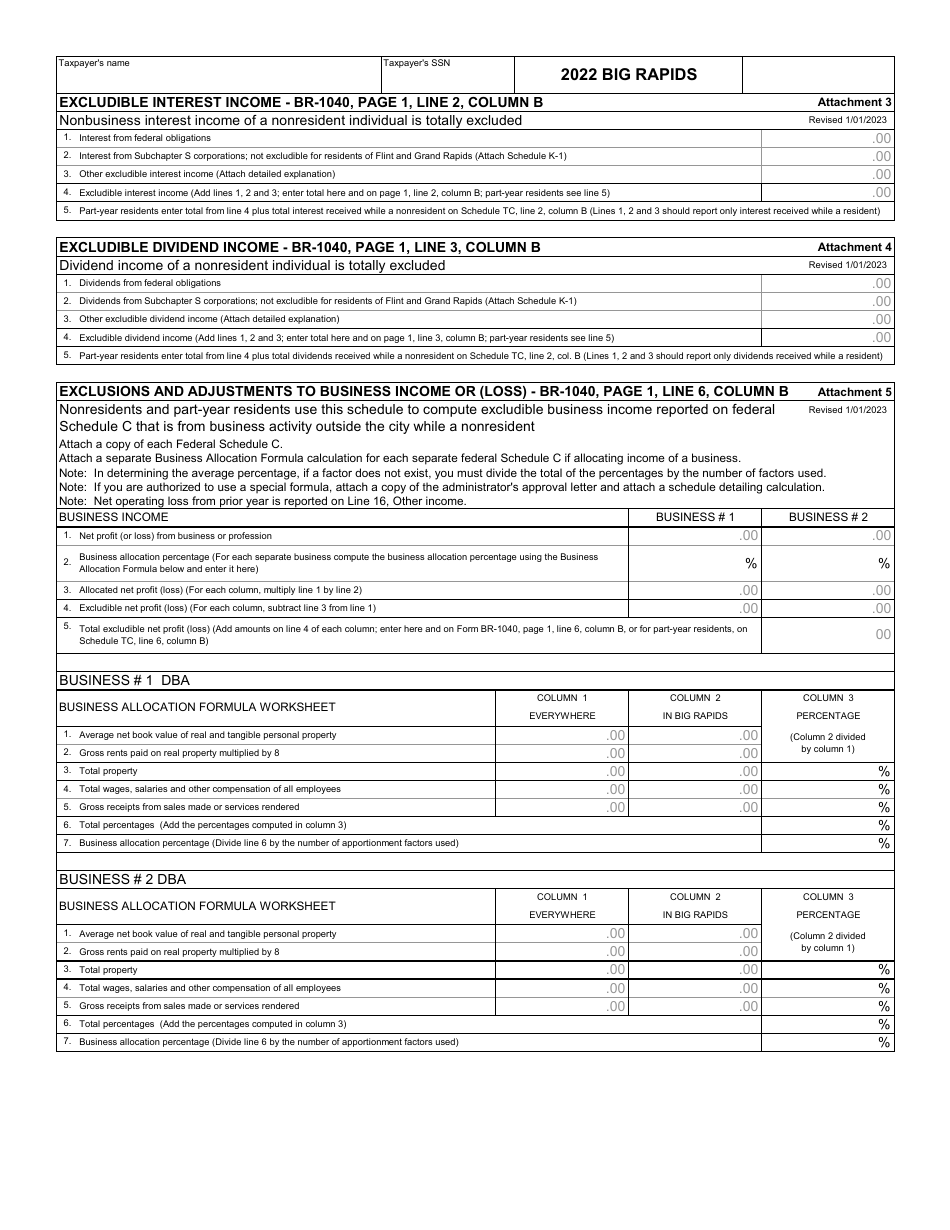

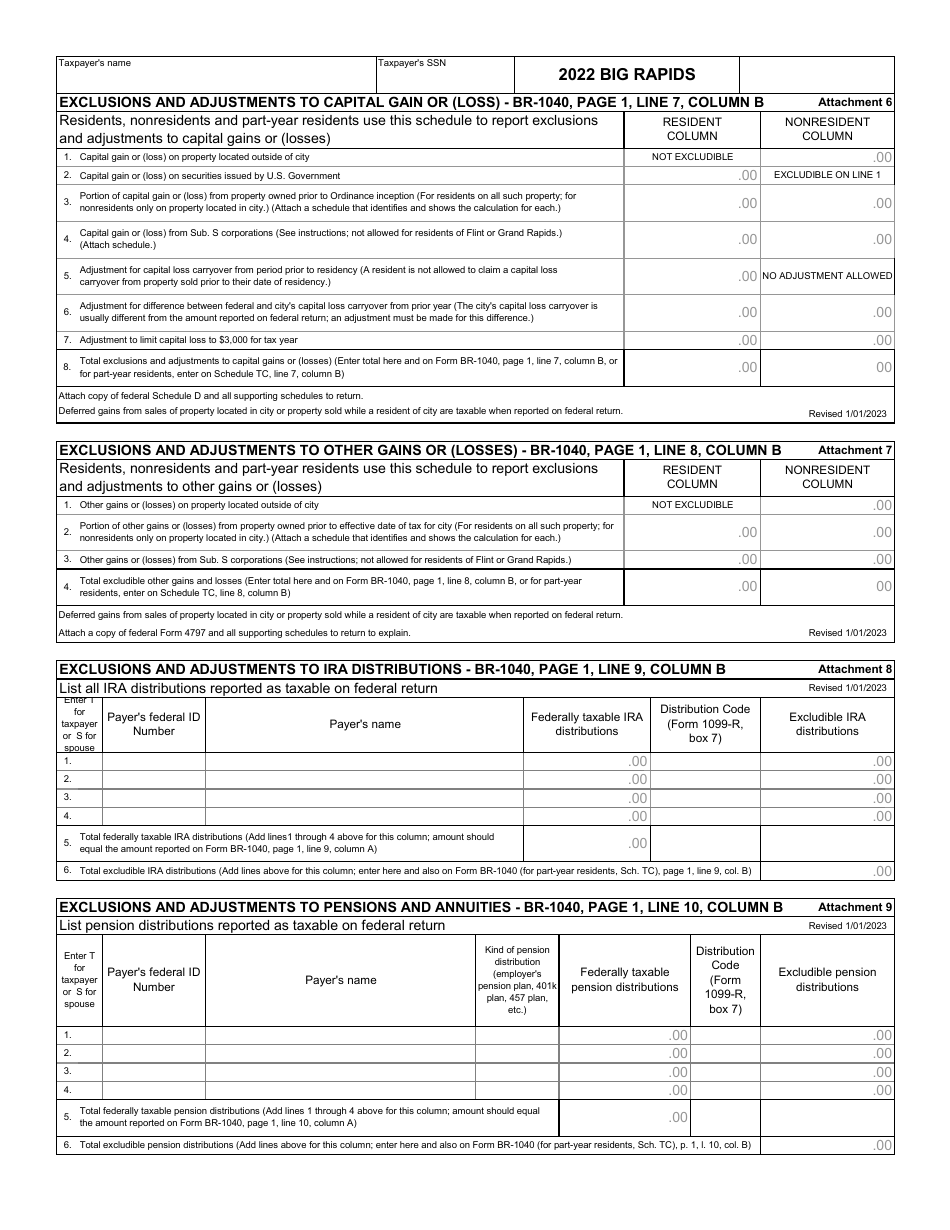

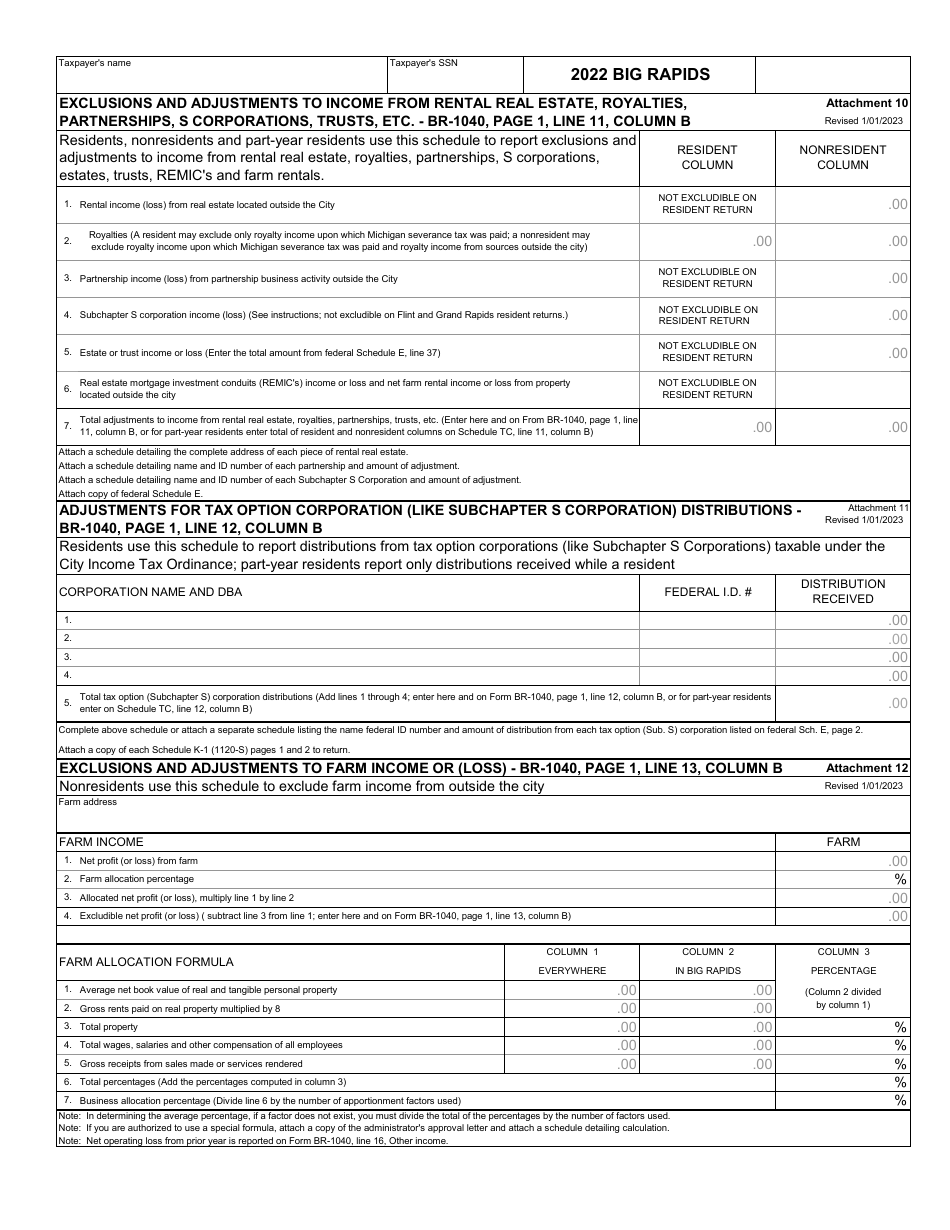

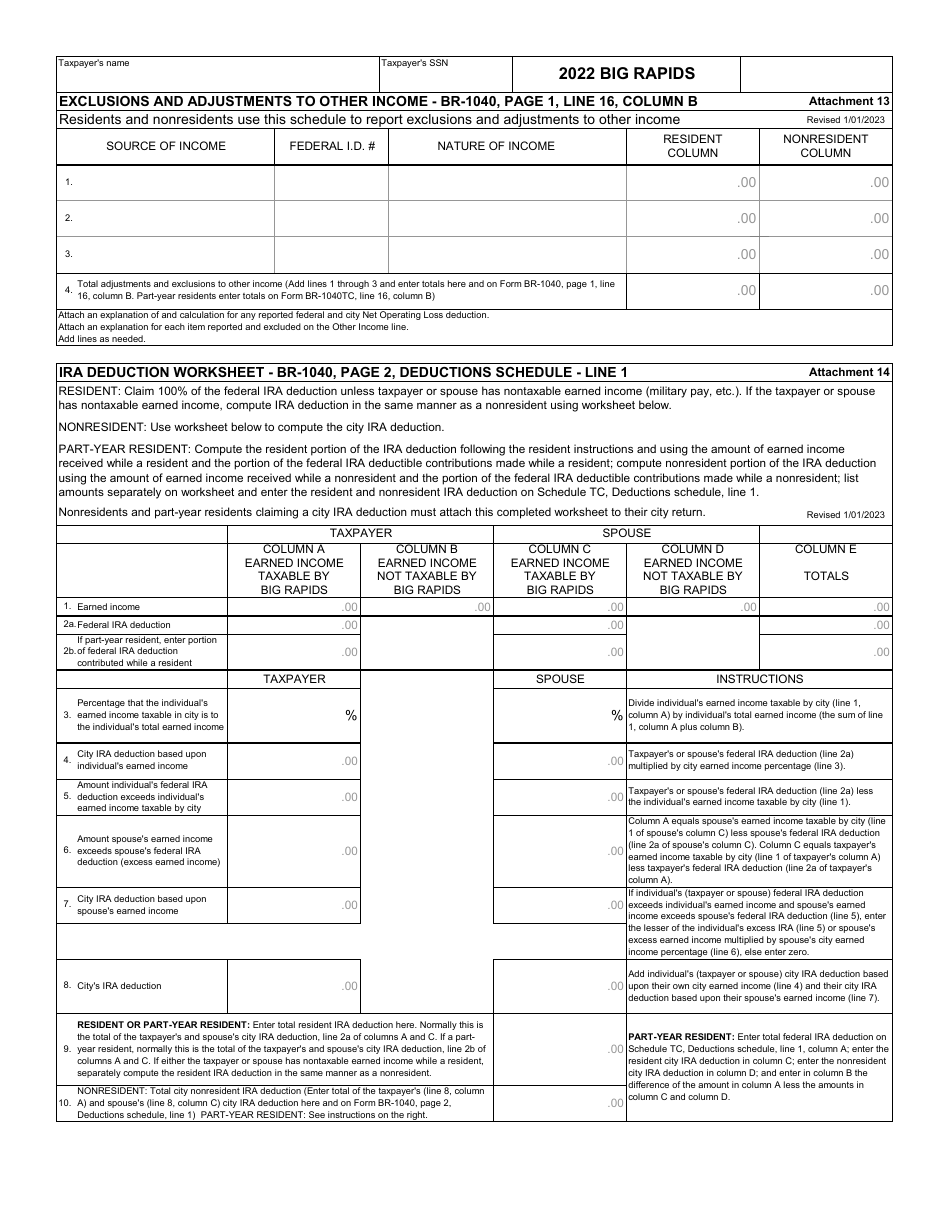

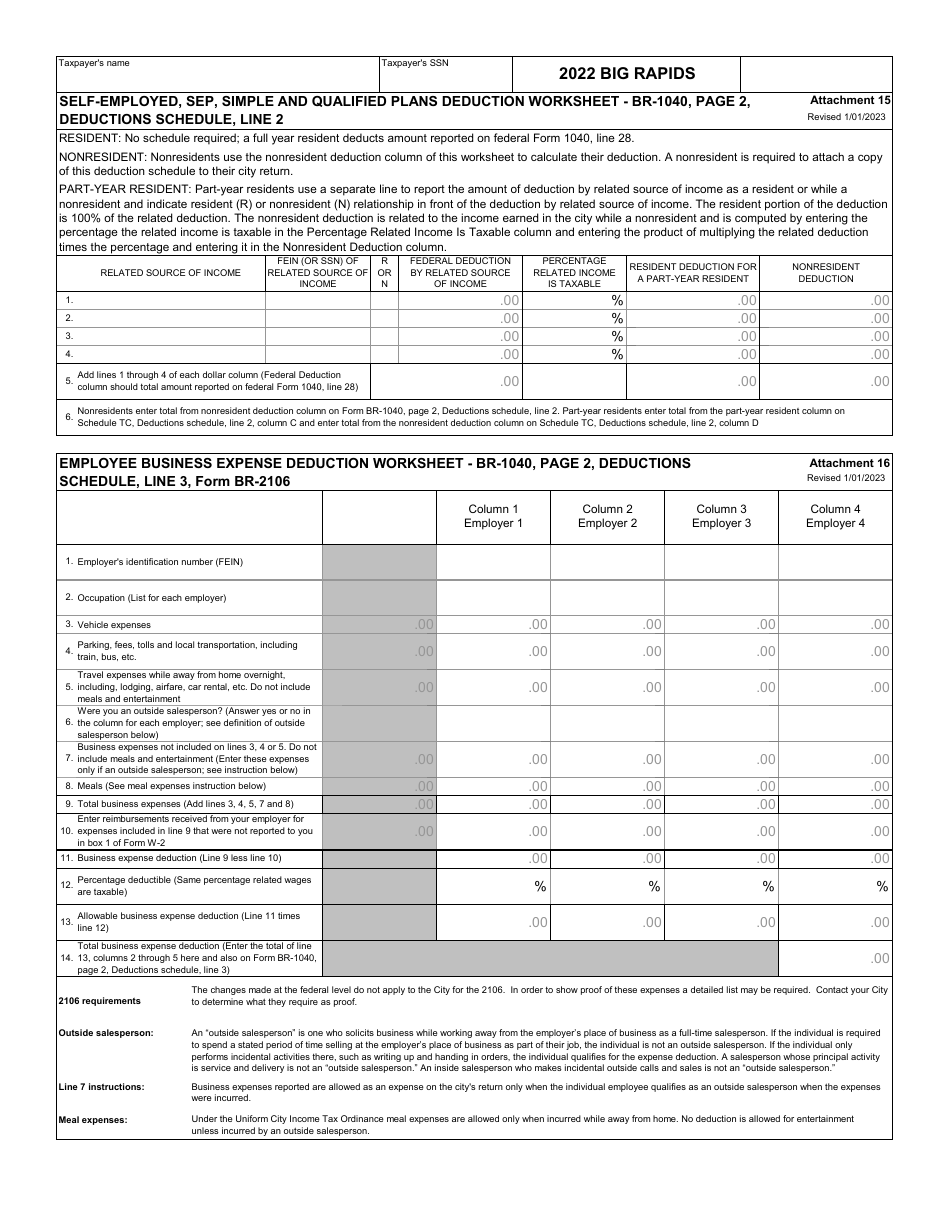

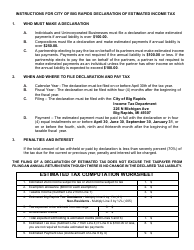

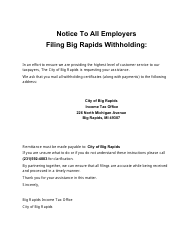

This is a legal form that was released by the Income Tax Department - City of Big Rapids, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Big Rapids. The document is a supplement to Form BR-1040, Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BR-1040 Schedule TC?

A: Form BR-1040 Schedule TC is a tax form used in the City of Big Rapids, Michigan.

Q: When do I need to use Form BR-1040 Schedule TC?

A: You need to use Form BR-1040 Schedule TC when you are a resident of the City of Big Rapids, Michigan and you have tax obligations.

Q: What information is required on Form BR-1040 Schedule TC?

A: Form BR-1040 Schedule TC requires you to provide information about your income, deductions, and credits for the City of Big Rapids, Michigan.

Q: Can Form BR-1040 Schedule TC be filed electronically?

A: Yes, Form BR-1040 Schedule TC can be filed electronically if you choose to do so.

Q: Is Form BR-1040 Schedule TC only for residents of Big Rapids, Michigan?

A: Yes, Form BR-1040 Schedule TC is specifically for residents of the City of Big Rapids, Michigan.

Q: What should I do if I have questions about Form BR-1040 Schedule TC?

A: If you have questions about Form BR-1040 Schedule TC, you should contact the tax office of the City of Big Rapids, Michigan for assistance.

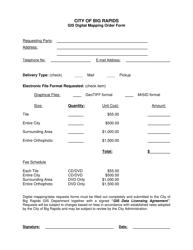

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Income Tax Department - City of Big Rapids, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BR-1040 Schedule TC by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Big Rapids, Michigan.