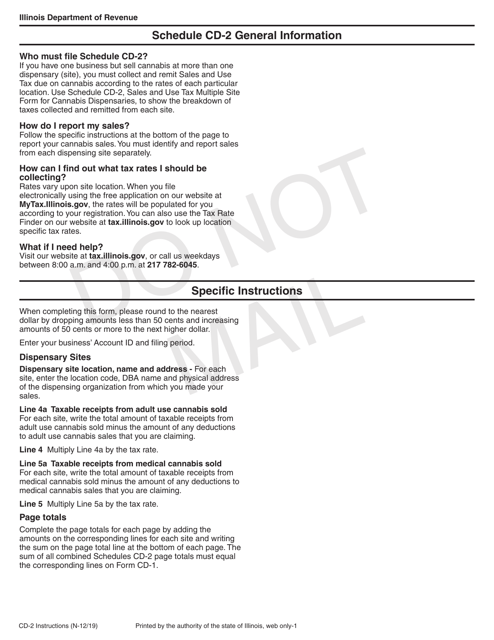

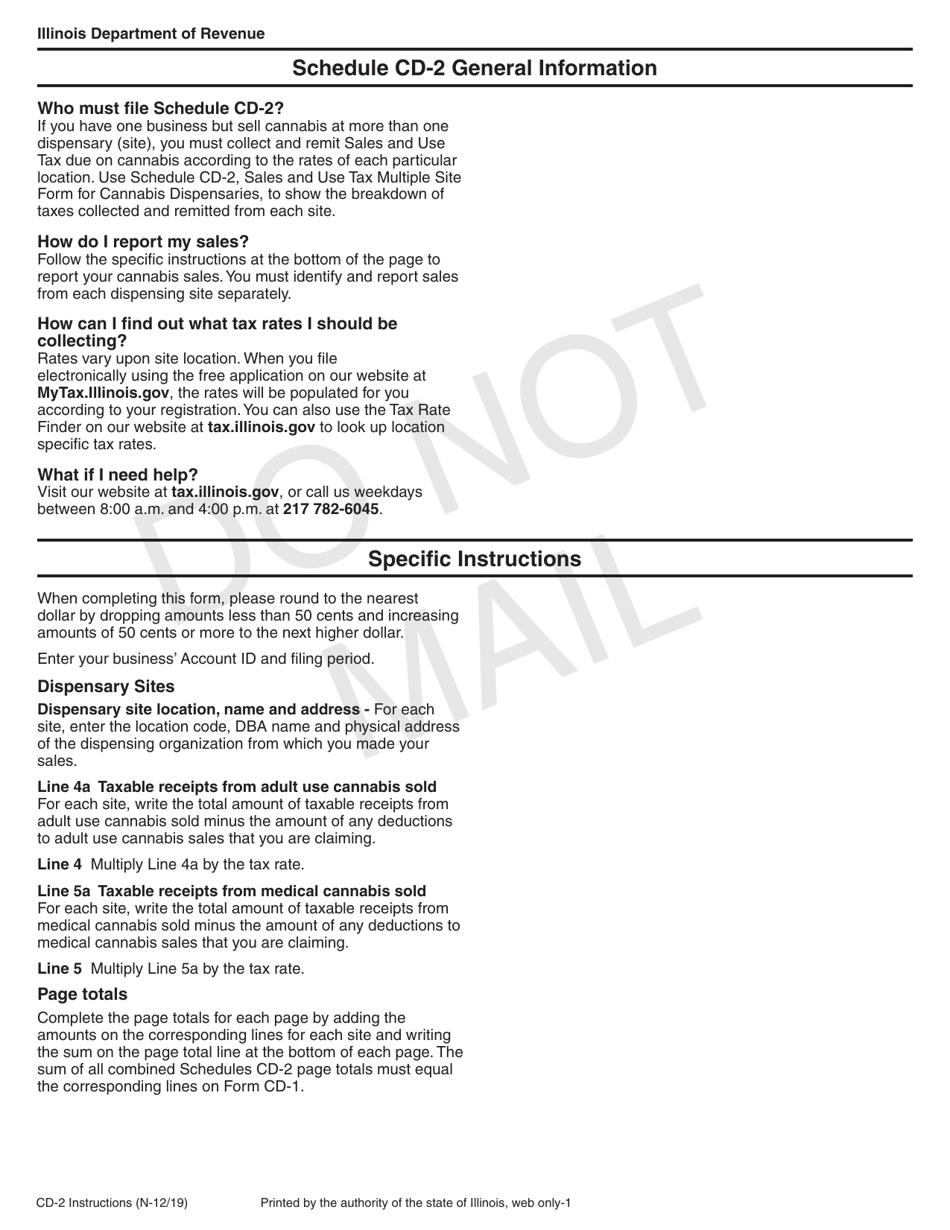

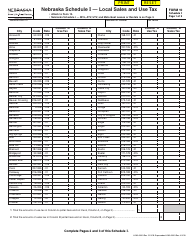

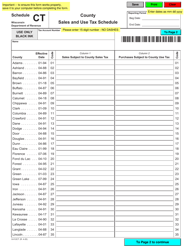

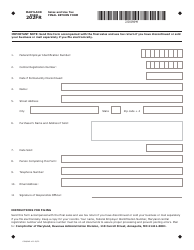

Instructions for Schedule CD-2 Sales and Use Tax Multiple Site Form for Cannabis Dispensaries - Illinois

This document contains official instructions for Schedule CD-2 , Sales and Multiple Site Form for Cannabis Dispensaries - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Schedule CD-2?

A: Schedule CD-2 is a form used for reporting sales and use tax for cannabis dispensaries in Illinois.

Q: Who needs to file Schedule CD-2?

A: Cannabis dispensaries in Illinois need to file Schedule CD-2.

Q: What is the purpose of Schedule CD-2?

A: The purpose of Schedule CD-2 is to report sales and use tax for cannabis dispensaries in Illinois with multiple locations.

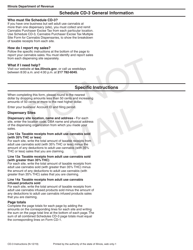

Q: How do I complete Schedule CD-2?

A: You need to provide the required information about your cannabis dispensary locations and sales transactions.

Q: What information do I need to provide on Schedule CD-2?

A: You need to provide the location codes, tax periods, gross receipts, and tax due for each of your dispensary locations.

Q: When is the deadline for filing Schedule CD-2?

A: The deadline for filing Schedule CD-2 is usually the same as the regular sales and use tax returnfiling deadline, which is the 20th day of the month following the reporting period.

Q: What happens if I don't file Schedule CD-2?

A: Failure to file Schedule CD-2 or the timely payment of the tax due may result in penalties and interest.

Q: What should I do if I have additional questions about Schedule CD-2?

A: If you have additional questions about Schedule CD-2, you should contact the Illinois Department of Revenue for assistance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.