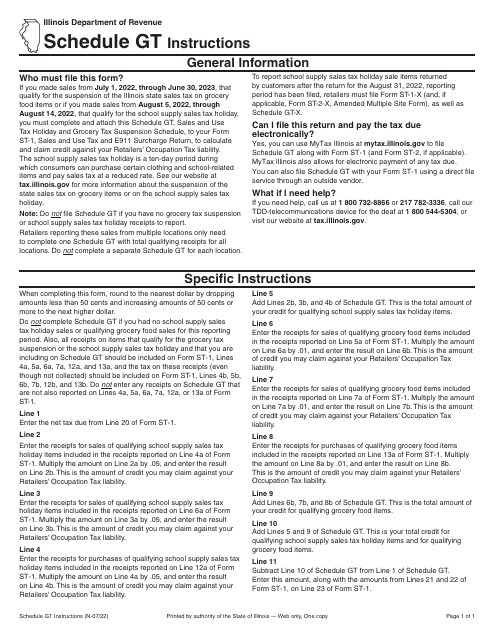

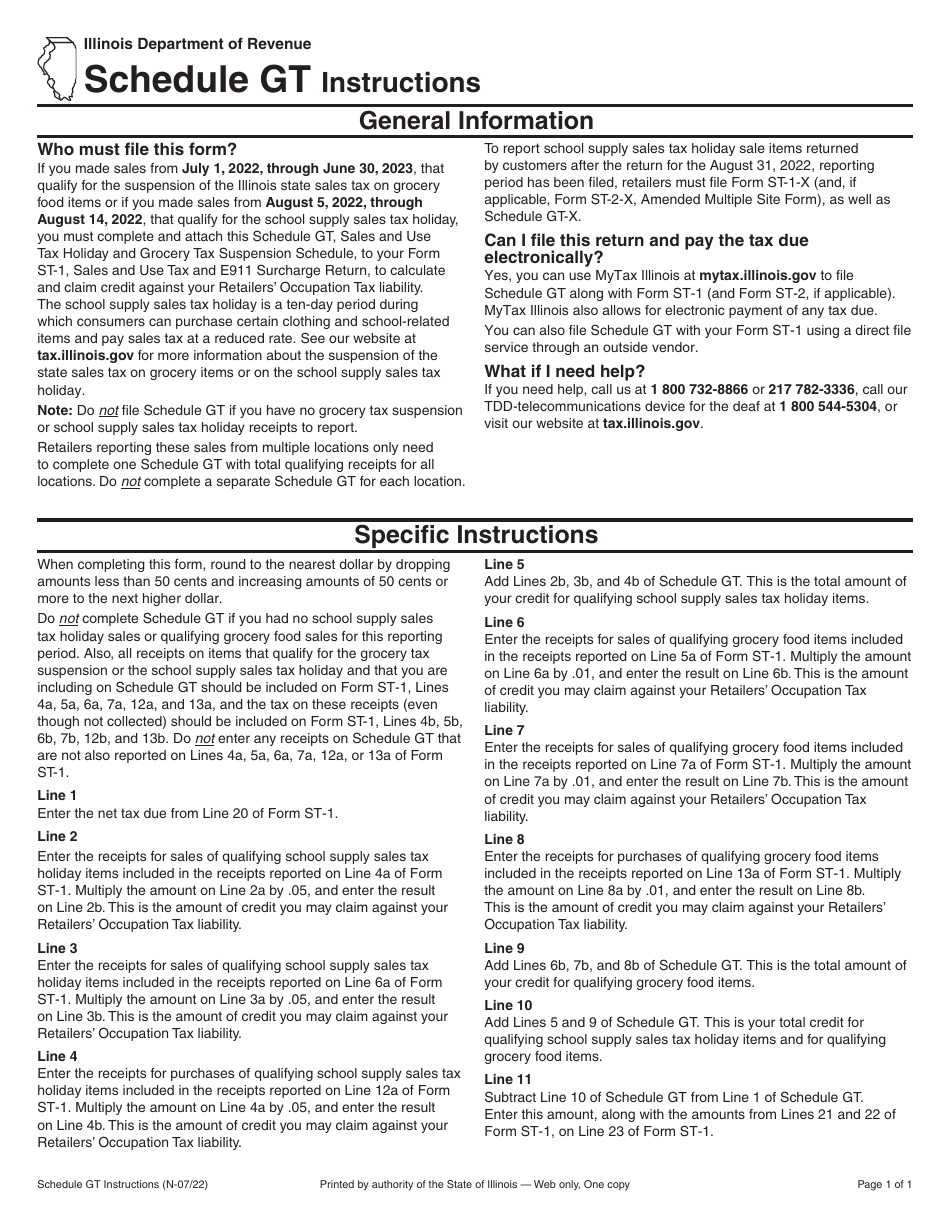

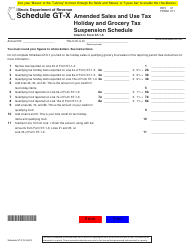

Instructions for Form ST-1, 010 Schedule GT Sales and Use Tax Holiday and Grocery Tax Suspension Schedule - Illinois

This document contains official instructions for Form ST-1 Schedule GT and Form 010 Schedule GT . Both forms are released and collected by the Illinois Department of Revenue. An up-to-date fillable Form ST-1 (010) Schedule GT is available for download through this link.

FAQ

Q: What is Form ST-1?

A: Form ST-1 is a form used in Illinois for reporting and paying sales and use tax.

Q: What is Schedule GT?

A: Schedule GT is a schedule on Form ST-1 used to report sales and use tax exemptions related to sales tax holidays and grocery tax suspensions.

Q: What is a sales tax holiday?

A: A sales tax holiday is a period of time during which certain items are exempt from sales tax.

Q: What is a grocery tax suspension?

A: A grocery tax suspension is a period of time during which the sales tax rate on grocery items is reduced or temporarily eliminated.

Q: Who needs to file Form ST-1 Schedule GT?

A: Retailers in Illinois who participate in sales tax holidays or grocery tax suspensions need to file Form ST-1 Schedule GT.

Q: How often do retailers need to file Schedule GT?

A: Retailers need to file Schedule GT on a monthly basis.

Q: What information is required on Schedule GT?

A: Schedule GT requires retailers to report the total sales amount, taxable amount, and exempt amount for each individual item exempted or subject to reduced tax rates during a sales tax holiday or grocery tax suspension.

Q: When is the deadline for filing Schedule GT?

A: Schedule GT must be filed by the 20th day of the month following the end of the reporting period.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.