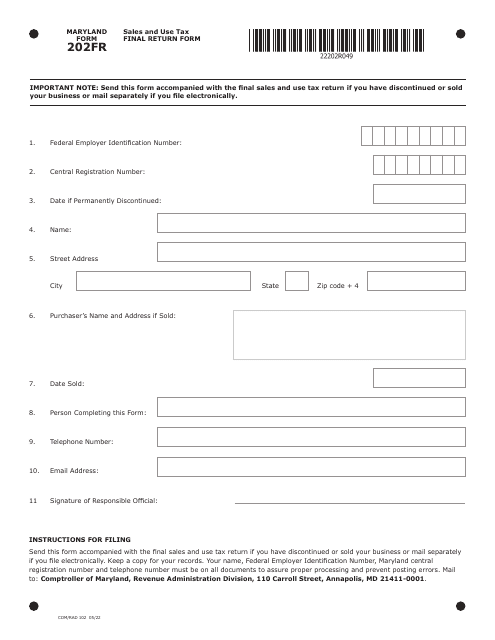

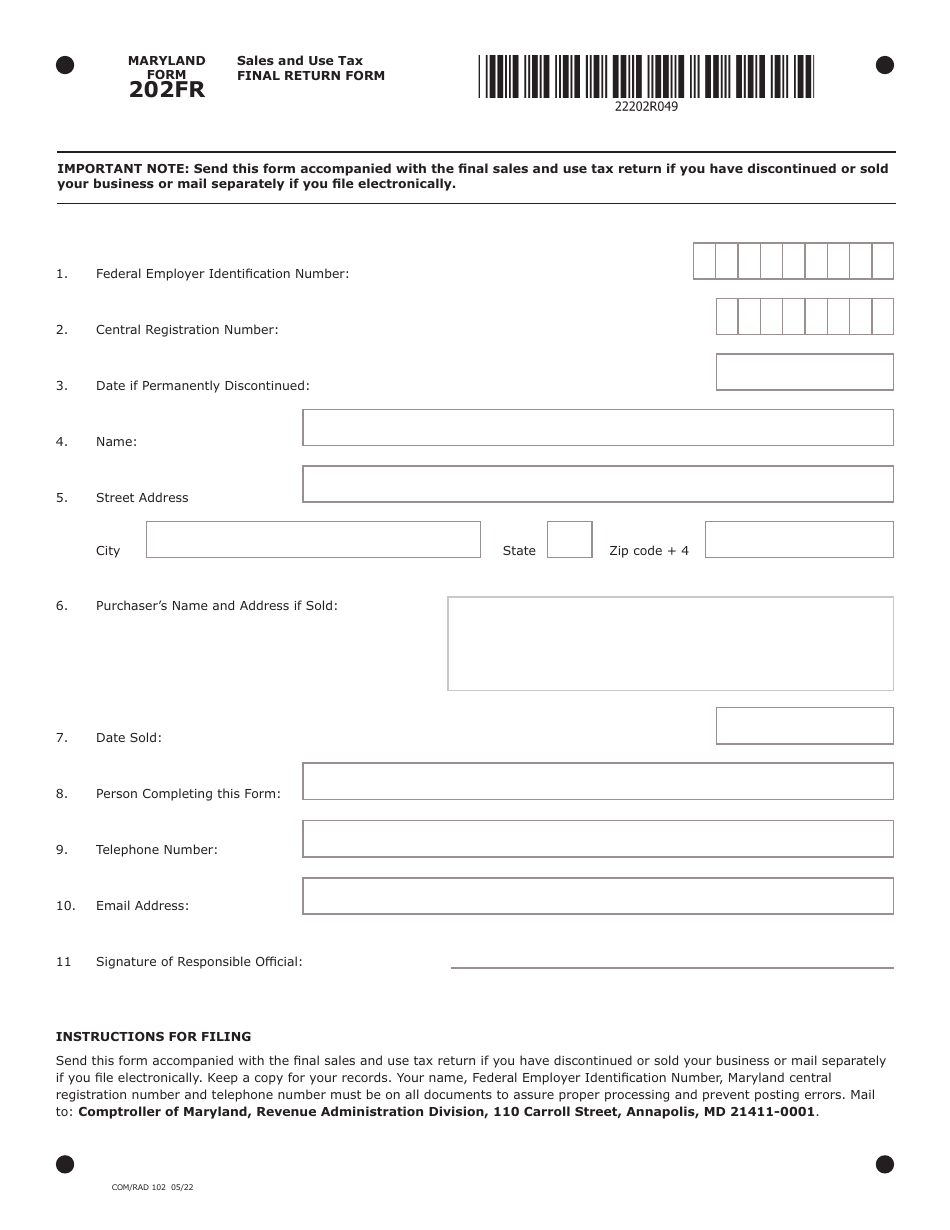

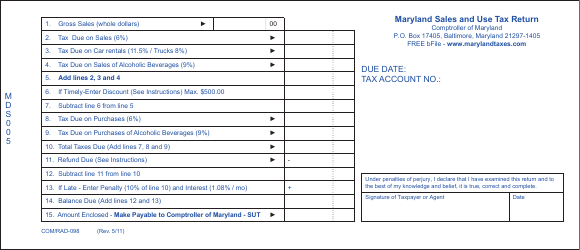

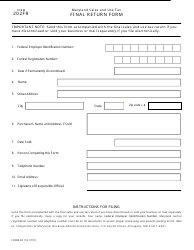

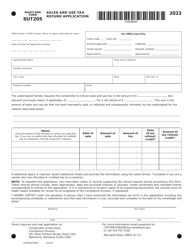

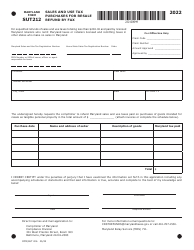

Maryland Form 202FR (COM / RAD102) Sales and Use Tax Final Return Form - Maryland

What Is Maryland Form 202FR (COM/RAD102)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 202FR?

A: Maryland Form 202FR is the Sales and Use TaxFinal Return Form.

Q: Who uses Maryland Form 202FR?

A: Businesses in Maryland that collect sales and use tax use this form to file their final tax return.

Q: What is the purpose of Maryland Form 202FR?

A: The purpose of this form is to report and remit the sales and use tax collected by businesses in Maryland.

Q: When is Maryland Form 202FR due?

A: Maryland Form 202FR is due on the 20th day of the month following the end of the tax period.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 202FR (COM/RAD102) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.