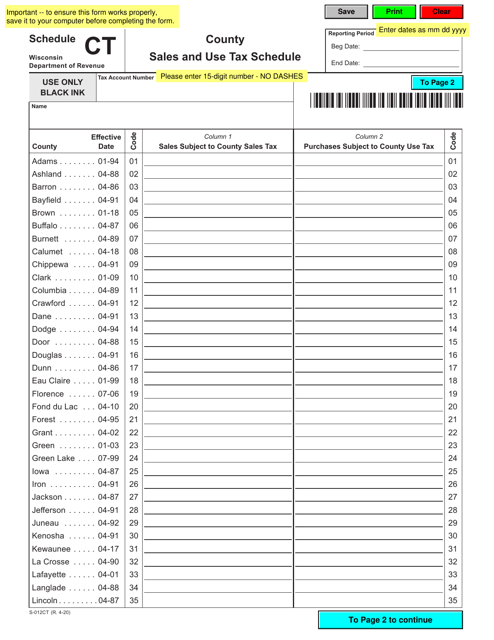

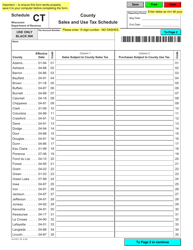

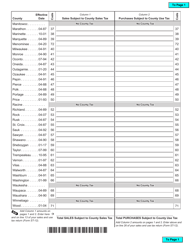

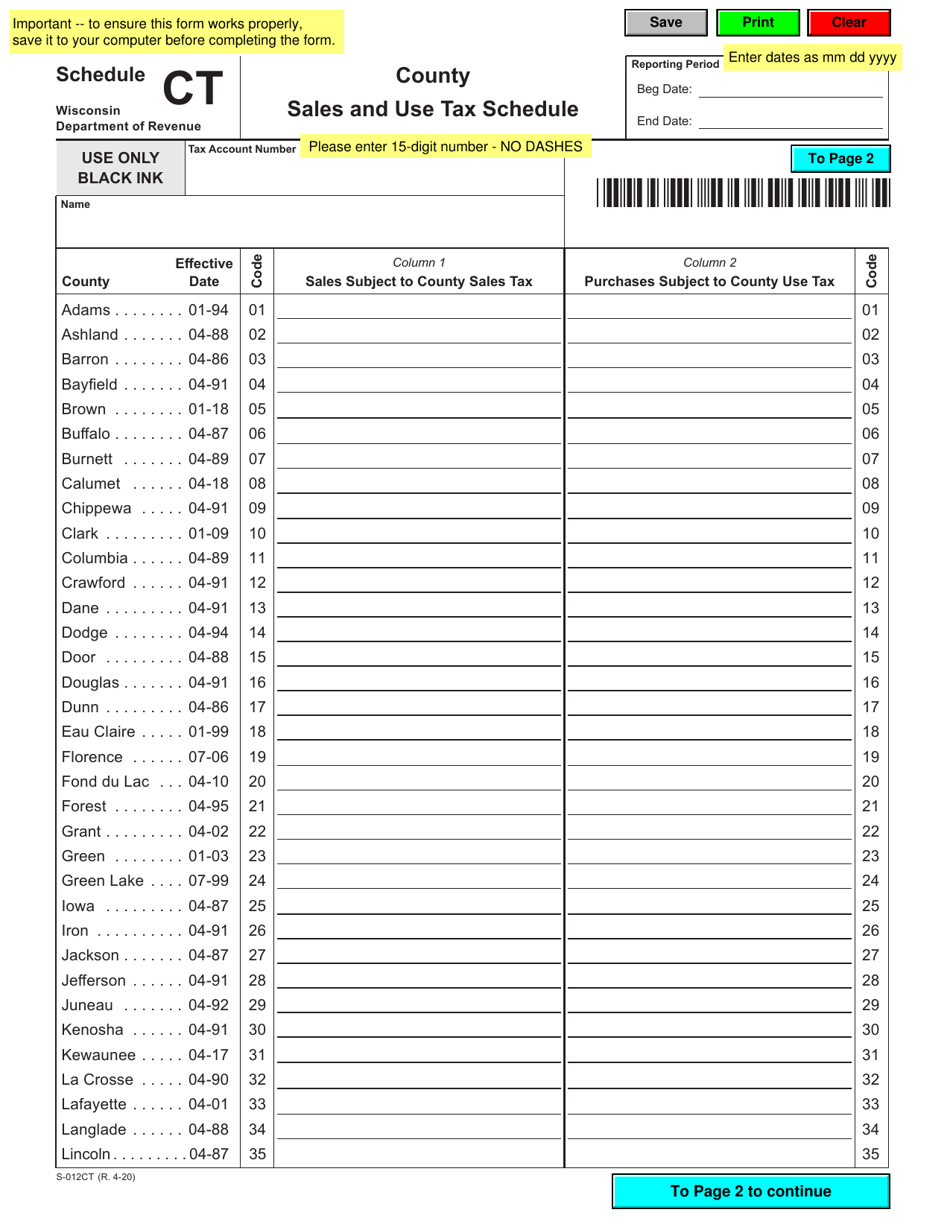

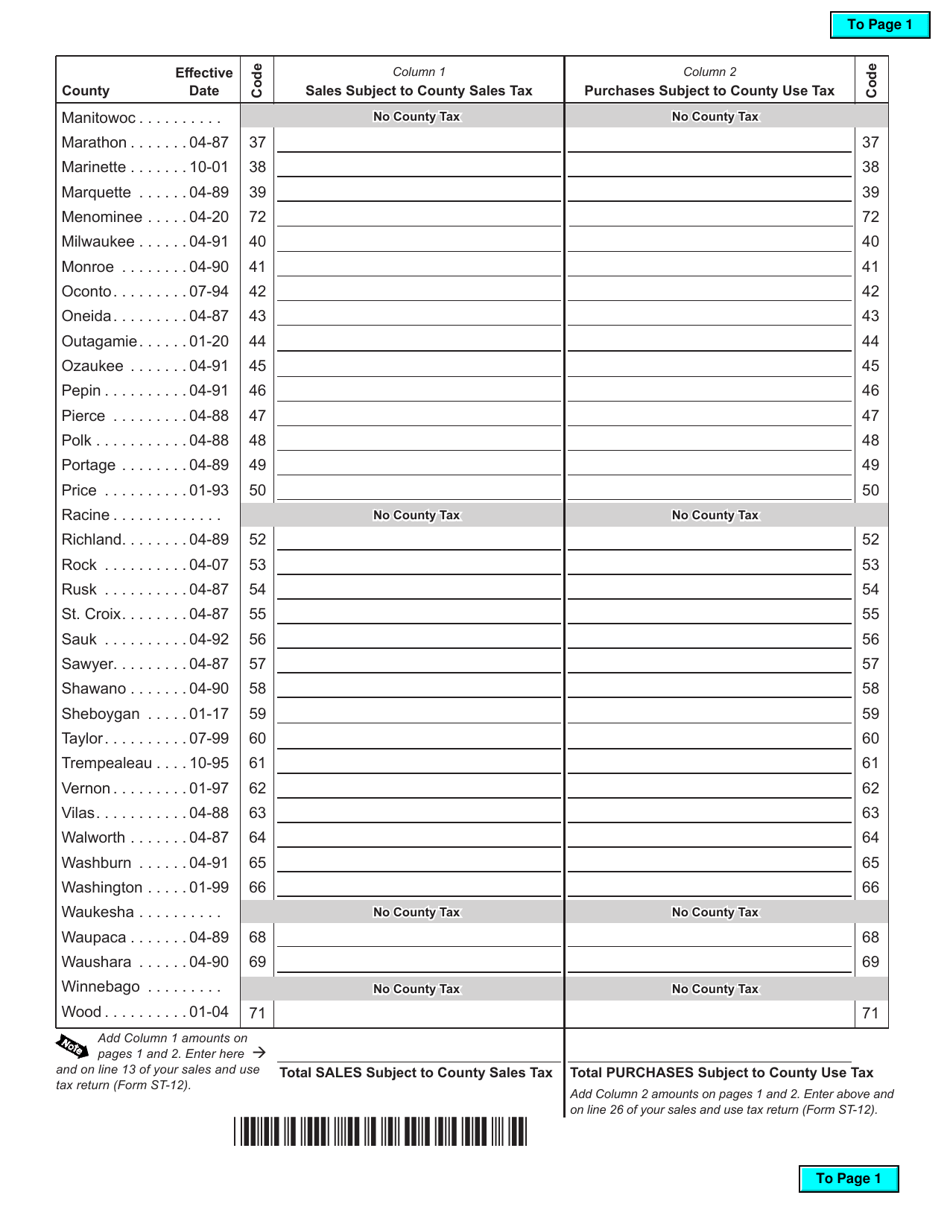

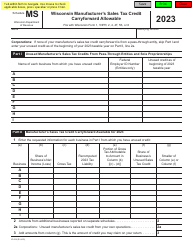

Form S-012CT Schedule CT County Sales and Use Tax Schedule - Wisconsin

What Is Form S-012CT Schedule CT?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-012CT?

A: Form S-012CT is a schedule used in Wisconsin to report county sales and use taxes.

Q: What is Schedule CT?

A: Schedule CT is a specific section of Form S-012CT that is used to report county sales and use taxes.

Q: What is County Sales and Use Tax?

A: County sales and use tax is a tax imposed by counties in Wisconsin on the retail sales, rentals, and other taxable transactions that occur within their jurisdiction.

Q: Why do I need to file Schedule CT?

A: You need to file Schedule CT if you have collected county sales and use tax during the reporting period.

Q: How do I complete Schedule CT?

A: To complete Schedule CT, you need to provide information about the county or counties where you collected sales and use tax, the tax rate for each county, and the total tax collected.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S-012CT Schedule CT by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.