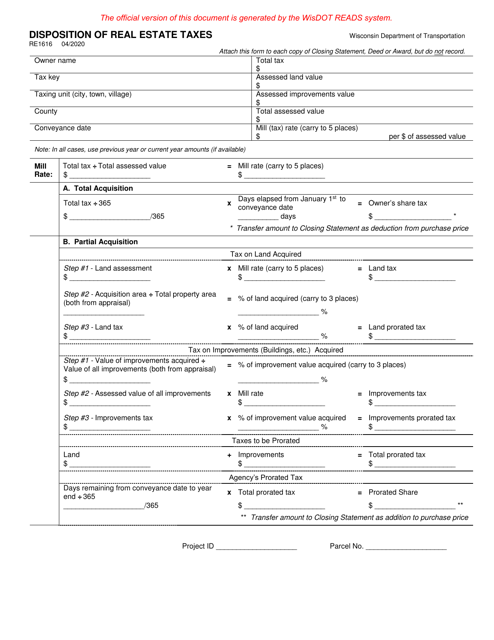

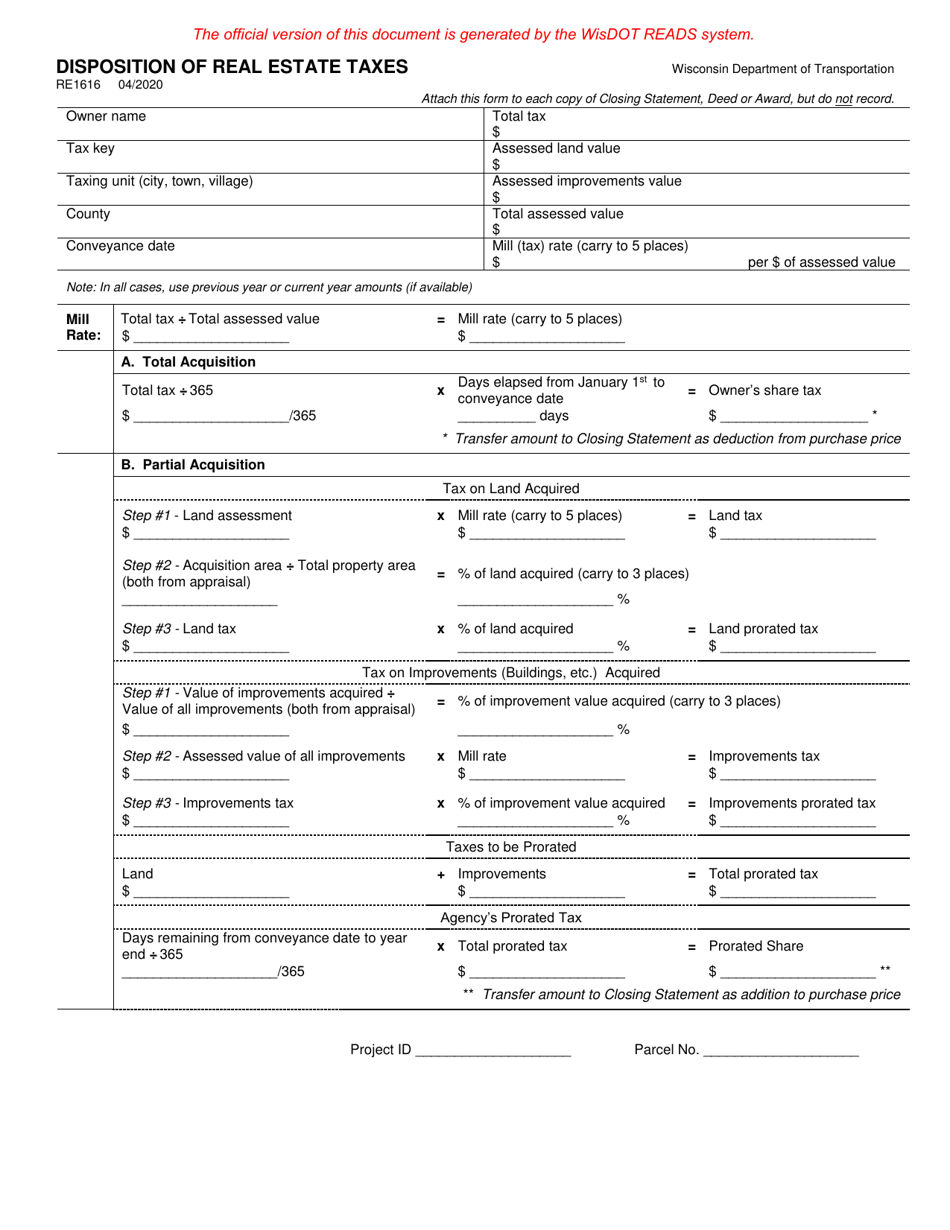

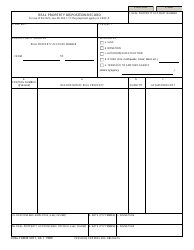

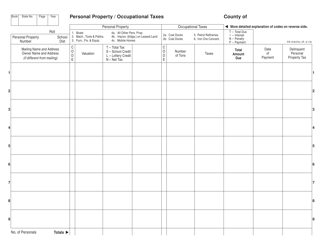

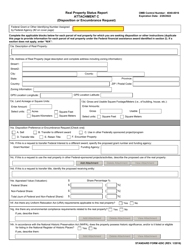

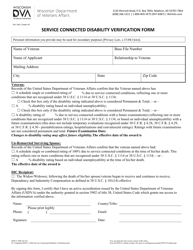

Form RE1616 Disposition of Real Estate Taxes - Wisconsin

What Is Form RE1616?

This is a legal form that was released by the Wisconsin Department of Transportation - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RE1616?

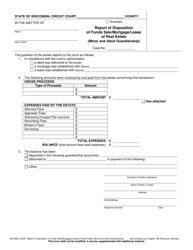

A: Form RE1616 is a document used in Wisconsin to report the disposition of real estate taxes.

Q: Who needs to use Form RE1616?

A: Property owners in Wisconsin who have paid or received real estate taxes need to use Form RE1616.

Q: What is the purpose of Form RE1616?

A: The purpose of Form RE1616 is to report and document the payment or receipt of real estate taxes in Wisconsin.

Q: What information is required on Form RE1616?

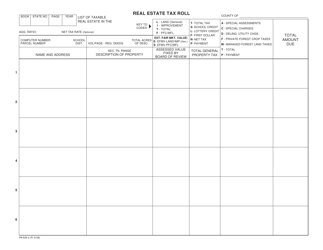

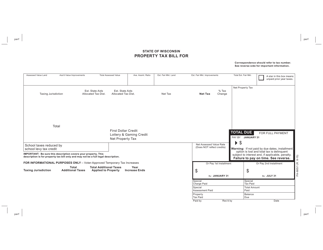

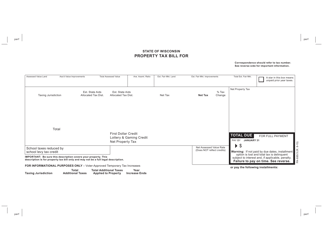

A: Form RE1616 requires information such as the property address, the amount of taxes paid or received, and the parties involved in the transaction.

Q: Is Form RE1616 mandatory?

A: Yes, property owners in Wisconsin who paid or received real estate taxes are required to report the disposition of those taxes using Form RE1616.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Wisconsin Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RE1616 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Transportation.