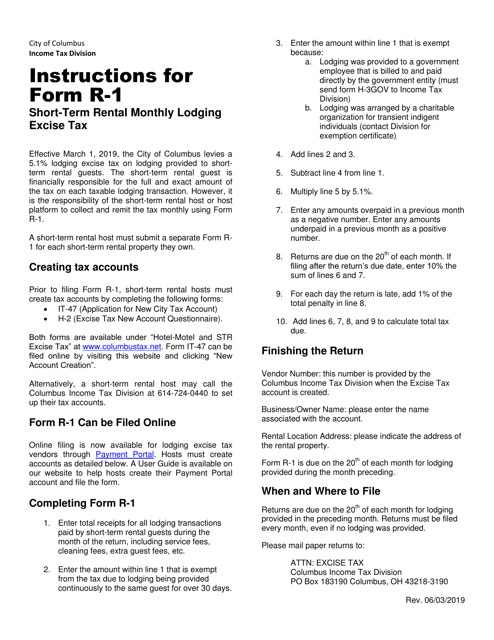

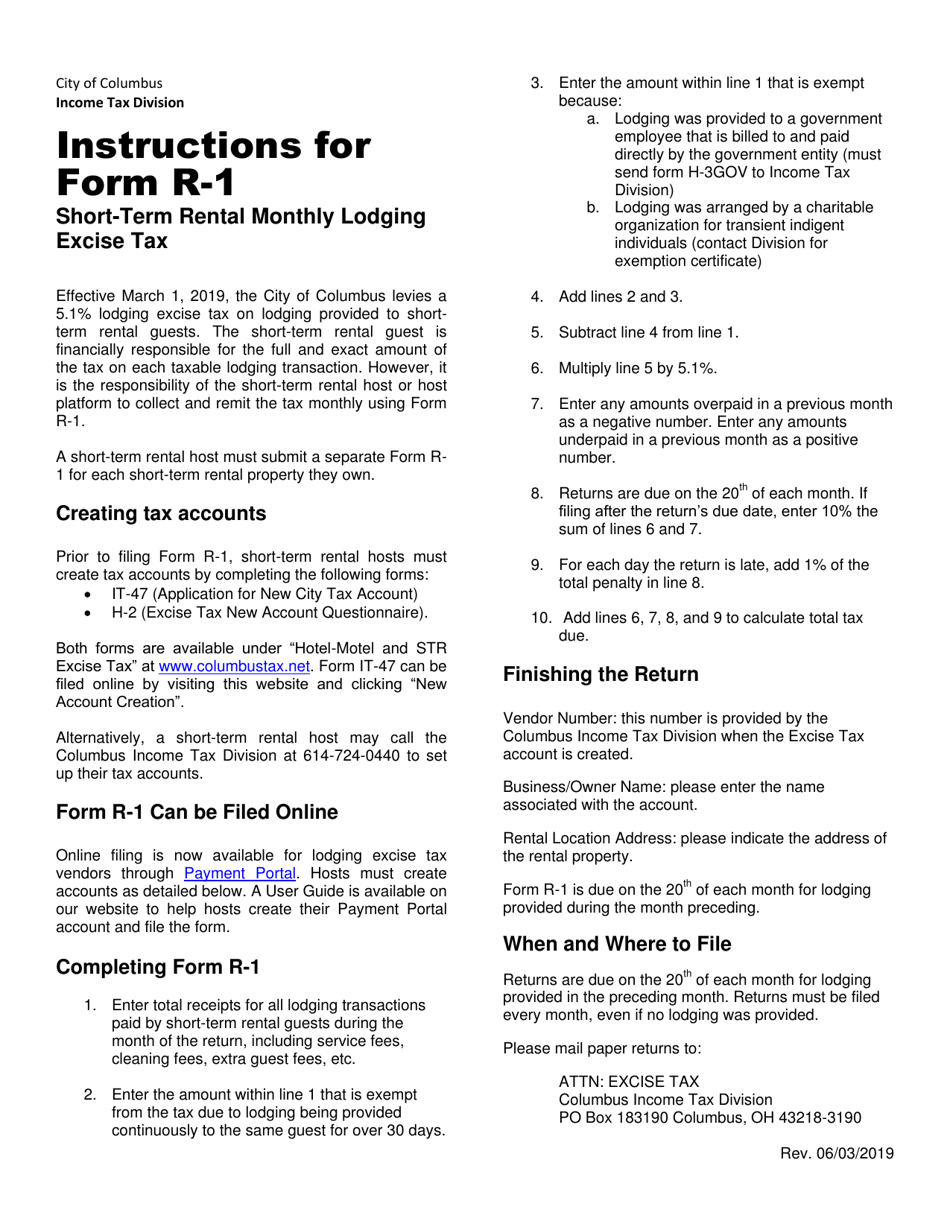

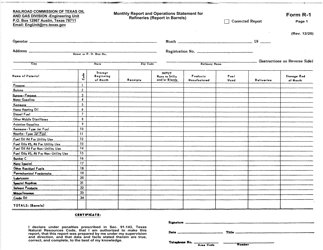

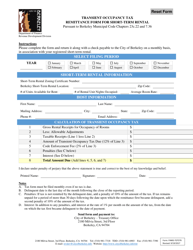

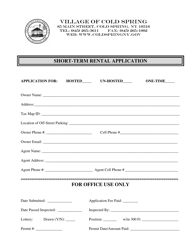

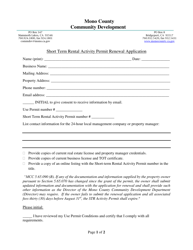

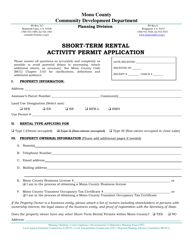

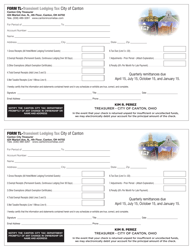

Instructions for Form R-1 Short-Term Rental Monthly Lodging Excise Tax - City of Columbus, Ohio

This document contains official instructions for Form R-1 , Short-Term Rental Monthly Lodging Excise Tax - a form released and collected by the Office of the City Auditor - City of Columbus, Ohio.

FAQ

Q: What is Form R-1?

A: Form R-1 is the form used for reporting and paying the monthly lodging excise tax for short-term rentals in the City of Columbus, Ohio.

Q: What is the purpose of Form R-1?

A: The purpose of Form R-1 is to report and pay the monthly lodging excise tax on short-term rentals in Columbus, Ohio.

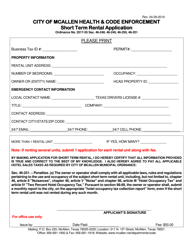

Q: Who needs to file Form R-1?

A: Owners or operators of short-term rental properties in the City of Columbus, Ohio need to file Form R-1.

Q: What is the lodging excise tax?

A: The lodging excise tax is a tax imposed on short-term rentals in the City of Columbus, Ohio.

Q: How often do I need to file Form R-1?

A: Form R-1 needs to be filed and the tax needs to be paid on a monthly basis.

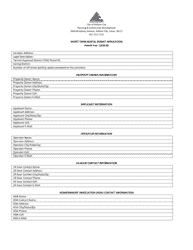

Q: What information do I need to provide on Form R-1?

A: You will need to provide information about the rental property, the number of nights rented, and the total amount of rent collected.

Q: How do I file Form R-1?

A: Form R-1 can be filed electronically or by mail.

Q: When is the deadline for filing Form R-1?

A: Form R-1 and the tax payment must be submitted on or before the 20th day of the month following the end of the reporting month.

Q: Are there any penalties for late filing or non-payment?

A: Yes, there are penalties for late filing or non-payment, including interest charges and potential legal action.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Office of the City Auditor - City of Columbus, Ohio.