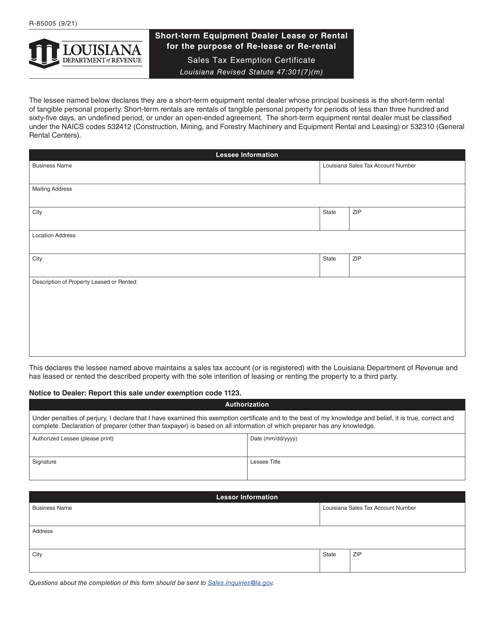

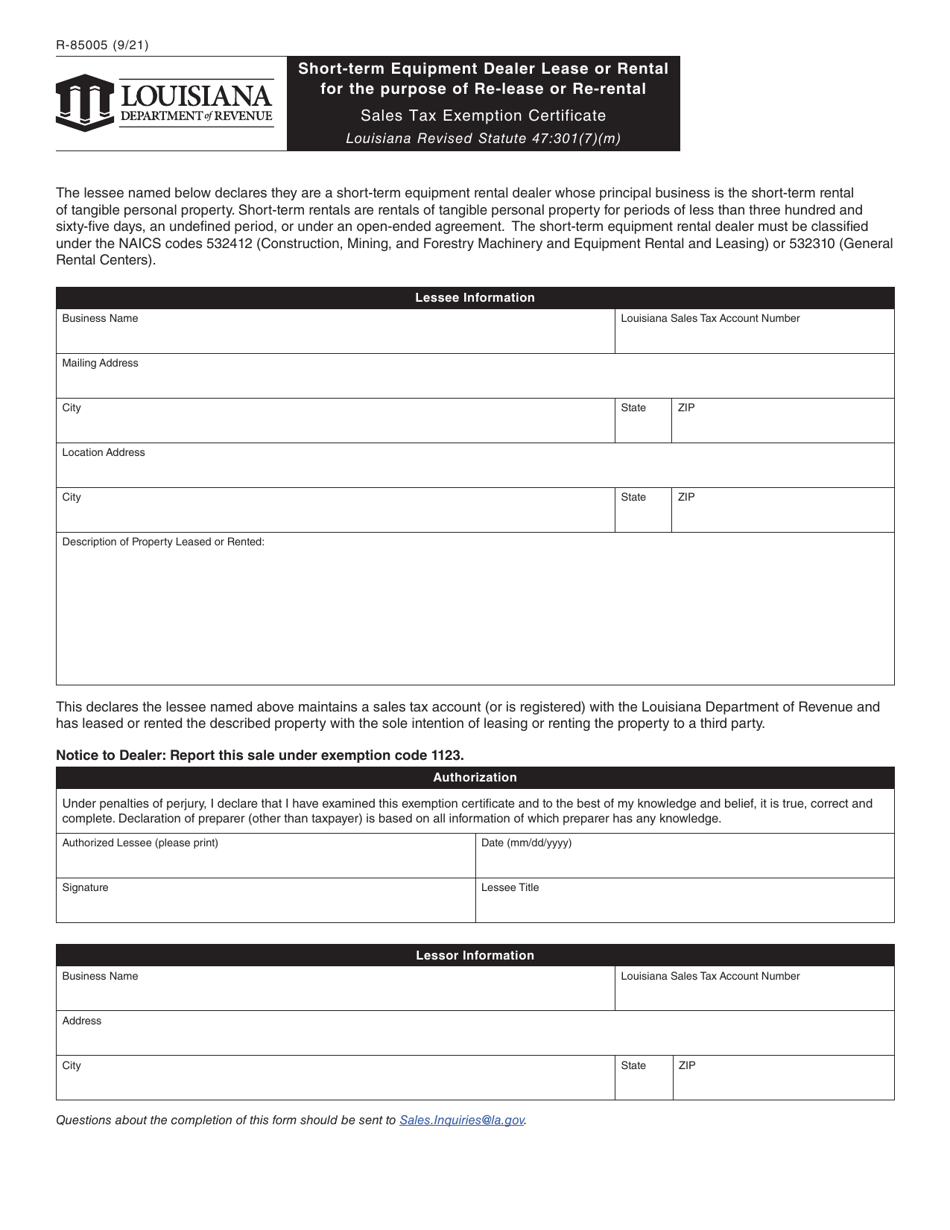

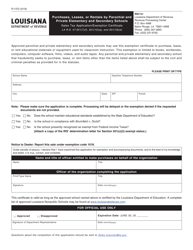

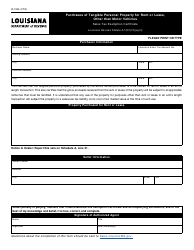

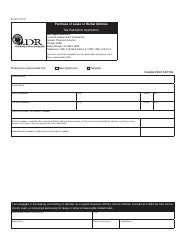

Form R-85005 Short-Term Equipment Dealer Lease or Rental for the Purpose of Re-lease or Re-rental Sales Tax Exemption Certificate - Louisiana

What Is Form R-85005?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-85005?

A: Form R-85005 is a Short-Term Equipment Dealer Lease or Rental for the Purpose of Re-lease or Re-rental Sales Tax Exemption Certificate in Louisiana.

Q: What is the purpose of Form R-85005?

A: The purpose of Form R-85005 is to claim a sales tax exemption for short-term equipment dealer leases or rentals in Louisiana when the equipment will be re-leased or re-rented.

Q: Who can use Form R-85005?

A: Equipment dealers or lessors in Louisiana can use Form R-85005 to claim a sales tax exemption for short-term equipment leases or rentals that will be re-leased or re-rented.

Q: What equipment is covered by Form R-85005?

A: Form R-85005 covers short-term equipment leases or rentals in Louisiana that are intended for re-lease or re-rental.

Q: Is there a deadline for submitting Form R-85005?

A: There is no specific deadline for submitting Form R-85005, but it must be kept on file for at least four years.

Q: Are there any exemptions or special circumstances for using Form R-85005?

A: Yes, Form R-85005 cannot be used for leases or rentals longer than 180 days, and certain conditions must be met to qualify for the sales tax exemption.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-85005 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.