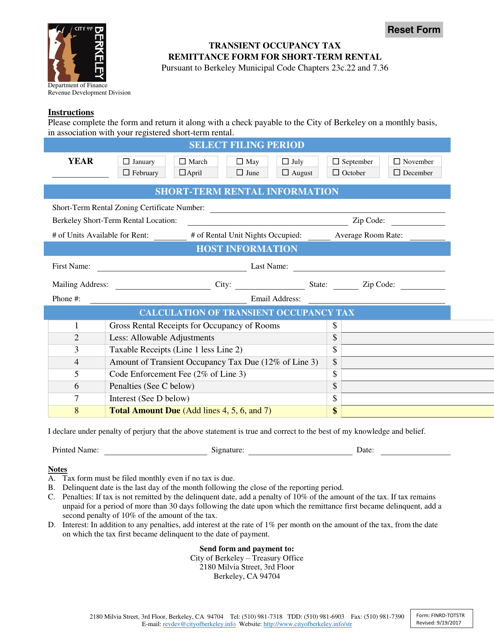

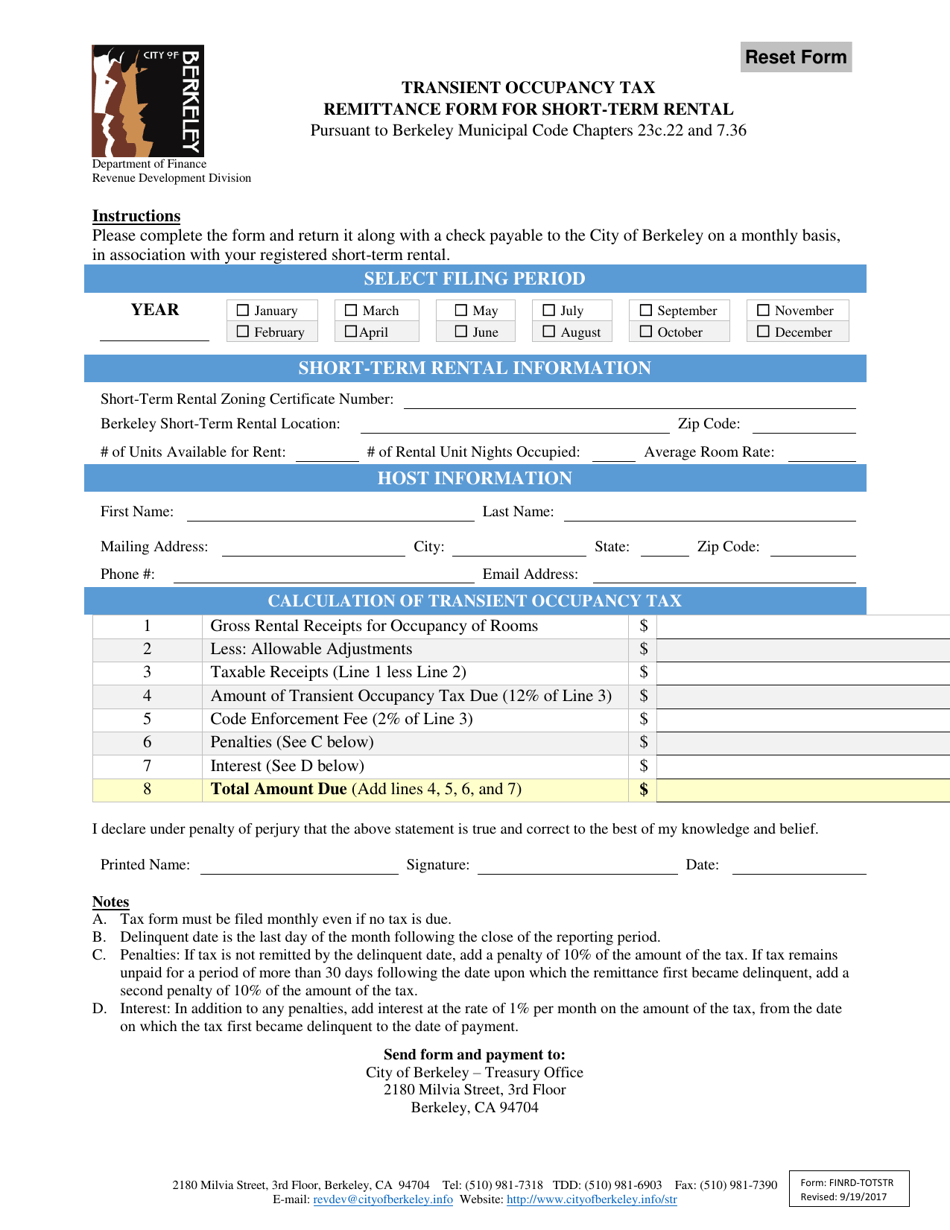

Form FINRD-TOTSTR Transient Occupancy Tax Remittance Form for Short-Term Rental - City of Berkeley, California

What Is Form FINRD-TOTSTR?

This is a legal form that was released by the Finance Department - City of Berkeley, California - a government authority operating within California. The form may be used strictly within City of Berkeley. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FINRD-TOTSTR?

A: FINRD-TOTSTR is the Transient Occupancy Tax Remittance Form for Short-Term Rental.

Q: Who needs to fill out FINRD-TOTSTR?

A: Anyone who operates a short-term rental in the City of Berkeley, California needs to fill out FINRD-TOTSTR.

Q: What is the purpose of FINRD-TOTSTR?

A: The purpose of FINRD-TOTSTR is to remit the Transient Occupancy Tax for short-term rentals in Berkeley, California.

Q: What information do I need to fill out FINRD-TOTSTR?

A: You will need to provide information about your short-term rental, including the number of nights rented and the rental income.

Q: When is the deadline to submit FINRD-TOTSTR?

A: The deadline to submit FINRD-TOTSTR and remit the Transient Occupancy Tax is typically on a quarterly basis.

Q: What happens if I do not submit FINRD-TOTSTR?

A: Failure to submit FINRD-TOTSTR and remit the Transient Occupancy Tax may result in penalties and fines from the City of Berkeley, California.

Q: Are there any exemptions or deductions available for the Transient Occupancy Tax?

A: It is best to consult with the City of Berkeley, California or a tax professional to determine if there are any exemptions or deductions available for the Transient Occupancy Tax.

Form Details:

- Released on September 19, 2017;

- The latest edition provided by the Finance Department - City of Berkeley, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FINRD-TOTSTR by clicking the link below or browse more documents and templates provided by the Finance Department - City of Berkeley, California.