Form TL Transient Lodging Excise Tax Form - City of Canton, Ohio

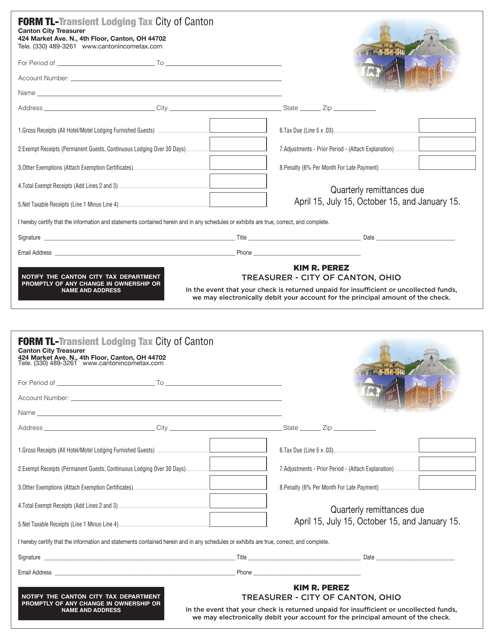

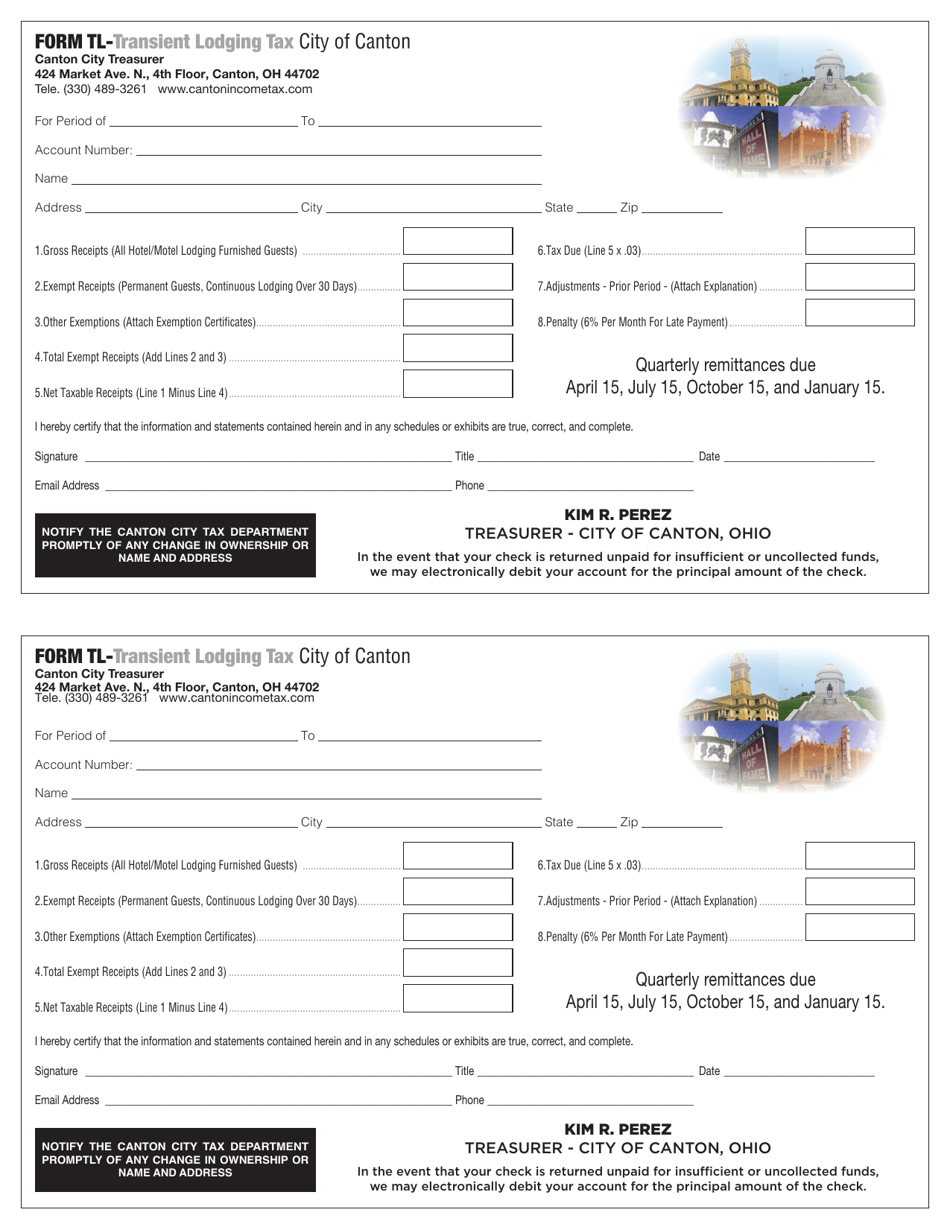

What Is Form TL?

This is a legal form that was released by the Treasury Department - City of Canton, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Canton. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TL Transient Lodging Excise Tax Form?

A: The TL Transient Lodging Excise Tax Form is a tax form used to report and pay the transient lodging excise tax in the City of Canton, Ohio.

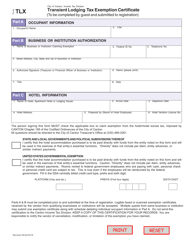

Q: Who needs to file the TL Transient Lodging Excise Tax Form?

A: Any person or business that operates a transient lodging establishment in the City of Canton, Ohio needs to file this form.

Q: What is transient lodging?

A: Transient lodging refers to any facility that provides lodging accommodations for periods of less than 30 consecutive days, such as hotels, motels, bed and breakfasts, and vacation rentals.

Q: What is the transient lodging excise tax used for?

A: The transient lodging excise tax is used to fund various city services and projects, such as tourism promotion, infrastructure improvements, and public safety.

Q: When is the TL Transient Lodging Excise Tax Form due?

A: The TL Transient Lodging Excise Tax Form is typically due on a quarterly basis. The specific due dates can be found on the form or by contacting the City of Canton's tax department.

Form Details:

- The latest edition provided by the Treasury Department - City of Canton, Ohio;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TL by clicking the link below or browse more documents and templates provided by the Treasury Department - City of Canton, Ohio.