This version of the form is not currently in use and is provided for reference only. Download this version of

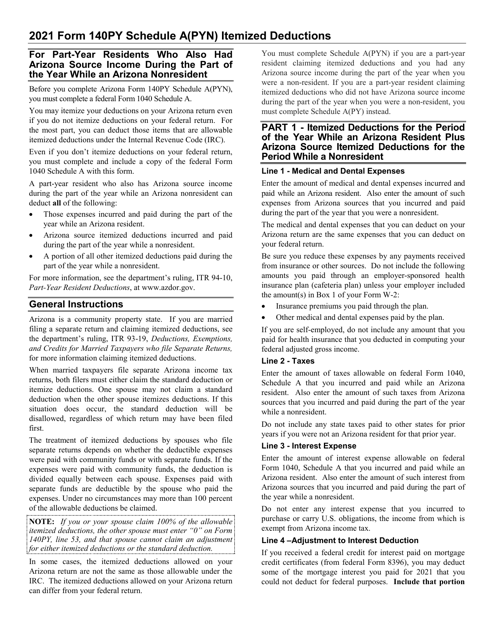

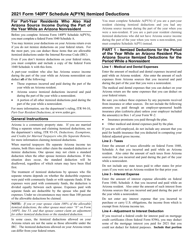

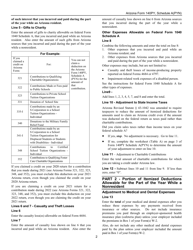

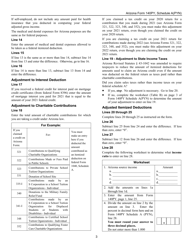

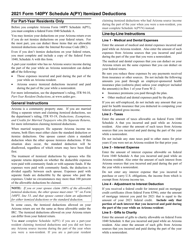

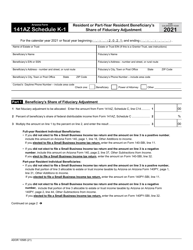

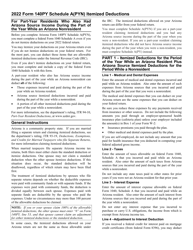

Instructions for Arizona Form 140PY, ADOR10176 Schedule A(PYN)

for the current year.

Instructions for Arizona Form 140PY, ADOR10176 Schedule A(PYN) Itemized Deductions for Part-Year Residents Who Also Had Arizona Source Income During the Period of the Year While a Nonresident - Arizona

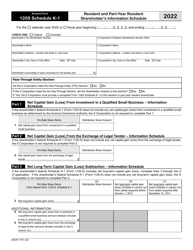

This document contains official instructions for Arizona Form 140PY Schedule A(PYN) and Form ADOR10176 Schedule A(PYN) . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

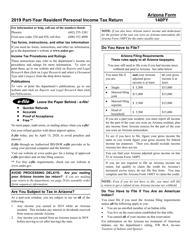

Q: What is Arizona Form 140PY?

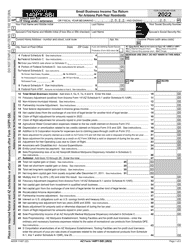

A: Arizona Form 140PY is a tax form for part-year residents who had Arizona source income during the year while they were nonresidents.

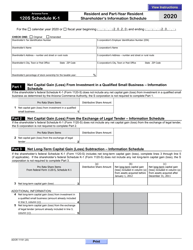

Q: What is ADOR10176 Schedule A(PYN)?

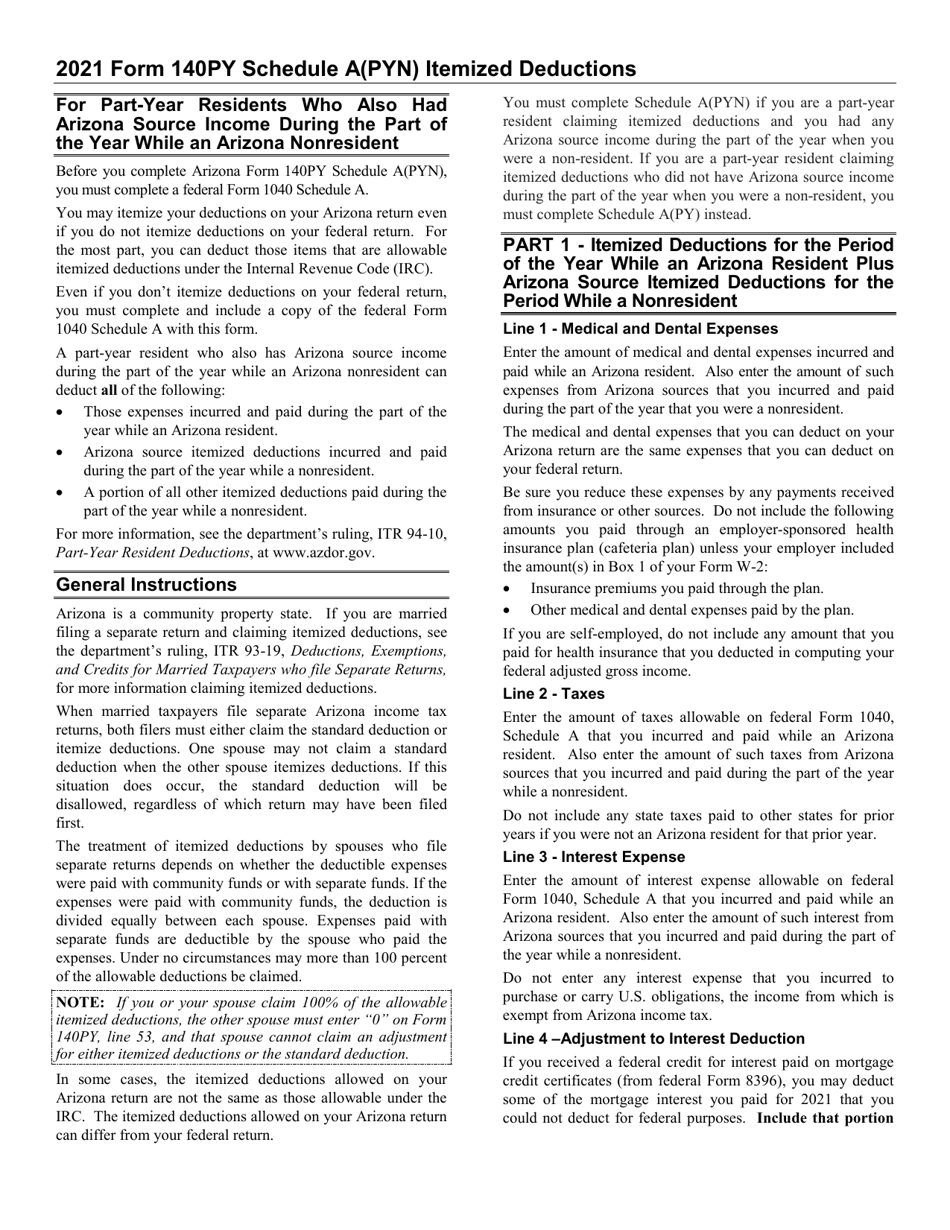

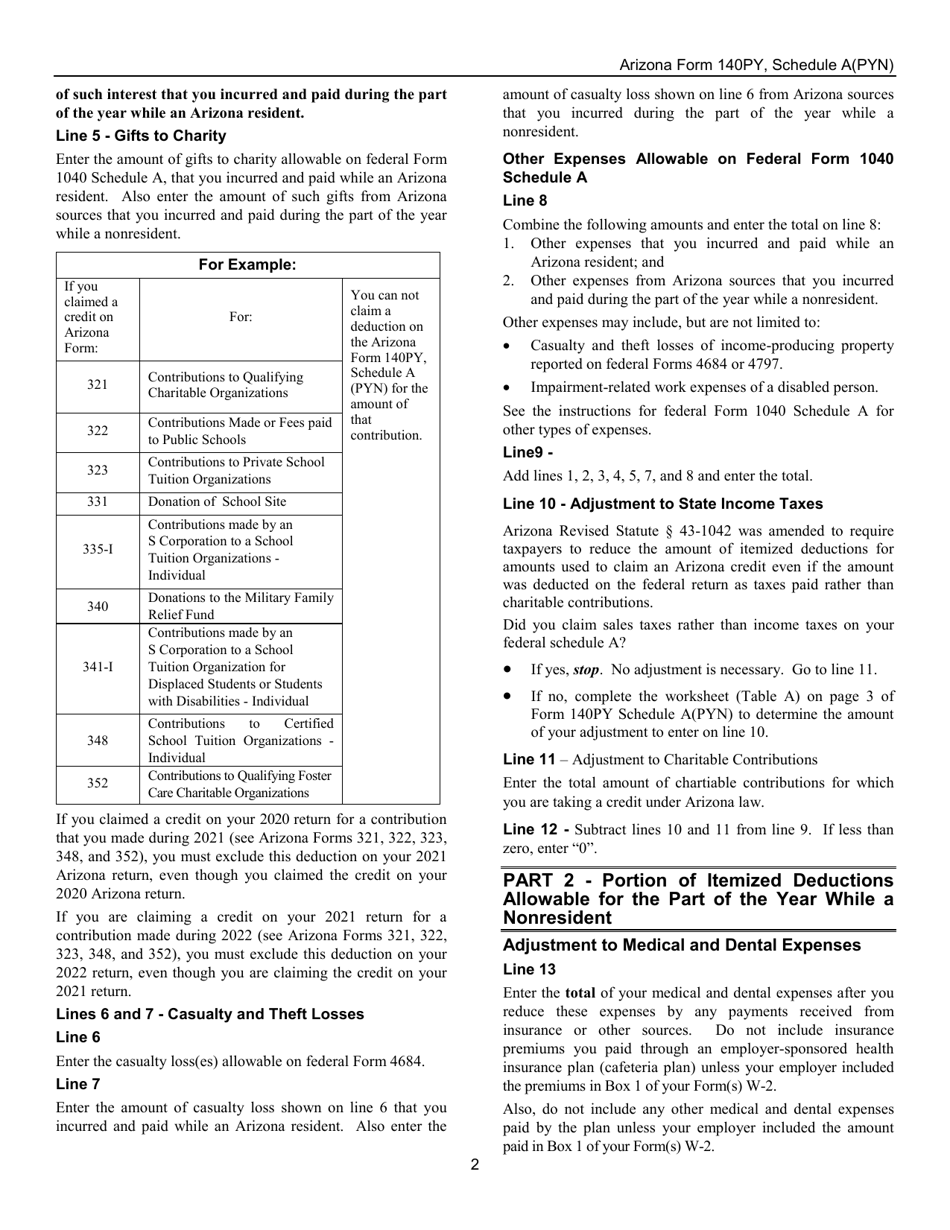

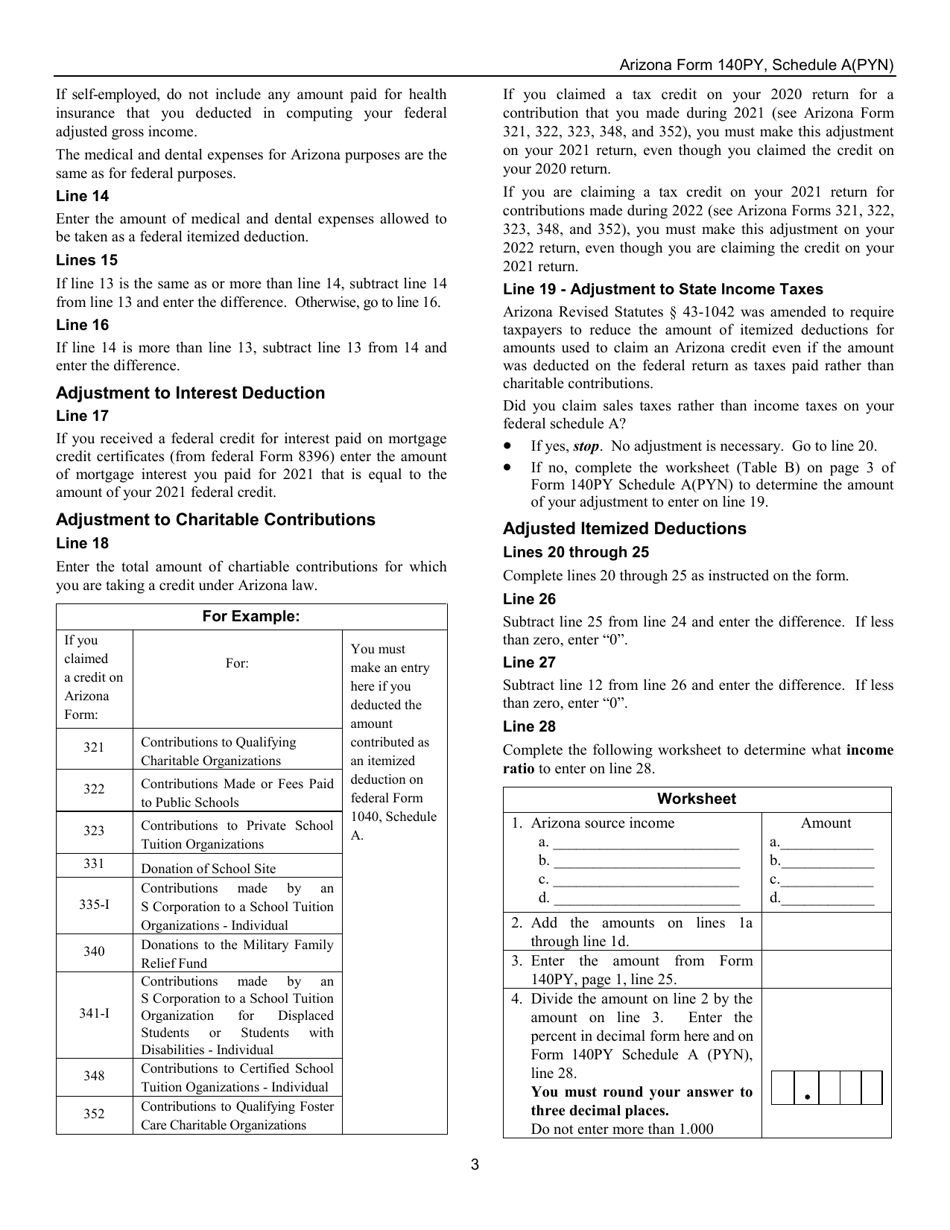

A: ADOR10176 Schedule A(PYN) is a schedule that needs to be filled out along with the Arizona Form 140PY. It is used for reporting itemized deductions for part-year residents with Arizona source income.

Q: Who needs to fill out Arizona Form 140PY?

A: Part-year residents who had Arizona source income during the year while they were nonresidents need to fill out Arizona Form 140PY.

Q: What is the purpose of Arizona Form 140PY?

A: The purpose of Arizona Form 140PY is to report income and calculate tax liability for part-year residents with Arizona source income.

Q: What are itemized deductions?

A: Itemized deductions are deductions that reduce your taxable income based on specific expenses you incurred during the tax year, such as medical expenses, mortgage interest, and charitable contributions.

Q: What is the period of the year while a nonresident?

A: The period of the year while a nonresident refers to the time during the tax year when the individual was not a resident of Arizona.

Q: What is Arizona source income?

A: Arizona source income refers to income earned or received from sources within the state of Arizona, such as wages, salaries, and self-employment income.

Q: What information is required on ADOR10176 Schedule A(PYN)?

A: ADOR10176 Schedule A(PYN) requires information about your itemized deductions, such as medical expenses, mortgage interest, property taxes, and charitable contributions.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.