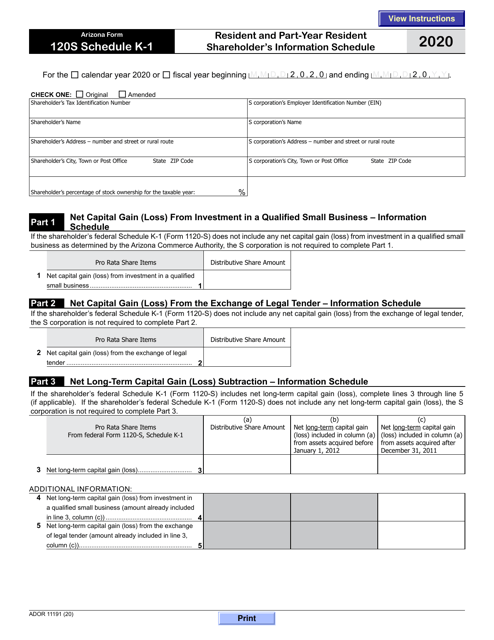

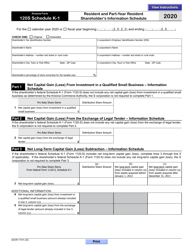

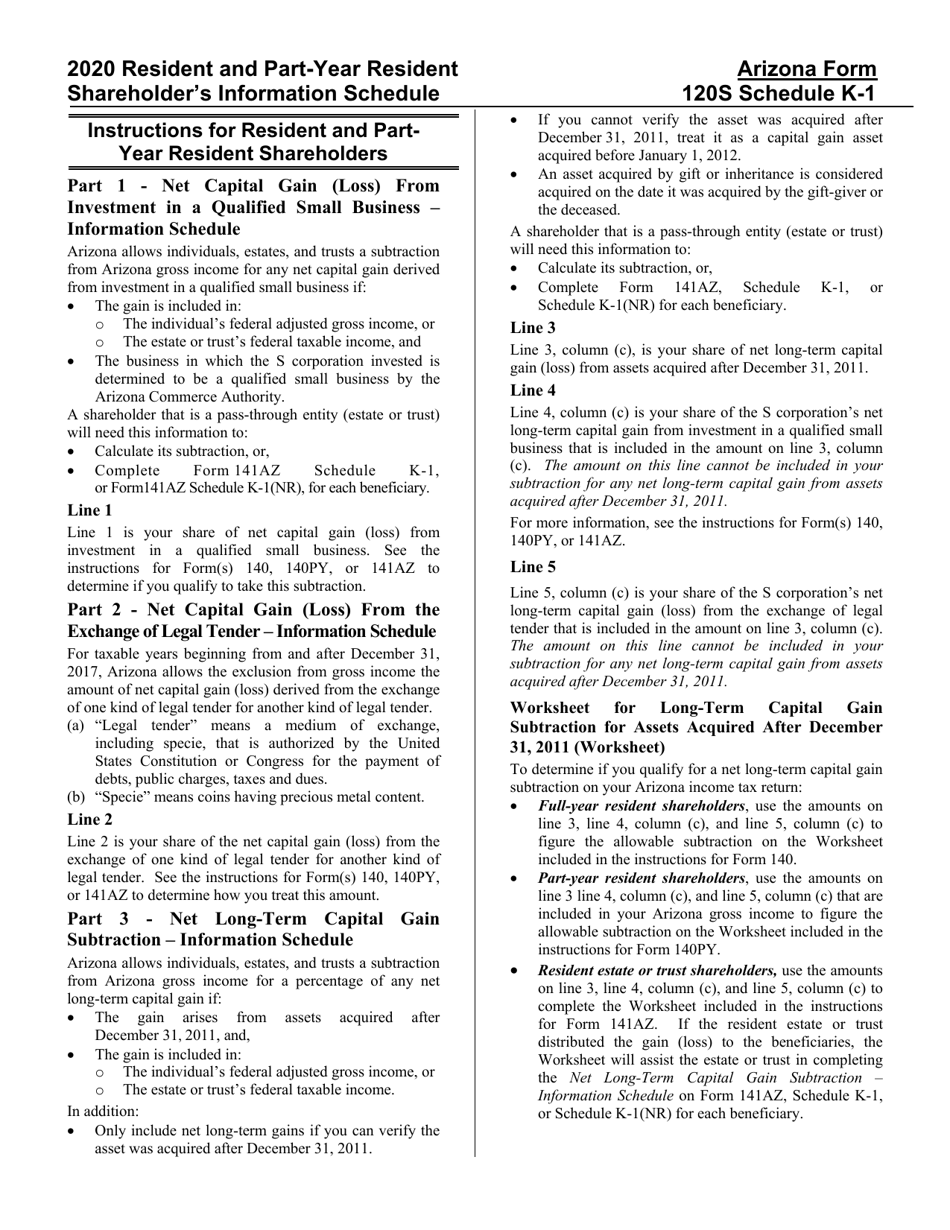

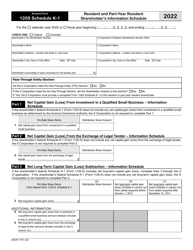

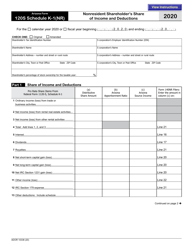

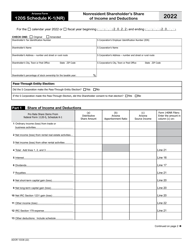

Arizona Form 120S (ADOR11191) Schedule K-1 Resident and Part-Year Resident Shareholder's Information Schedule - Arizona

What Is Arizona Form 120S (ADOR11191) Schedule K-1?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 120S?

A: Arizona Form 120S is a tax form used by residents and part-year residents in Arizona.

Q: What is the purpose of Arizona Form 120S?

A: The purpose of Arizona Form 120S is to provide information about the income, deductions, and credits for shareholders who are residents or part-year residents in Arizona.

Q: Who needs to file Arizona Form 120S?

A: Residents and part-year residents who are shareholders in an S-corporation need to file Arizona Form 120S.

Q: What information is required on Arizona Form 120S?

A: Arizona Form 120S requires shareholders to provide information about their income, deductions, and credits.

Q: When is the deadline to file Arizona Form 120S?

A: The deadline to file Arizona Form 120S is the same as the deadline for filing your Arizona individual income tax return, which is generally April 15th.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 120S (ADOR11191) Schedule K-1 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.