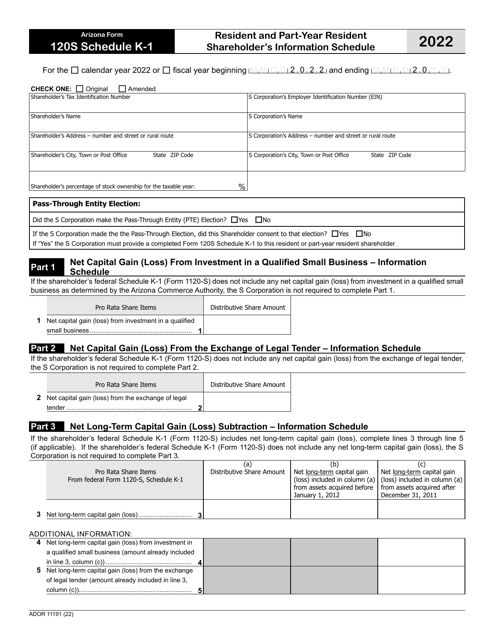

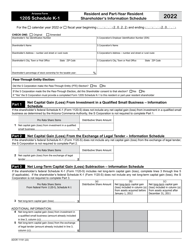

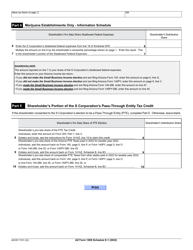

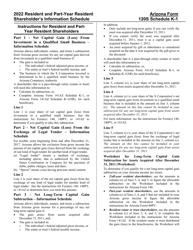

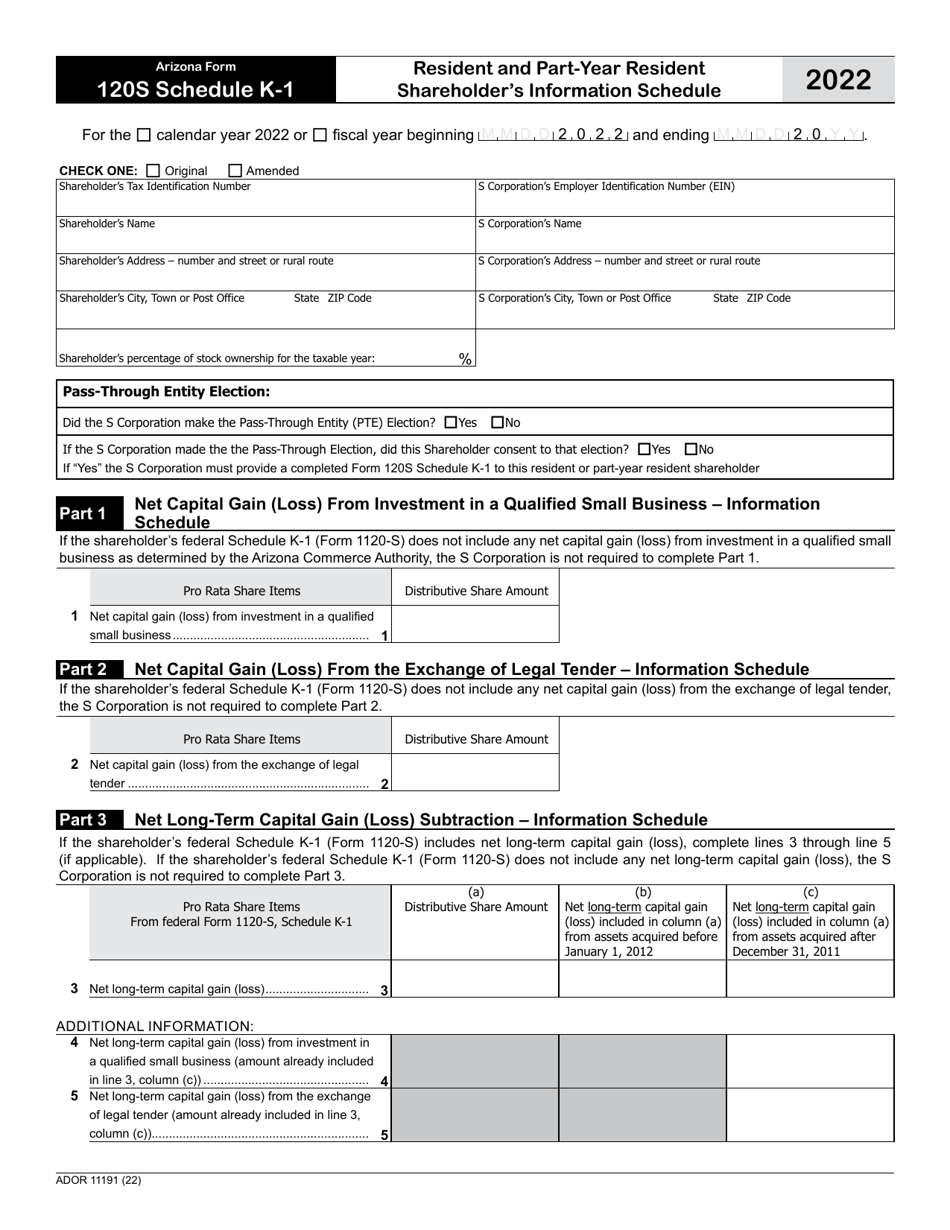

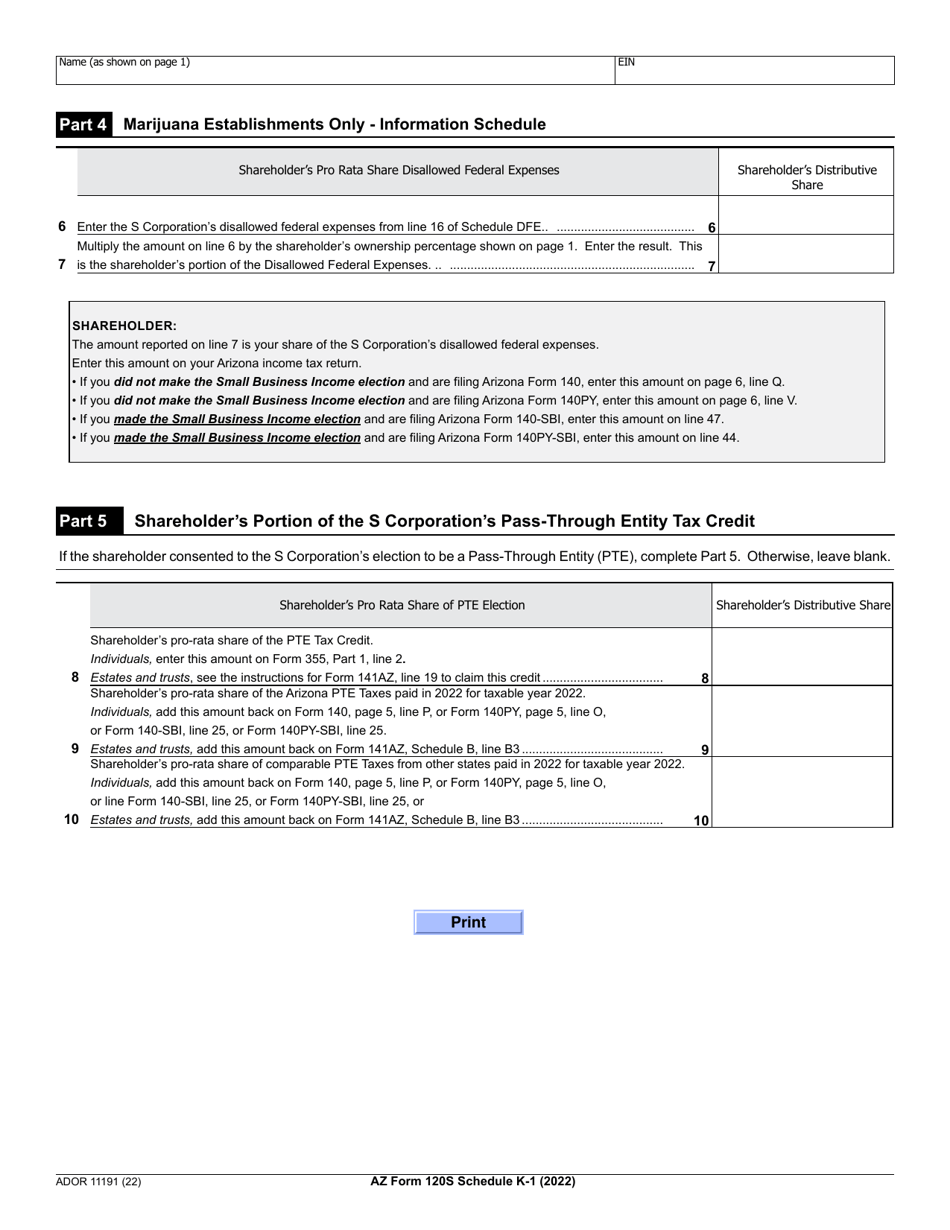

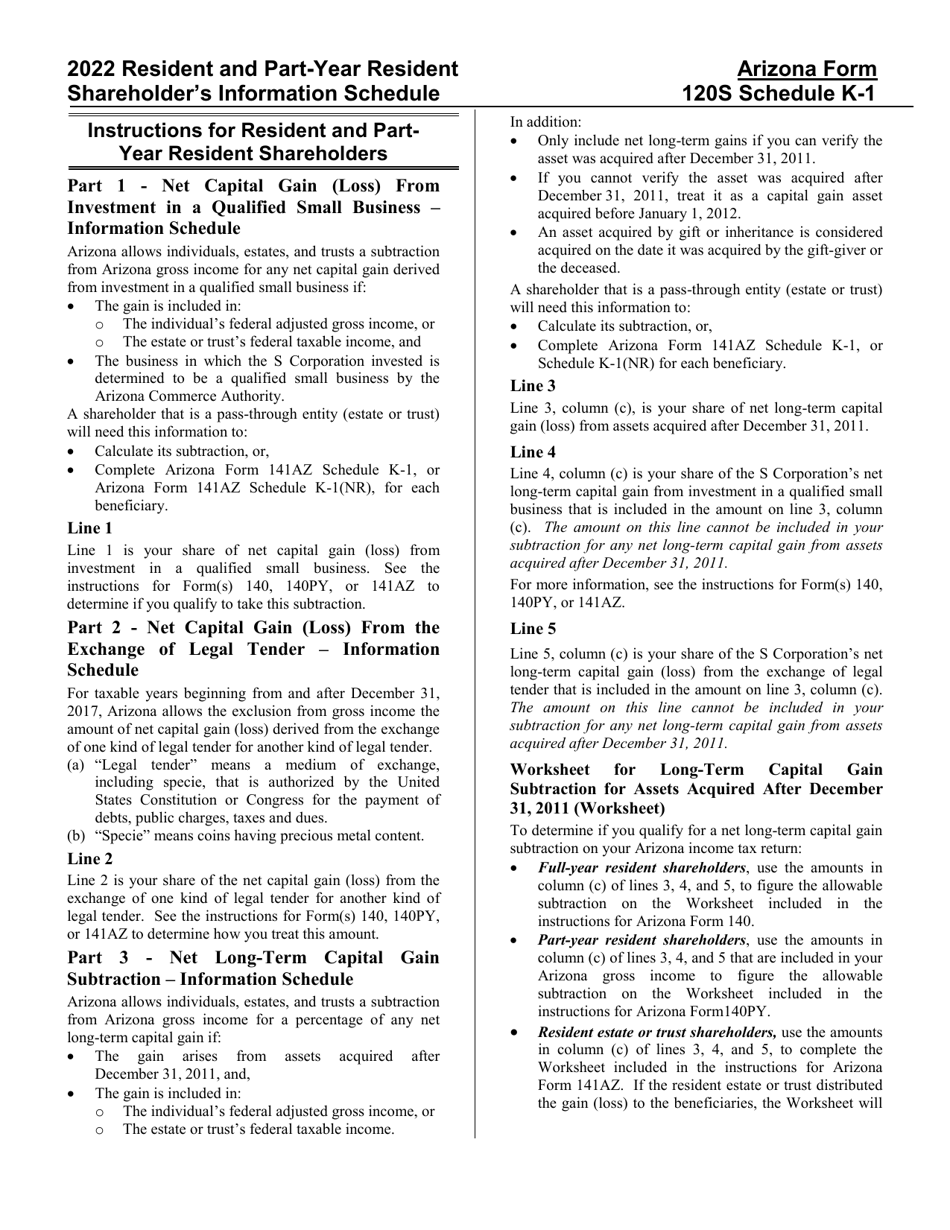

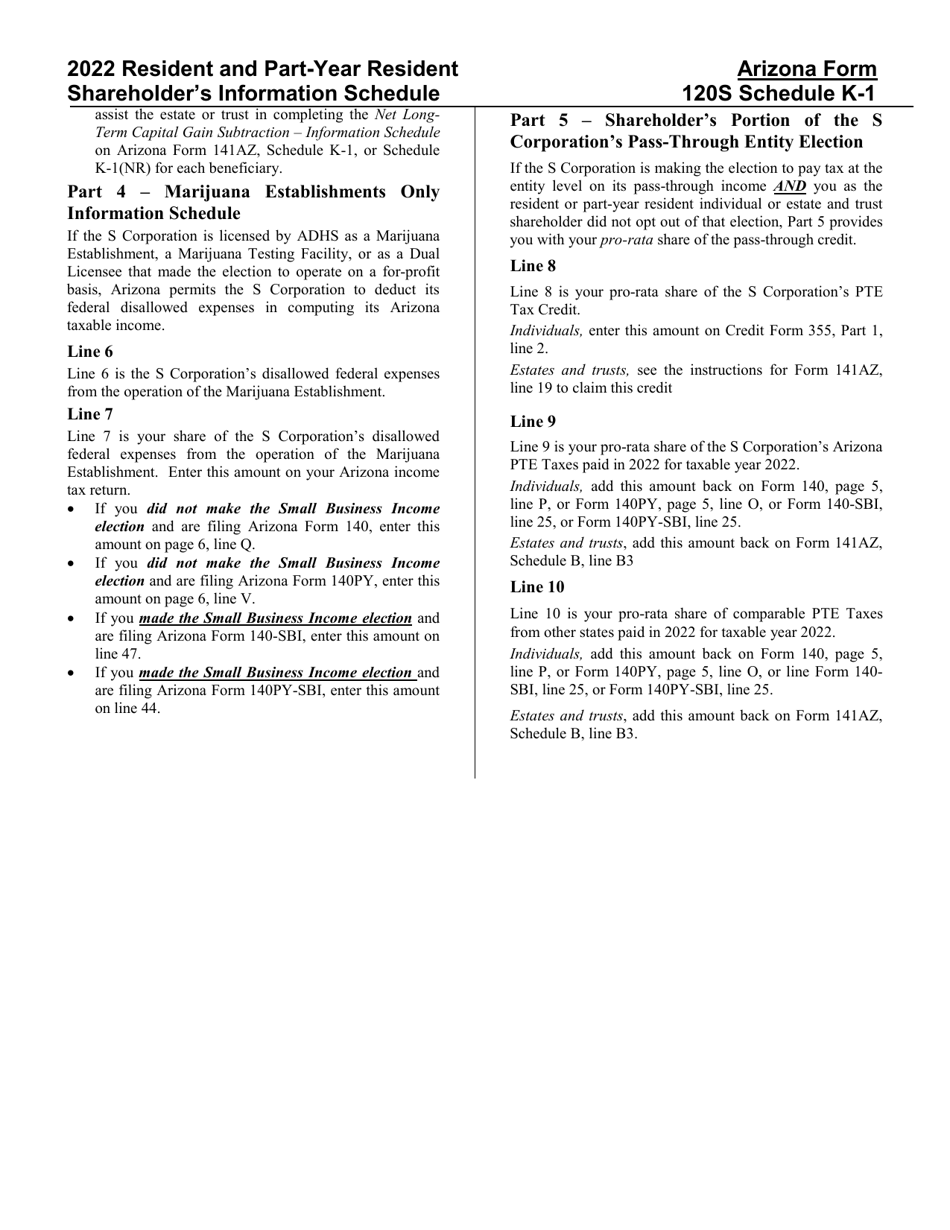

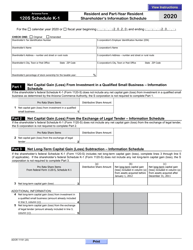

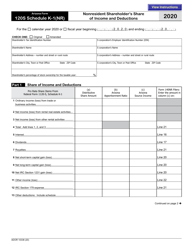

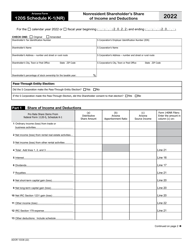

Arizona Form 120S (ADOR11191) Schedule K-1 Resident and Part-Year Resident Shareholder's Information Schedule - Arizona

What Is Arizona Form 120S (ADOR11191) Schedule K-1?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona.The document is a supplement to Arizona Form 120S, Arizona S Corporation Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 120S?

A: Arizona Form 120S is a tax form used by resident and part-year resident shareholders to report their income and deductions related to an S corporation in Arizona.

Q: What is Schedule K-1?

A: Schedule K-1 is an attachment to Arizona Form 120S that provides shareholder-specific information about income, deductions, credits, etc., reported by the S corporation.

Q: Who needs to file Arizona Form 120S?

A: Residents and part-year residents of Arizona who are shareholders of an S corporation need to file Arizona Form 120S.

Q: What information is required on Arizona Form 120S?

A: Arizona Form 120S requires information about the S corporation, the shareholder's personal information, income and deductions, and other relevant details.

Q: When is the deadline to file Arizona Form 120S?

A: The deadline to file Arizona Form 120S is generally the same as the federal income tax deadline, which is April 15th.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 120S (ADOR11191) Schedule K-1 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.