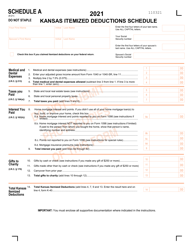

Instructions for Arizona Form 140NR, ADOR10562 Schedule A(NR) Itemized Deductions for Nonresidents - Arizona

This document contains official instructions for Arizona Form 140NR Schedule A(NR) and Form ADOR10562 Schedule A(NR) . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

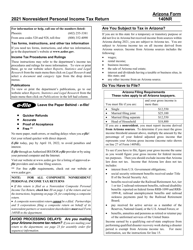

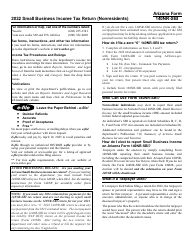

Q: What is Arizona Form 140NR?

A: Arizona Form 140NR is a tax form for nonresidents of Arizona who need to file their state income tax return.

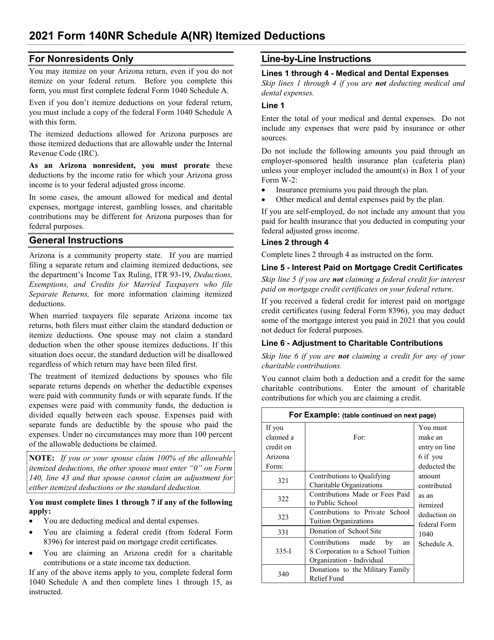

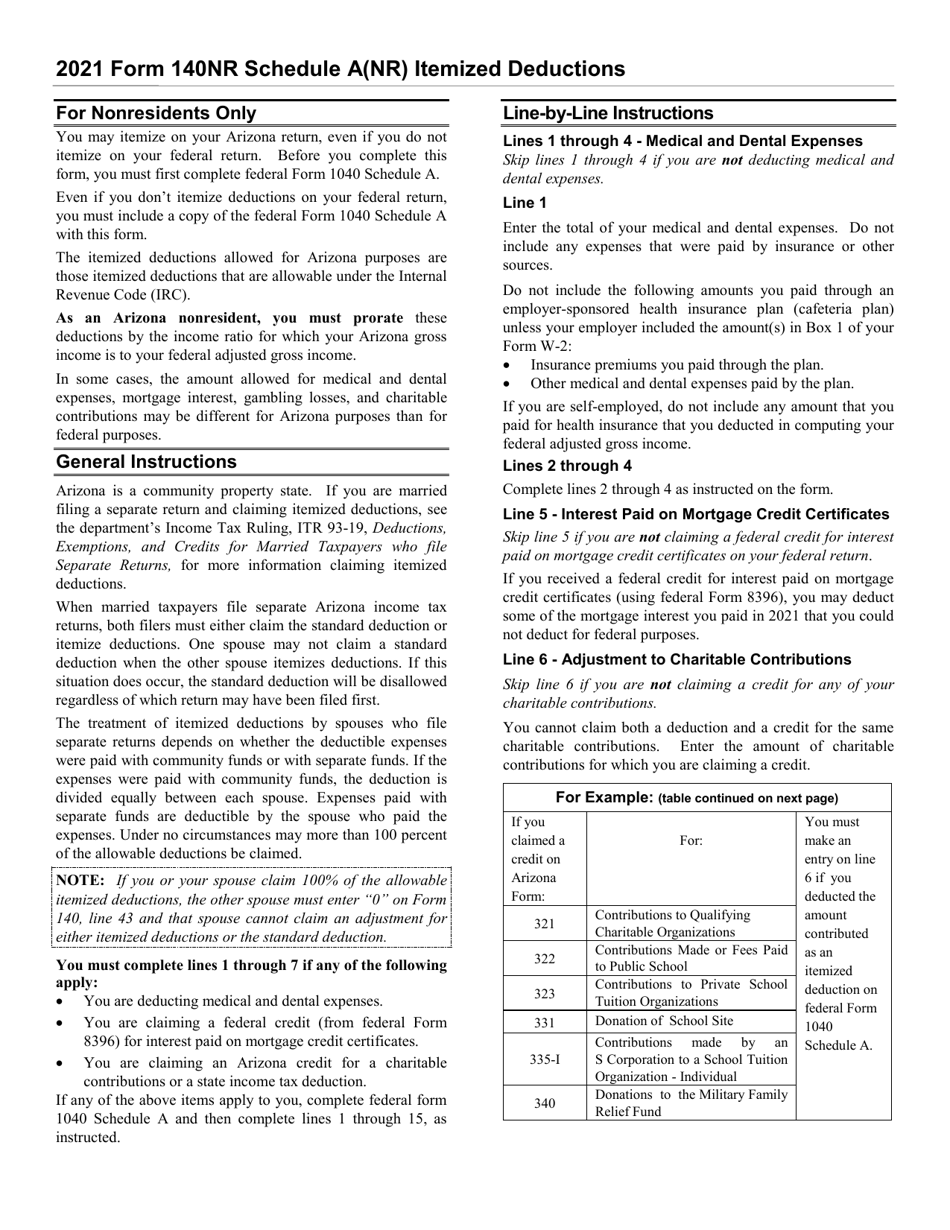

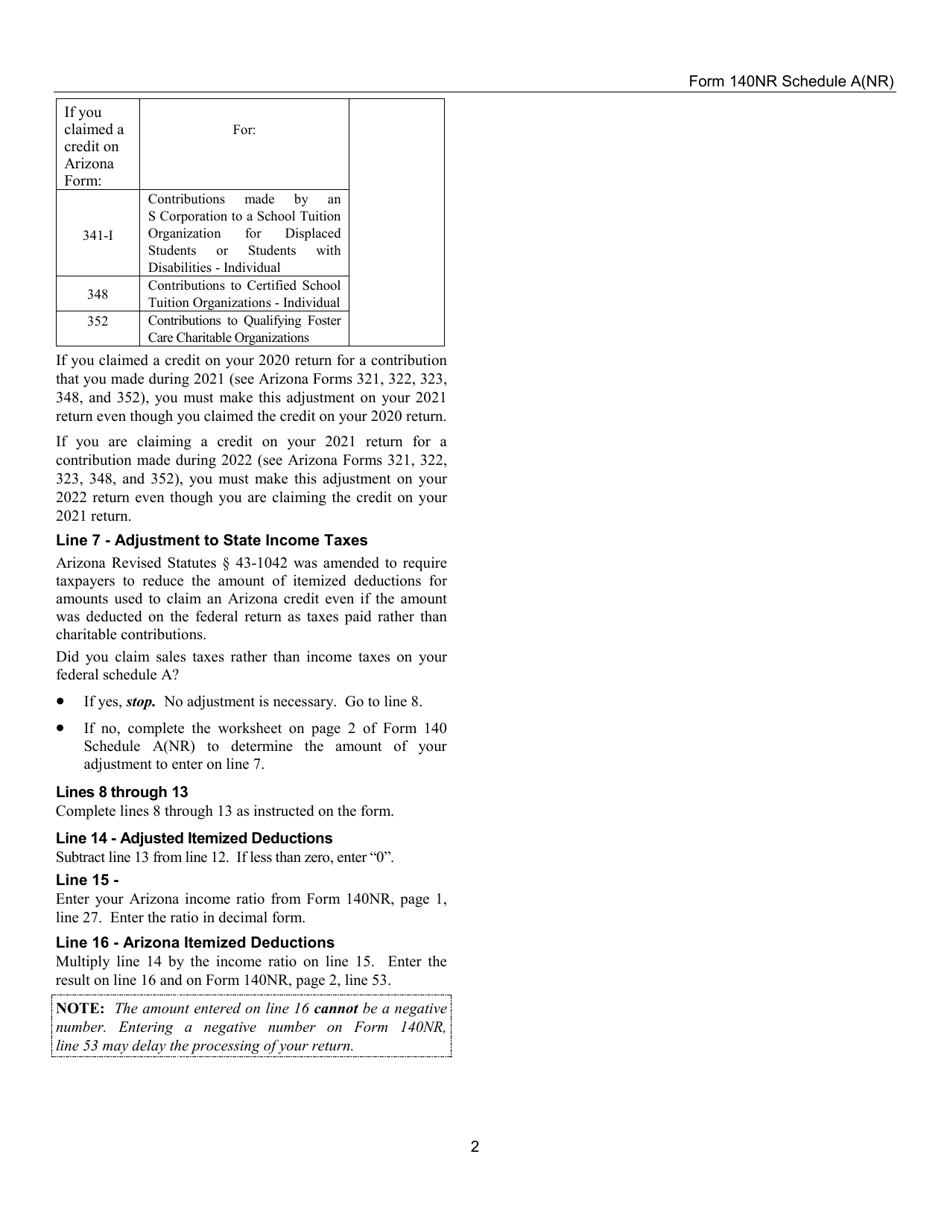

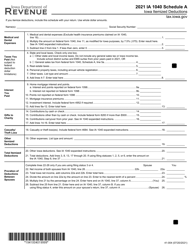

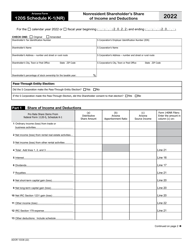

Q: What is ADOR10562 Schedule A(NR)?

A: ADOR10562 Schedule A(NR) is a specific schedule within Arizona Form 140NR that is used for reporting itemized deductions for nonresidents.

Q: Who should file Arizona Form 140NR?

A: Nonresidents of Arizona who have income from Arizona sources and meet certain filing requirements should file Arizona Form 140NR.

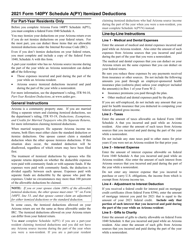

Q: What are itemized deductions?

A: Itemized deductions are expenses that can be subtracted from your taxable income, potentially reducing your overall tax liability.

Q: What expenses can be reported on ADOR10562 Schedule A(NR)?

A: Expenses such as medical expenses, mortgage interest, charitable contributions, and state and local taxes can be reported on ADOR10562 Schedule A(NR).

Q: Are nonresidents eligible for the same deductions as residents of Arizona?

A: No, nonresidents may have different deductions and requirements compared to residents of Arizona.

Q: Do I need to file Arizona Form 140NR if I have no income from Arizona sources?

A: If you are a nonresident of Arizona and have no income from Arizona sources, you generally do not need to file Arizona Form 140NR.

Q: What should I do if I need assistance with filling out Arizona Form 140NR?

A: If you need assistance with filling out Arizona Form 140NR, you can consider seeking help from a tax professional or contacting the Arizona Department of Revenue.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.