This version of the form is not currently in use and is provided for reference only. Download this version of

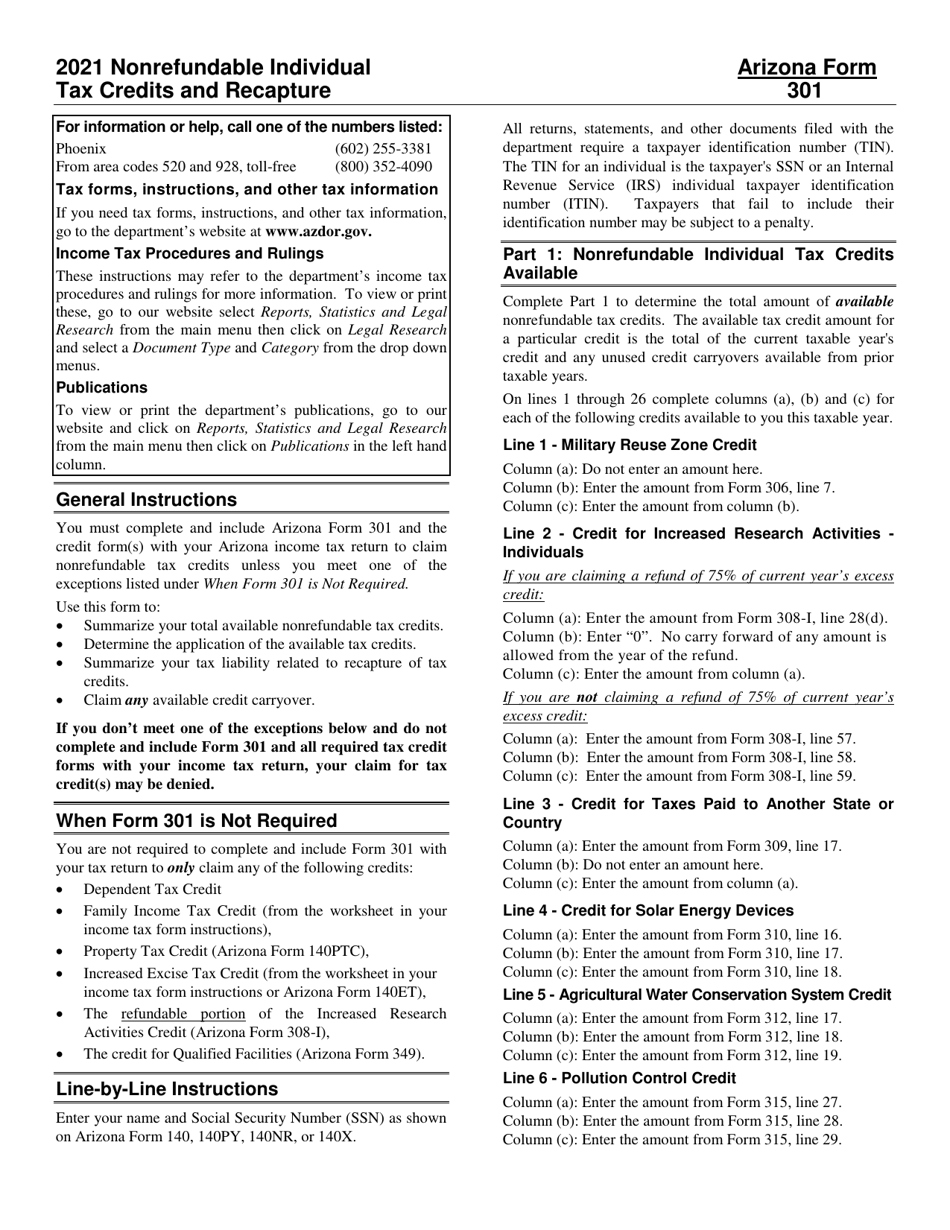

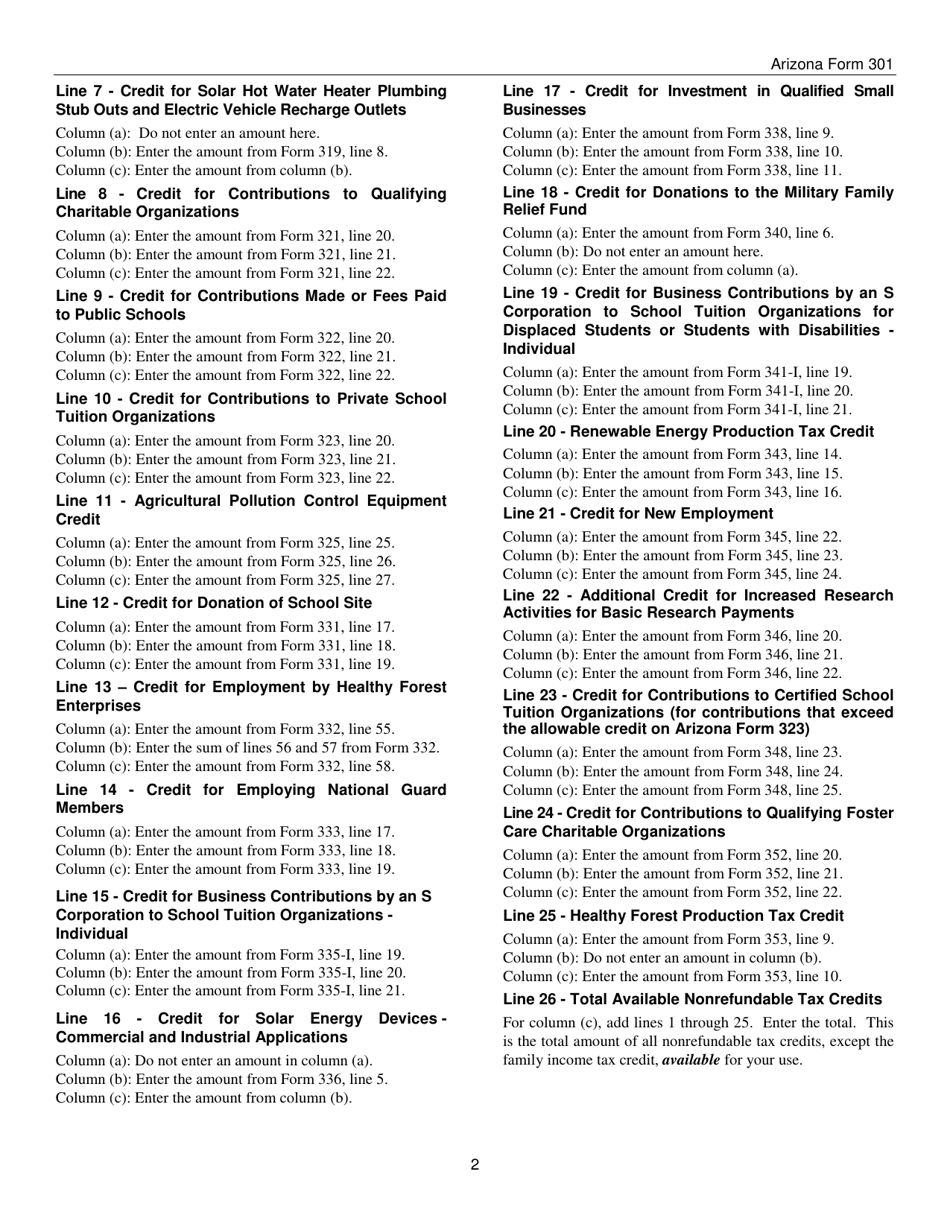

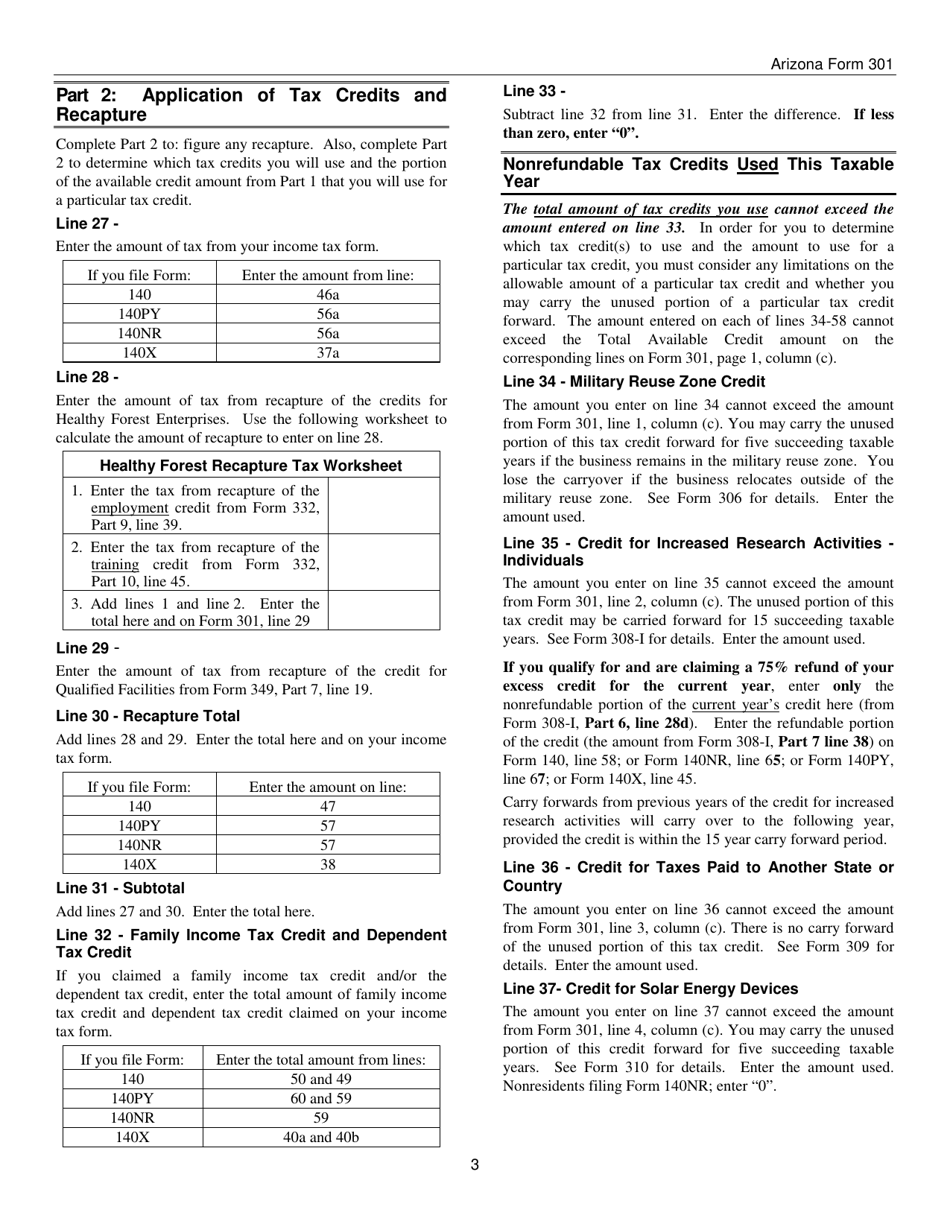

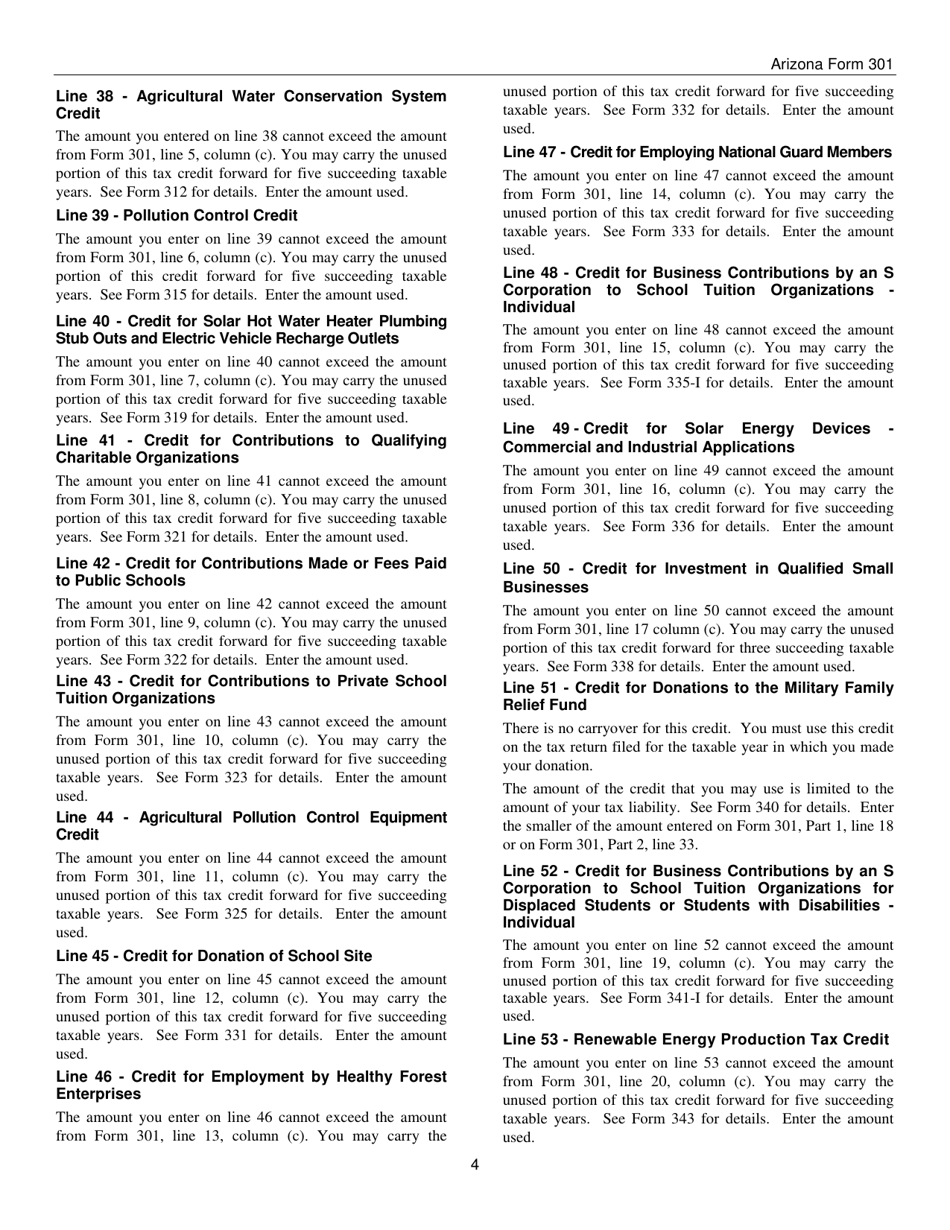

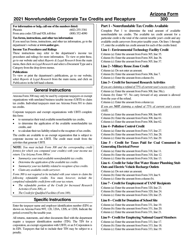

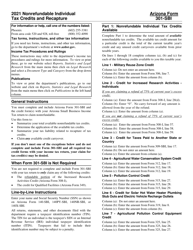

Instructions for Arizona Form 301, ADOR10127

for the current year.

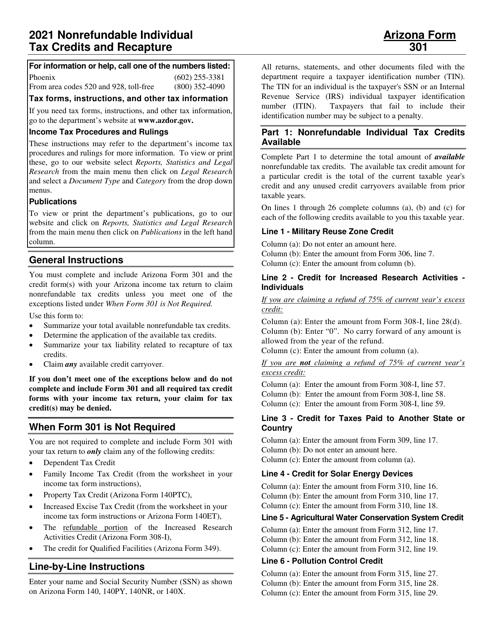

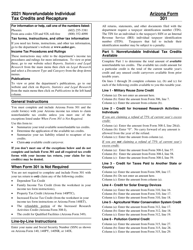

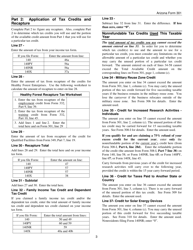

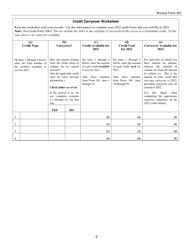

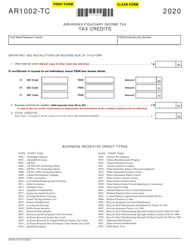

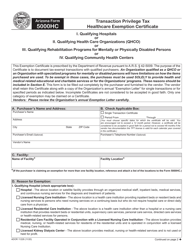

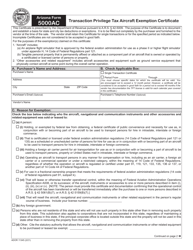

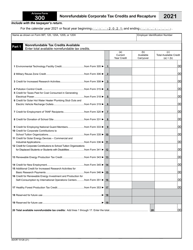

Instructions for Arizona Form 301, ADOR10127 Nonrefundable Individual Tax Credits and Recapture - Arizona

This document contains official instructions for Arizona Form 301 , and Form ADOR10127 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is Arizona Form 301?

A: Arizona Form 301 is a tax form used for claiming nonrefundable individual tax credits and recapture in Arizona.

Q: What is ADOR10127?

A: ADOR10127 is the form number assigned to Arizona Form 301.

Q: What are nonrefundable tax credits?

A: Nonrefundable tax credits are credits that can reduce your tax liability, but if they exceed your tax owed, you won't receive a refund for the excess.

Q: What is tax recapture?

A: Tax recapture is the process of reclaiming previously claimed tax credits if you no longer qualify for them.

Q: Who needs to file Arizona Form 301?

A: Arizona residents who are eligible for nonrefundable tax credits or need to recapture previously claimed credits must file Arizona Form 301.

Q: Are all tax credits nonrefundable in Arizona?

A: No, not all tax credits in Arizona are nonrefundable. Some tax credits may be refundable if they exceed your tax liability.

Q: What should I do if I need to recapture tax credits?

A: If you need to recapture tax credits, you should complete the appropriate sections of Arizona Form 301 and submit it with your tax return.

Q: Can I claim nonrefundable tax credits and recapture credits in the same tax year?

A: Yes, you can claim nonrefundable tax credits and recapture credits in the same tax year on Arizona Form 301.

Q: Is Arizona Form 301 only for individuals?

A: Yes, Arizona Form 301 is specifically for individual taxpayers.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.