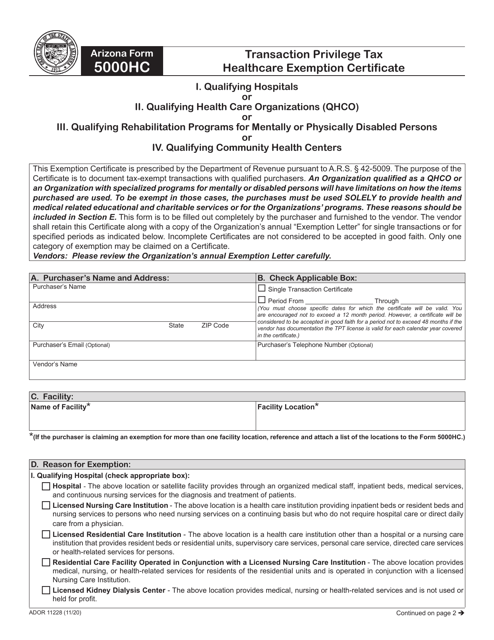

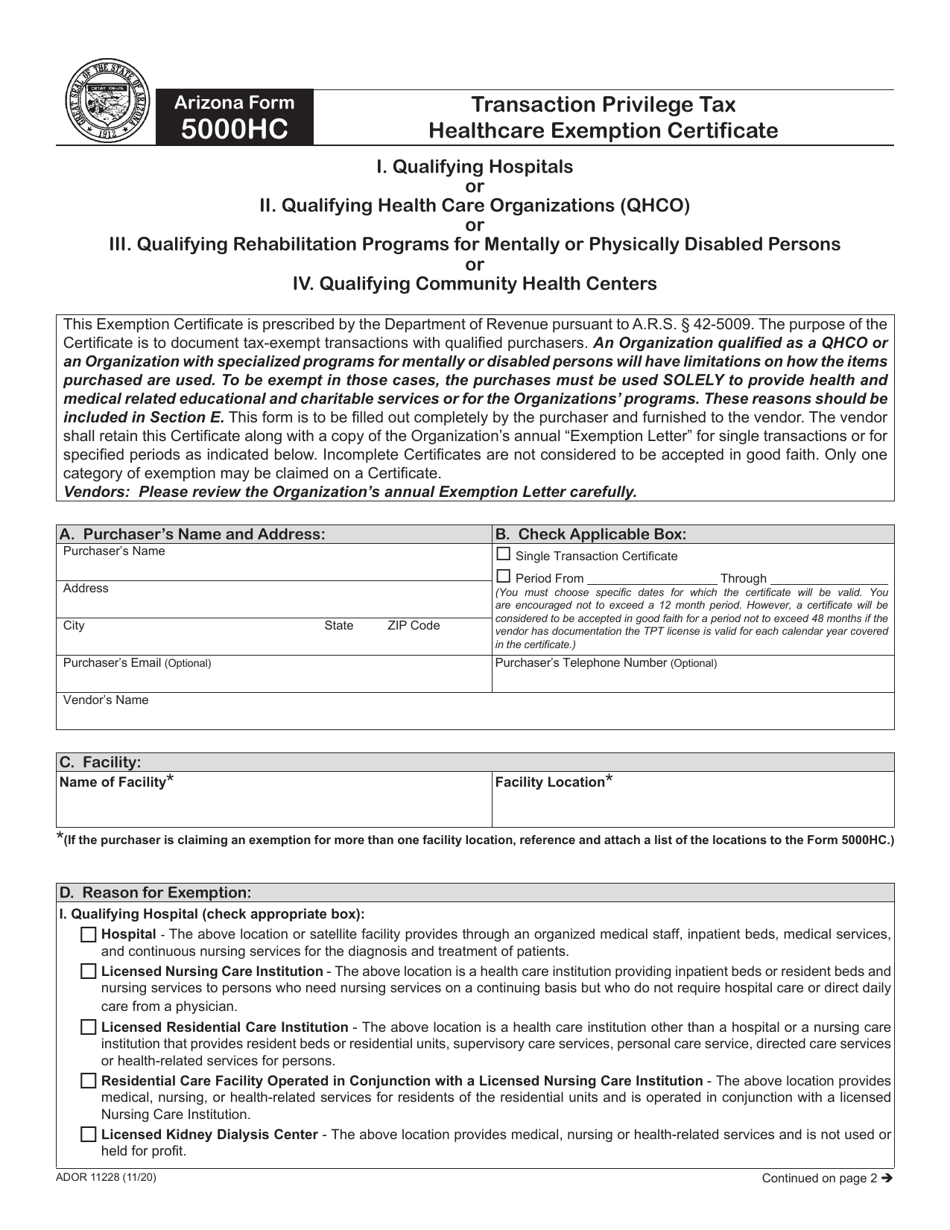

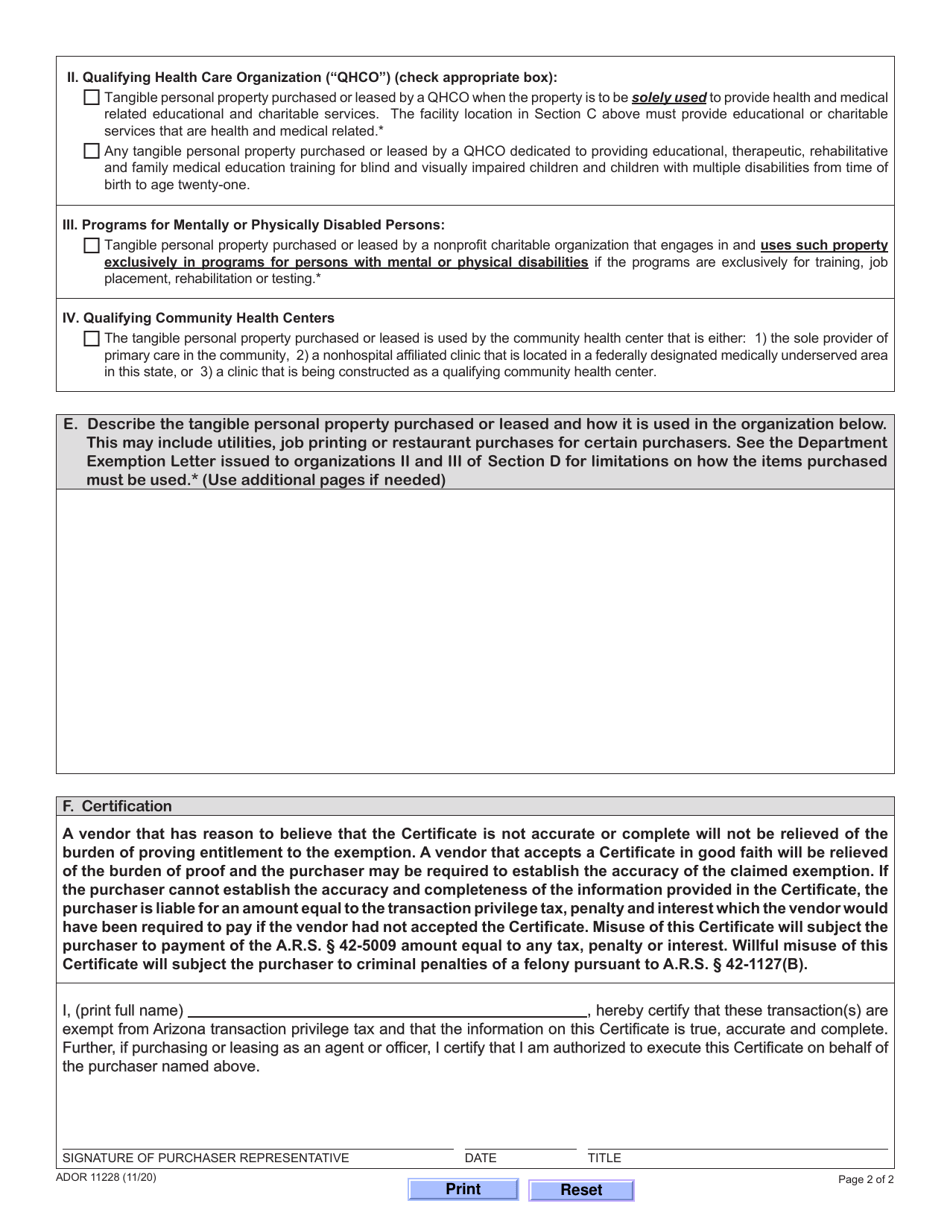

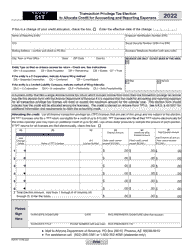

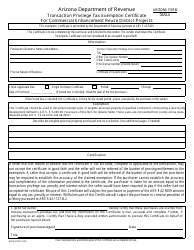

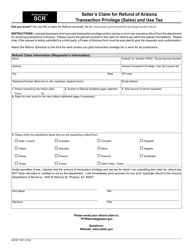

Arizona Form 5000HC (ADOR11228) Transaction Privilege Tax Healthcare Exemption Certificate - Arizona

What Is Arizona Form 5000HC (ADOR11228)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

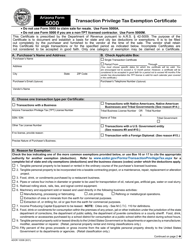

Q: What is the Arizona Form 5000HC?

A: The Arizona Form 5000HC is a Transaction Privilege Tax Healthcare Exemption Certificate.

Q: What is the purpose of the Arizona Form 5000HC?

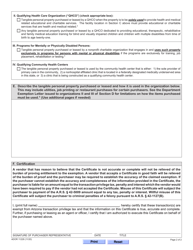

A: The purpose of the Arizona Form 5000HC is to provide a tax exemption for healthcare transactions.

Q: Who can use the Arizona Form 5000HC?

A: Healthcare providers and organizations can use the Arizona Form 5000HC to claim tax exemptions.

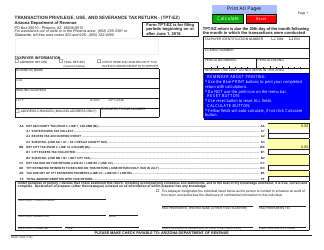

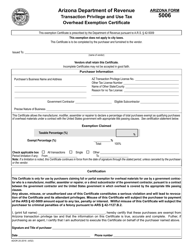

Q: What is the Transaction Privilege Tax?

A: The Transaction Privilege Tax is a tax on the privilege of conducting business in Arizona.

Q: What transactions are covered by the healthcare exemption?

A: The healthcare exemption covers transactions related to healthcare services and products.

Q: Are there any eligibility requirements for the healthcare exemption?

A: Yes, there are eligibility requirements for claiming the healthcare exemption. You should consult the instructions and guidelines provided with the form for more details.

Q: Is the healthcare exemption valid for all healthcare transactions?

A: No, the healthcare exemption may not be valid for all healthcare transactions. It is important to review the guidelines and consult with the Arizona Department of Revenue for specific details.

Q: How long is the Arizona Form 5000HC valid?

A: The Arizona Form 5000HC is valid until it is revoked or cancelled by the Department of Revenue.

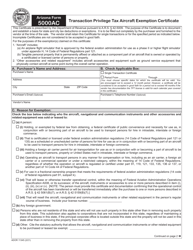

Q: What should I do if I have questions about the Arizona Form 5000HC?

A: If you have questions about the Arizona Form 5000HC, you should contact the Arizona Department of Revenue for assistance.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 5000HC (ADOR11228) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.