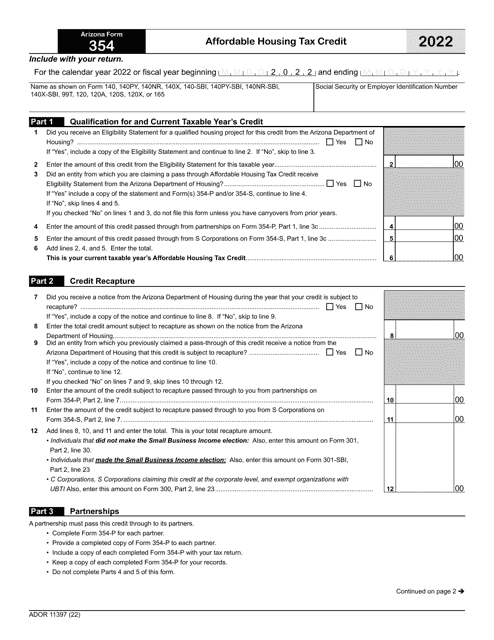

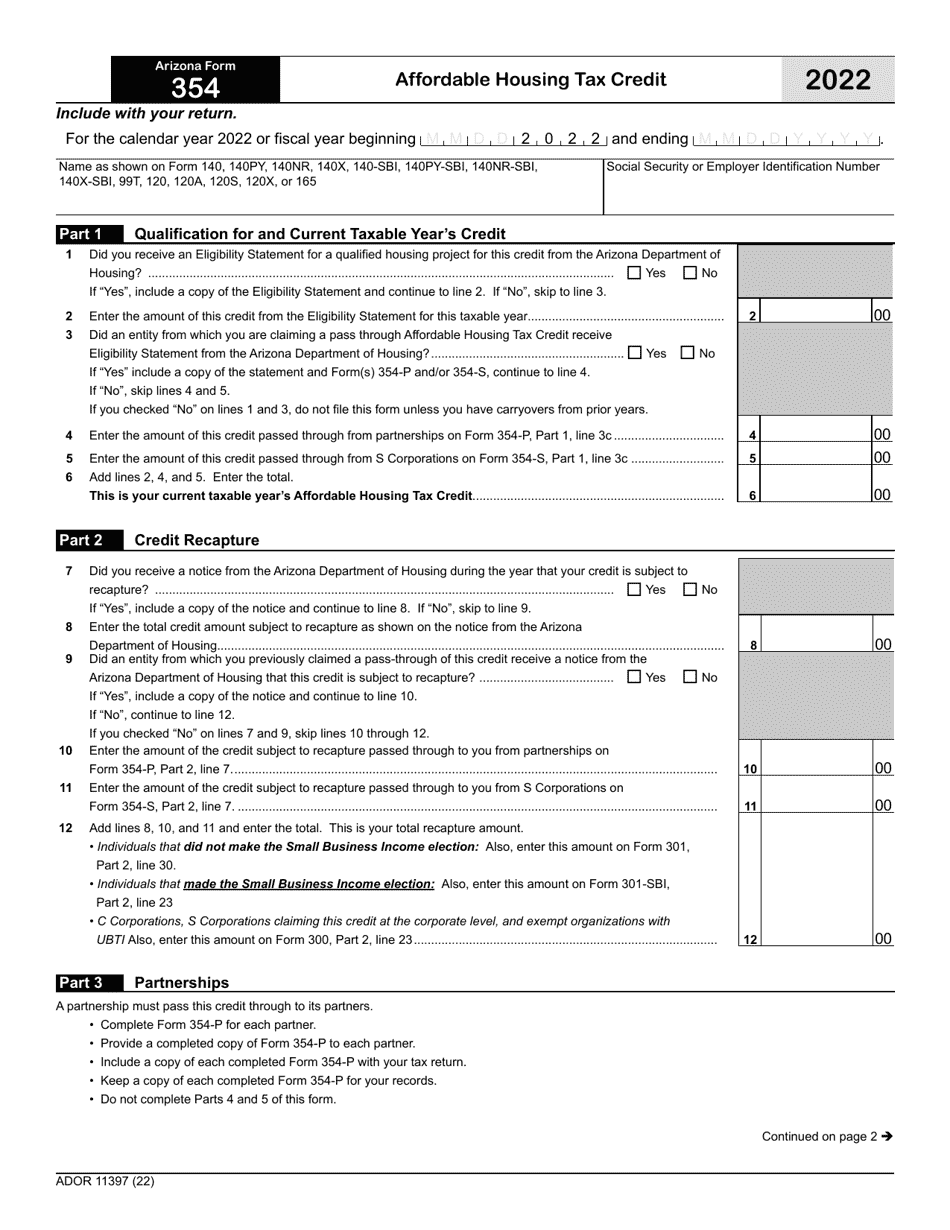

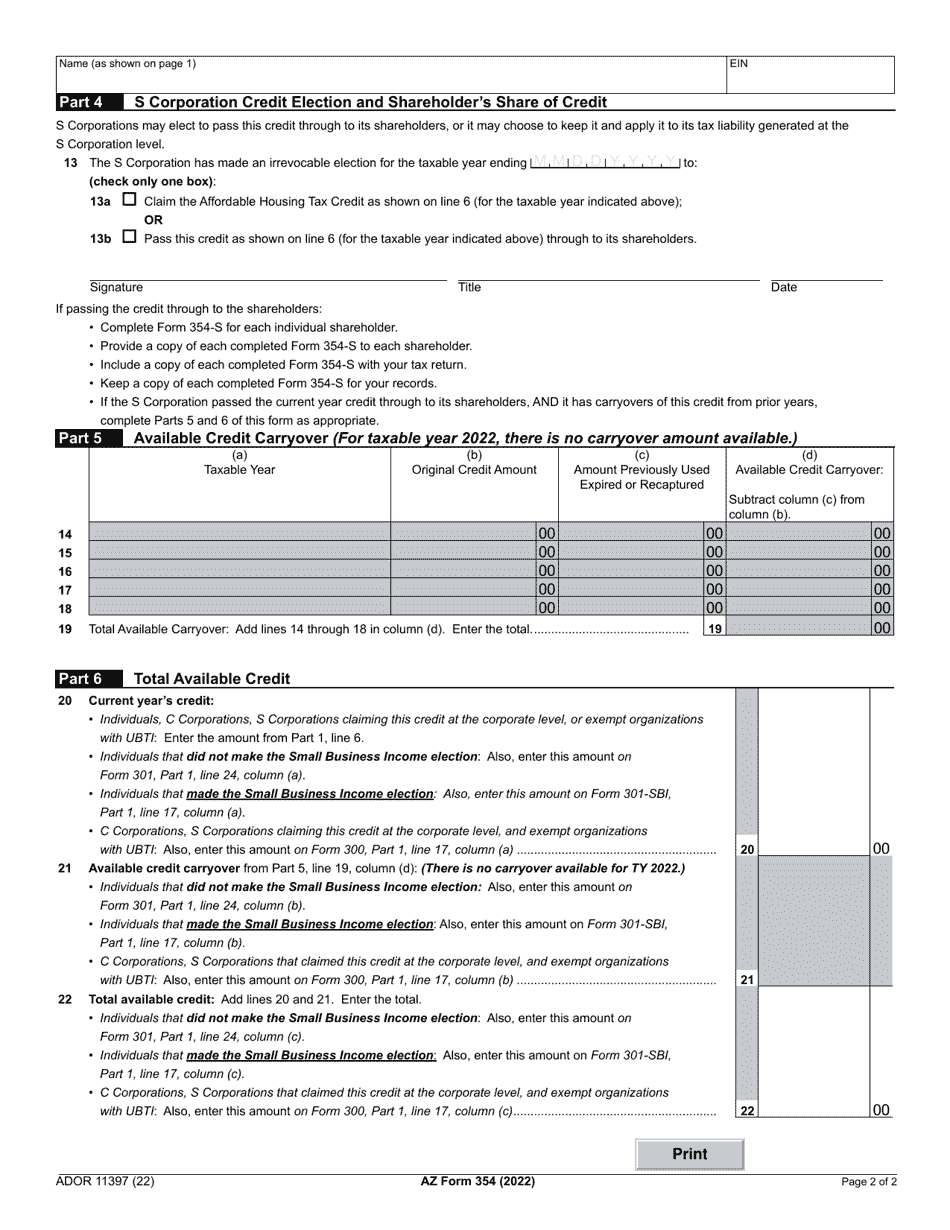

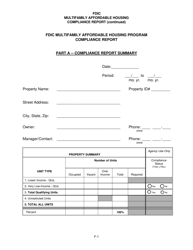

Arizona Form 354 (ADOR11397) Affordable Housing Tax Credit - Arizona

What Is Arizona Form 354 (ADOR11397)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 354?

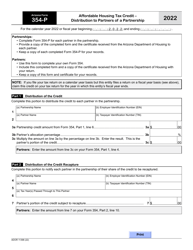

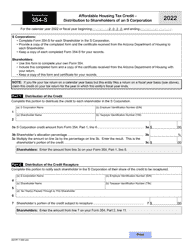

A: Arizona Form 354 is a form used to claim the Affordable HousingTax Credit in Arizona.

Q: What is the Affordable Housing Tax Credit in Arizona?

A: The Affordable Housing Tax Credit in Arizona is a tax credit program designed to incentivize affordable housing development.

Q: Who can claim the Affordable Housing Tax Credit in Arizona?

A: Developers or individuals involved in the construction of eligible affordable housing projects in Arizona can claim the tax credit.

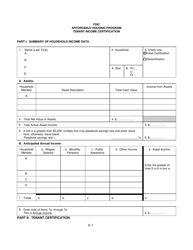

Q: How do I claim the Affordable Housing Tax Credit using Arizona Form 354?

A: To claim the tax credit, you need to complete and submit Arizona Form 354 along with the required documentation to the Arizona Department of Revenue.

Q: Are there any eligibility criteria to claim the Affordable Housing Tax Credit in Arizona?

A: Yes, there are eligibility criteria that need to be met, such as the completion of an approved affordable housing project and compliance with state regulations.

Q: What is the benefit of claiming the Affordable Housing Tax Credit in Arizona?

A: By claiming the tax credit, developers or individuals can reduce their tax liability and encourage the development of affordable housing in Arizona.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 354 (ADOR11397) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.