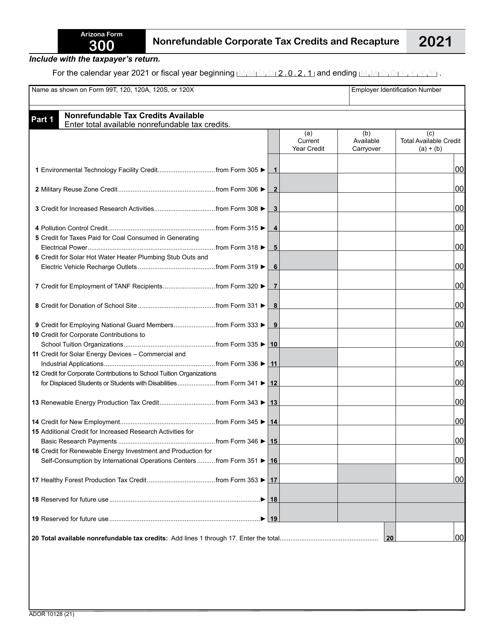

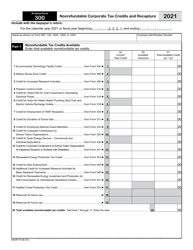

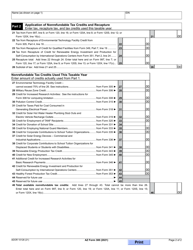

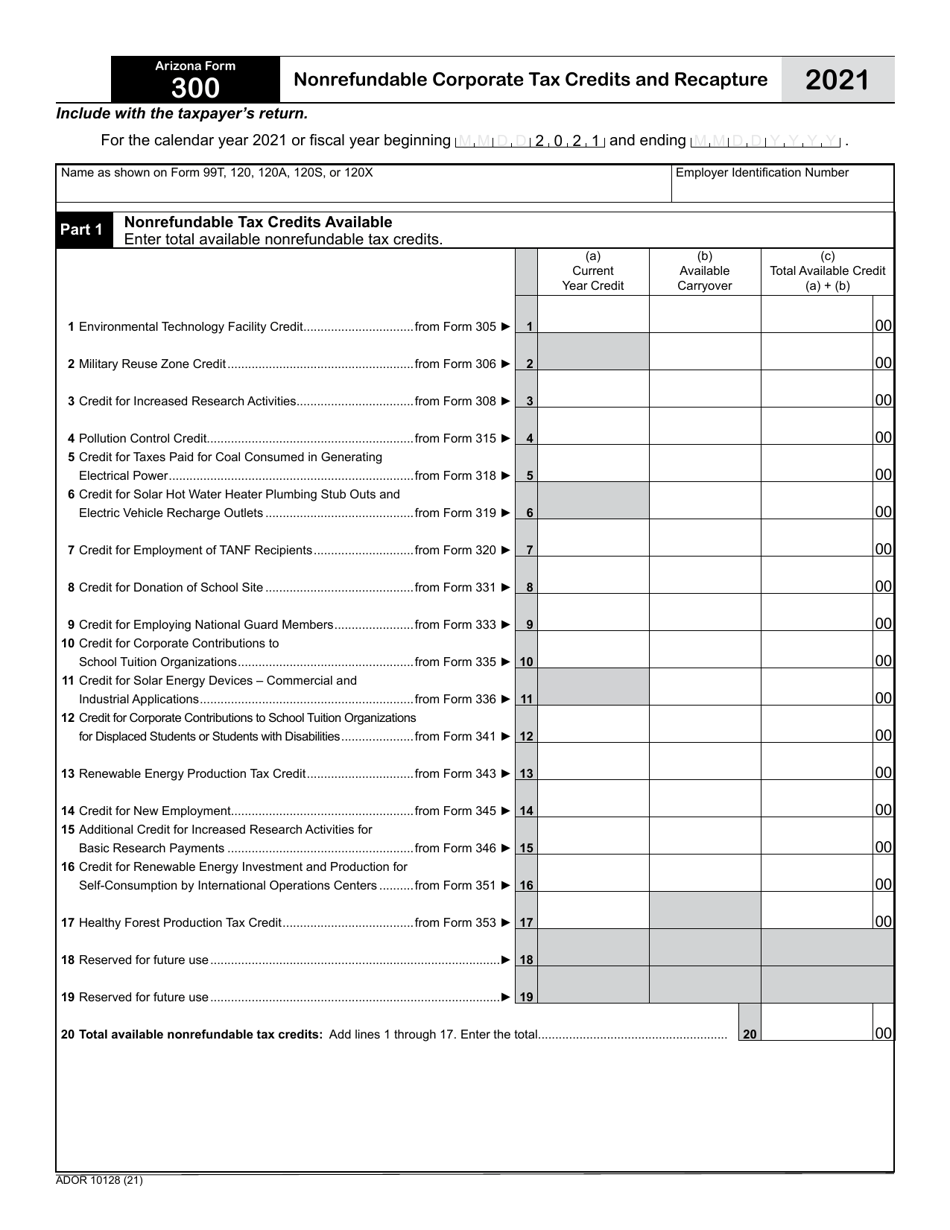

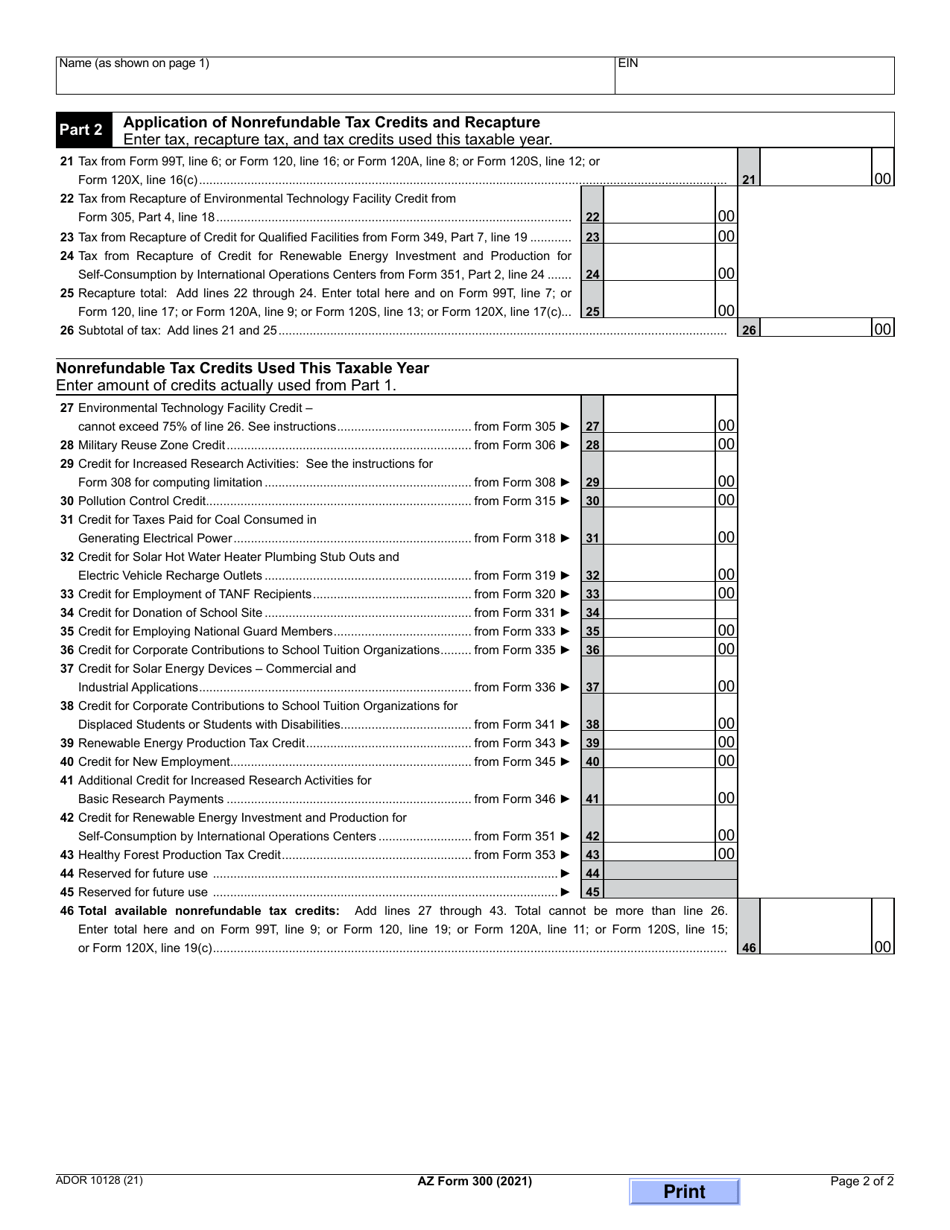

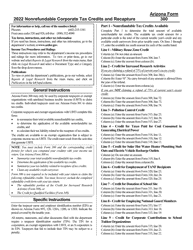

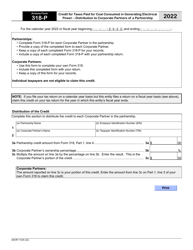

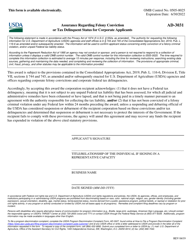

Arizona Form 300 (ADOR10128) Nonrefundable Corporate Tax Credits and Recapture - Arizona

What Is Arizona Form 300 (ADOR10128)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 300?

A: Arizona Form 300 is a form used to claim nonrefundable corporate tax credits and recapture in Arizona.

Q: What does nonrefundable corporate tax credit mean?

A: Nonrefundable corporate tax credit is a type of credit that cannot be refunded but can be used to reduce a company's tax liability.

Q: What is tax credit recapture?

A: Tax credit recapture is the process by which a previously claimed tax credit must be repaid or recaptured.

Q: Who needs to fill out Arizona Form 300?

A: Arizona Form 300 should be filled out by corporations claiming nonrefundable tax credits or recapture in Arizona.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 300 (ADOR10128) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.