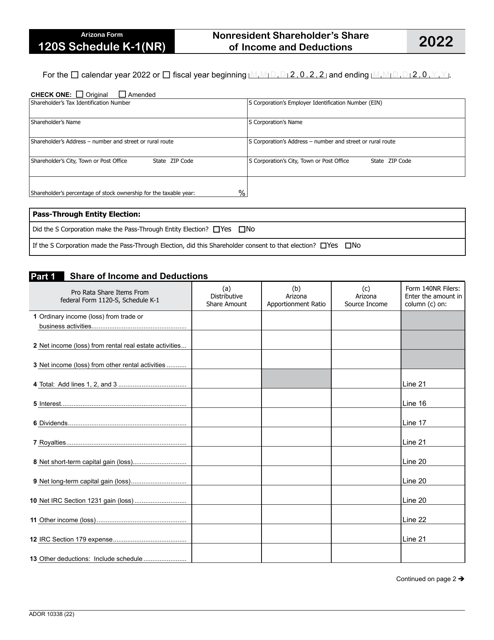

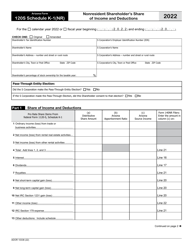

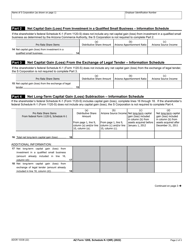

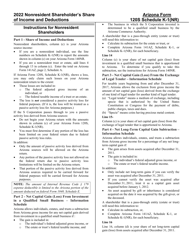

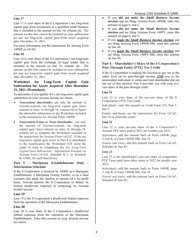

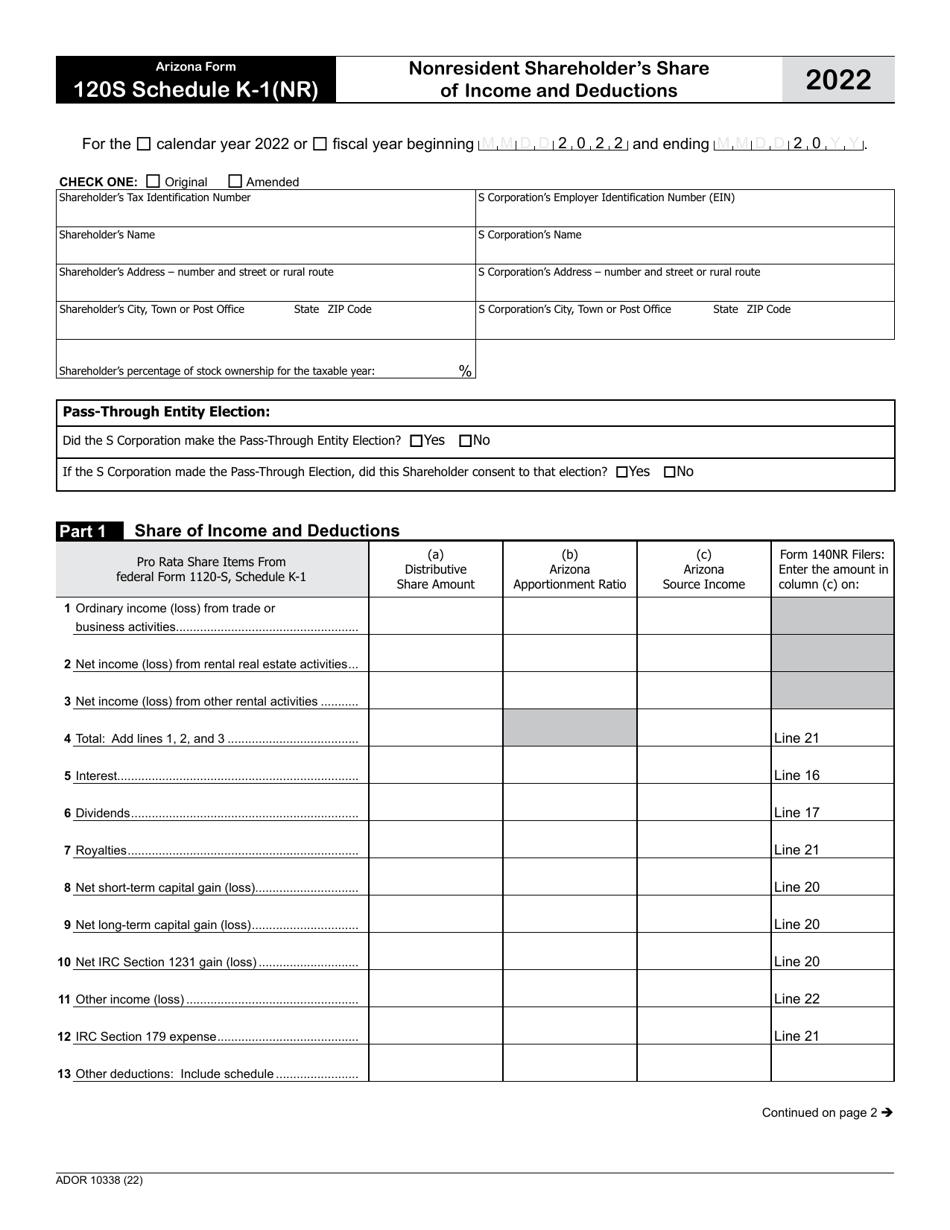

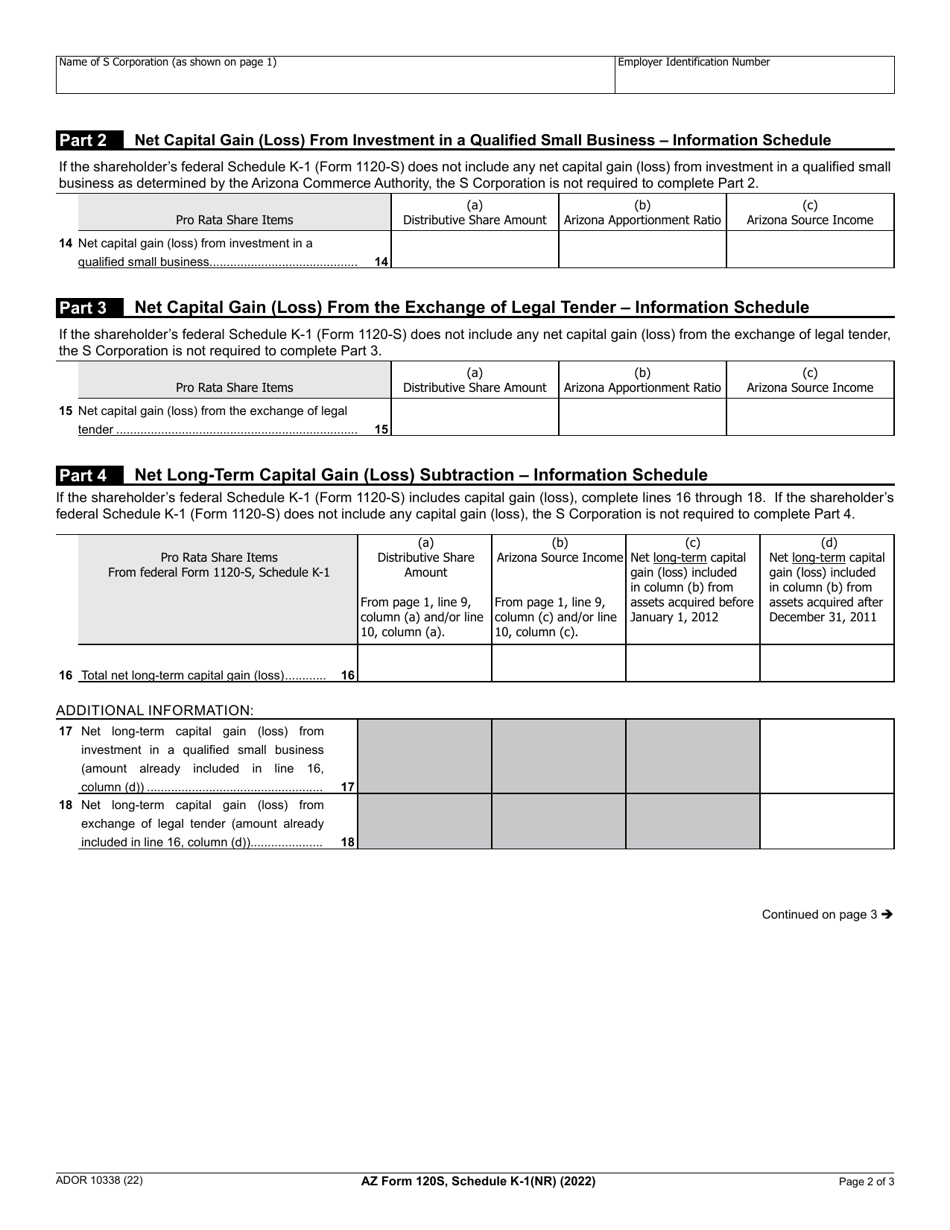

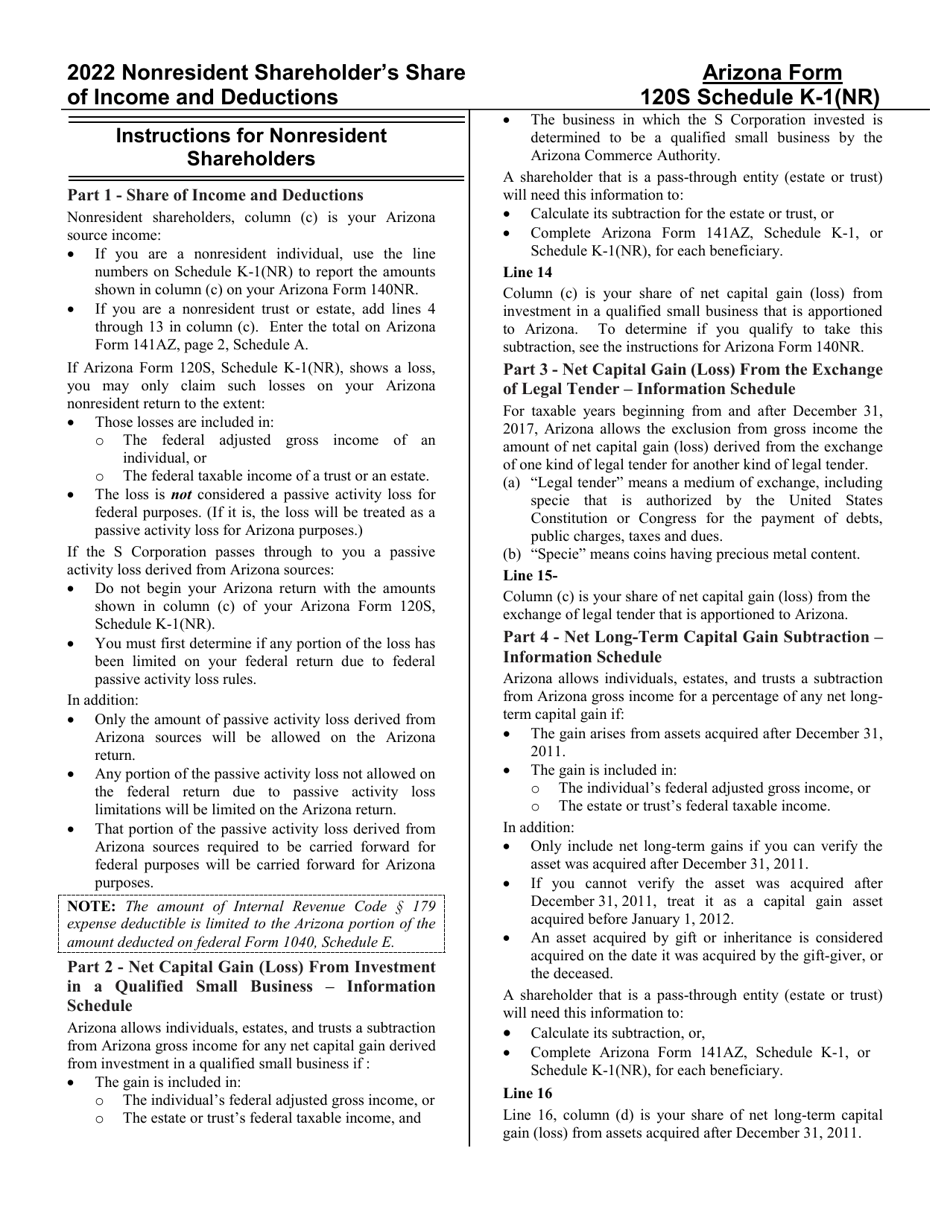

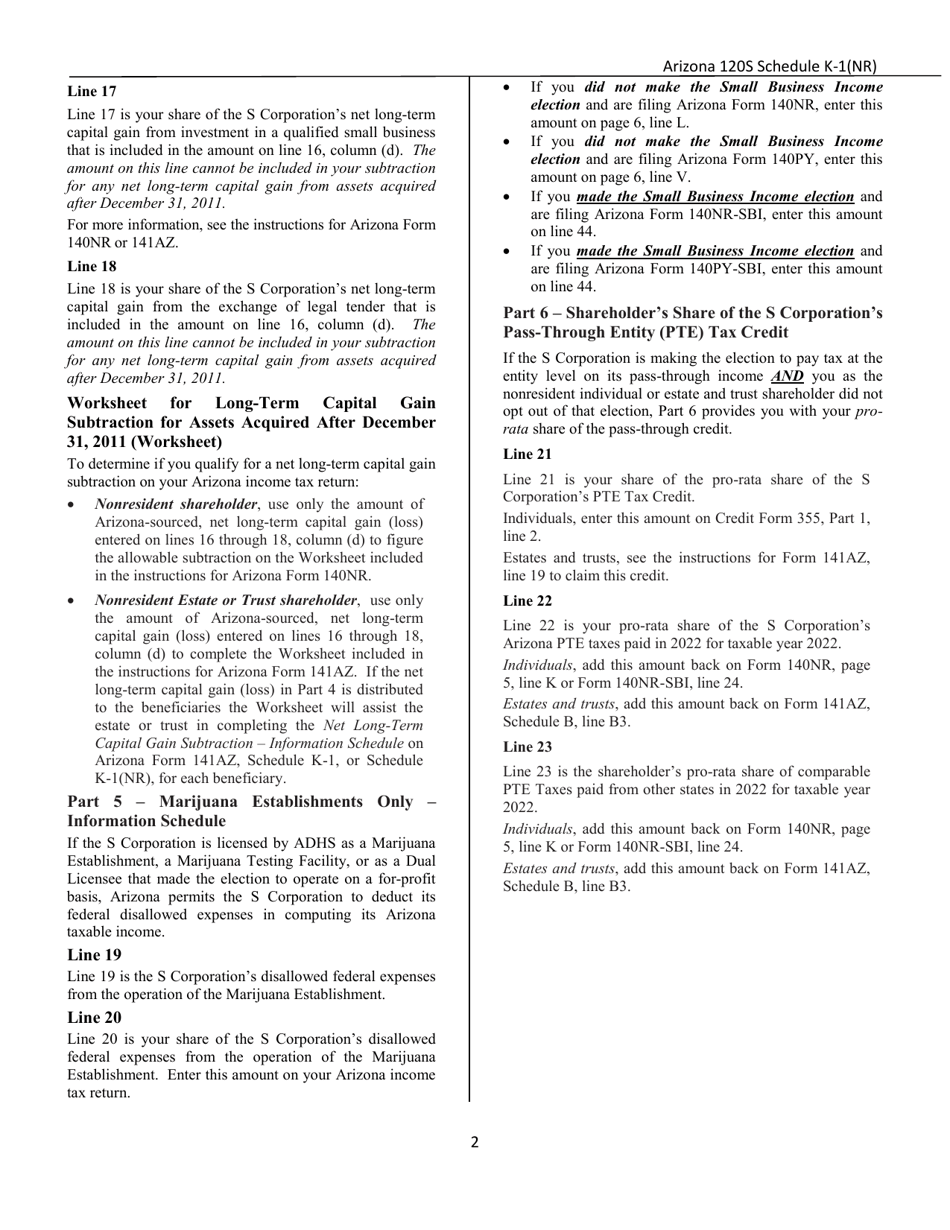

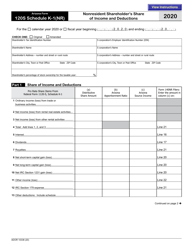

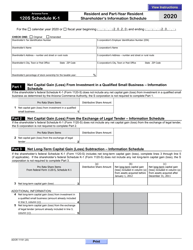

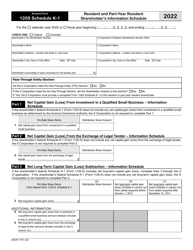

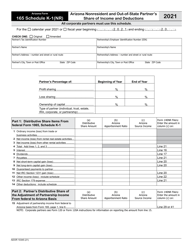

Arizona Form 120S (ADOR10338) Schedule K-1(NR) Nonresident Shareholder's Share of Income and Deductions - Arizona

What Is Arizona Form 120S (ADOR10338) Schedule K-1(NR)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona.The document is a supplement to Arizona Form 120S, Arizona S Corporation Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 120S?

A: Arizona Form 120S is a tax form used by nonresident shareholders to report their share of income and deductions in Arizona.

Q: Who needs to file Arizona Form 120S?

A: Nonresident shareholders who have income and deductions in Arizona need to file Arizona Form 120S.

Q: What is Schedule K-1(NR)?

A: Schedule K-1(NR) is a part of Arizona Form 120S that helps nonresident shareholders report their share of income and deductions.

Q: What does nonresident shareholder mean?

A: A nonresident shareholder is someone who owns shares in an Arizona company but is not a resident of Arizona.

Q: What information is reported on Schedule K-1(NR)?

A: Schedule K-1(NR) reports the nonresident shareholder's share of income and deductions from the Arizona company.

Q: Do nonresident shareholders need to pay Arizona income tax?

A: Yes, nonresident shareholders may need to pay Arizona income tax on their share of income from the Arizona company.

Q: Are there any filing deadlines for Arizona Form 120S?

A: Yes, Arizona Form 120S must be filed by the due date of the Arizona income tax return.

Q: Can nonresident shareholders e-file Arizona Form 120S?

A: Yes, nonresident shareholders can e-file Arizona Form 120S if they meet the requirements for electronic filing.

Q: What should nonresident shareholders do if they have questions about Arizona Form 120S?

A: Nonresident shareholders should contact the Arizona Department of Revenue for assistance with any questions or concerns about Arizona Form 120S.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 120S (ADOR10338) Schedule K-1(NR) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.