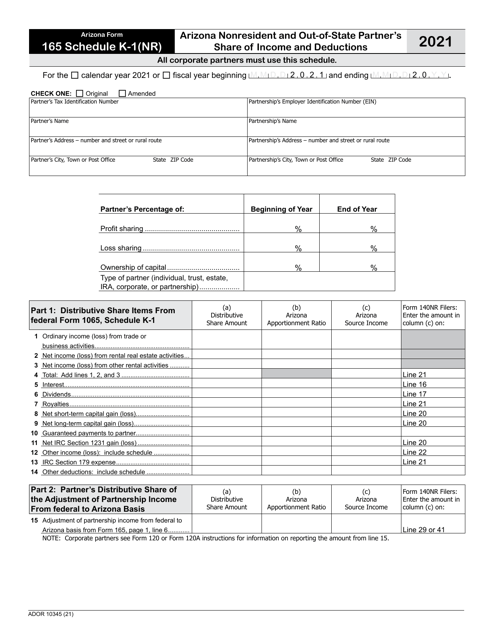

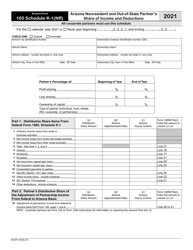

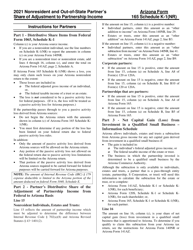

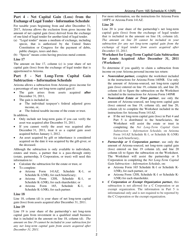

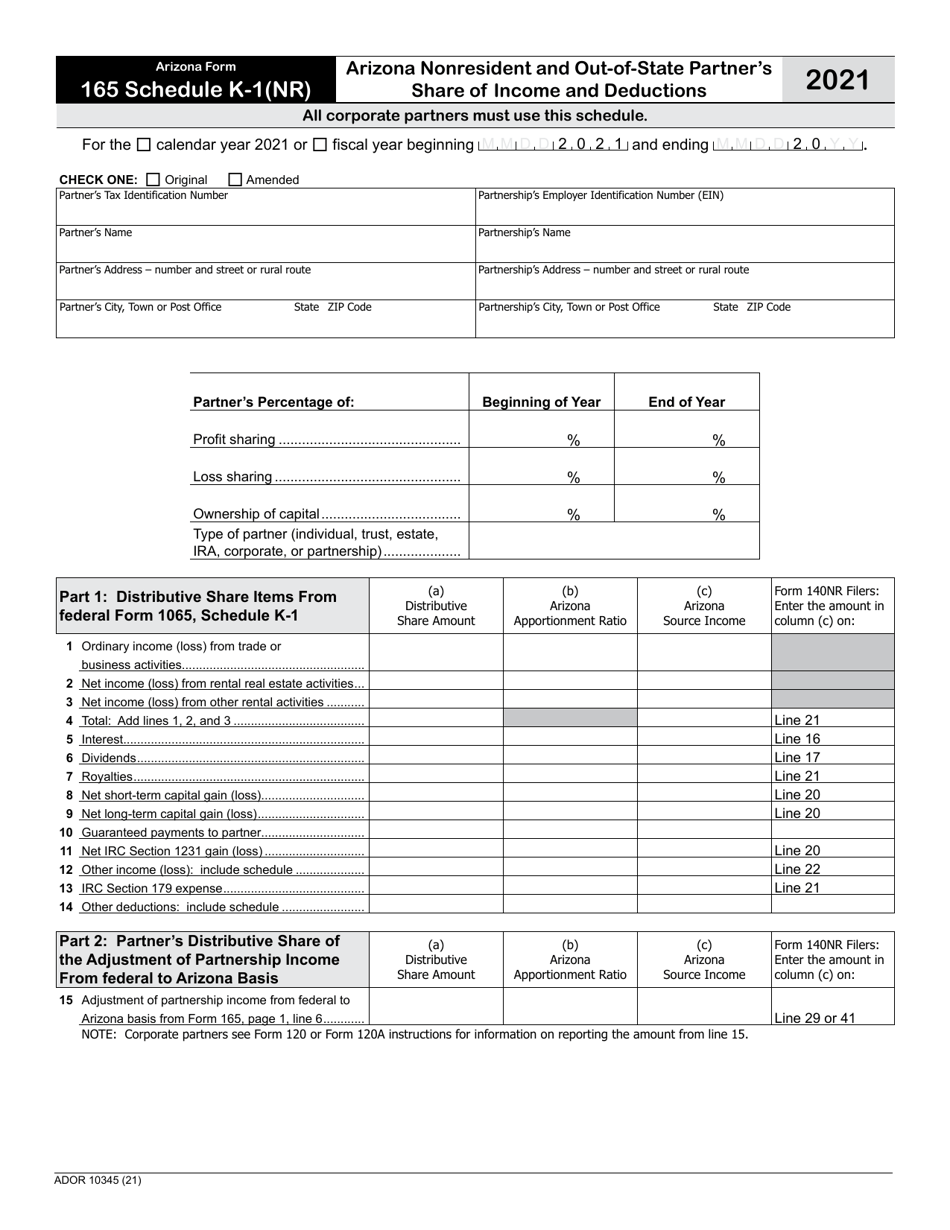

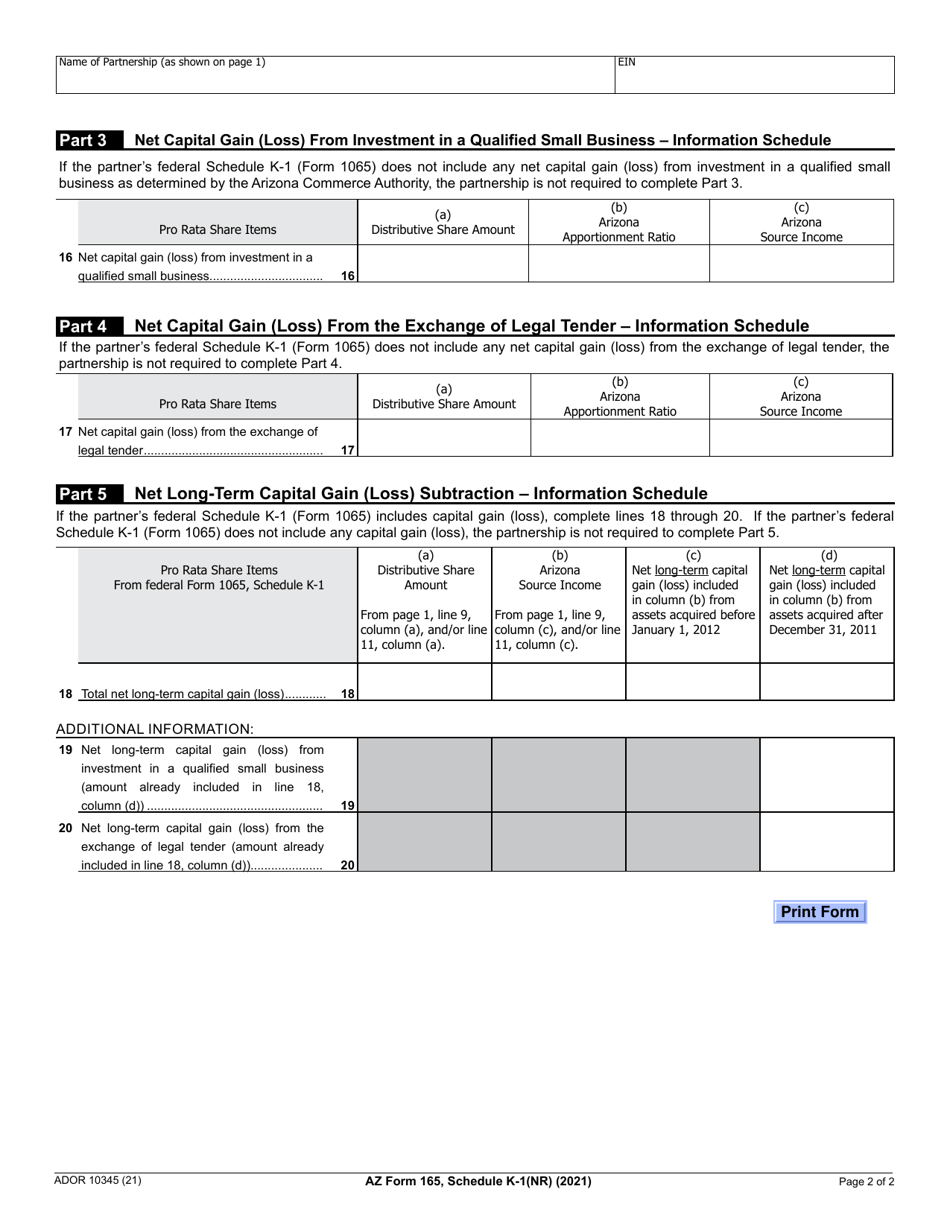

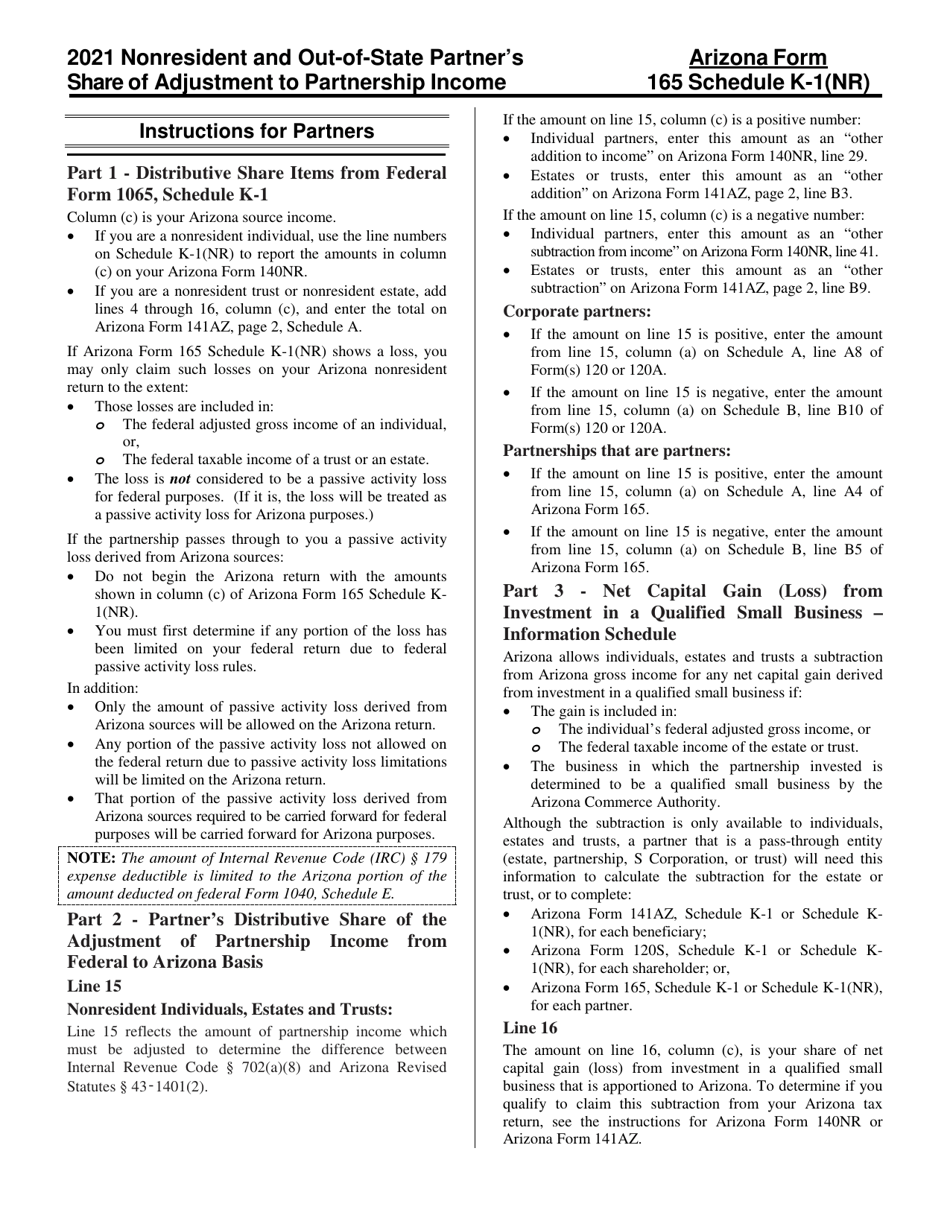

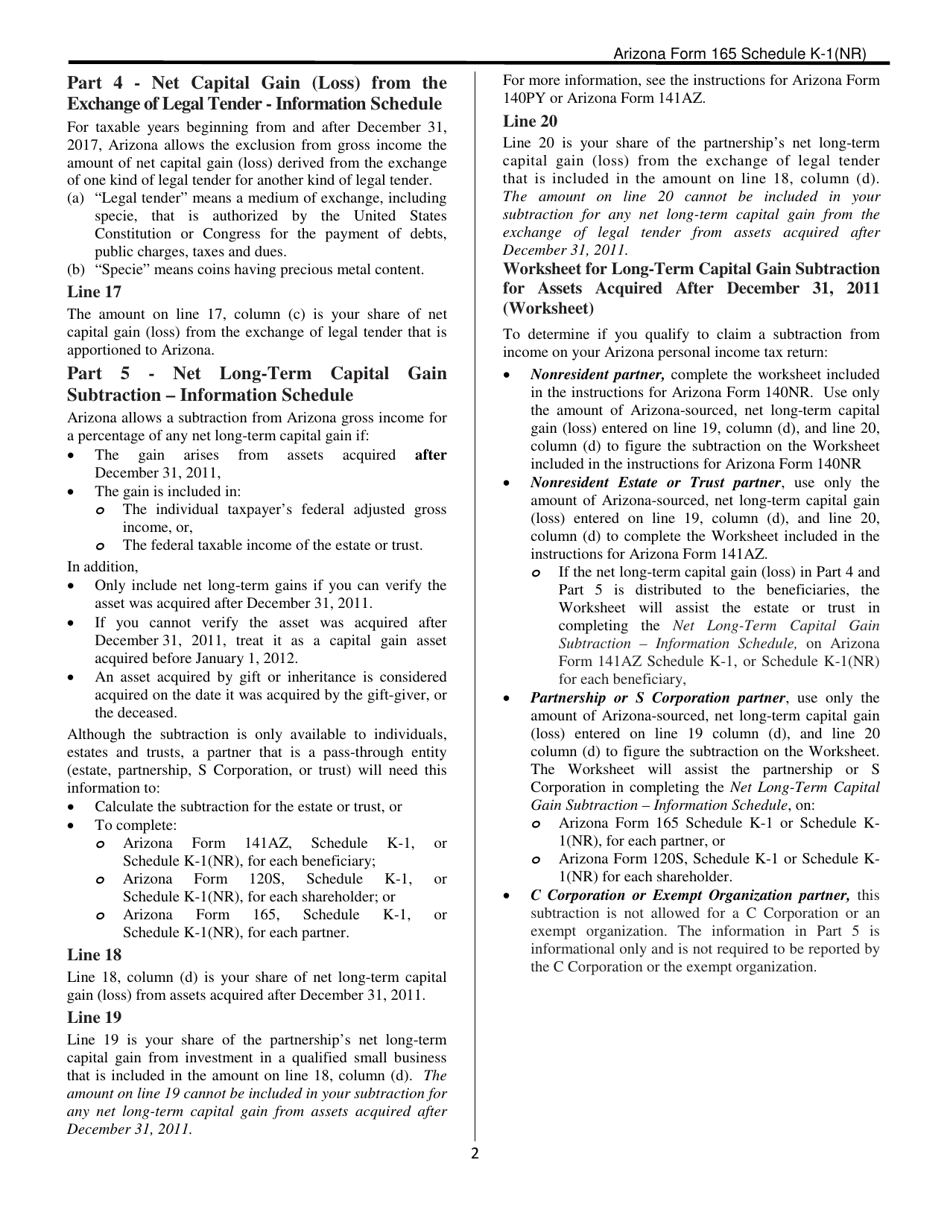

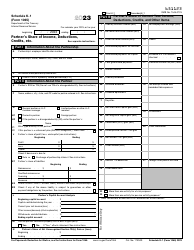

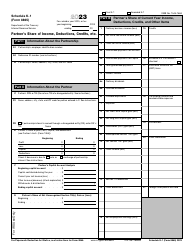

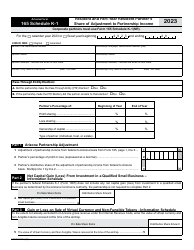

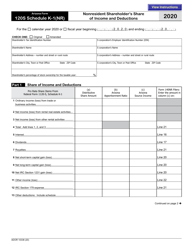

Arizona Form 165 (ADOR10345) Schedule K-1(NR) Arizona Nonresident and Out-of-State Partner's Share of Income and Deductions - Arizona

What Is Arizona Form 165 (ADOR10345) Schedule K-1(NR)?

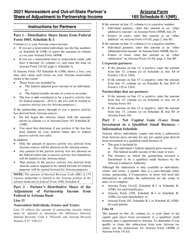

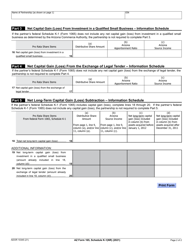

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona.The document is a supplement to Arizona Form 165, Arizona Partnership Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 165?

A: Arizona Form 165 is a tax form used to report a nonresident or out-of-state partner's share of income and deductions in Arizona.

Q: Who needs to file Arizona Form 165?

A: Nonresident or out-of-state partners who have income and deductions in Arizona need to file Arizona Form 165.

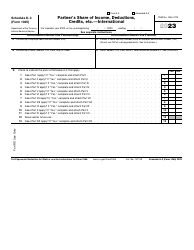

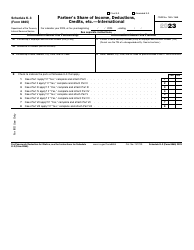

Q: What is Schedule K-1(NR)?

A: Schedule K-1(NR) is a specific part of Arizona Form 165 that is used to report a nonresident or out-of-state partner's share of income and deductions in Arizona.

Q: What information is required on Schedule K-1(NR)?

A: Schedule K-1(NR) requires the nonresident or out-of-state partner to provide their share of income and deductions in Arizona.

Q: When is the deadline to file Arizona Form 165?

A: The deadline to file Arizona Form 165 is typically April 15th, or the same date as your federal tax return.

Q: Is Arizona Form 165 only for nonresidents?

A: No, Arizona Form 165 is also for out-of-state partners who have income and deductions in Arizona.

Q: Are there any penalties for not filing Arizona Form 165?

A: Yes, if you are required to file Arizona Form 165 and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 165 (ADOR10345) Schedule K-1(NR) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.