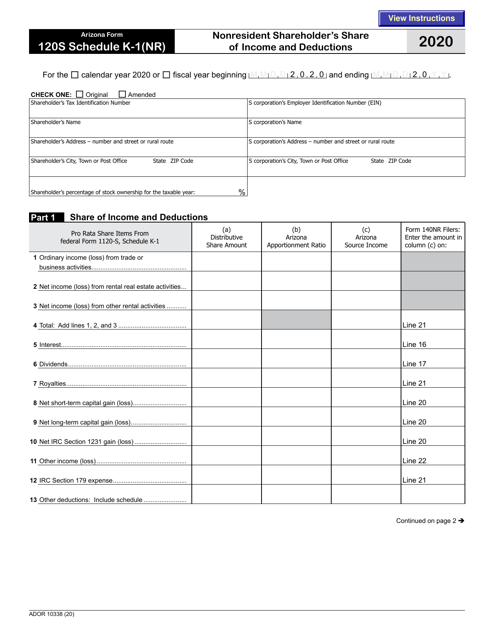

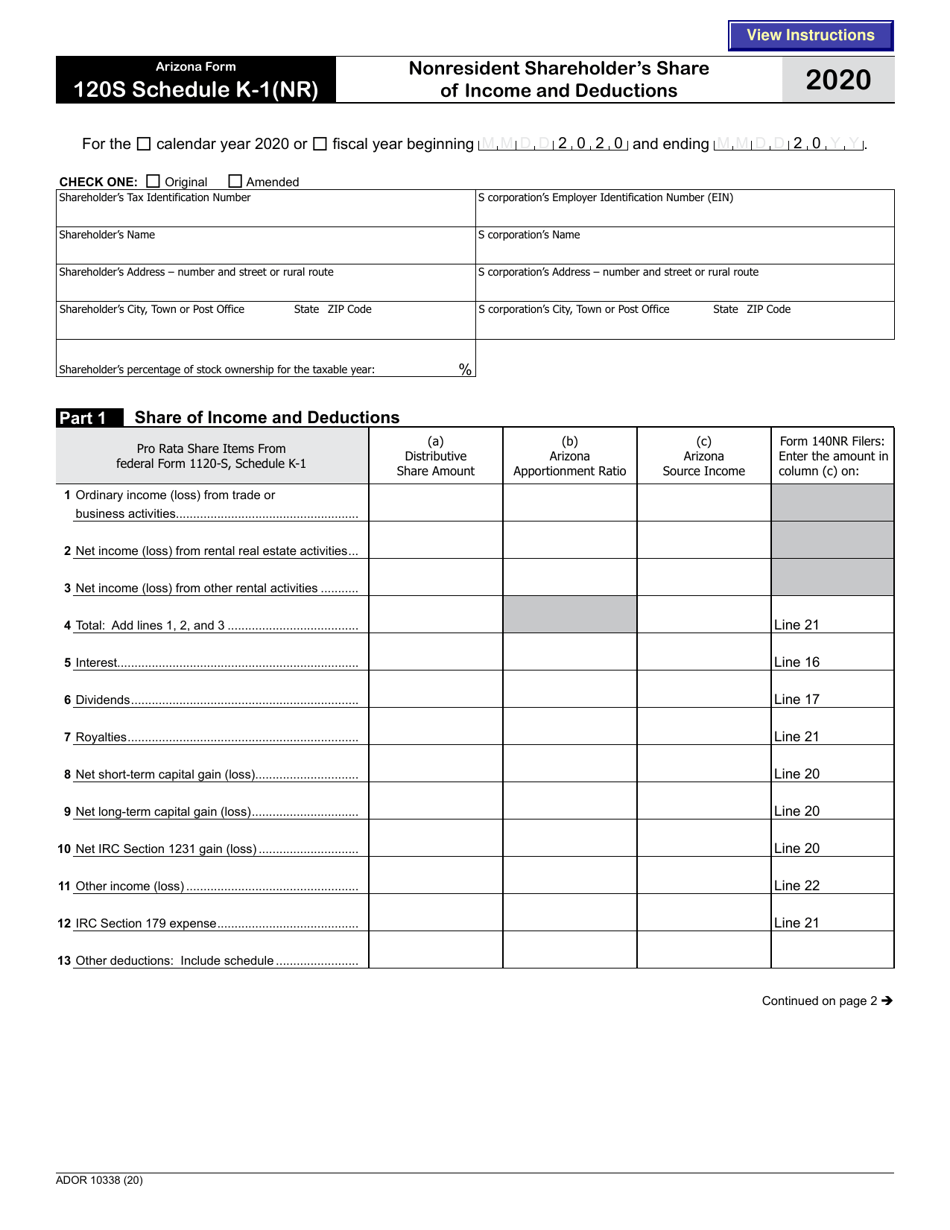

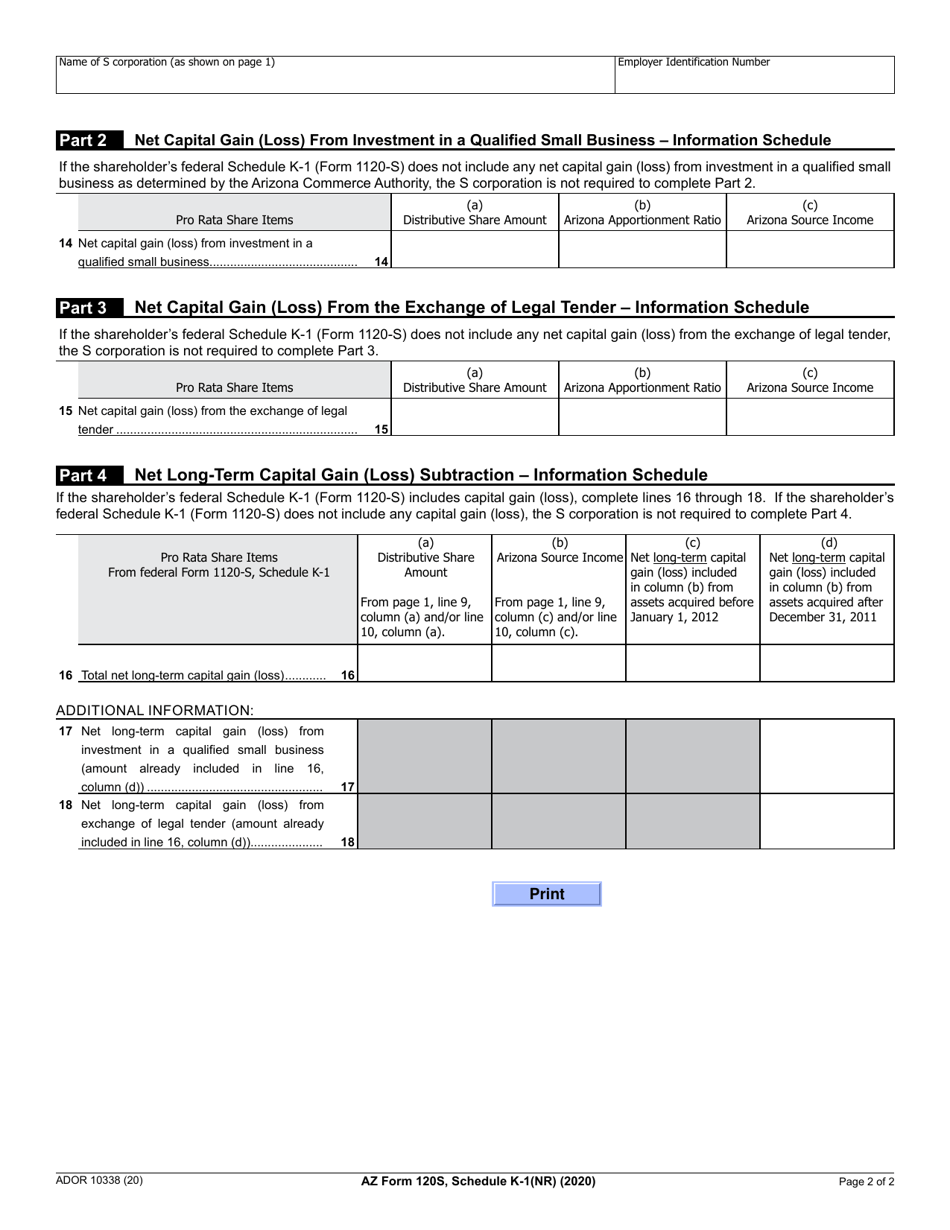

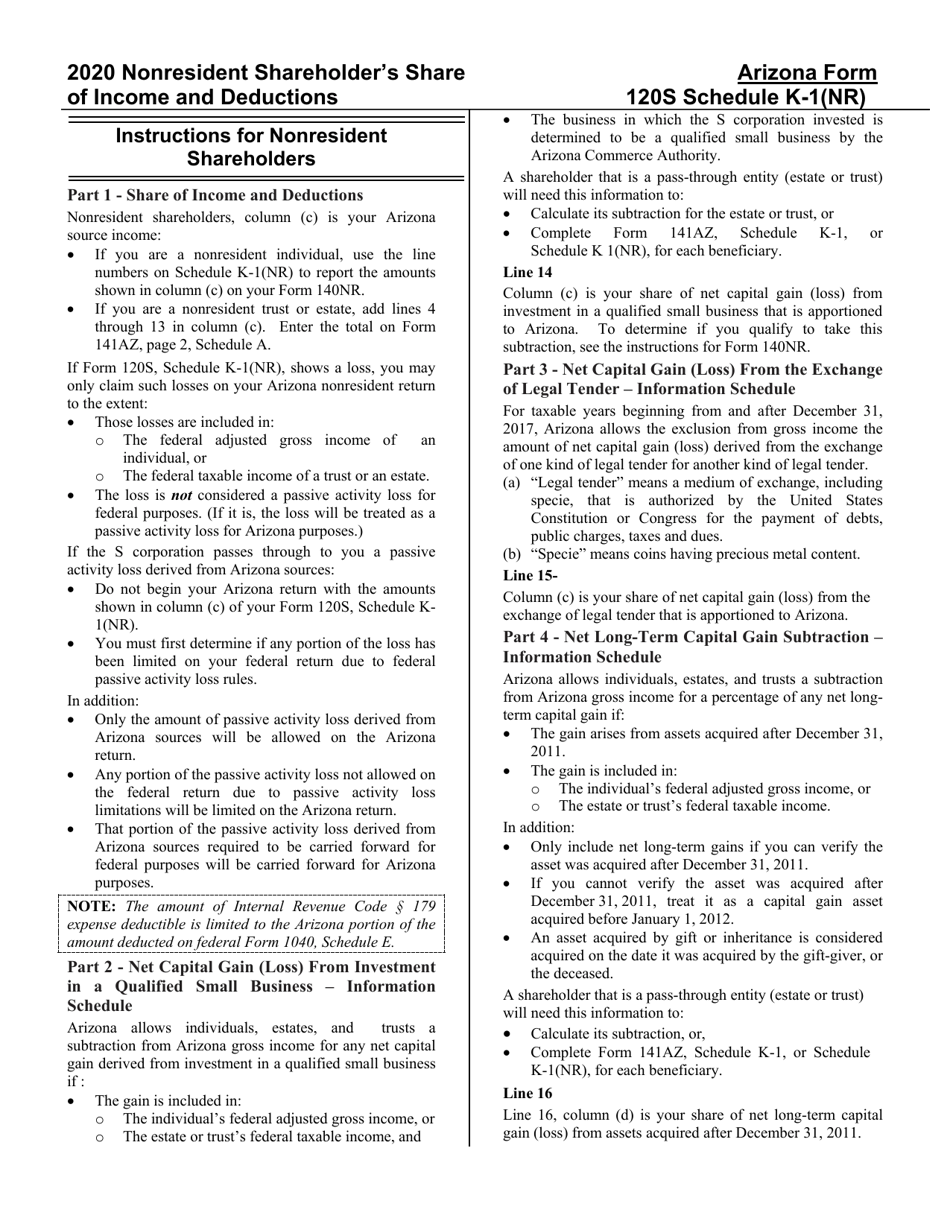

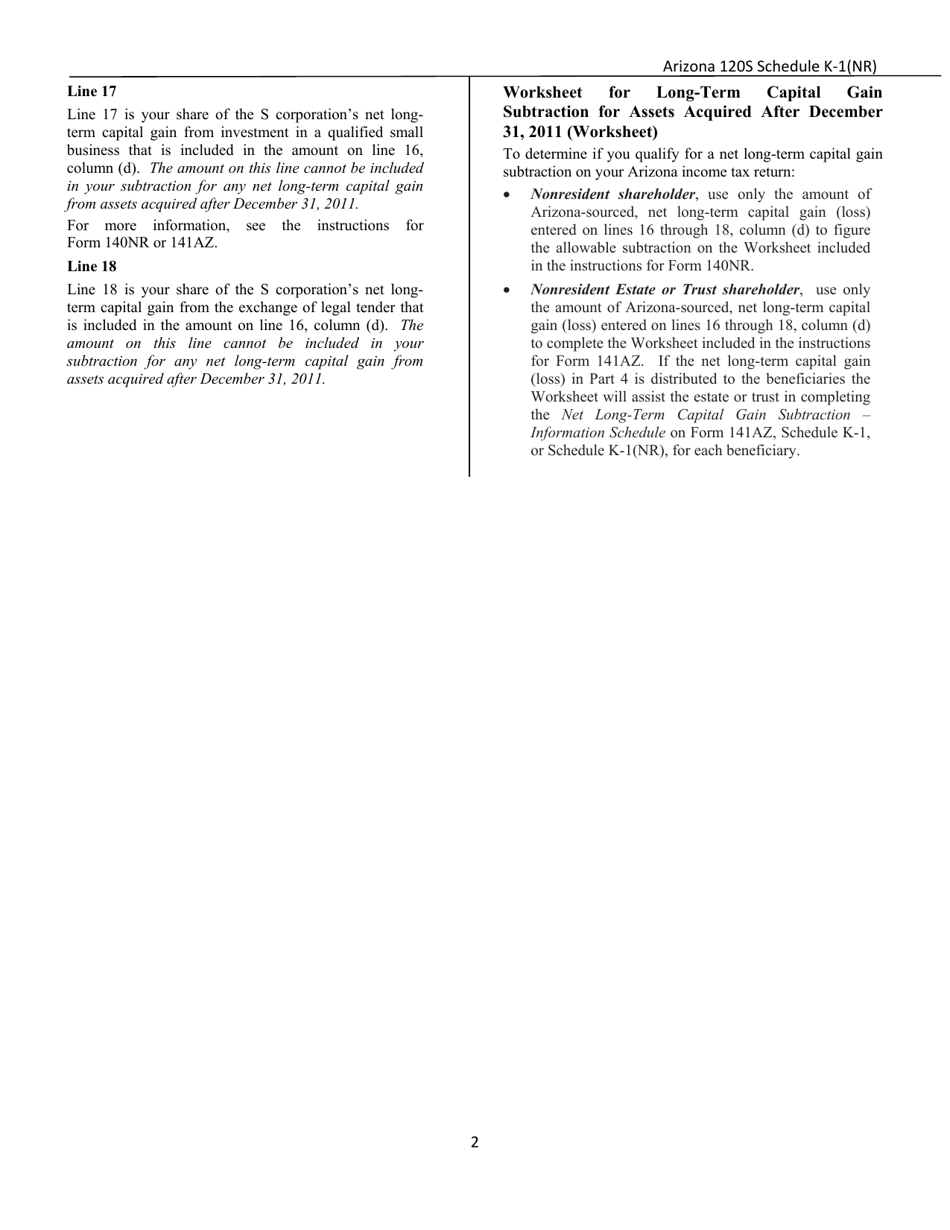

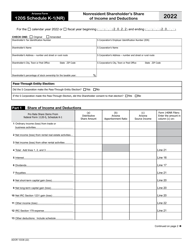

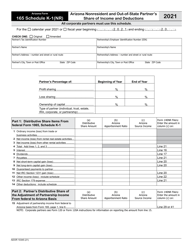

Arizona Form 120S (ADOR10338) Schedule K-1(NR) Nonresident Shareholder's Share of Income and Deductions - Arizona

What Is Arizona Form 120S (ADOR10338) Schedule K-1(NR)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 120S?

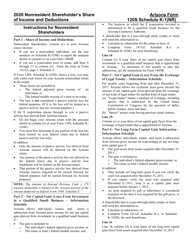

A: Arizona Form 120S is a tax form used by nonresident shareholders to report their share of income and deductions in Arizona.

Q: Who should file Arizona Form 120S?

A: Nonresident shareholders who have income or deductions from an Arizona S corporation should file Form 120S.

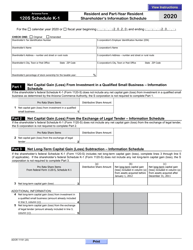

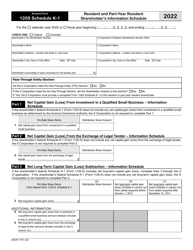

Q: What is Schedule K-1(NR)?

A: Schedule K-1(NR) is a specific part of Arizona Form 120S that reports a nonresident shareholder's share of income and deductions.

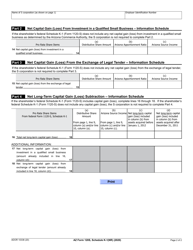

Q: What information is included in Schedule K-1(NR)?

A: Schedule K-1(NR) includes details about the nonresident shareholder's share of income, deductions, and any other relevant information.

Q: When is the deadline to file Arizona Form 120S?

A: The deadline to file Arizona Form 120S is usually April 15th, or the same deadline as the individual income tax return.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Arizona Form 120S, including potential interest charges on any taxes owed.

Q: Do nonresident shareholders need to file any other tax forms in Arizona?

A: Nonresident shareholders may need to file other tax forms in Arizona, depending on their specific tax situation.

Q: Can I e-file Arizona Form 120S?

A: Yes, Arizona Form 120S can be filed electronically through the Arizona Department of Revenue's e-file system.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 120S (ADOR10338) Schedule K-1(NR) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.