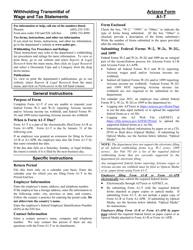

This version of the form is not currently in use and is provided for reference only. Download this version of

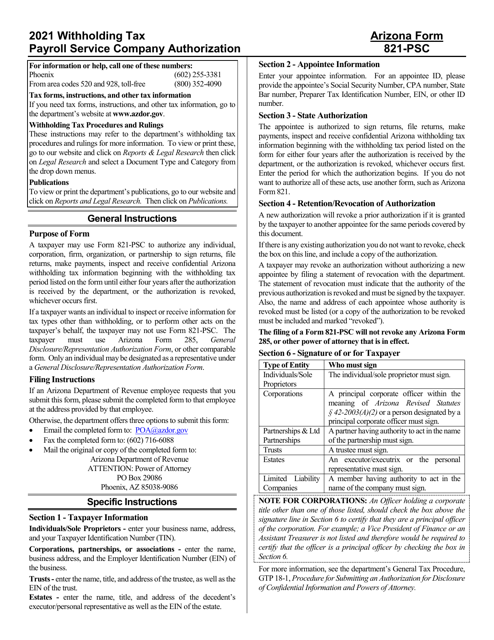

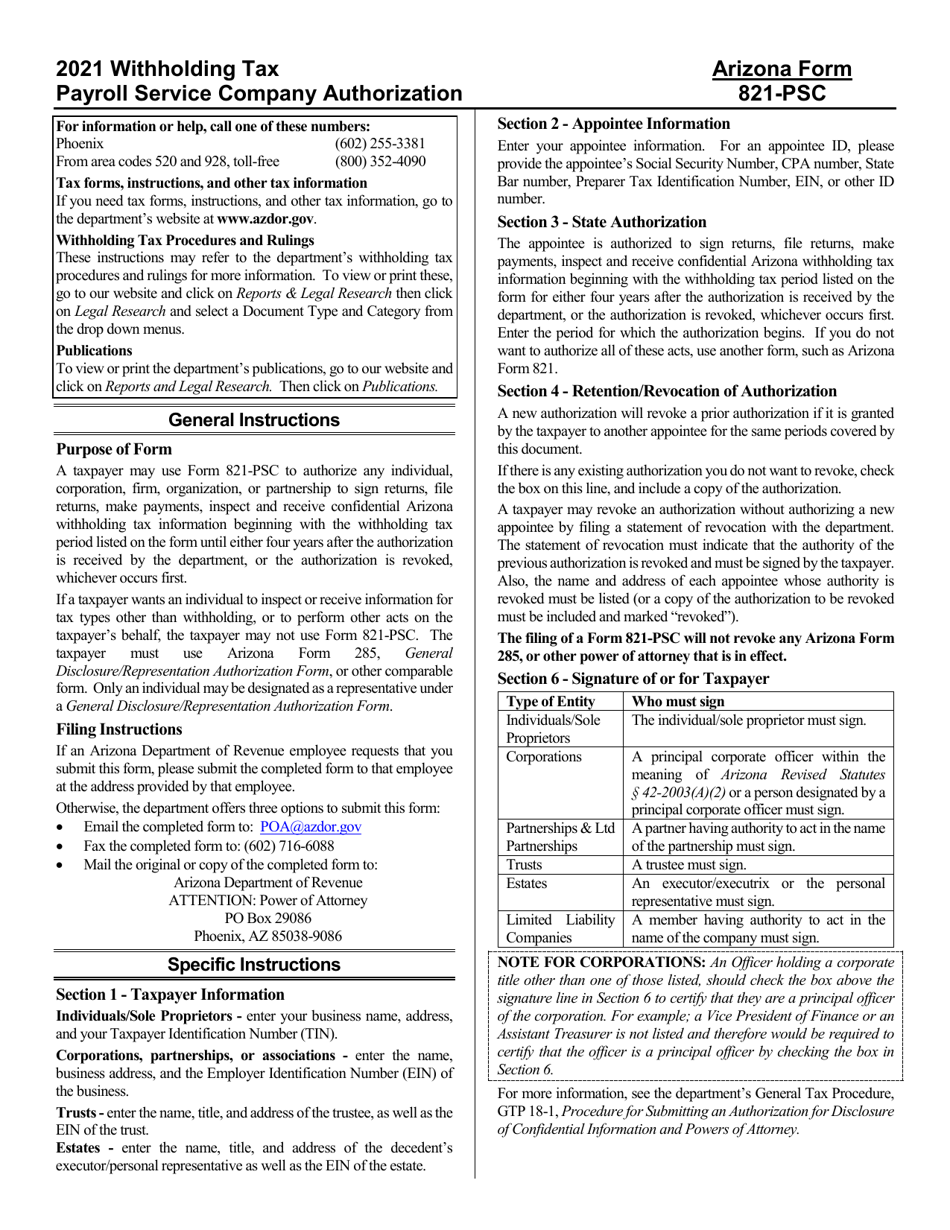

Instructions for Arizona Form 821-PSC, ADOR11154

for the current year.

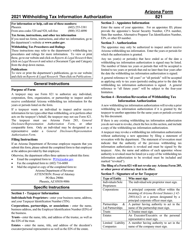

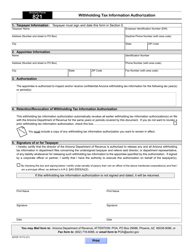

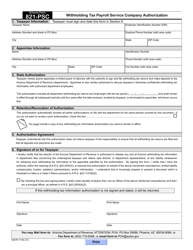

Instructions for Arizona Form 821-PSC, ADOR11154 Withholding Tax Payroll Service Company Authorization - Arizona

This document contains official instructions for Arizona Form 821-PSC , and Form ADOR11154 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is Arizona Form 821-PSC?

A: Arizona Form 821-PSC is the Withholding TaxPayroll Service Company Authorization form.

Q: What is the purpose of Arizona Form 821-PSC?

A: The form is used to authorize a payroll service company to remit withholding taxes on behalf of employers in Arizona.

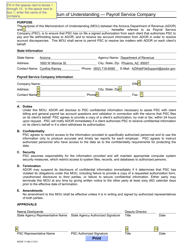

Q: Who needs to file Arizona Form 821-PSC?

A: Employers in Arizona who want to authorize a payroll service company to handle their withholding tax payments.

Q: What information is required on Arizona Form 821-PSC?

A: The form requires the employer's identification information, payroll service company information, and authorization details.

Q: Is there a deadline for filing Arizona Form 821-PSC?

A: The form should be filed before the payroll service company starts to remit withholding taxes on behalf of the employer.

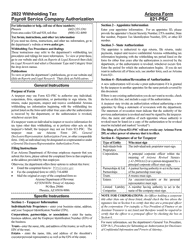

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.