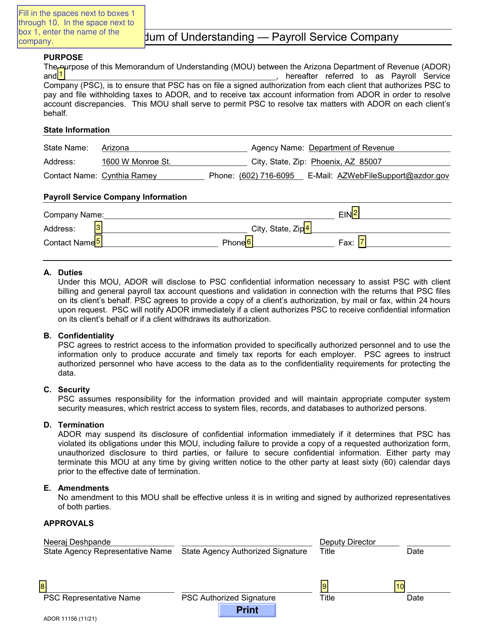

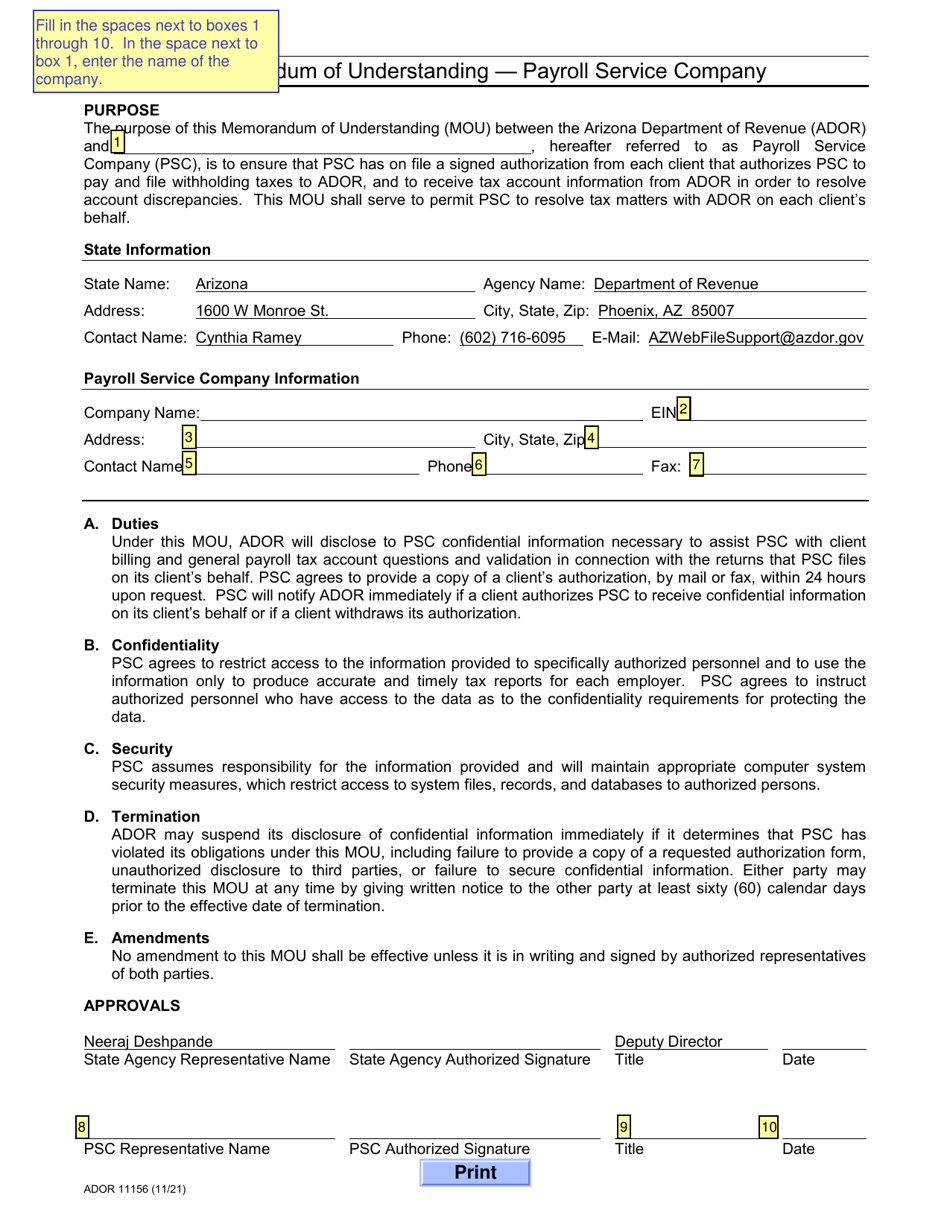

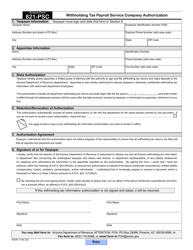

Form MOU-PS (ADOR11156) Memorandum of Understanding - Payroll Service Company - Arizona

What Is Form MOU-PS (ADOR11156)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MOU-PS?

A: MOU-PS stands for Memorandum of Understanding - Payroll Service Company.

Q: What does the MOU-PS cover?

A: The MOU-PS covers the terms and conditions between a payroll service company and a party in Arizona.

Q: What is the purpose of the MOU-PS?

A: The purpose of the MOU-PS is to establish an agreement for payroll services between the parties involved.

Q: Who can use the MOU-PS?

A: The MOU-PS can be used by a payroll service company operating in Arizona and a party seeking payroll services.

Q: What are the key components of the MOU-PS?

A: The key components of the MOU-PS include the scope of services, payment terms, confidentiality, and termination provisions.

Q: Is the MOU-PS legally binding?

A: Yes, the MOU-PS is a legally binding agreement once it is signed by the parties involved.

Q: Are there any specific regulations in Arizona for payroll service companies?

A: It is recommended to consult with an attorney or a relevant regulatory agency to understand the specific regulations for payroll service companies in Arizona.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MOU-PS (ADOR11156) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.