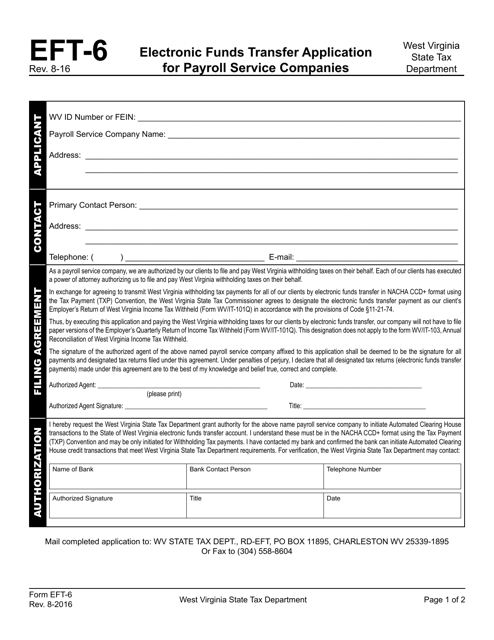

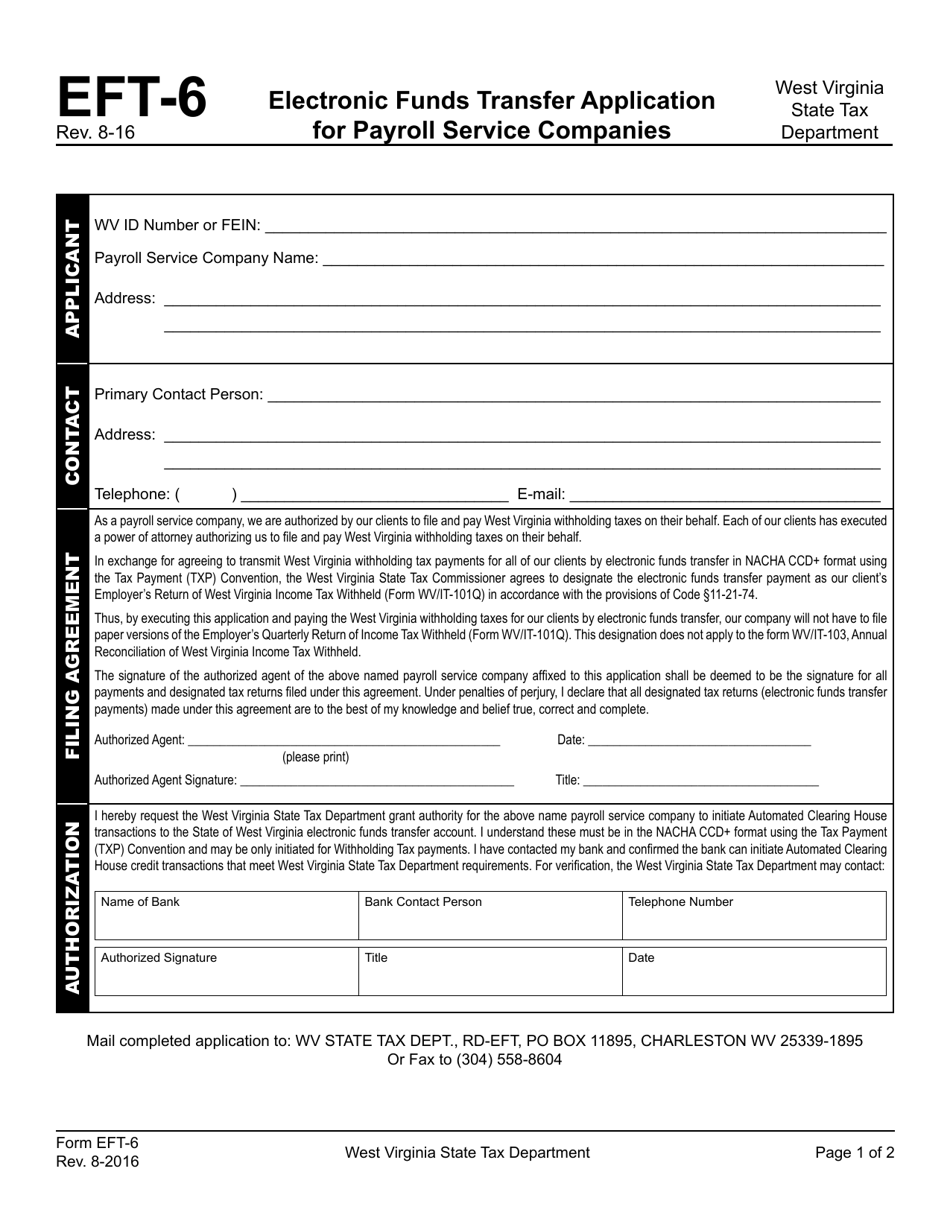

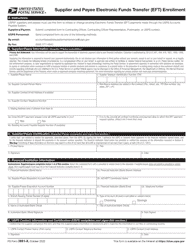

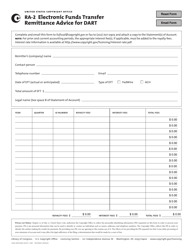

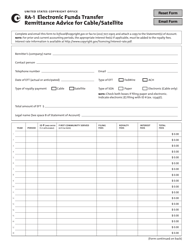

Form EFT-6 Electronic Funds Transfer Application for Payroll Service Companies - West Virginia

What Is Form EFT-6?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

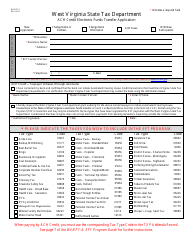

Q: What is the Form EFT-6 for?

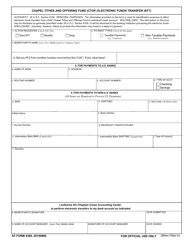

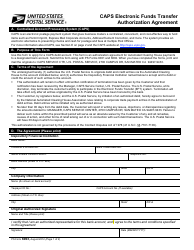

A: The Form EFT-6 is for electronic funds transfer application for payroll service companies.

Q: Who is required to file Form EFT-6?

A: Payroll service companies in West Virginia are required to file Form EFT-6.

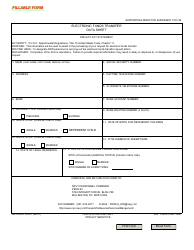

Q: What is the purpose of electronic funds transfer?

A: Electronic funds transfer allows for the secure and efficient transfer of funds between bank accounts.

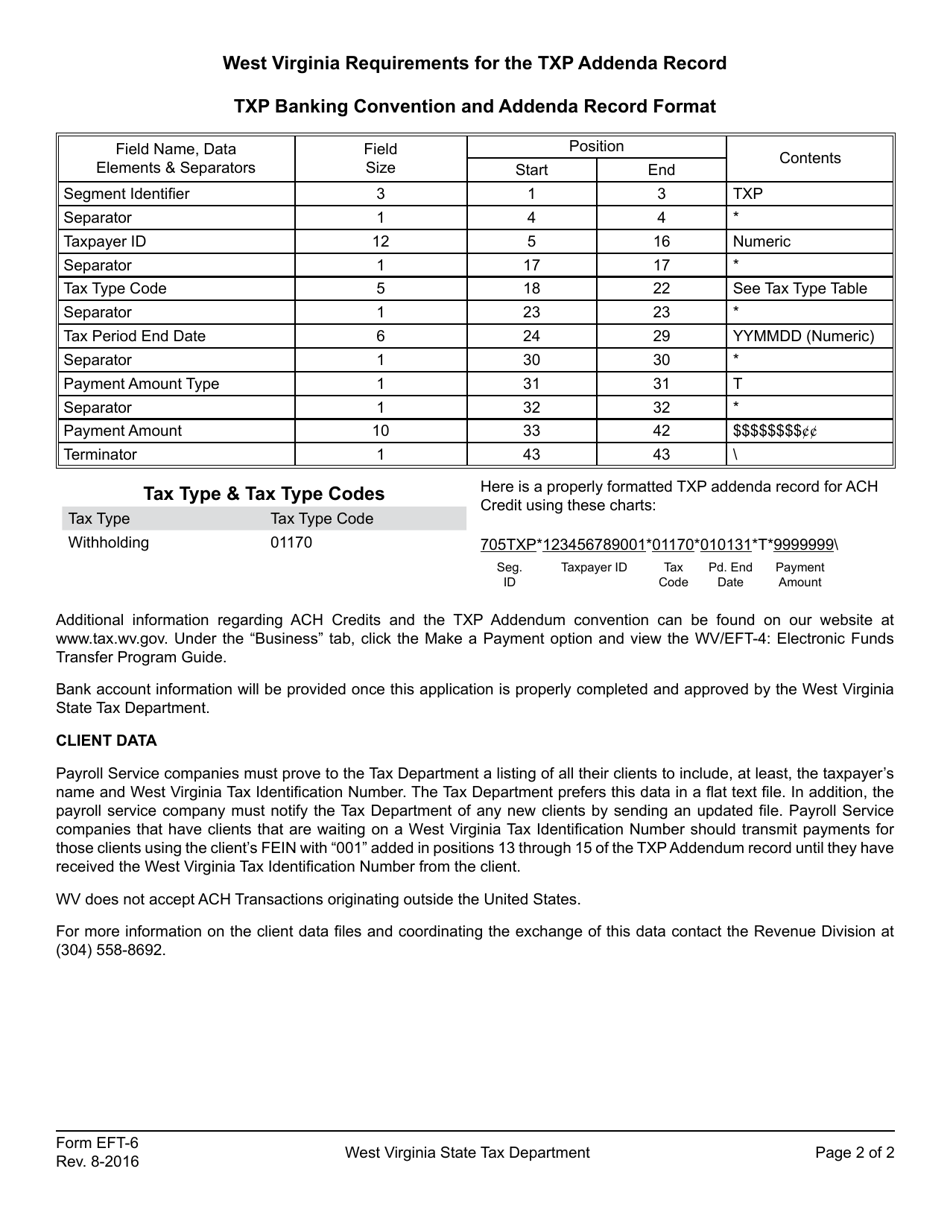

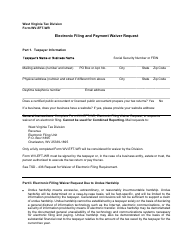

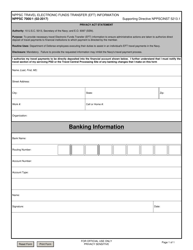

Q: Are there any specific requirements for completing Form EFT-6?

A: Yes, payroll service companies must provide detailed information about their business and banking information in order to complete Form EFT-6.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form EFT-6 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.