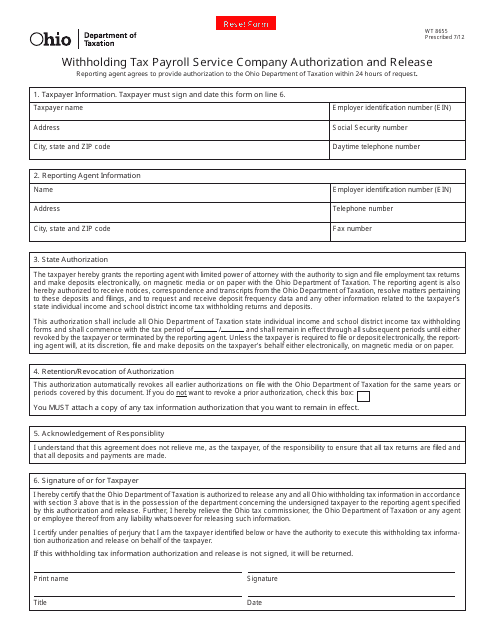

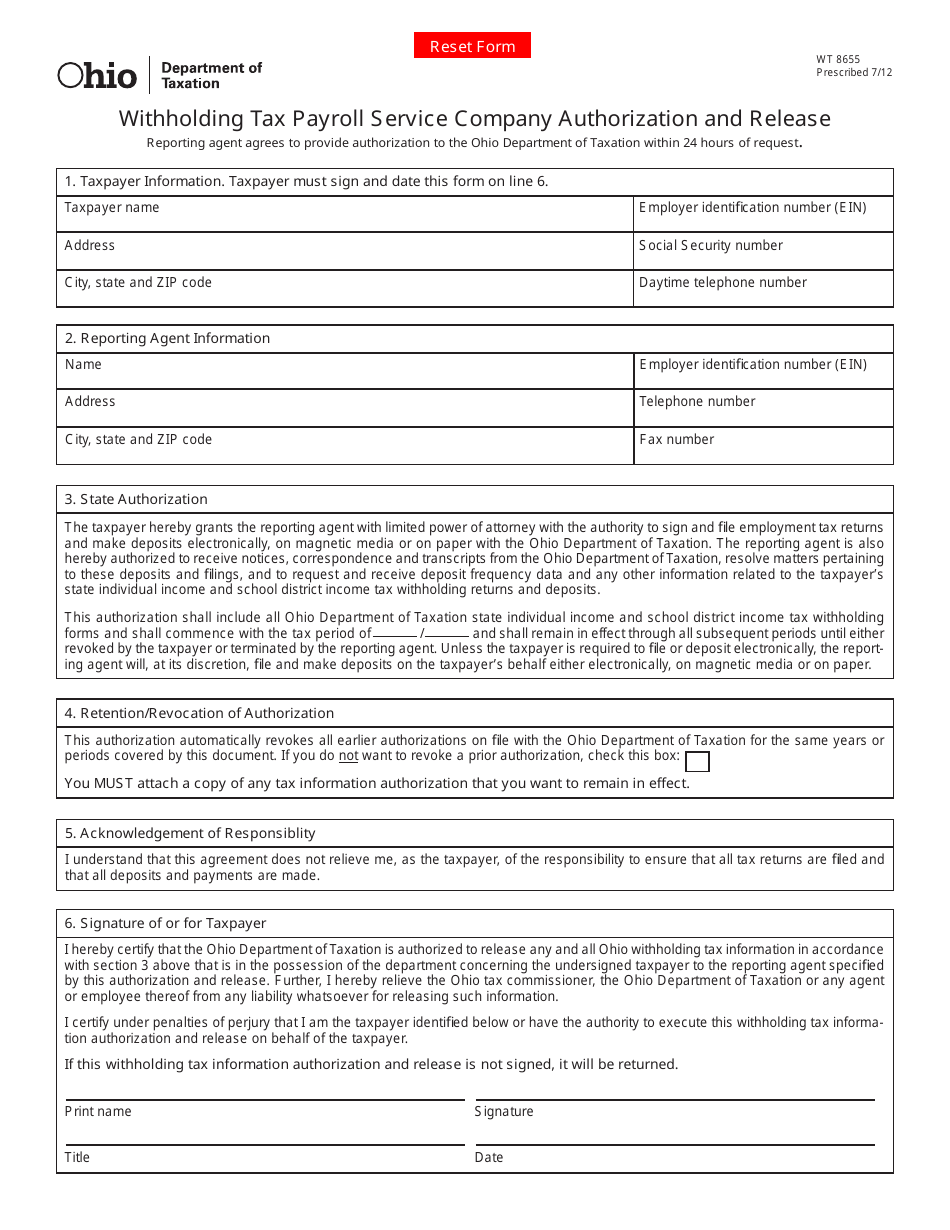

Form WT8655 Withholding Tax Payroll Service Company Authorization and Release - Ohio

What Is Form WT8655?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WT8655?

A: Form WT8655 is an authorization and release form for payroll service companies in Ohio.

Q: Who needs to use Form WT8655?

A: Payroll service companies in Ohio need to use Form WT8655.

Q: What is the purpose of Form WT8655?

A: The purpose of Form WT8655 is to authorize the release of tax information to a payroll service company.

Q: Is Form WT8655 specific to Ohio?

A: Yes, Form WT8655 is specific to Ohio and is used for withholding tax purposes.

Q: Do I need to submit Form WT8655 every year?

A: No, you only need to submit Form WT8655 when you begin using a new payroll service company or if there are changes to the authorization.

Q: What information do I need to provide on Form WT8655?

A: You will need to provide your business information, the payroll service company's information, and details about the authorization and release.

Q: What happens after I submit Form WT8655?

A: After you submit Form WT8655, the Ohio Department of Taxation will update their records to authorize the release of tax information to the payroll service company.

Q: Is there a deadline for submitting Form WT8655?

A: There is no specific deadline for submitting Form WT8655, but it is recommended to submit it as soon as you begin using a new payroll service company.

Q: Can I revoke the authorization on Form WT8655?

A: Yes, you can revoke the authorization on Form WT8655 by submitting a written request to the Ohio Department of Taxation.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WT8655 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.