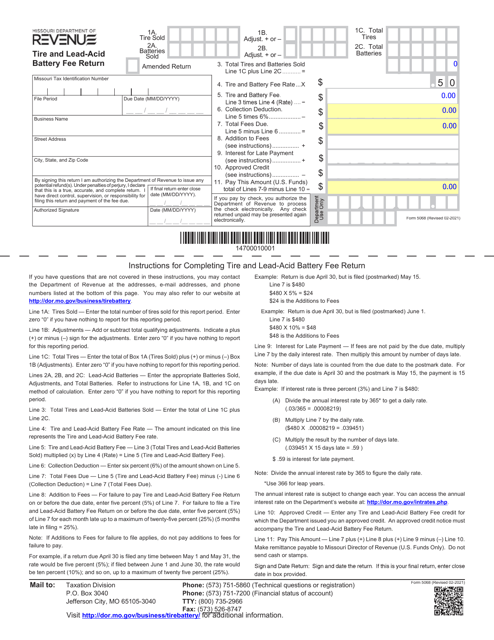

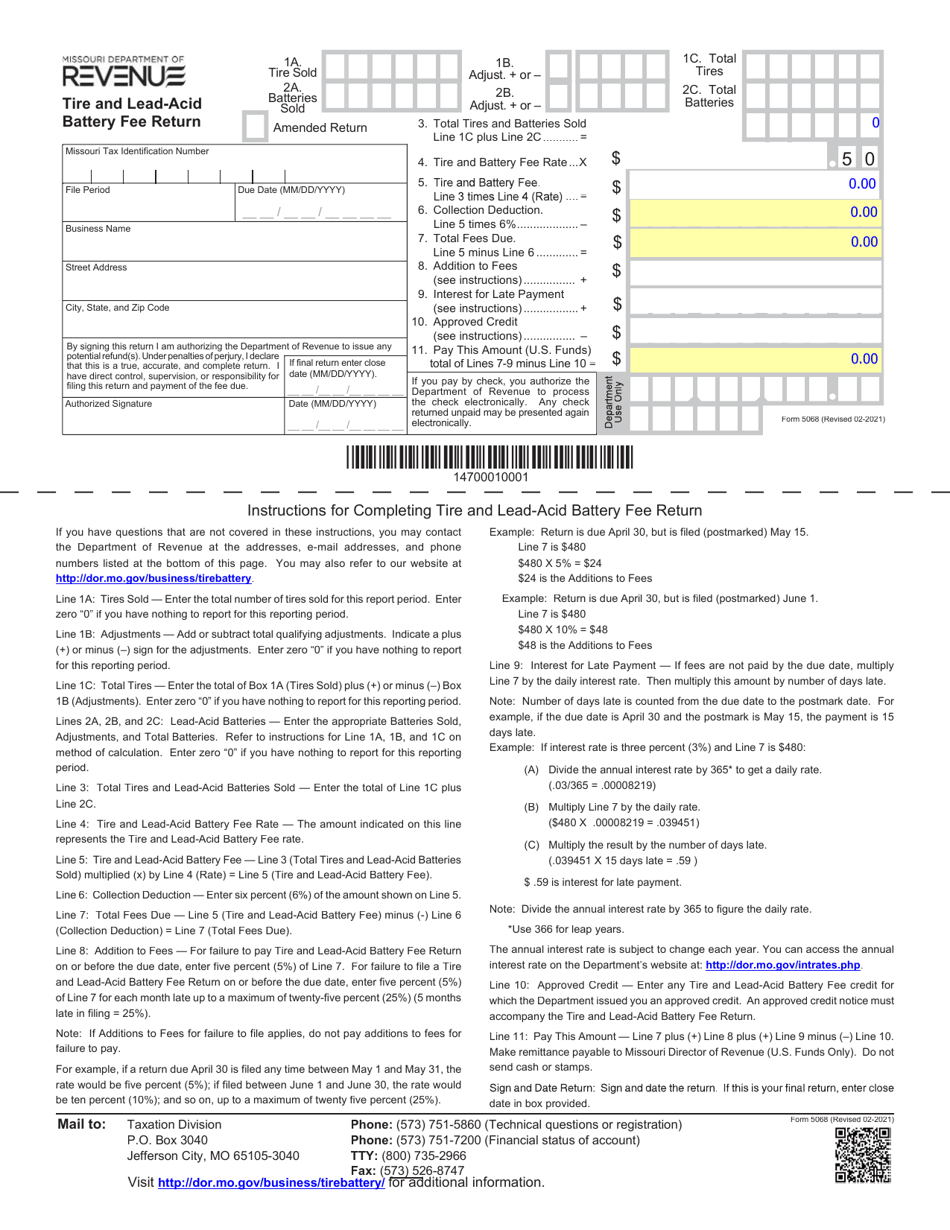

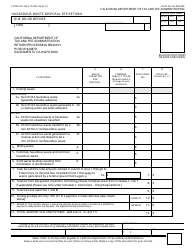

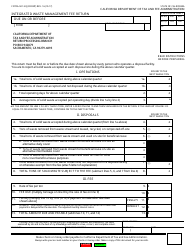

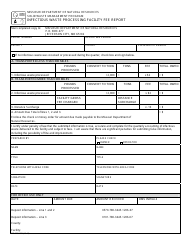

Form 5068 Tire and Lead-Acid Battery Fee Return - Missouri

What Is Form 5068?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5068?

A: Form 5068 is the Tire and Lead-Acid Battery Fee Return form used in the state of Missouri.

Q: Who needs to file Form 5068?

A: Any person or business engaged in the sale or distribution of tires or lead-acid batteries in Missouri needs to file Form 5068.

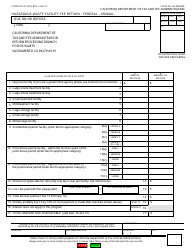

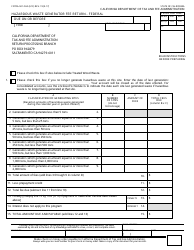

Q: When is Form 5068 due?

A: Form 5068 is due annually, on or before the 20th day of the month following the end of the reporting period.

Q: What are the reporting periods for Form 5068?

A: The reporting periods for Form 5068 are quarterly, with due dates on April 20, July 20, October 20, and January 20.

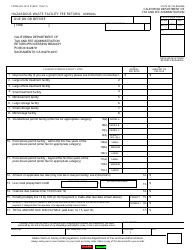

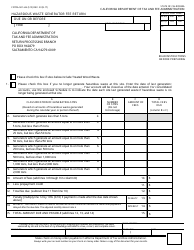

Q: What information is required to complete Form 5068?

A: The form requires information such as the number of tires or lead-acid batteries sold or distributed in Missouri, the amount of fees collected, and other business details.

Q: Are there any penalties for late or non-filing of Form 5068?

A: Yes, failure to file or late filing of Form 5068 may result in penalties and interest charges.

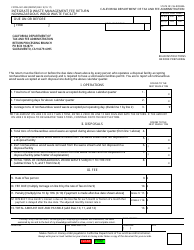

Q: Who should I contact for more information about Form 5068?

A: For more information about Form 5068, you can contact the Missouri Department of Revenue.

Form Details:

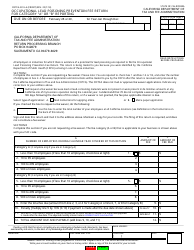

- Released on February 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5068 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.