This version of the form is not currently in use and is provided for reference only. Download this version of

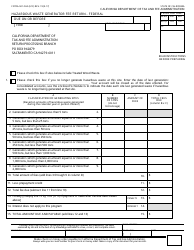

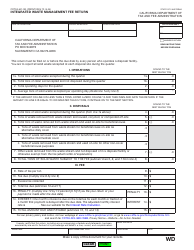

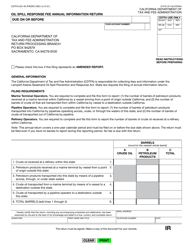

Form CDTFA-501-HF

for the current year.

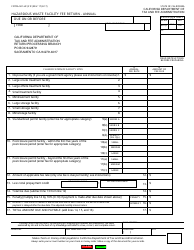

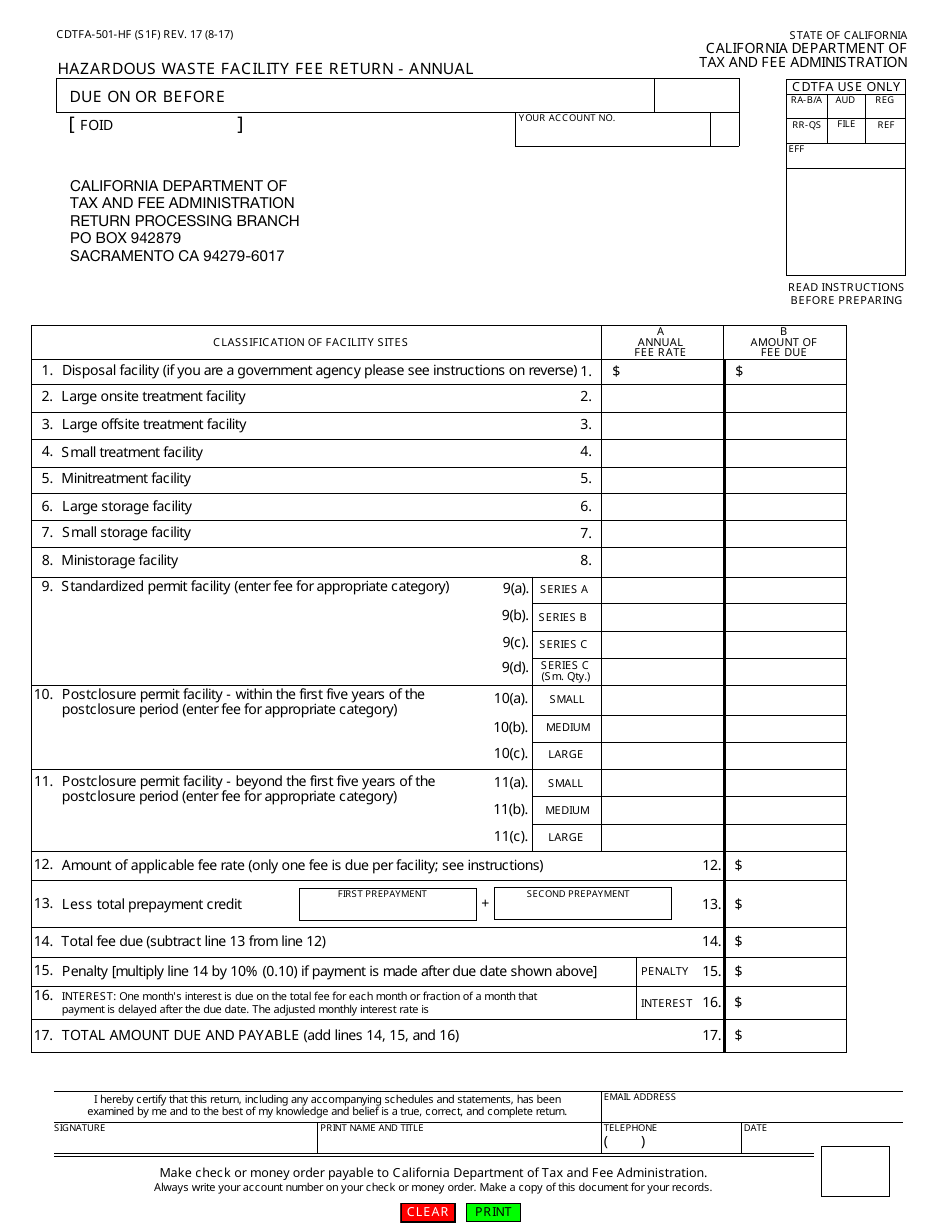

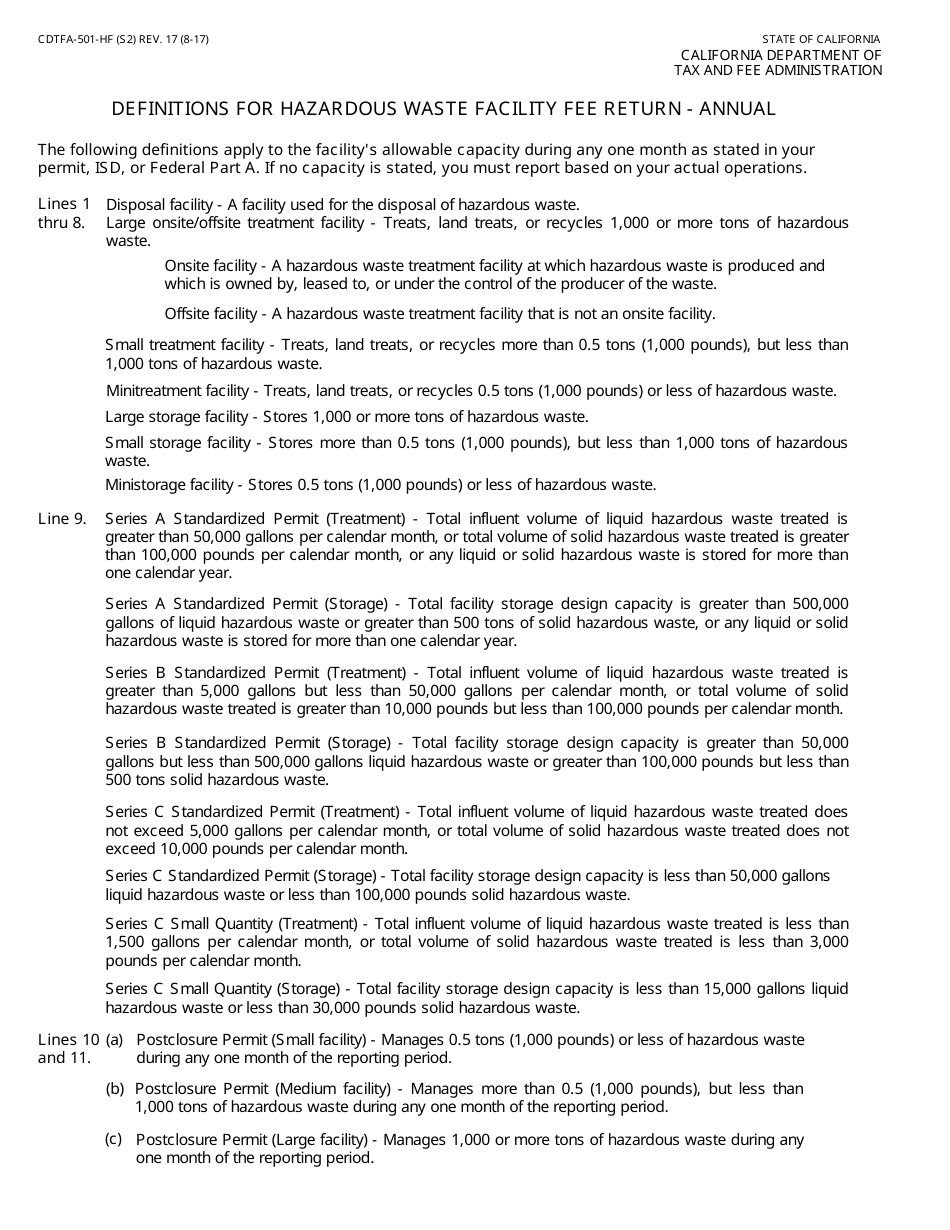

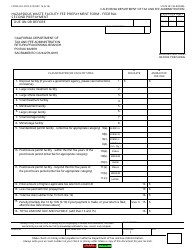

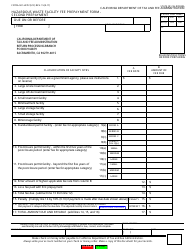

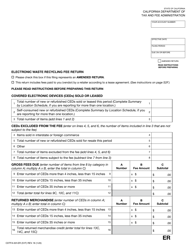

Form CDTFA-501-HF Hazardous Waste Facility Fee Return - Annual - California

What Is Form CDTFA-501-HF?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-HF?

A: Form CDTFA-501-HF is a Hazardous Waste Facility Fee Return.

Q: Who needs to file Form CDTFA-501-HF?

A: Facilities in California that generate, treat, or store hazardous waste are required to file Form CDTFA-501-HF.

Q: How often do I need to file Form CDTFA-501-HF?

A: Form CDTFA-501-HF should be filed on an annual basis.

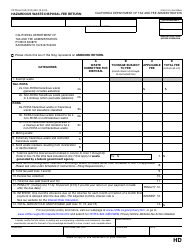

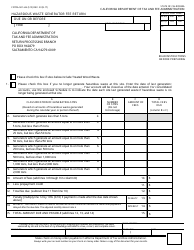

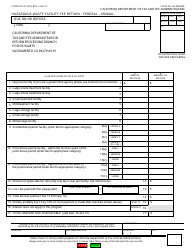

Q: What is the purpose of Form CDTFA-501-HF?

A: The purpose of Form CDTFA-501-HF is to report and pay the hazardous waste facility fee to the California Department of Tax and Fee Administration (CDTFA).

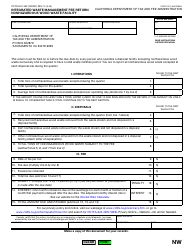

Q: Are there any penalties for not filing Form CDTFA-501-HF?

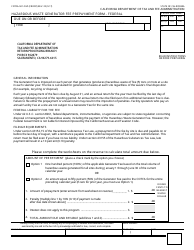

A: Yes, there may be penalties for not filing Form CDTFA-501-HF or for filing it late. It is important to file the return on time to avoid penalties and interest charges.

Q: Is there a fee associated with filing Form CDTFA-501-HF?

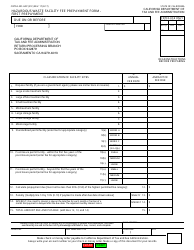

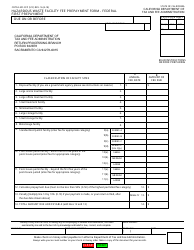

A: Yes, the hazardous waste facility fee is based on the amount of hazardous waste generated, treated, or stored.

Q: What supporting documentation do I need to include with Form CDTFA-501-HF?

A: You may be required to attach supporting documentation such as a manifest or other reports that provide information about the hazardous waste generated, treated, or stored.

Q: What if I need help with filing Form CDTFA-501-HF?

A: If you need assistance with filing Form CDTFA-501-HF, you can contact the California Department of Tax and Fee Administration (CDTFA) for guidance.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-HF by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.