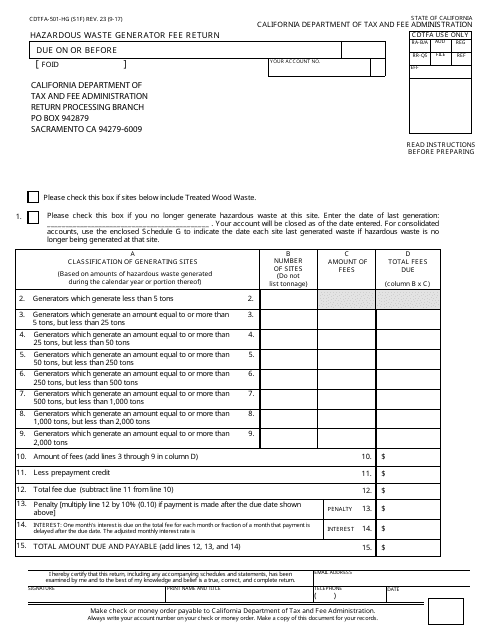

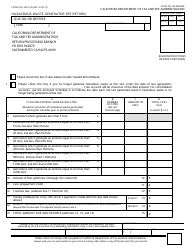

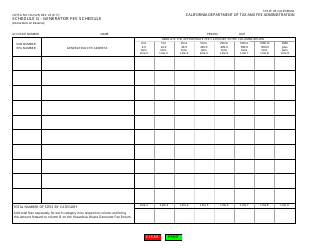

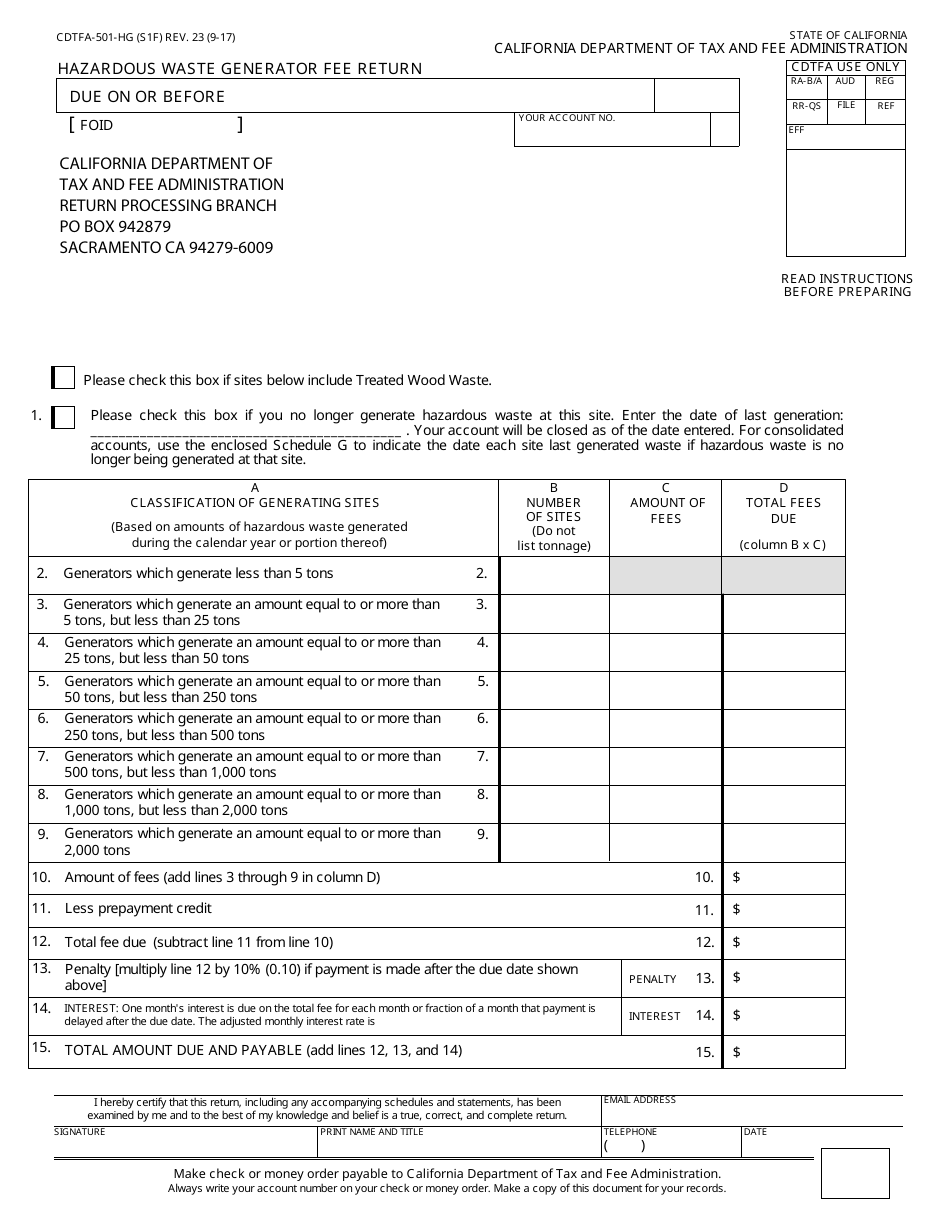

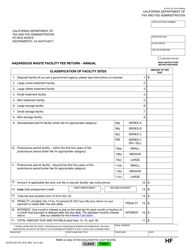

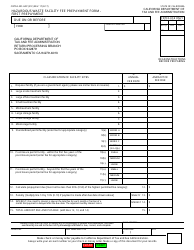

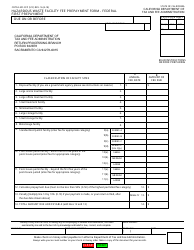

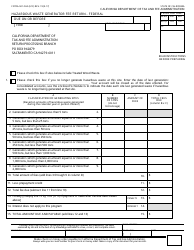

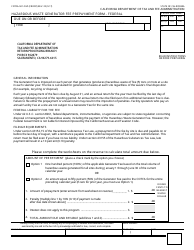

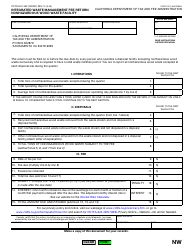

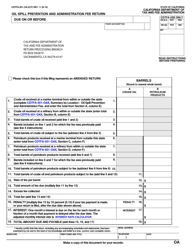

Form CDTFA-501-HG Hazardous Waste Generator Fee Return - California

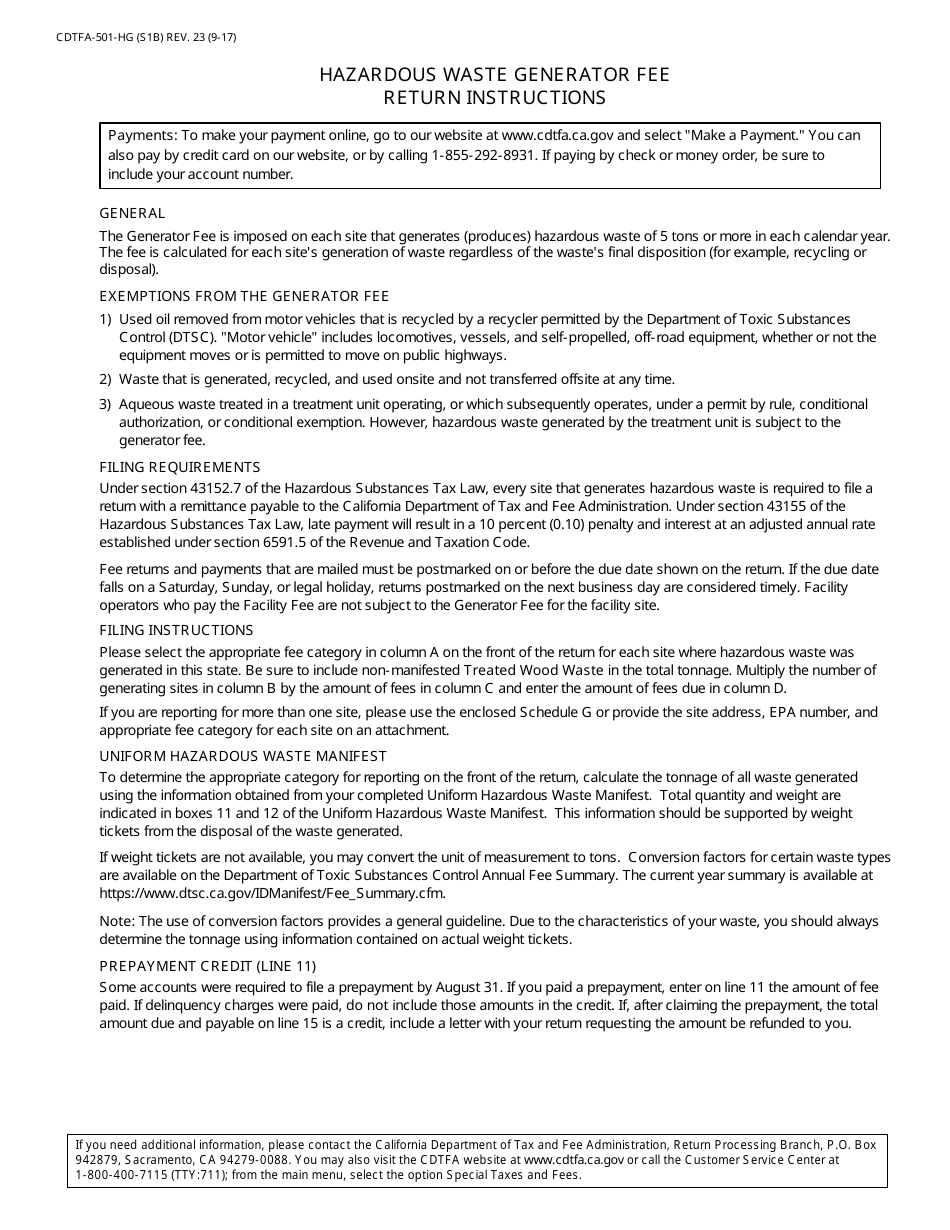

What Is Form CDTFA-501-HG?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-HG?

A: Form CDTFA-501-HG is the Hazardous Waste Generator Fee Return in California.

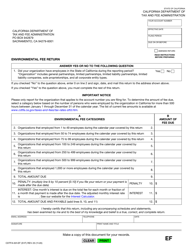

Q: Who needs to file Form CDTFA-501-HG?

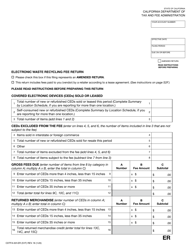

A: Any business or entity that generates or handles hazardous waste in California needs to file Form CDTFA-501-HG.

Q: What is the purpose of Form CDTFA-501-HG?

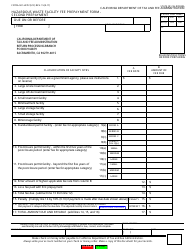

A: The purpose of Form CDTFA-501-HG is to report and pay the Hazardous Waste Generator Fee in California.

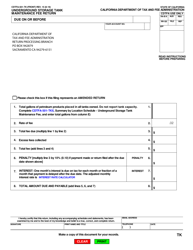

Q: How often do I need to file Form CDTFA-501-HG?

A: Form CDTFA-501-HG needs to be filed on a quarterly basis.

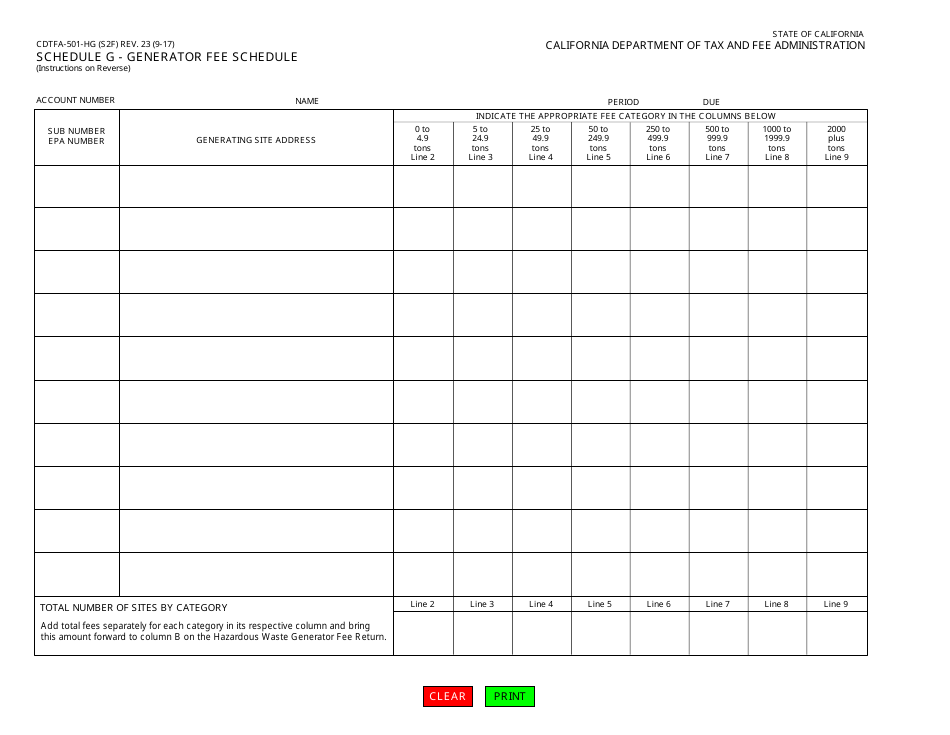

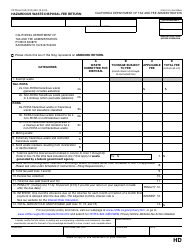

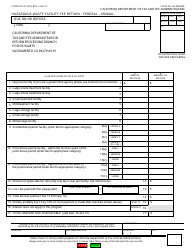

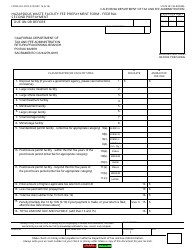

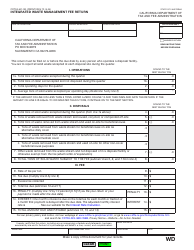

Q: What information do I need to complete Form CDTFA-501-HG?

A: You will need to provide information about the amount of hazardous waste generated or handled, as well as any exemptions or deductions that may apply.

Q: Are there any penalties for not filing Form CDTFA-501-HG?

A: Yes, there may be penalties for not filing Form CDTFA-501-HG, including late filing and late payment penalties.

Q: Is there a deadline for filing Form CDTFA-501-HG?

A: Yes, Form CDTFA-501-HG must be filed by the last day of the month following the end of the quarter.

Q: Do I need to submit any supporting documentation with Form CDTFA-501-HG?

A: No, you do not need to submit any supporting documentation with Form CDTFA-501-HG, but you should keep records of your hazardous waste activity in case of an audit.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-HG by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.