This version of the form is not currently in use and is provided for reference only. Download this version of

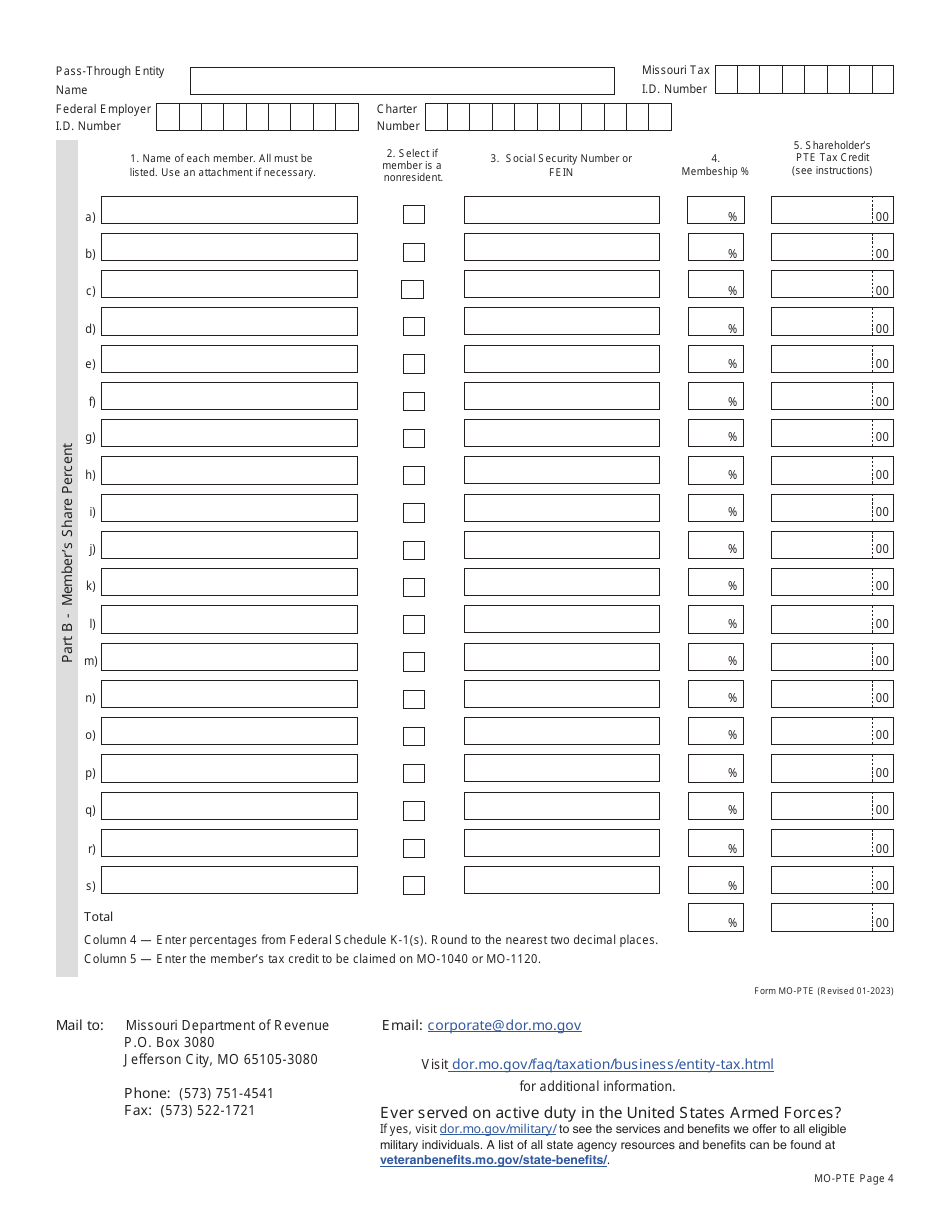

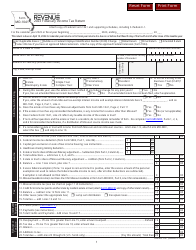

Form MO-PTE

for the current year.

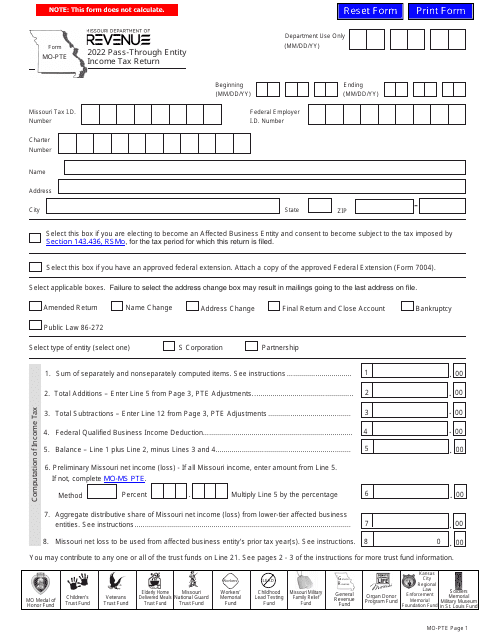

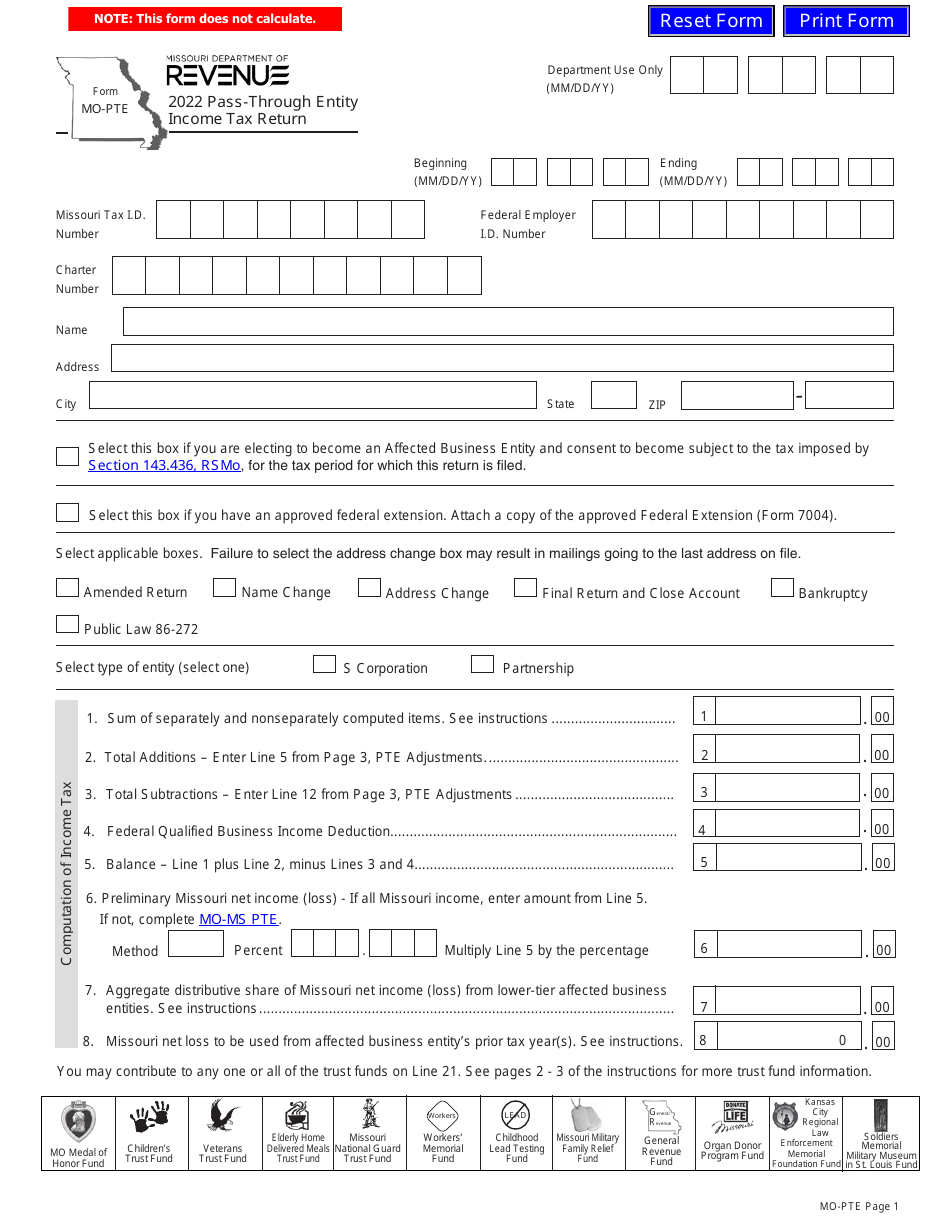

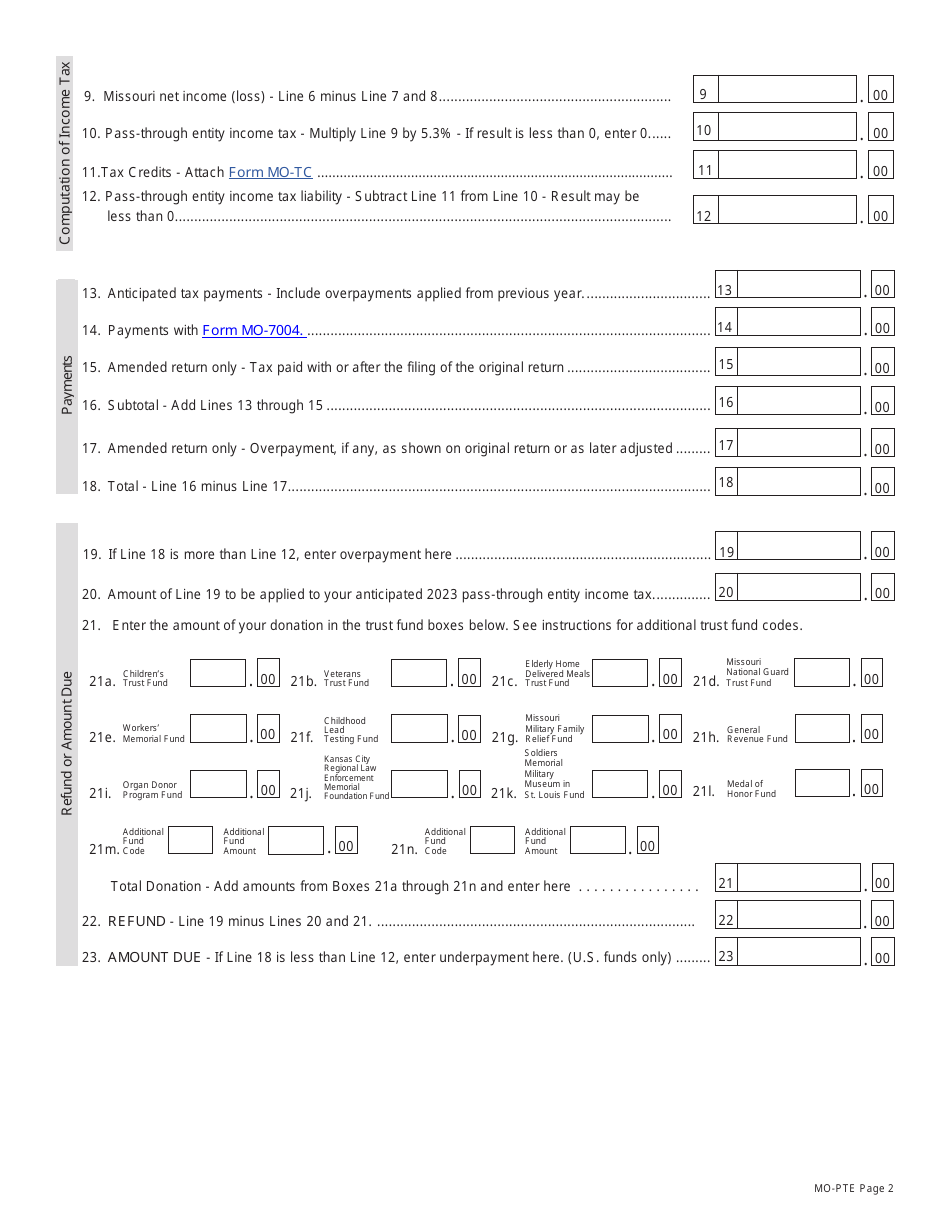

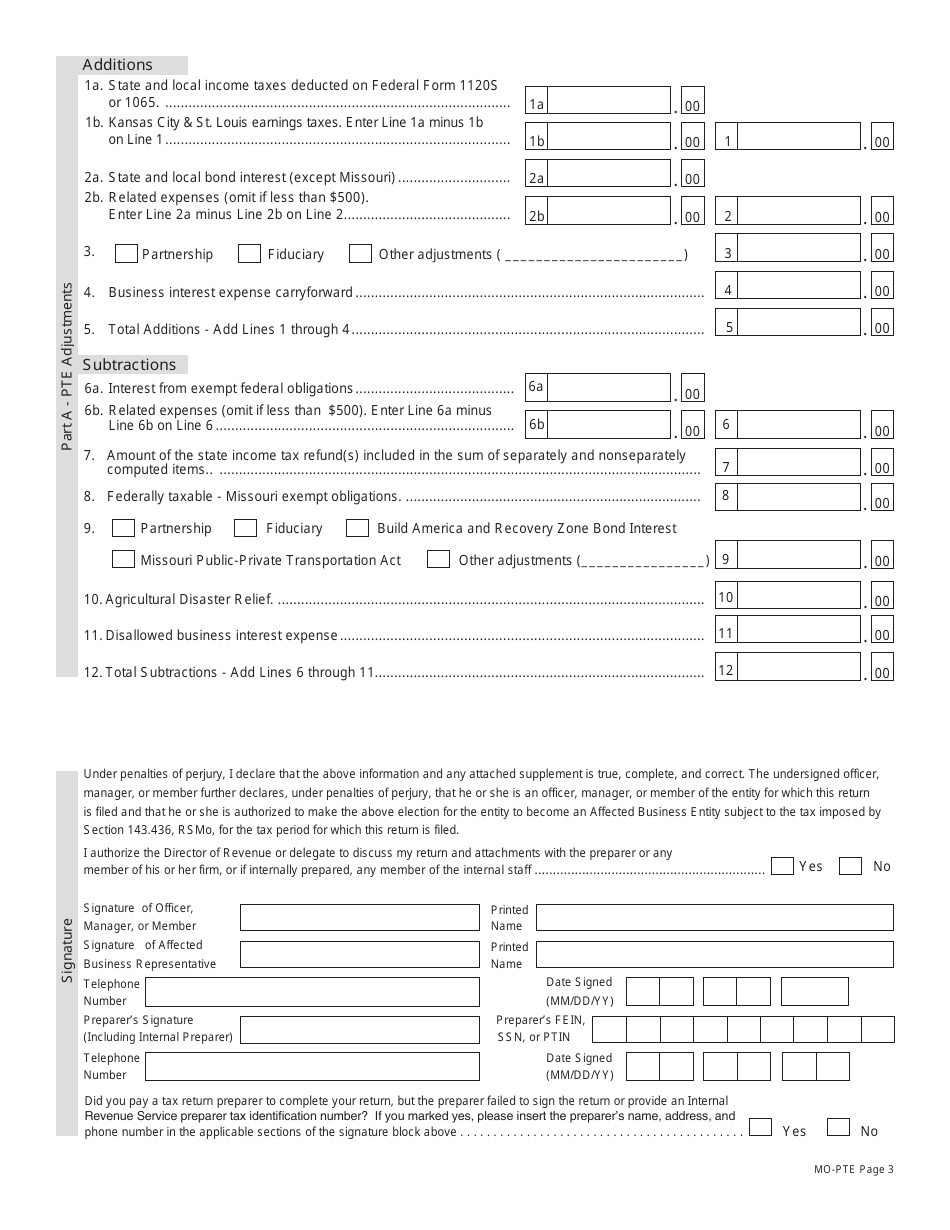

Form MO-PTE Pass-Through Entity Income Tax Return - Missouri

What Is Form MO-PTE?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a MO-PTE Pass-Through Entity Income Tax Return?

A: It is a tax return form used by pass-through entities in Missouri to report their income.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that does not pay income tax itself, but passes its income and deductions through to its owners or shareholders who then report them on their personal tax returns.

Q: Who needs to file a MO-PTE Pass-Through Entity Income Tax Return?

A: Any pass-through entity doing business in Missouri and meeting certain requirements may need to file this tax return.

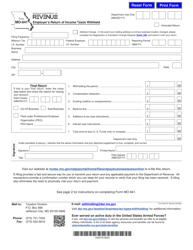

Q: What information is required to complete the MO-PTE Pass-Through Entity Income Tax Return?

A: You will need to provide information about the entity's income, deductions, and other related details.

Q: When is the deadline to file the MO-PTE Pass-Through Entity Income Tax Return?

A: The deadline to file this tax return is generally the same as the deadline for individual income tax returns, which is April 15th.

Q: Are there any penalties for late filing or non-filing of the MO-PTE Pass-Through Entity Income Tax Return?

A: Yes, there may be penalties and interest for late filing or non-filing, so it is important to file the tax return on time.

Q: Can I file the MO-PTE Pass-Through Entity Income Tax Return electronically?

A: Yes, Missouri allows electronic filing of this tax return.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-PTE by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.