This version of the form is not currently in use and is provided for reference only. Download this version of

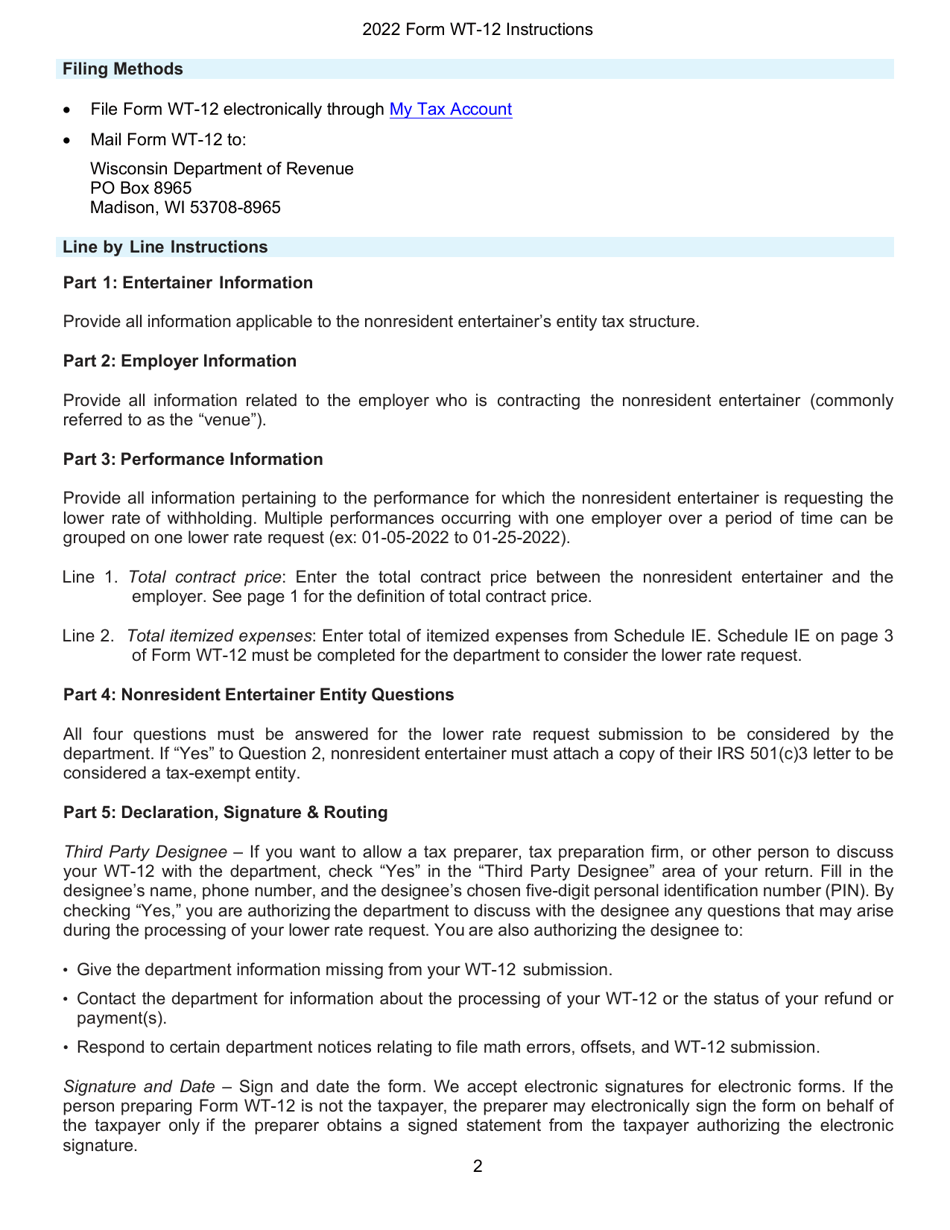

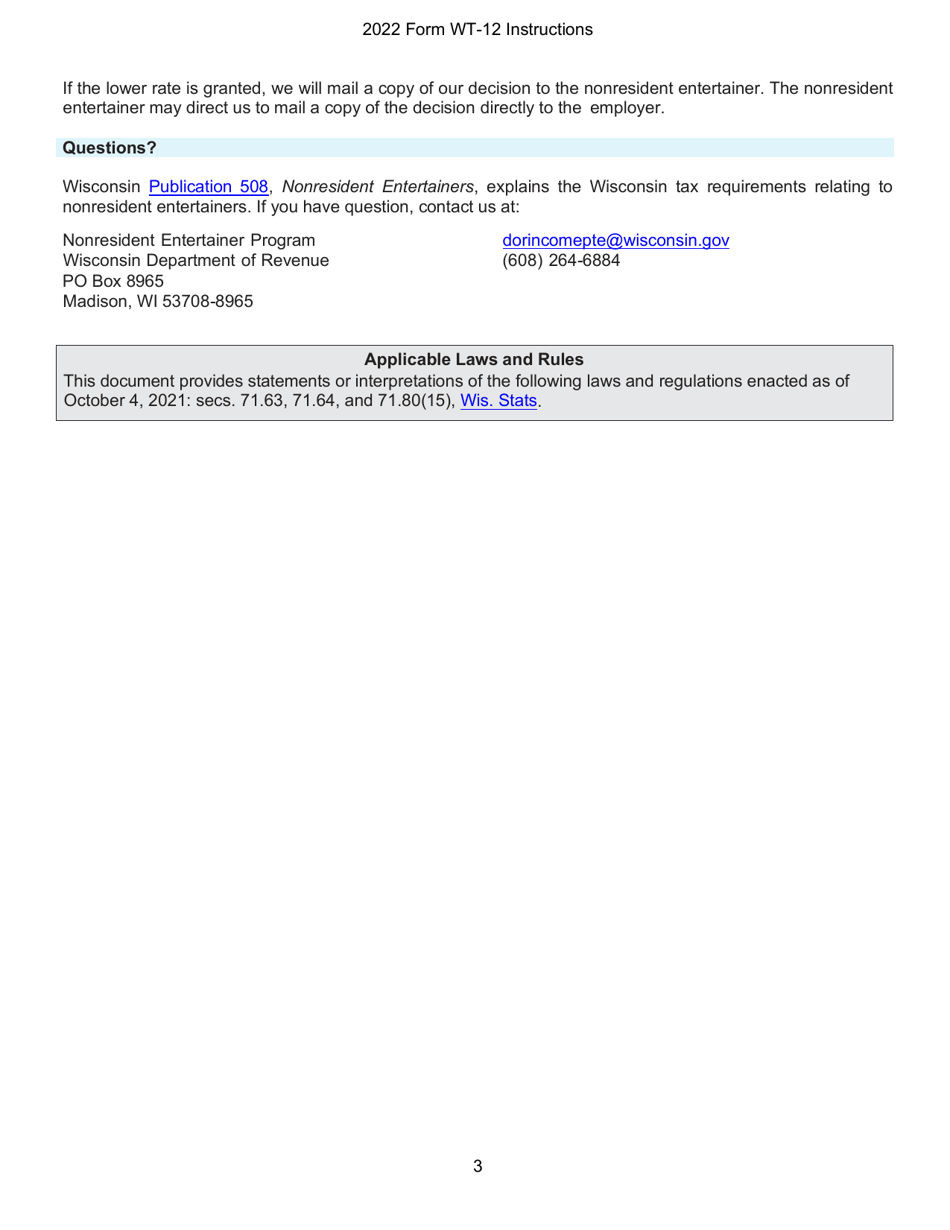

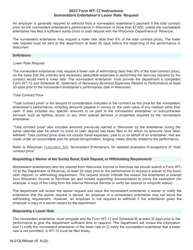

Instructions for Form WT-12, W-012LRR

for the current year.

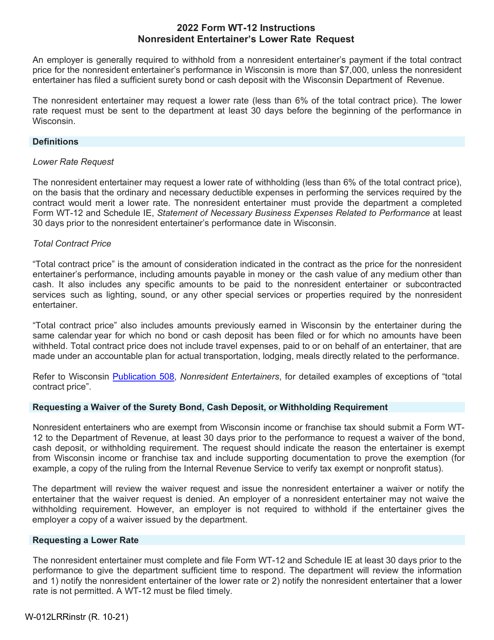

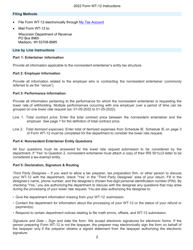

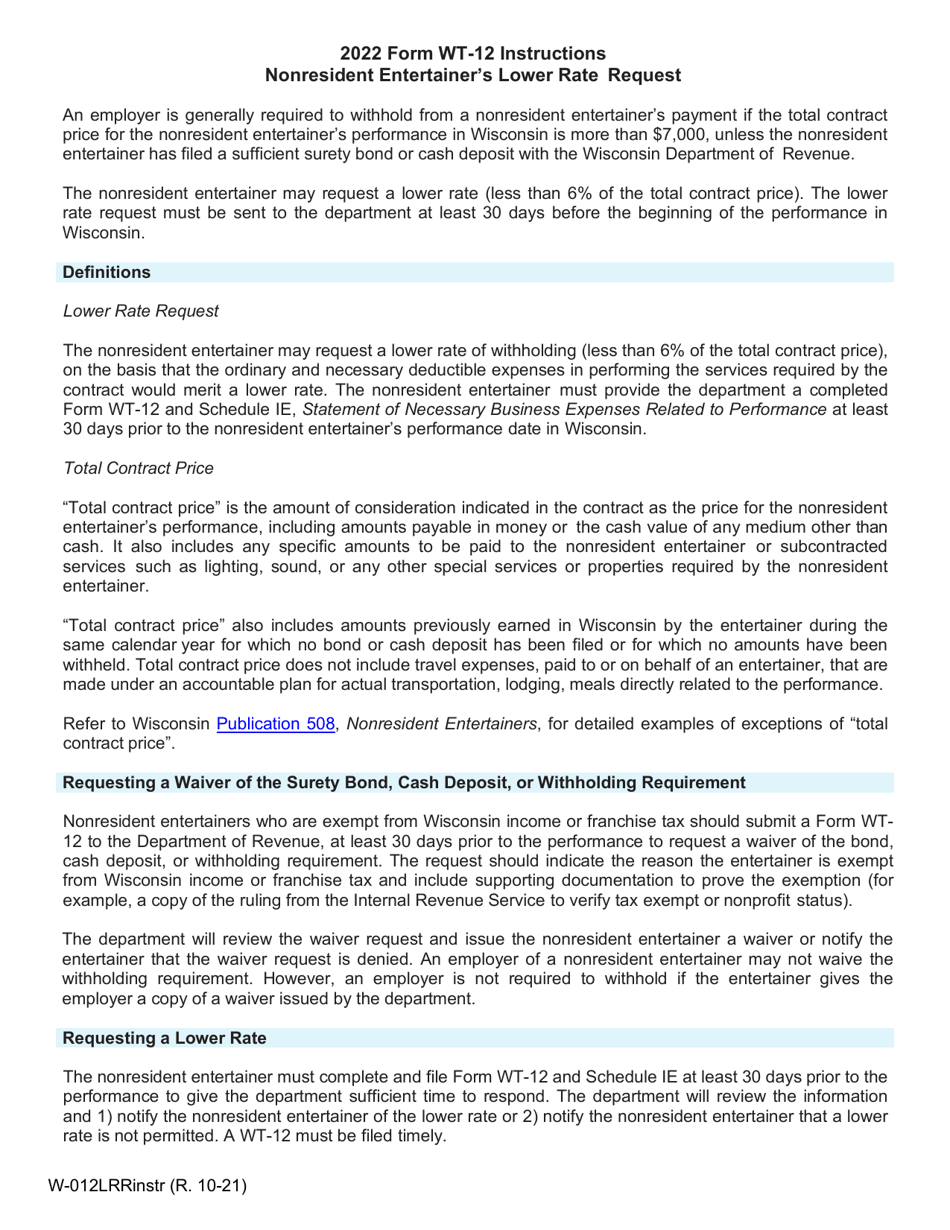

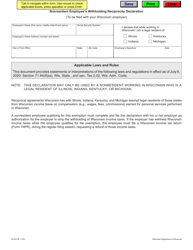

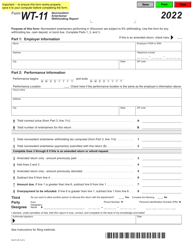

Instructions for Form WT-12, W-012LRR Nonresident Entertainer's Lower Rate Request - Wisconsin

This document contains official instructions for Form WT-12 , and Form W-012LRR . Both forms are released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form WT-12?

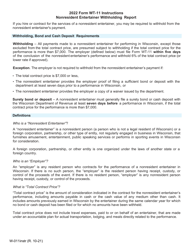

A: Form WT-12 is the Nonresident Entertainer's Lower Rate Request for the state of Wisconsin.

Q: Who should file Form WT-12?

A: Nonresident entertainers who performed in Wisconsin and wish to request a lower withholding rate on their income should file Form WT-12.

Q: What is the purpose of Form WT-12?

A: Form WT-12 is used to request a lower withholding rate on income earned by nonresident entertainers in Wisconsin.

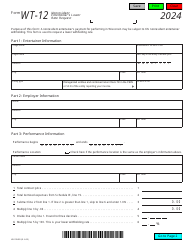

Q: What information is required on Form WT-12?

A: Form WT-12 requires the nonresident entertainer's personal information, details of the performance in Wisconsin, and supporting documentation.

Q: When should Form WT-12 be filed?

A: Form WT-12 should be filed at least 30 days before the performance in Wisconsin or as soon as possible.

Q: What happens after filing Form WT-12?

A: After filing Form WT-12, the Wisconsin Department of Revenue will review the request and determine if a lower withholding rate is applicable.

Q: Is there a fee for filing Form WT-12?

A: No, there is no fee for filing Form WT-12.

Q: Can Form WT-12 be filed electronically?

A: No, Form WT-12 cannot be filed electronically. It must be mailed to the Wisconsin Department of Revenue.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.