This version of the form is not currently in use and is provided for reference only. Download this version of

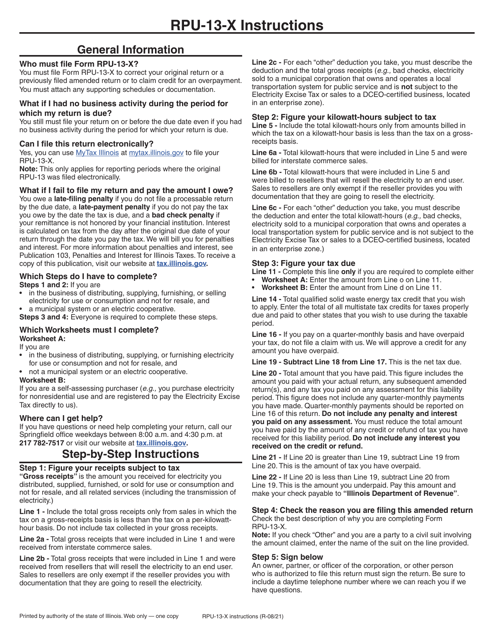

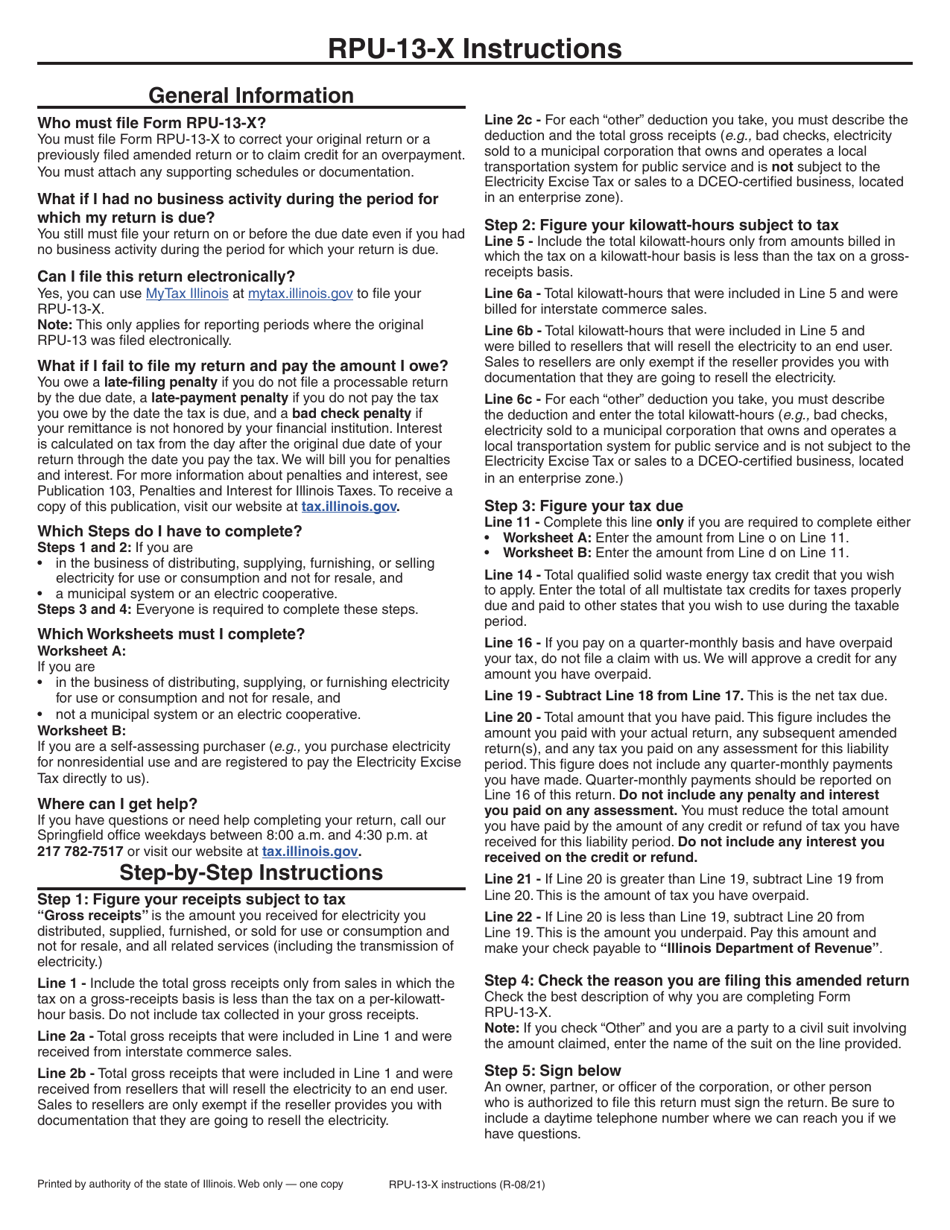

Instructions for Form RPU-13-X, 415

for the current year.

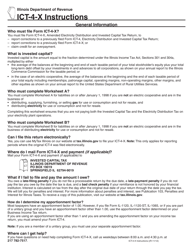

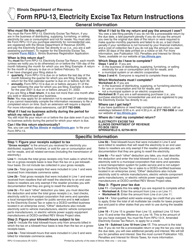

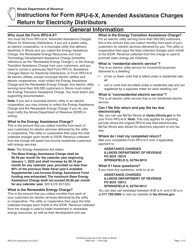

Instructions for Form RPU-13-X, 415 Amended Electricity Excise Tax Return - Illinois

This document contains official instructions for Form RPU-13-X , and Form 415 . Both forms are released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RPU-13-X, 415 Amended Electricity Excise Tax Return - Illinois?

A: Form RPU-13-X, 415 Amended Electricity Excise Tax Return - Illinois is a form used to amend the electricity excise tax return in the state of Illinois.

Q: Who needs to file Form RPU-13-X, 415 Amended Electricity Excise Tax Return - Illinois?

A: Anyone who needs to make amendments to their electricity excise tax return in Illinois must file Form RPU-13-X, 415.

Q: When is the deadline to file Form RPU-13-X, 415 Amended Electricity Excise Tax Return - Illinois?

A: The deadline to file Form RPU-13-X, 415 Amended Electricity Excise Tax Return - Illinois is determined by the Illinois Department of Revenue.

Q: What information do I need to complete Form RPU-13-X, 415 Amended Electricity Excise Tax Return - Illinois?

A: You will need your original electricity excise tax return information, as well as any changes or amendments you need to make.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.