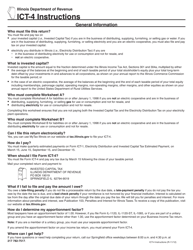

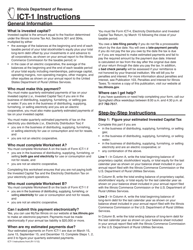

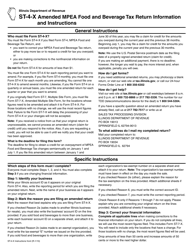

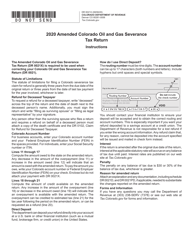

Instructions for Form ICT-4-X, 493 Amended Electricity Distribution and Invested Capital Tax Return - Illinois

This document contains official instructions for Form ICT-4-X , and Form 493 . Both forms are released and collected by the Illinois Department of Revenue.

FAQ

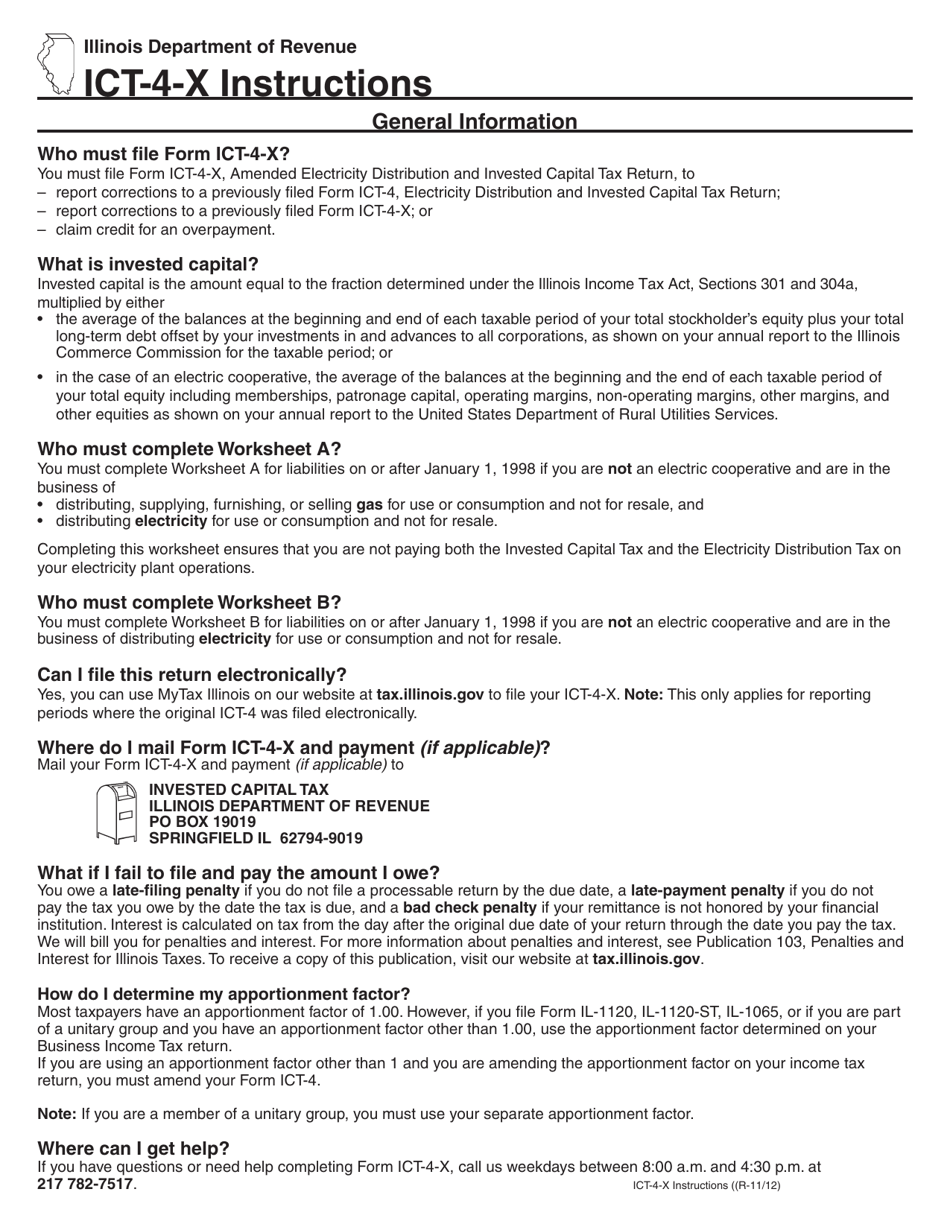

Q: What is Form ICT-4-X?

A: Form ICT-4-X is a tax return form used for reporting amended electricity distribution and invested capital taxes in Illinois.

Q: Who needs to file Form ICT-4-X?

A: Electricity distribution companies in Illinois who need to report amended taxes related to electricity distribution and invested capital.

Q: What taxes are reported on Form ICT-4-X?

A: Form ICT-4-X is used to report electricity distribution and invested capital taxes.

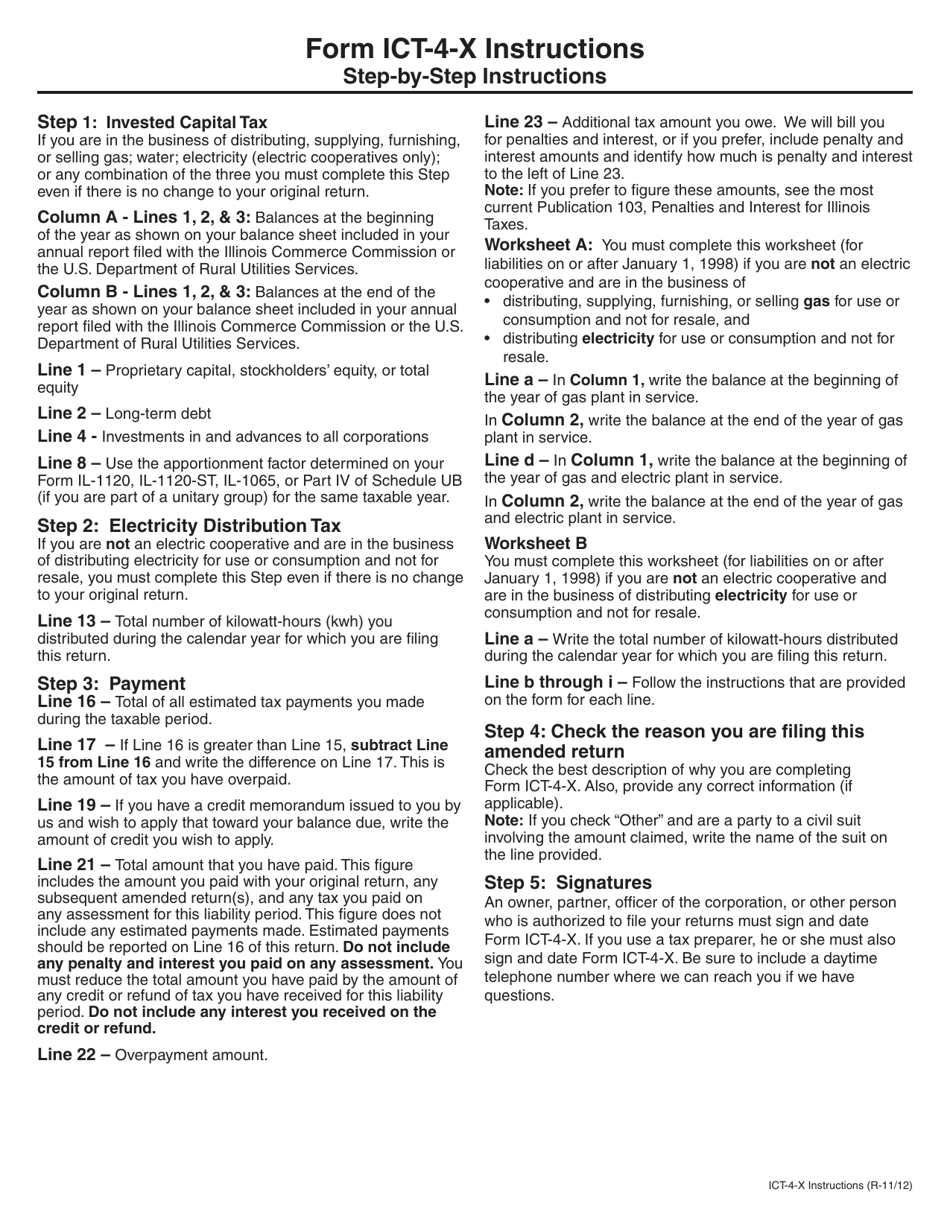

Q: What information do I need to complete Form ICT-4-X?

A: You will need information about your electricity distribution and invested capital taxes, including any amendments to previous filings.

Q: When is the deadline for filing Form ICT-4-X?

A: The deadline for filing Form ICT-4-X is typically the same as the regular tax filing deadline for electricity distribution and invested capital taxes in Illinois.

Q: Are there any penalties for filing a late or incomplete Form ICT-4-X?

A: Penalties may apply for late or incomplete filings of Form ICT-4-X, so it is important to file on time and ensure all required information is provided.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.