This version of the form is not currently in use and is provided for reference only. Download this version of

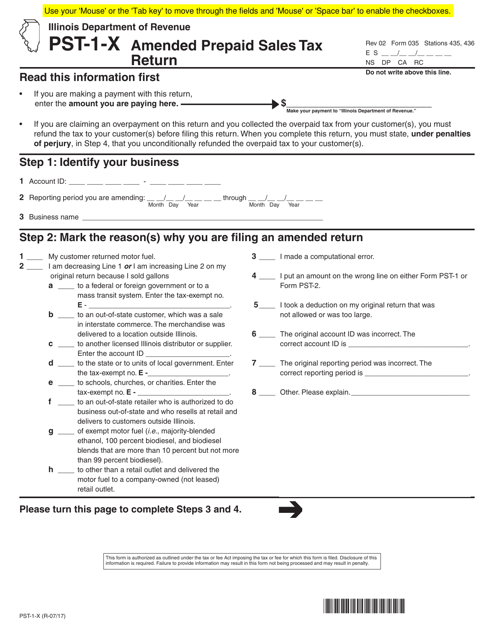

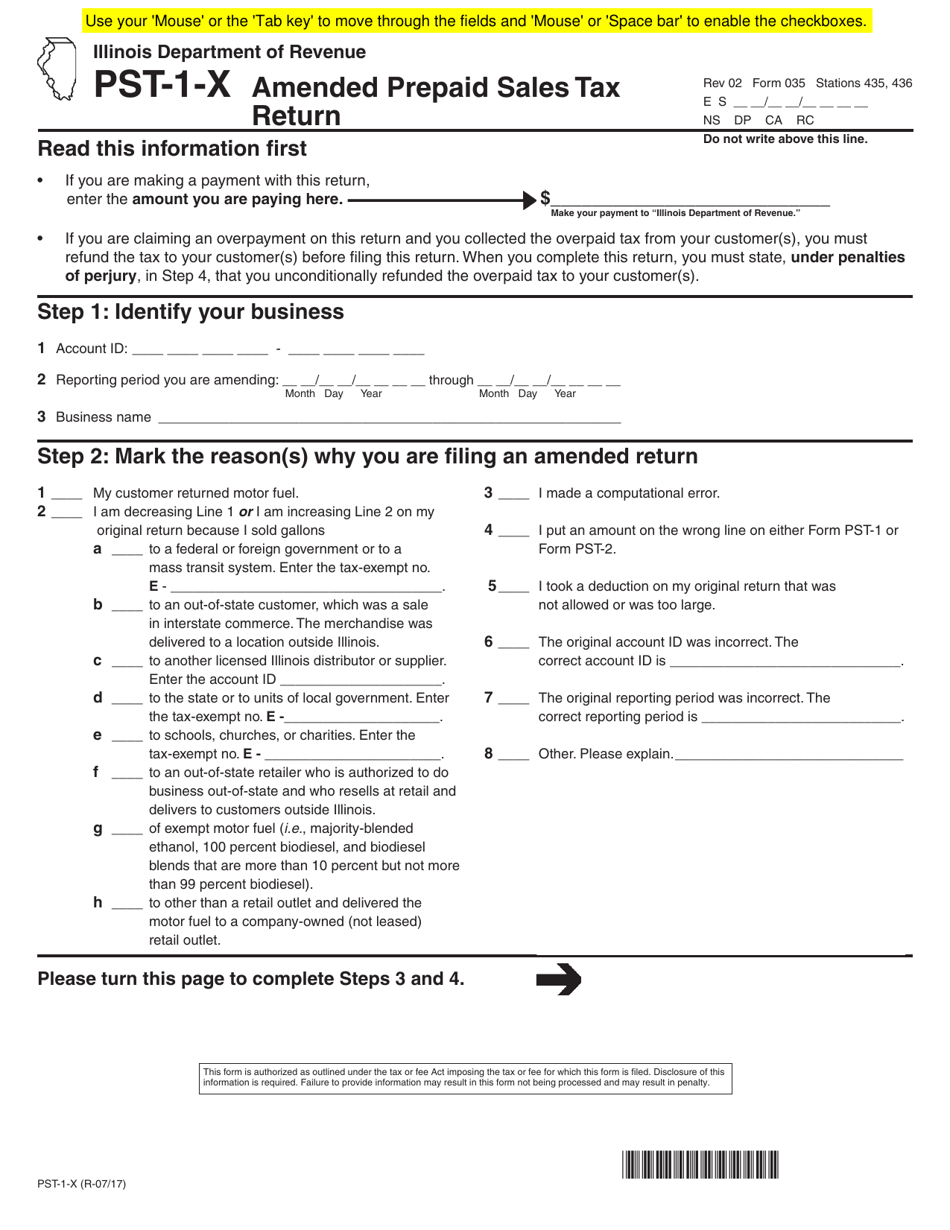

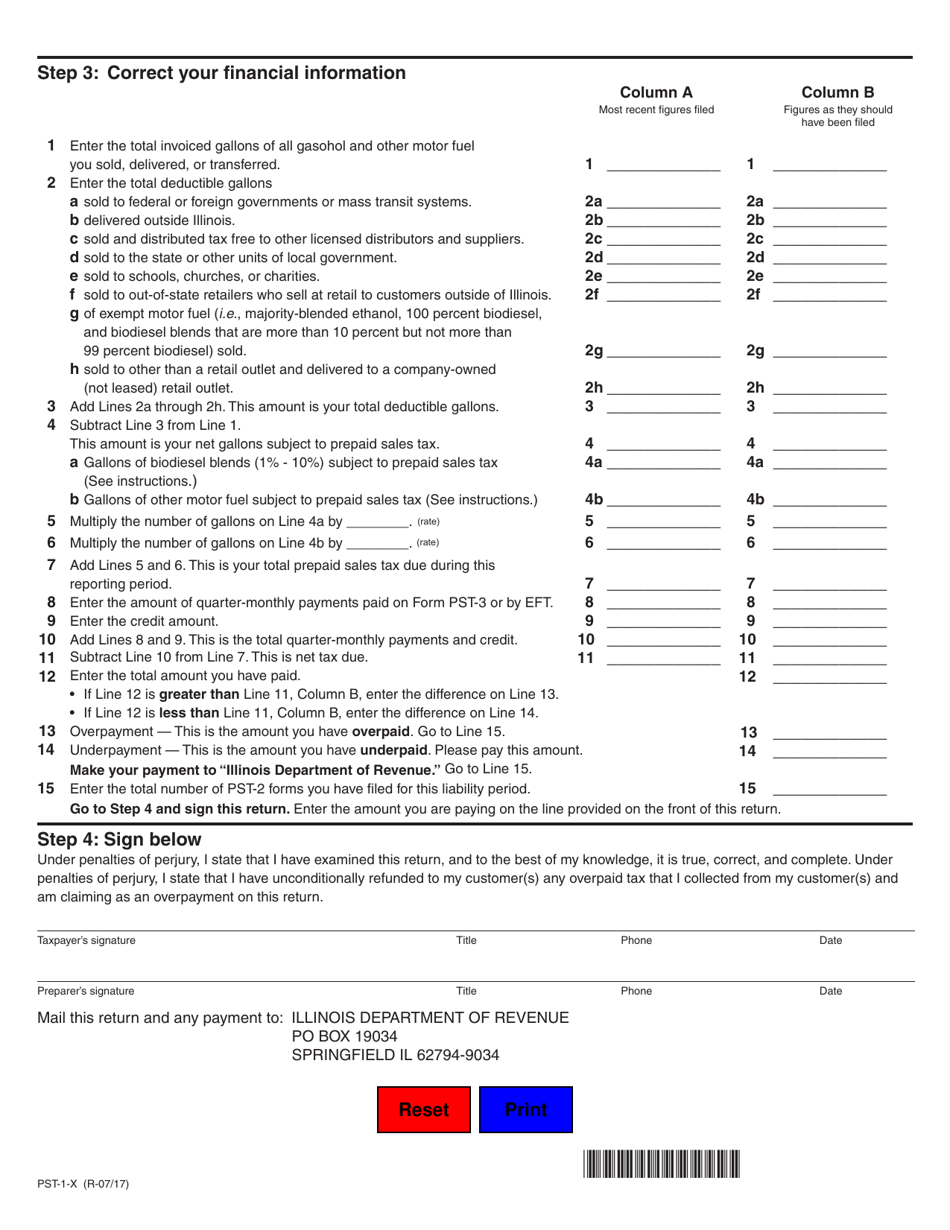

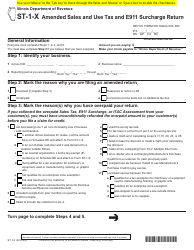

Form PST-1-X (035)

for the current year.

Form PST-1-X (035) Amended Prepaid Sales Tax Return - Illinois

What Is Form PST-1-X (035)?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is PST-1-X (035)?

A: PST-1-X (035) is an Amended Prepaid Sales Tax Return form.

Q: Which state is PST-1-X (035) used for?

A: PST-1-X (035) is used for filing amended prepaid sales tax returns in Illinois.

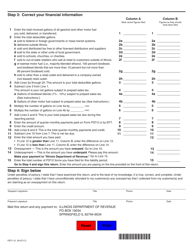

Q: What is the purpose of filing PST-1-X (035)?

A: The purpose of filing PST-1-X (035) is to correct errors or make changes to a previously filed prepaid sales tax return.

Q: When should PST-1-X (035) be filed?

A: PST-1-X (035) should be filed when there are errors or changes to be made to a previously filed prepaid sales tax return.

Q: Is there a deadline for filing PST-1-X (035)?

A: Yes, there is a deadline for filing PST-1-X (035). The deadline is generally the same as the original due date for the prepaid sales tax return.

Q: Are there any penalties for filing PST-1-X (035) late?

A: Yes, there may be penalties for filing PST-1-X (035) late. It is important to file the amended return as soon as possible to avoid penalties.

Q: What should I do if I have questions about PST-1-X (035) or need help with filing?

A: If you have questions about PST-1-X (035) or need help with filing, you can contact the Illinois Department of Revenue for assistance.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PST-1-X (035) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.