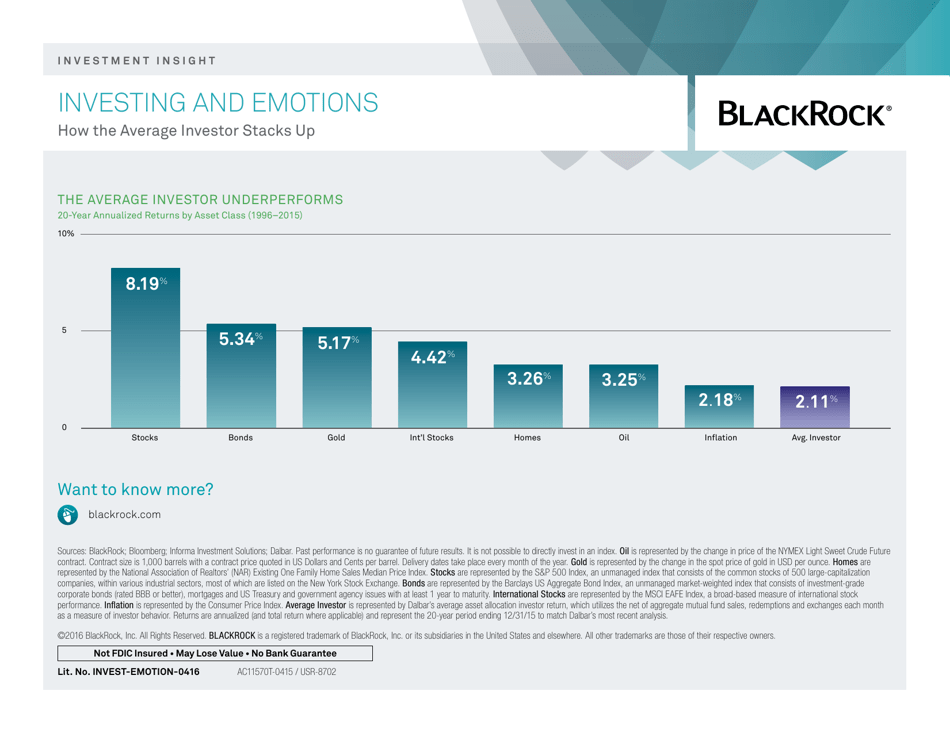

Investing and Emotions: the Ups and Downs of the Market - Blackrock

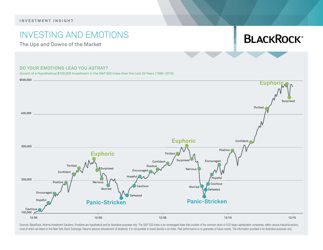

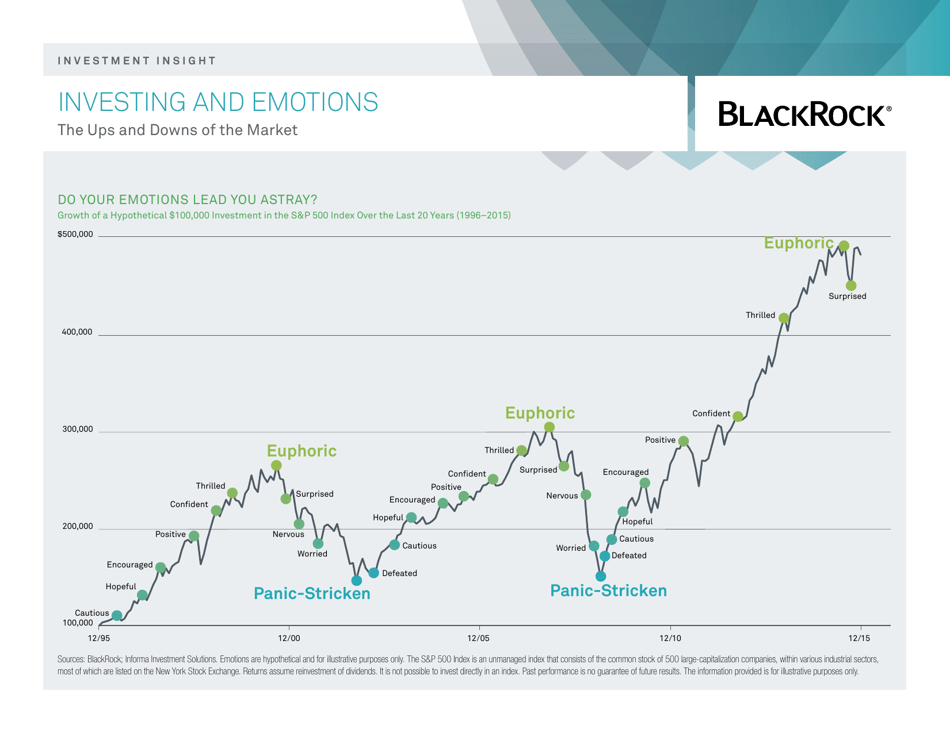

"Investing and Emotions: the Ups and Downs of the Market" by BlackRock is a document that provides insights and guidance on how emotions can affect investment decisions and strategies. It aims to help investors understand and navigate the fluctuations and volatility of the financial markets.

Blackrock is an investment management company that manages funds and investments on behalf of its clients. It does not file emotions or document them. It primarily files regulatory reports and disclosures to regulatory authorities.

FAQ

Q: What is the topic of the document?

A: Investing and Emotions: the Ups and Downs of the Market - Blackrock

Q: Who is the author of the document?

A: Blackrock

Q: What does the document discuss?

A: The relationship between investing and emotions and how they affect the ups and downs of the market

Q: Why is it important to understand the role of emotions in investing?

A: Emotions can impact investment decisions and potentially lead to poor financial outcomes

Q: What is Blackrock's perspective on investing and emotions?

A: The document provides insights and perspectives on how to navigate the emotional aspects of investing

Q: What are some of the common emotions experienced by investors?

A: Fear, greed, and uncertainty are common emotions experienced by investors

Q: How can emotions influence investment decisions?

A: Emotions can lead to impulsive decisions, selling low, buying high, or abandoning long-term investment plans

Q: What are some strategies to manage emotions in investing?

A: Some strategies include having a long-term perspective, diversifying investments, and seeking professional advice

Q: Is it possible to completely remove emotions from investing?

A: Completely removing emotions from investing is not possible, but managing and understanding them is key

Q: What role does Blackrock play in providing investment solutions?

A: Blackrock offers investment solutions and services to clients to help them navigate the ups and downs of the market