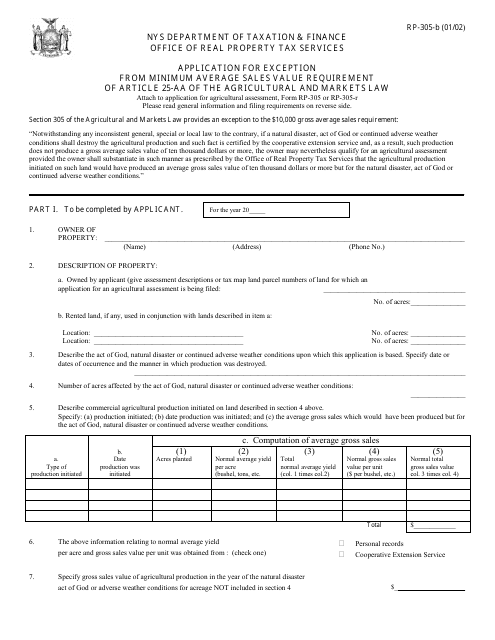

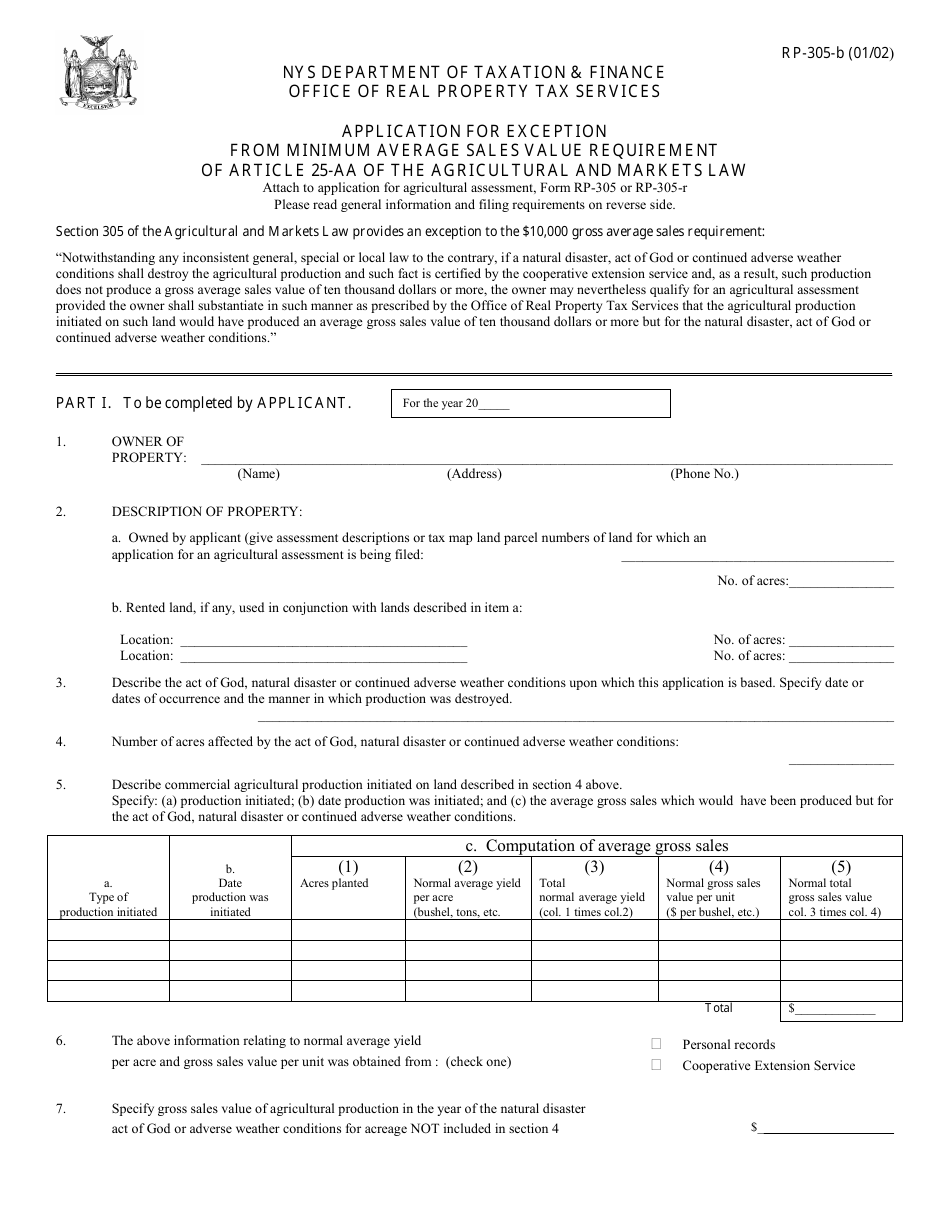

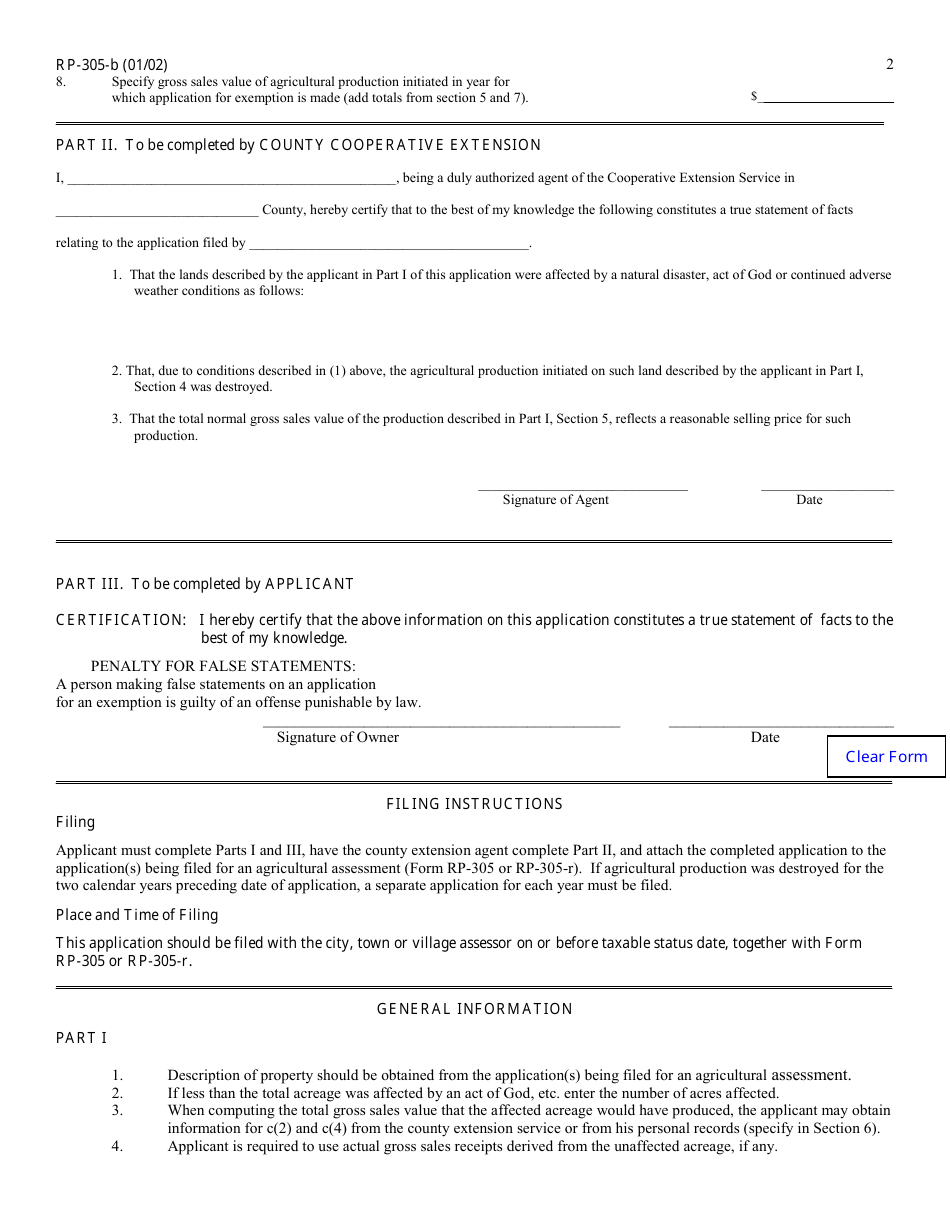

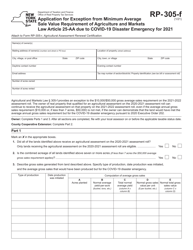

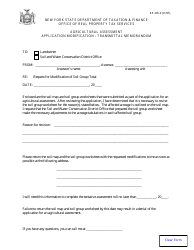

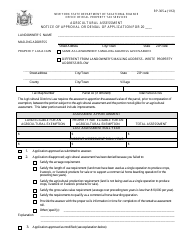

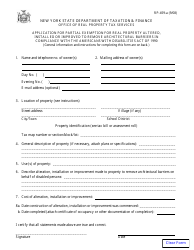

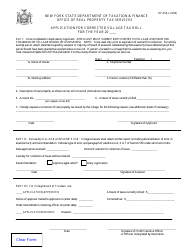

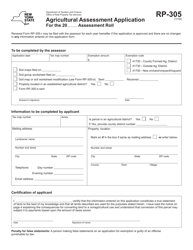

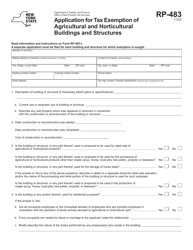

Form RP-305-B Application for Exception From Minimum Average Sales Value Requirement of Article 25-aa of the Agricultural and Markets Law - New York

What Is Form RP-305-B?

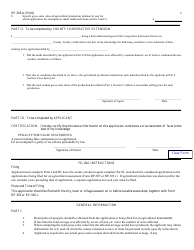

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-305-B?

A: Form RP-305-B is an application for an exception from the minimum average sales value requirement of Article 25-aa of the Agricultural and Markets Law in New York.

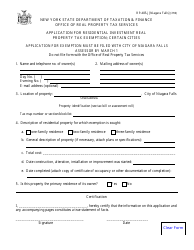

Q: What does Article 25-aa of the Agricultural and Markets Law refer to?

A: Article 25-aa of the Agricultural and Markets Law in New York refers to the minimum average sales value requirement for certain agricultural land.

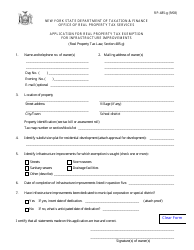

Q: Who needs to fill out Form RP-305-B?

A: Individuals or entities seeking an exception from the minimum average sales value requirement in Article 25-aa of the Agricultural and Markets Law in New York need to fill out Form RP-305-B.

Q: What is the purpose of Form RP-305-B?

A: The purpose of Form RP-305-B is to request an exception from the minimum average sales value requirement for certain agricultural land in New York.

Q: Are there any fees associated with submitting Form RP-305-B?

A: There may be fees associated with submitting Form RP-305-B. It is recommended to check the current fee schedule provided by the New York State Department of Agriculture and Markets.

Q: What documents are required to accompany Form RP-305-B?

A: The specific documents required to accompany Form RP-305-B may vary depending on individual circumstances. It is advisable to review the instructions provided with the form or consult with the relevant authorities.

Q: How long does it take to process Form RP-305-B?

A: The processing time for Form RP-305-B may vary. It is recommended to contact the appropriate authorities or check the estimated processing time provided by the New York State Department of Agriculture and Markets.

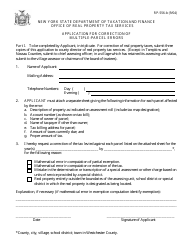

Q: Who can I contact for assistance with Form RP-305-B?

A: For assistance with Form RP-305-B, you can contact the New York State Department of Agriculture and Markets or consult with a local government office.

Q: Is Form RP-305-B applicable outside of New York?

A: Form RP-305-B is specific to the requirements of Article 25-aa of the Agricultural and Markets Law in New York and may not be applicable outside of the state.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-305-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.