The Cost of the Savings and Loan Crisis: Truth and Consequences - Timothy Curry, Lynn Shibut

The Cost of the Savings and Loan Crisis: Truth and Consequences - Timothy Curry, Lynn Shibut can be purchased for $39.95.

FAQ

Q: What is the Savings and Loan Crisis?

A: The Savings and Loan Crisis was a financial crisis that occurred in the 1980s and 1990s in the United States.

Q: What were the causes of the Savings and Loan Crisis?

A: The causes of the Savings and Loan Crisis included risky lending practices, lax regulations, and inadequate oversight.

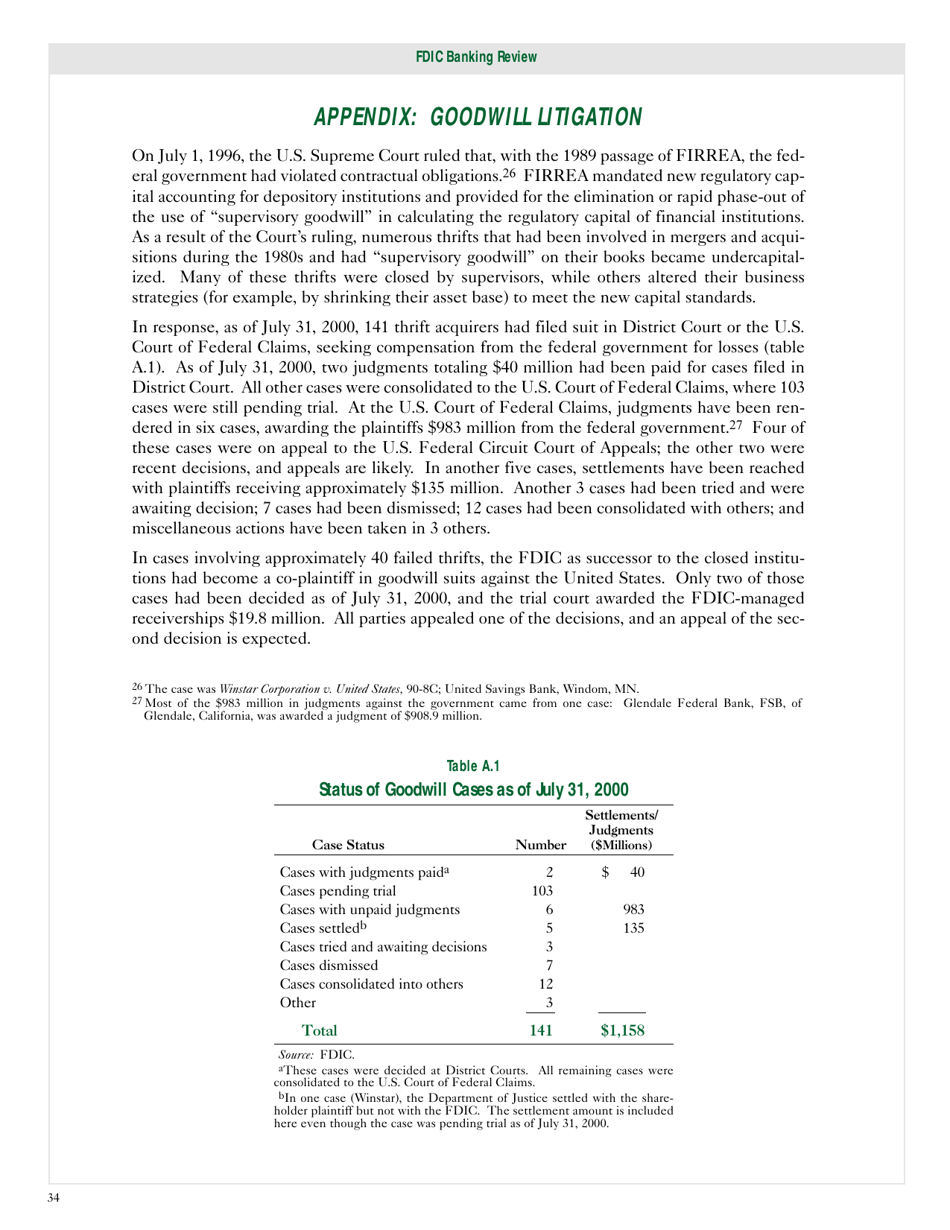

Q: What were the consequences of the Savings and Loan Crisis?

A: The consequences of the Savings and Loan Crisis included the closure or failure of many savings and loan institutions, financial losses for depositors, and a bailout by the government.

Q: How did the government respond to the Savings and Loan Crisis?

A: The government responded to the Savings and Loan Crisis by creating the Resolution Trust Corporation (RTC) to manage and sell the assets of failed savings and loan institutions.

Q: Did taxpayers have to pay for the Savings and Loan Crisis?

A: Yes, taxpayers ultimately had to bear the cost of the Savings and Loan Crisis through the government bailout and the resulting increase in the national debt.

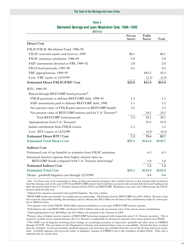

Q: How much did the Savings and Loan Crisis cost?

A: The total cost of the Savings and Loan Crisis is estimated to be around $160 billion.

Q: When did the Savings and Loan Crisis end?

A: The Savings and Loan Crisis officially ended in the early 1990s, although its effects continued to be felt for years afterward.