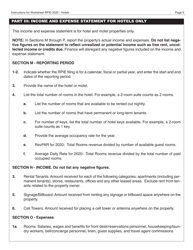

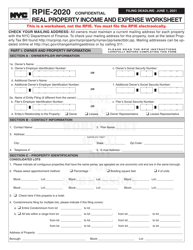

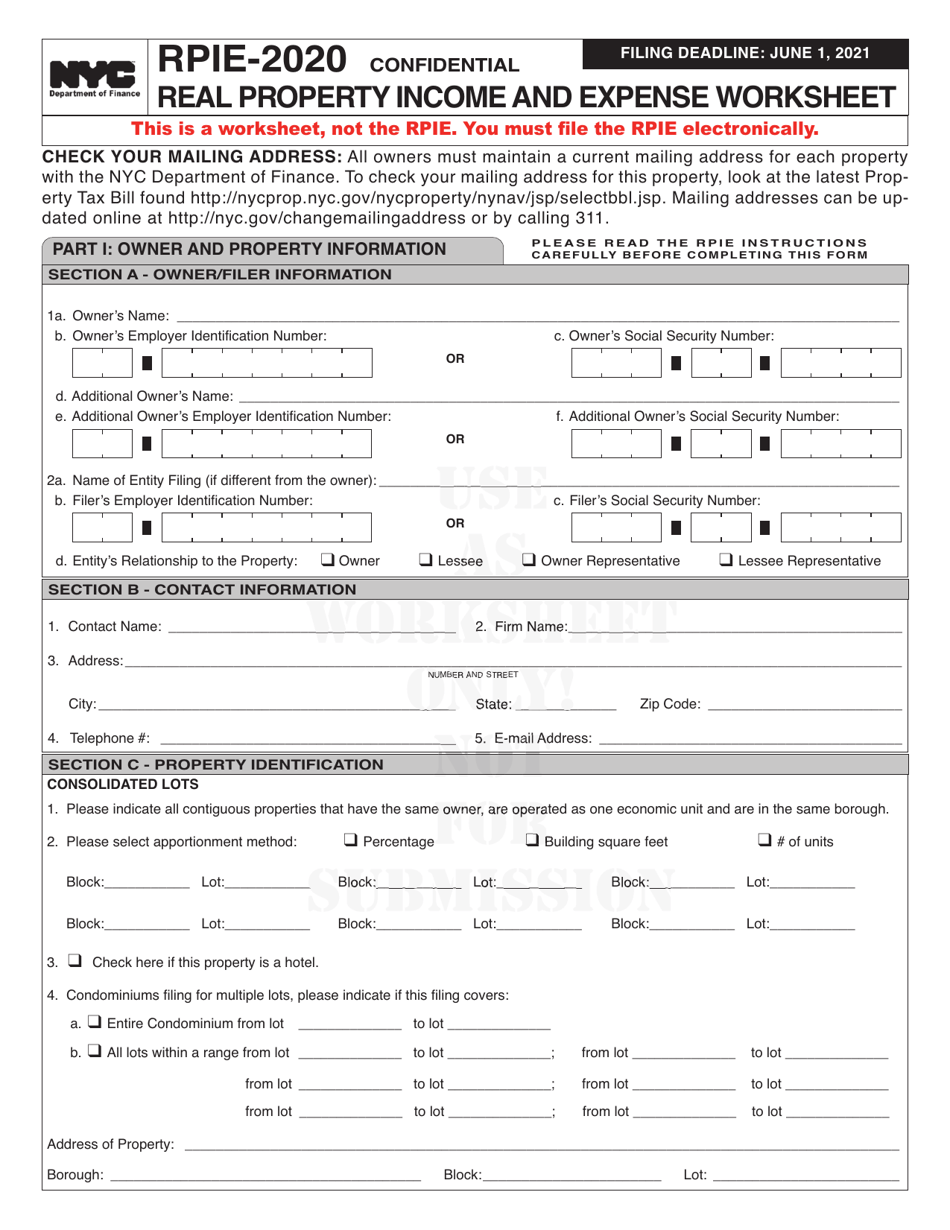

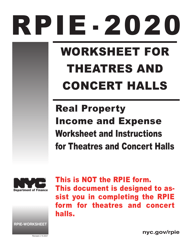

Instructions for Real Property Income and Expense (Rpie) Statement for Hotels - New York City

This document was released by New York City Department of Finance and contains the most recent official instructions for Real Property Income and Expense (Rpie) Statement for Hotels .

FAQ

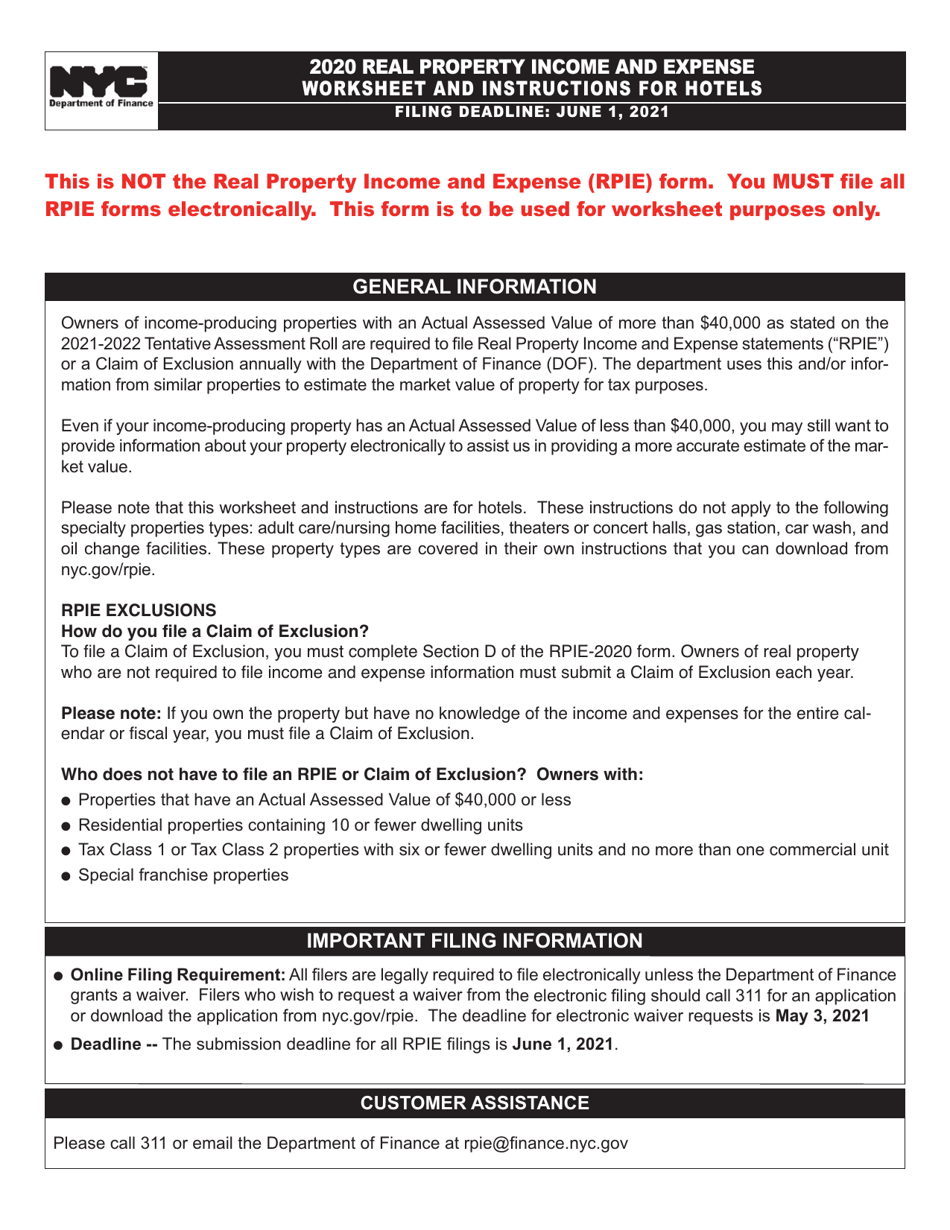

Q: What is an RPIE Statement?

A: An RPIE statement is a report that property owners in New York City must file each year to report income and expenses for their hotels.

Q: Who needs to file an RPIE Statement for hotels in New York City?

A: Owners of hotels in New York City need to file an RPIE statement each year.

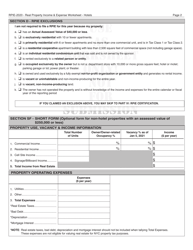

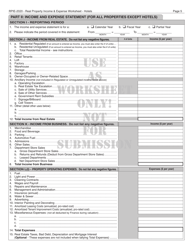

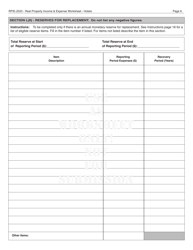

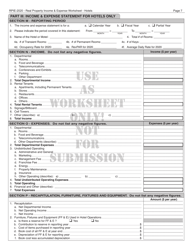

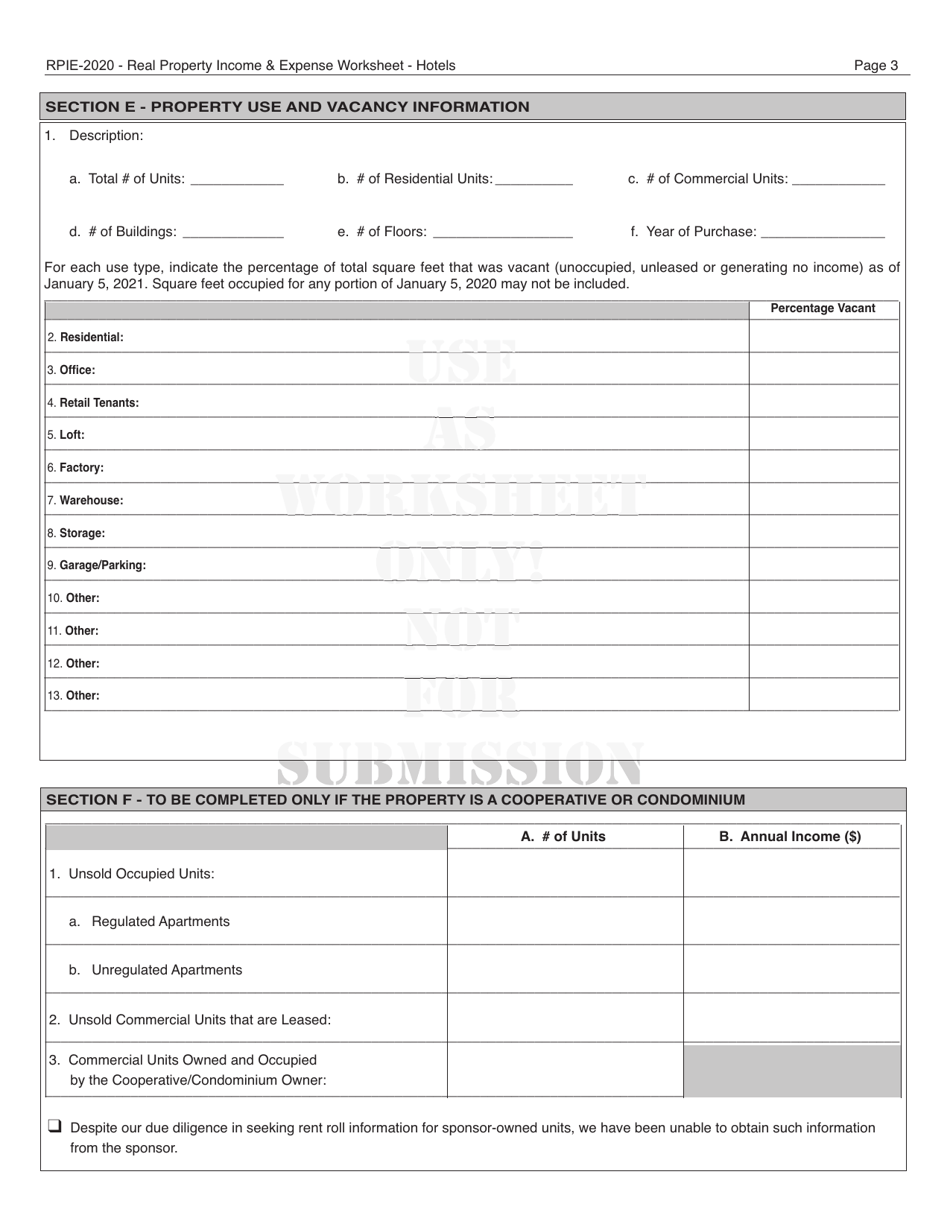

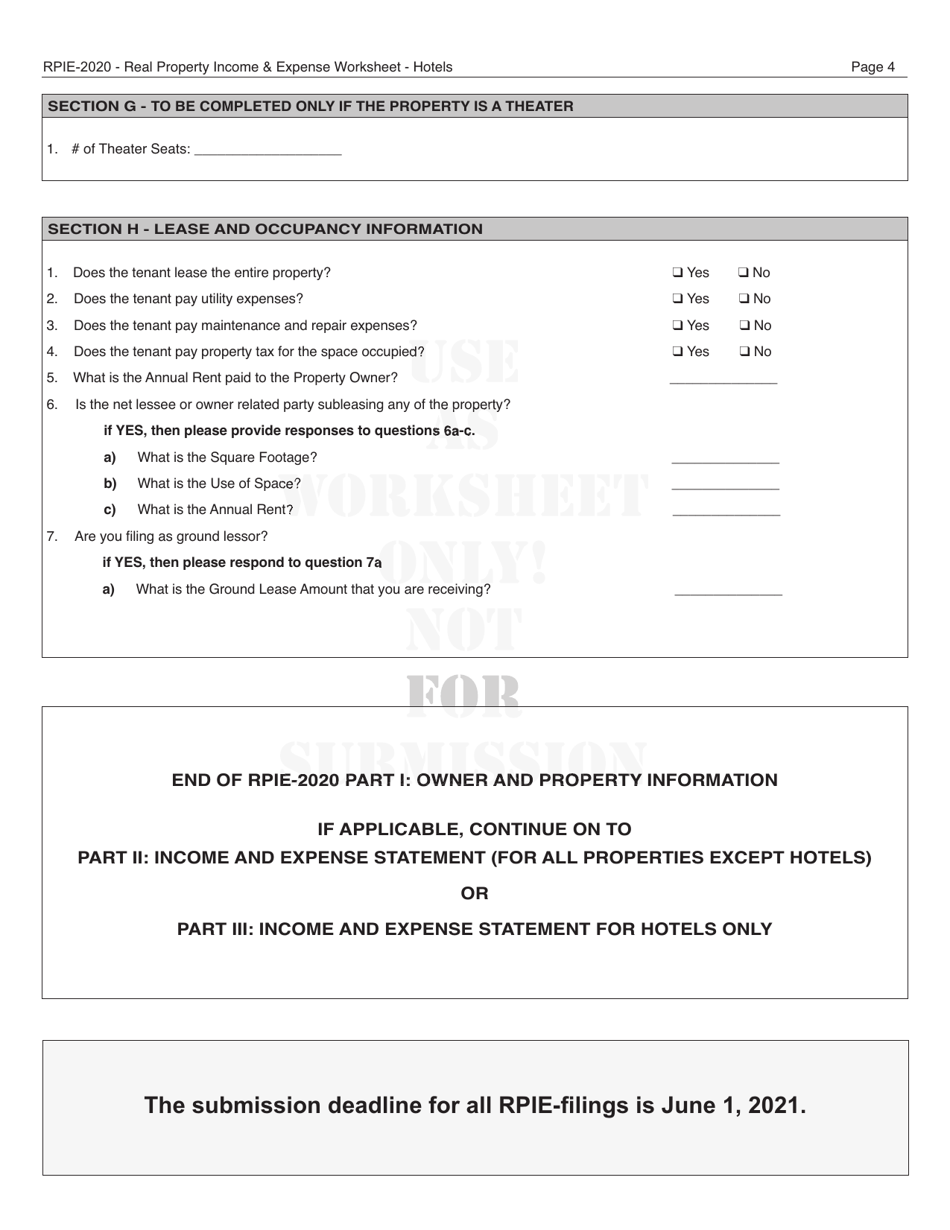

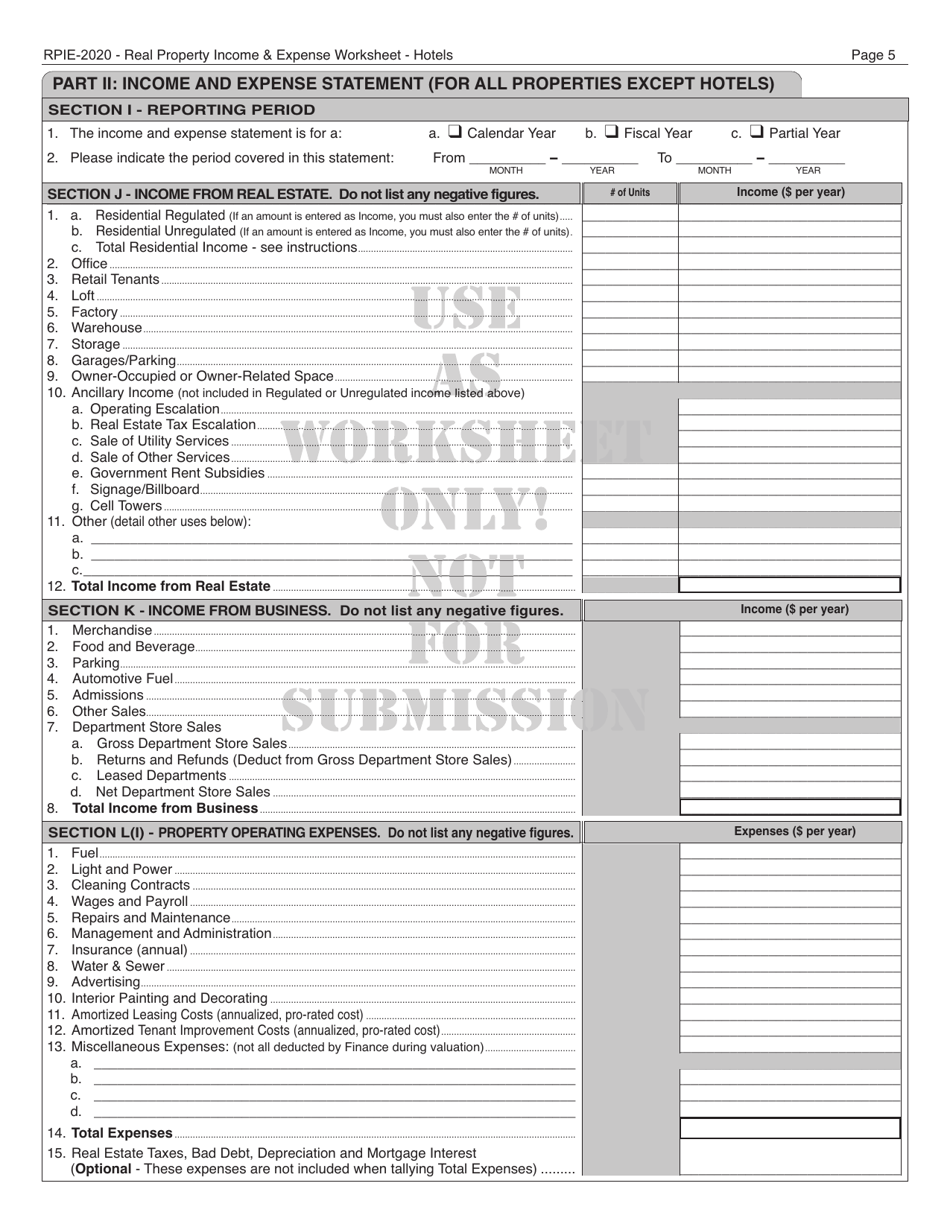

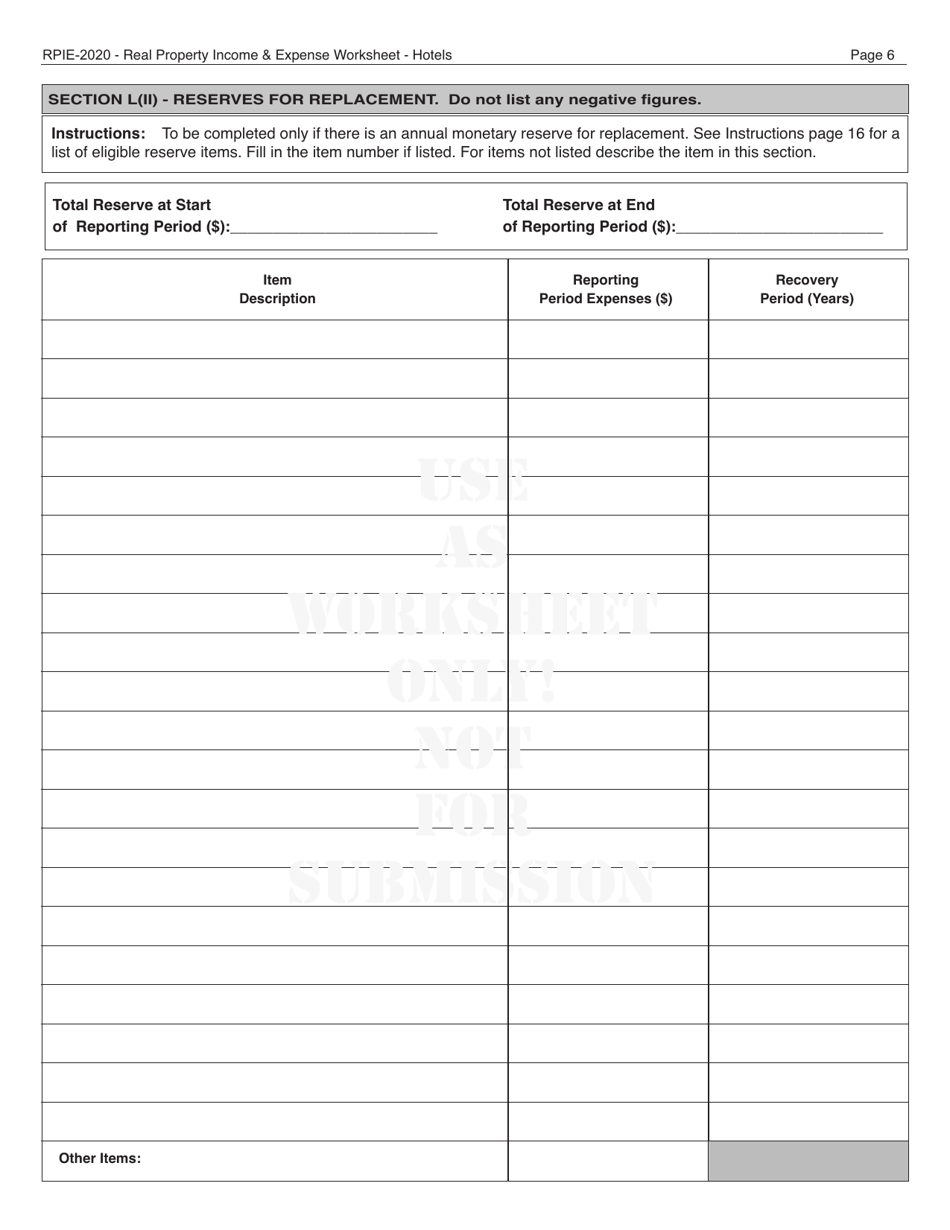

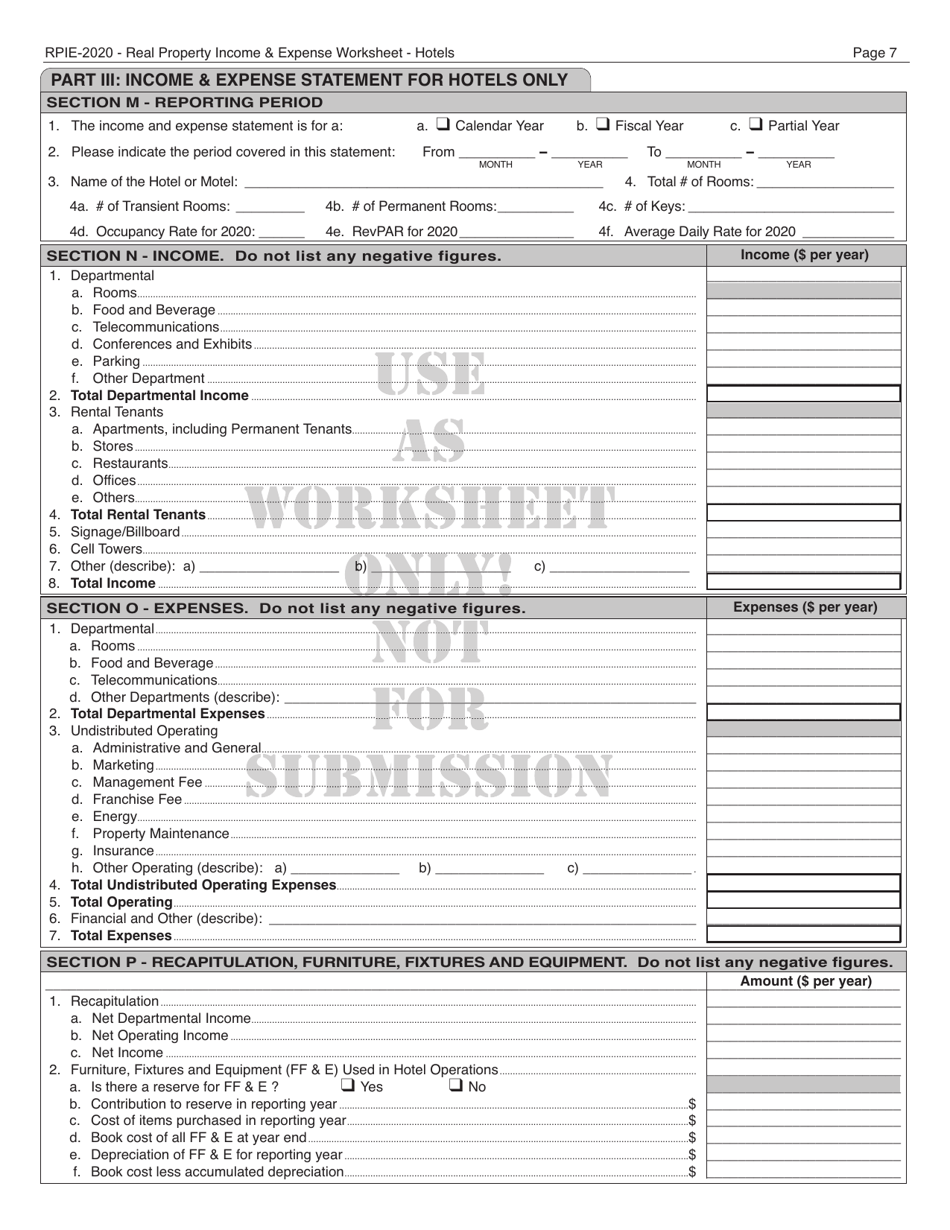

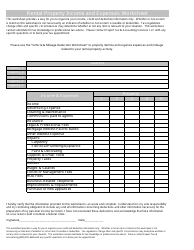

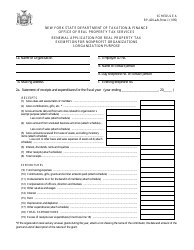

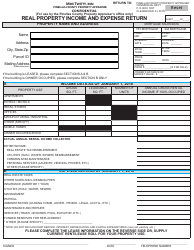

Q: What information do I need to include in the RPIE Statement?

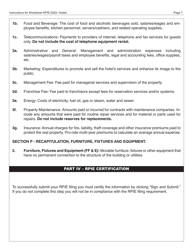

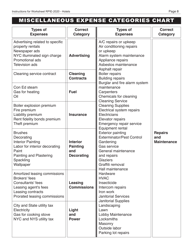

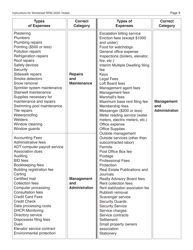

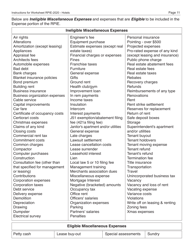

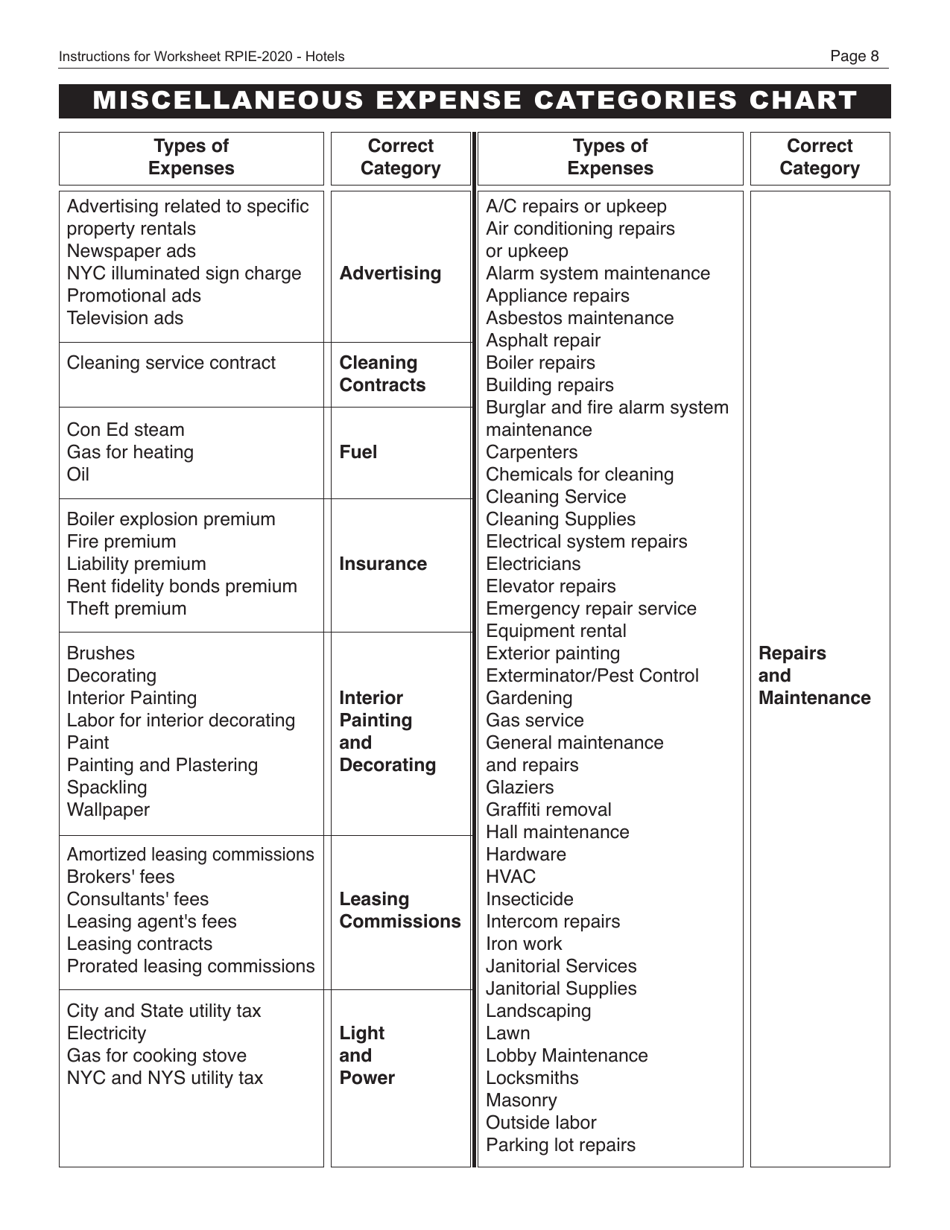

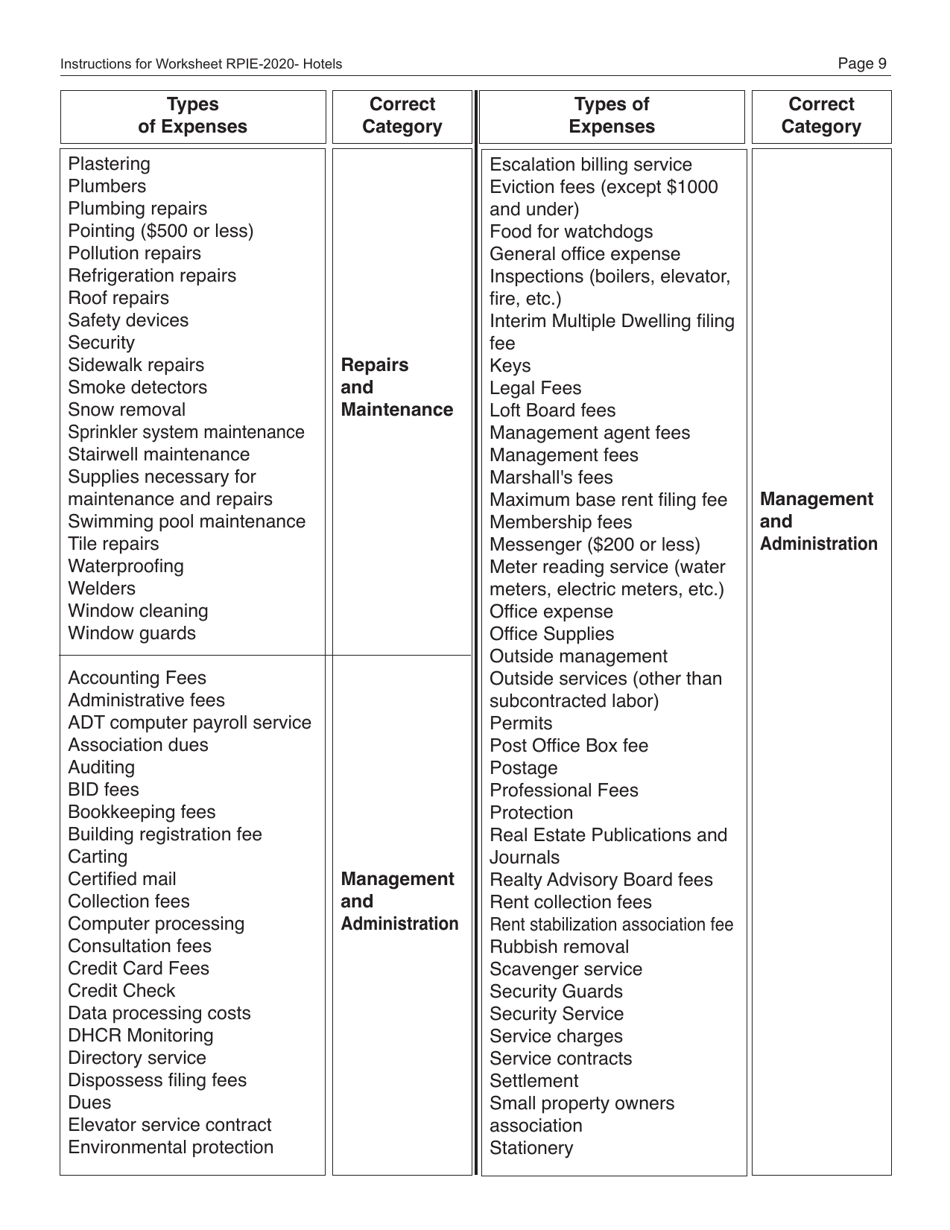

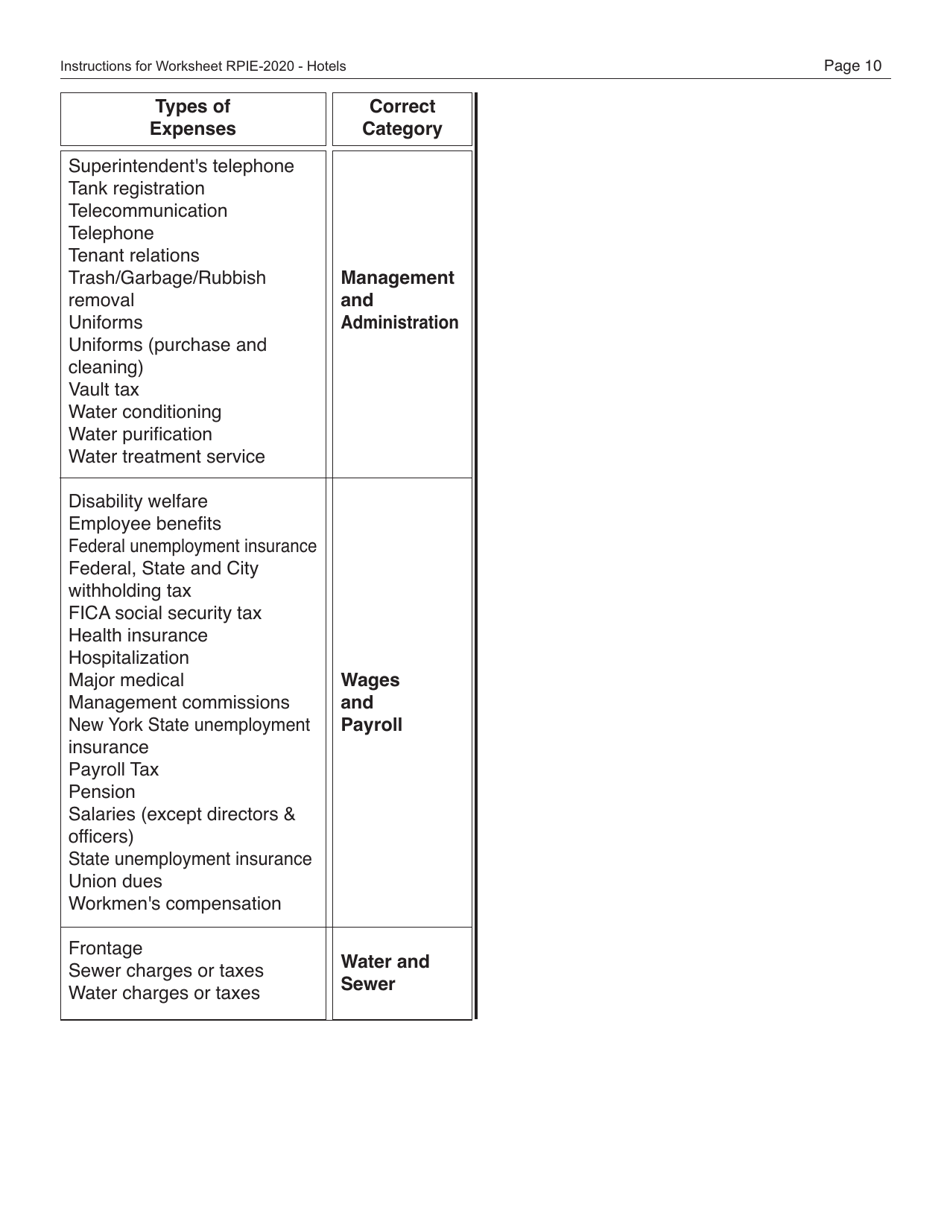

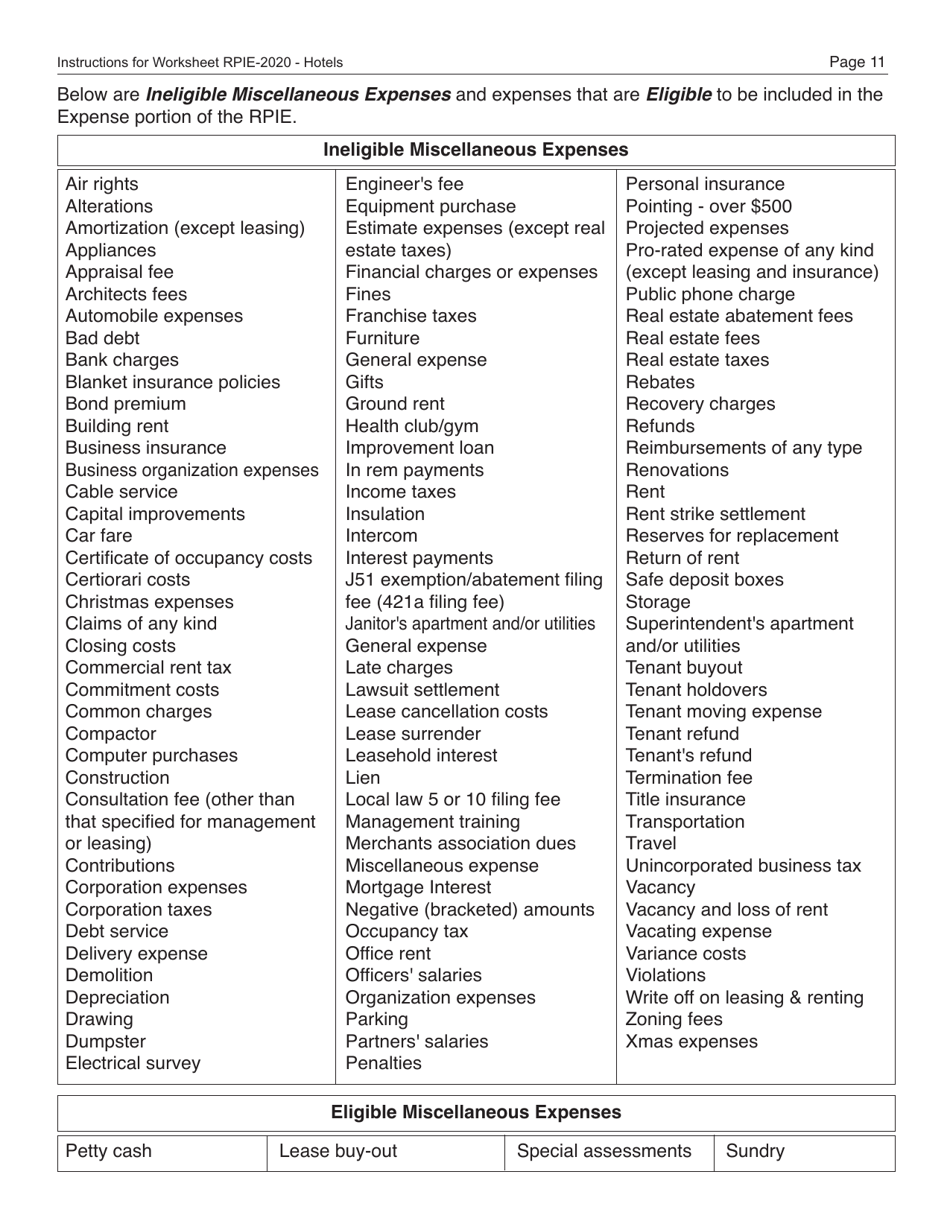

A: The RPIE Statement requires you to report income and expenses for your hotel, including details about room revenue, food and beverage revenue, and operating expenses.

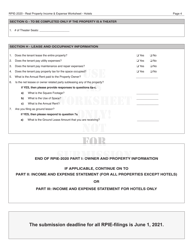

Q: When is the deadline to file the RPIE Statement for hotels in New York City?

A: The deadline to file the RPIE Statement for hotels in New York City is usually every year by July 1st.

Q: Are there any penalties for not filing the RPIE Statement?

A: Yes, there are penalties for not filing the RPIE Statement, including potential fines and the possibility of losing certain tax benefits.

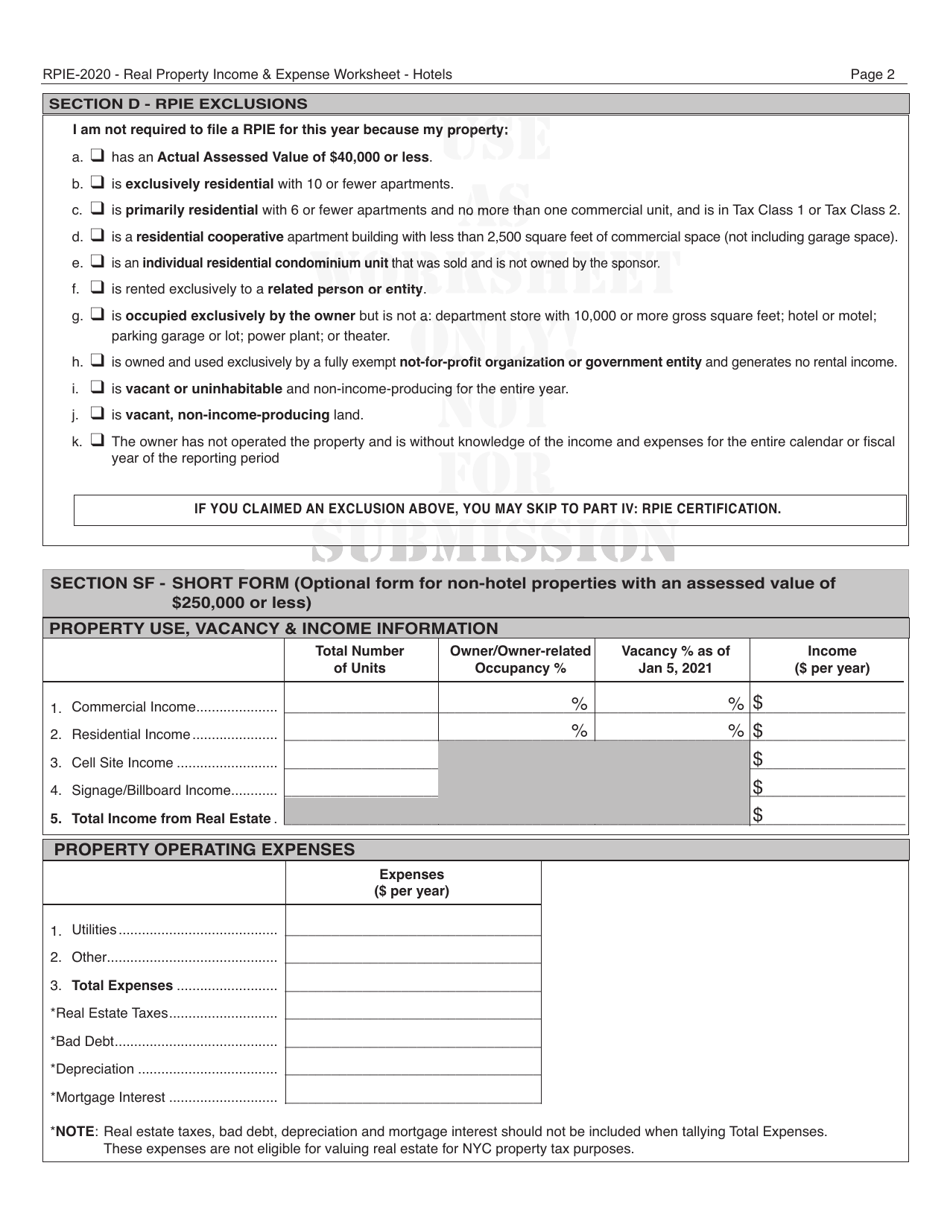

Q: Are there any exemptions for filing the RPIE Statement?

A: There may be exemptions for certain hotels, based on factors such as size and type of ownership. It is best to check with the New York City Department of Finance for specific exemptions.

Q: Is it necessary to hire a professional to help with filing the RPIE Statement?

A: While it is not required, hiring a professional such as an accountant or tax advisor can help ensure accurate and timely filing of the RPIE Statement.

Q: What happens after I file the RPIE Statement?

A: After you file the RPIE Statement, the New York City Department of Finance will review it and may contact you for additional information or clarification.

Instruction Details:

- This 20-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the New York City Department of Finance.