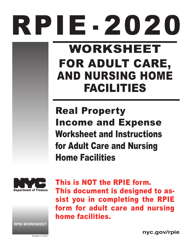

Instructions for Real Property Income and Expense Form for Theatres and Concert Halls - New York City

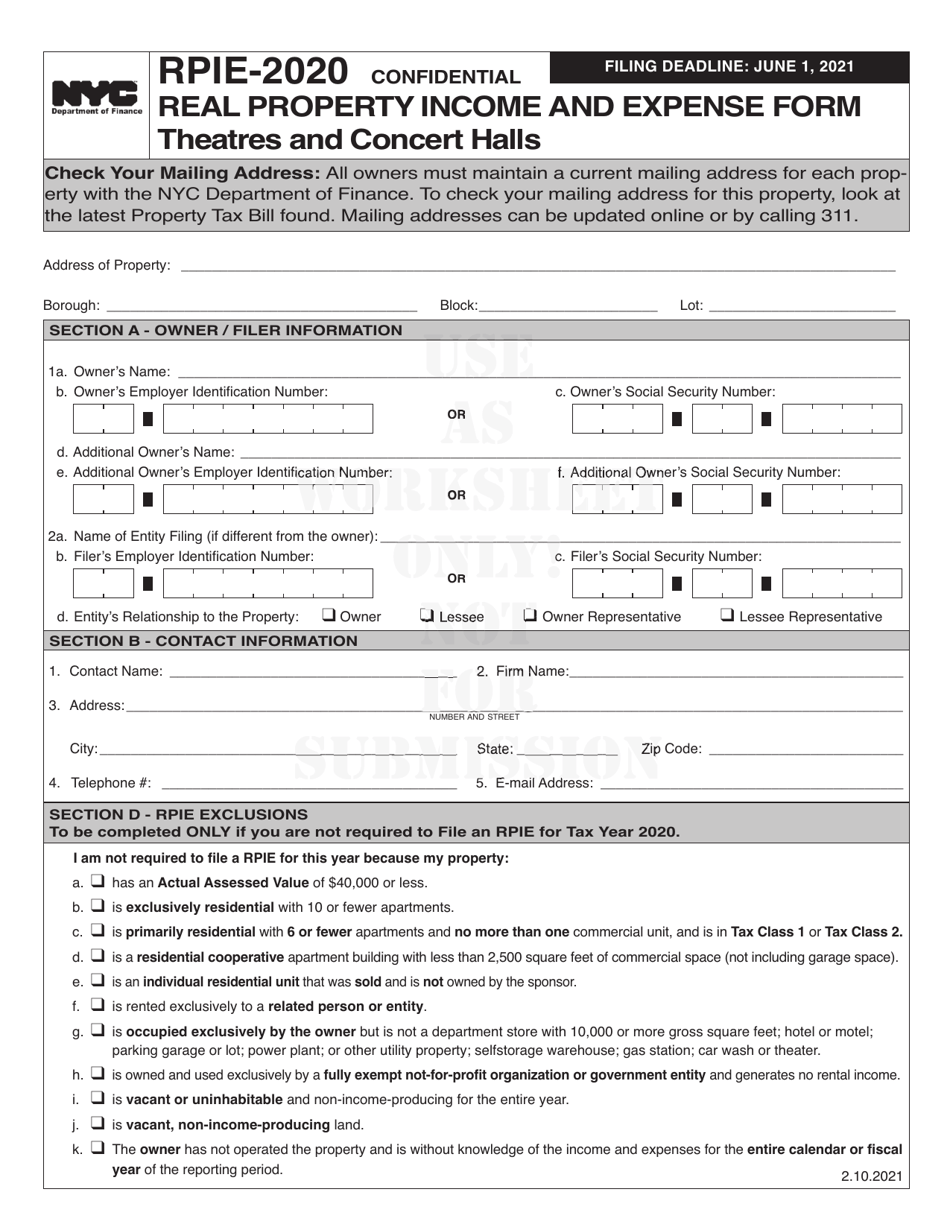

This document was released by New York City Department of Finance and contains the most recent official instructions for Real Property Income and Expense Form for Theatres and Concert Halls .

FAQ

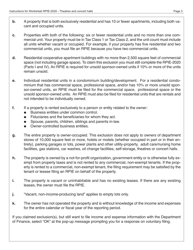

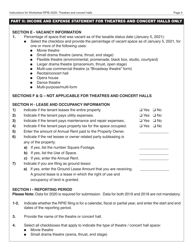

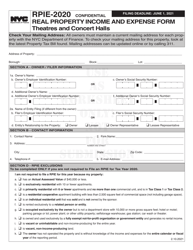

Q: What is the Real Property Income and Expense Form?

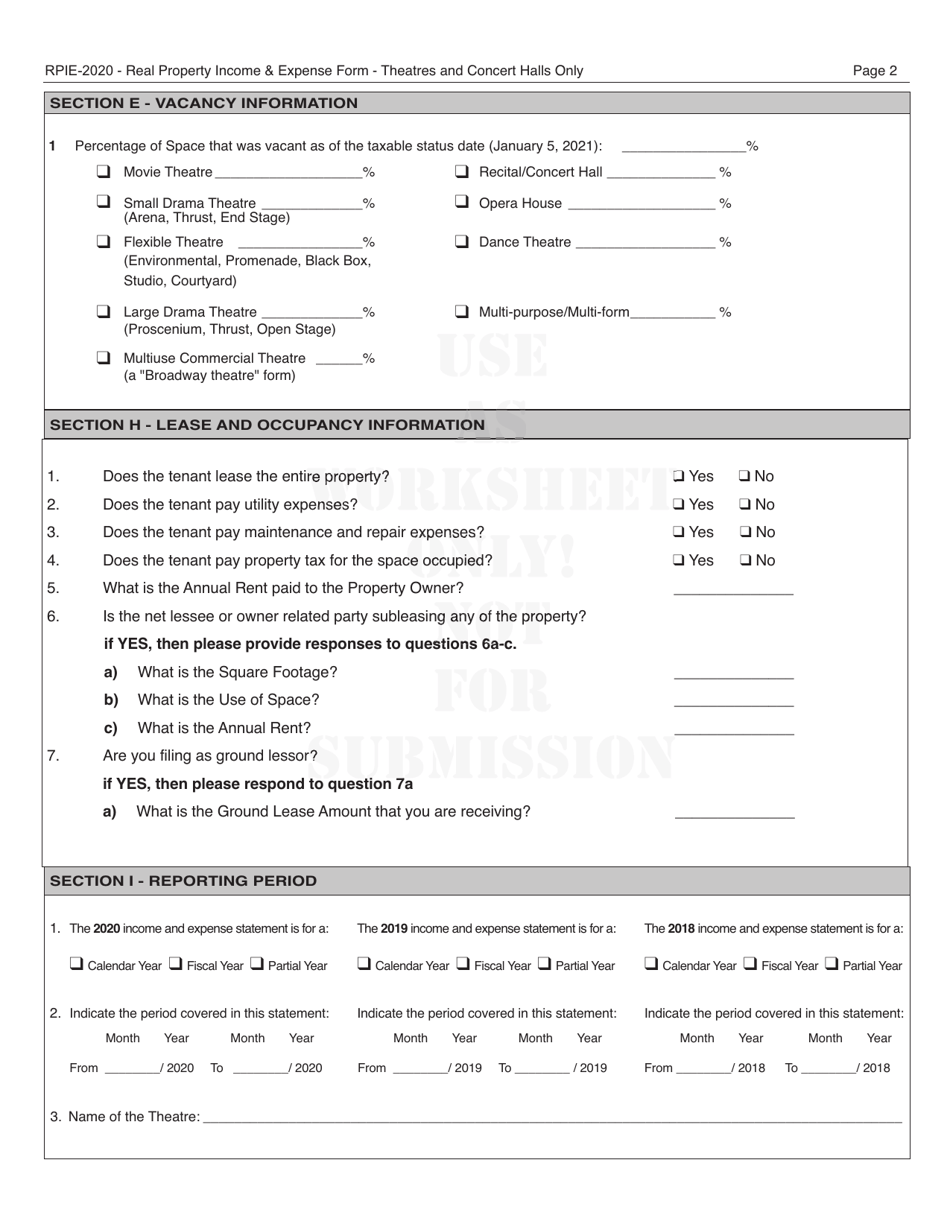

A: The Real Property Income and Expense Form is a form used to report income and expenses for theatres and concert halls in New York City.

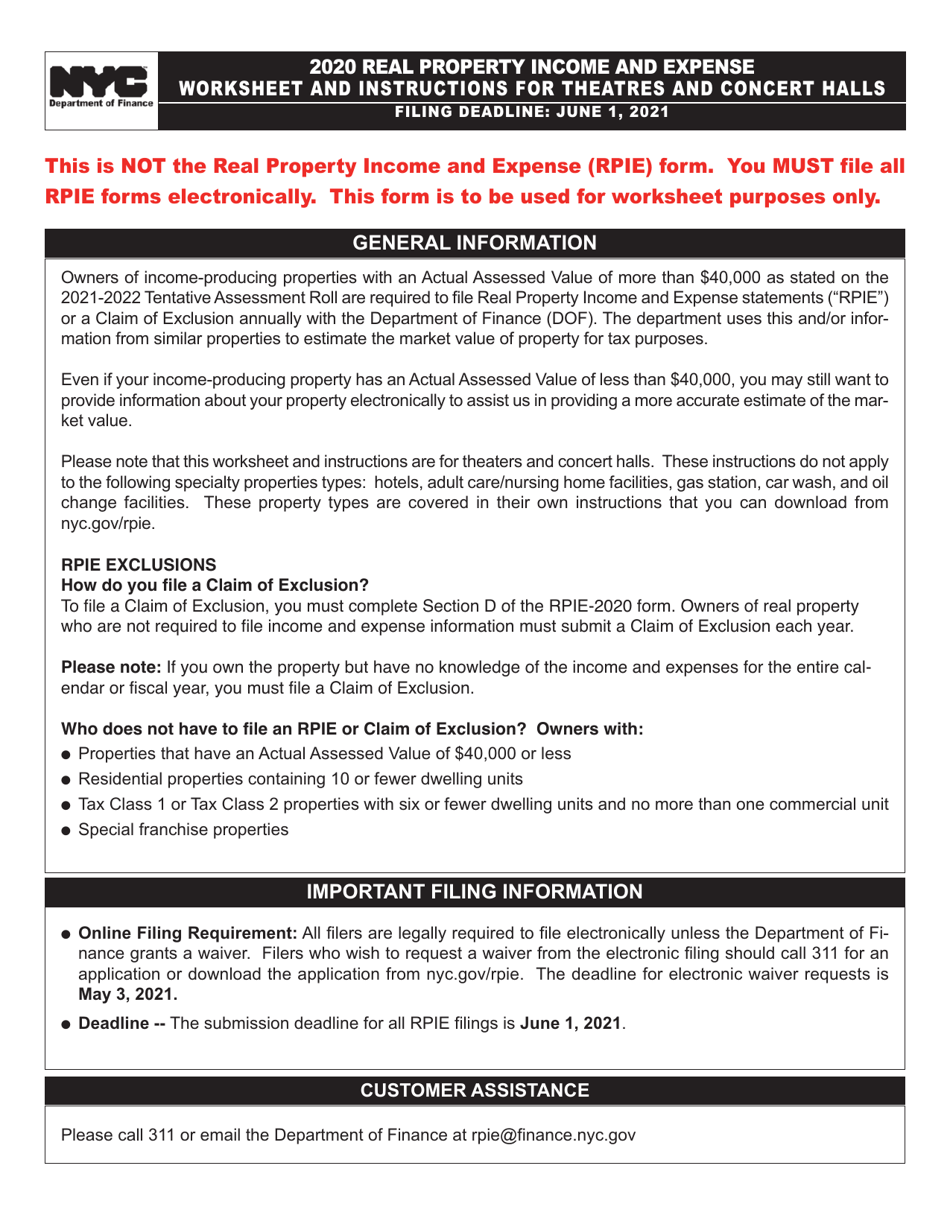

Q: Who is required to file the form?

A: Owners of theatres and concert halls in New York City are required to file the form.

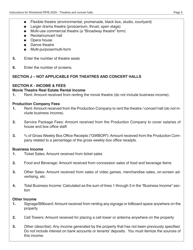

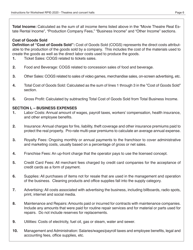

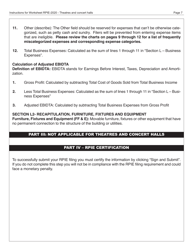

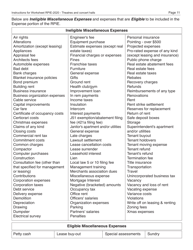

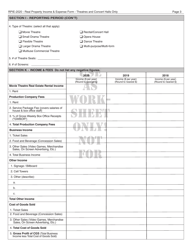

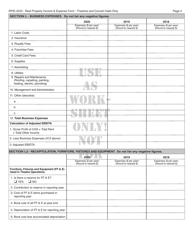

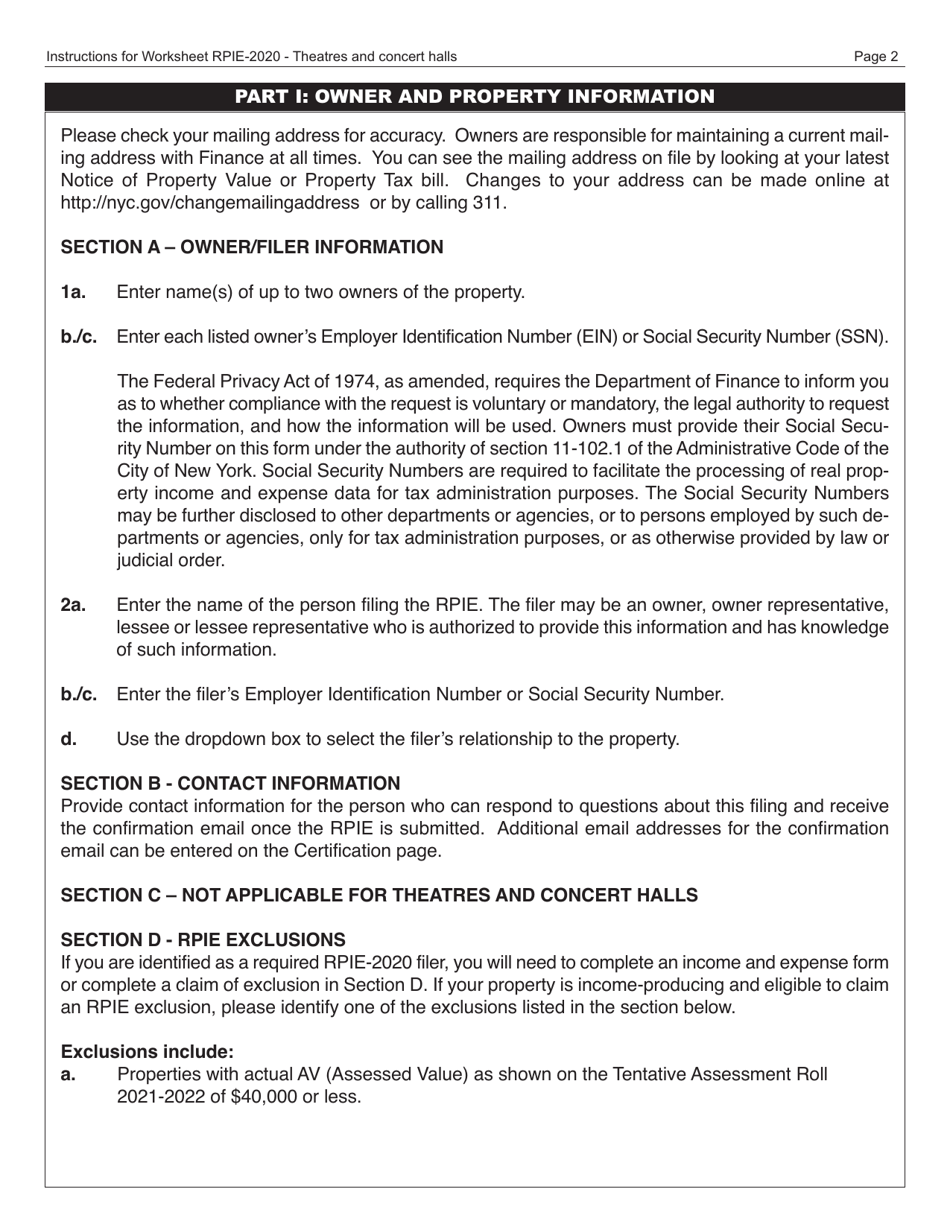

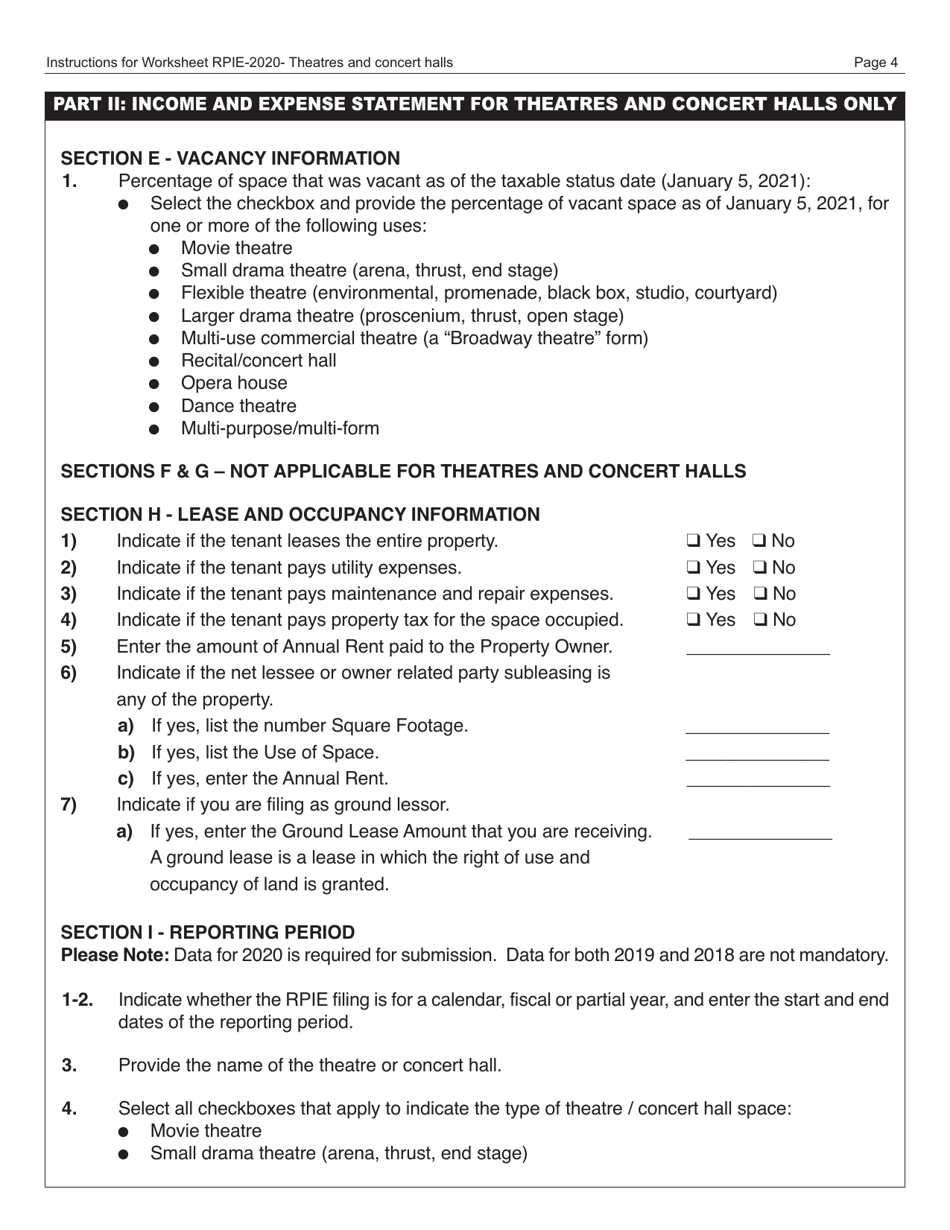

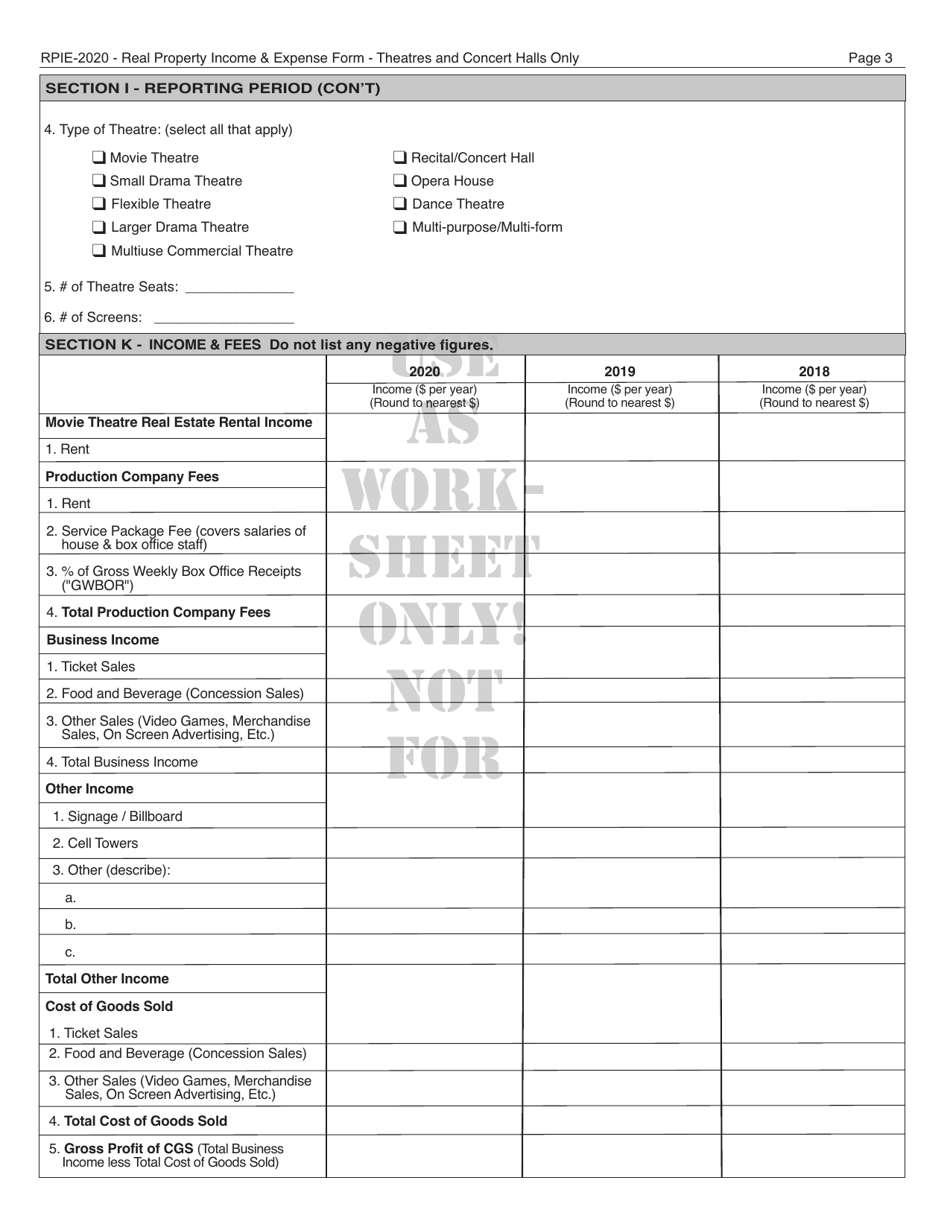

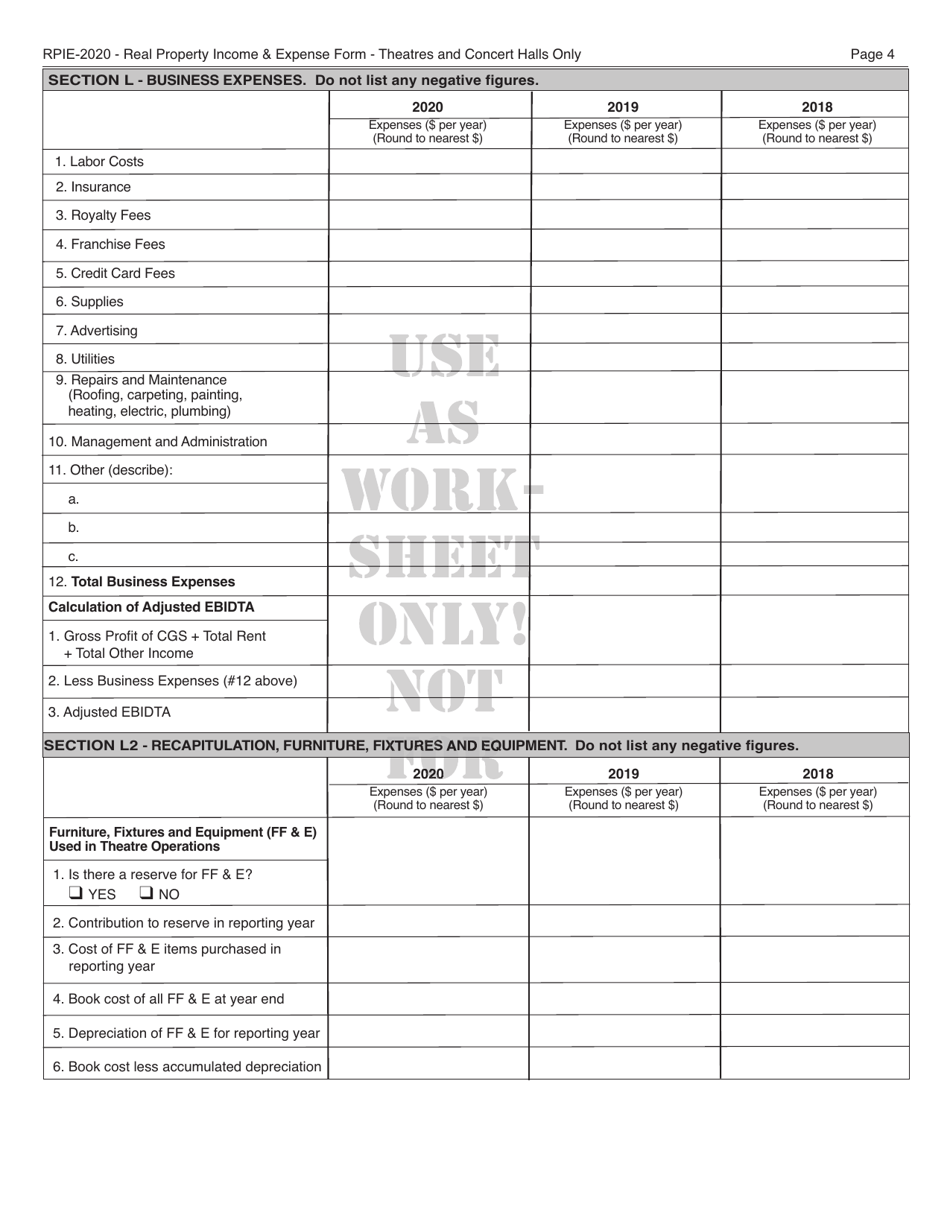

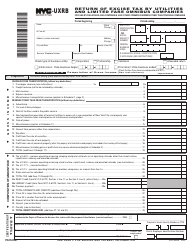

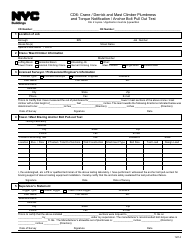

Q: What information is required on the form?

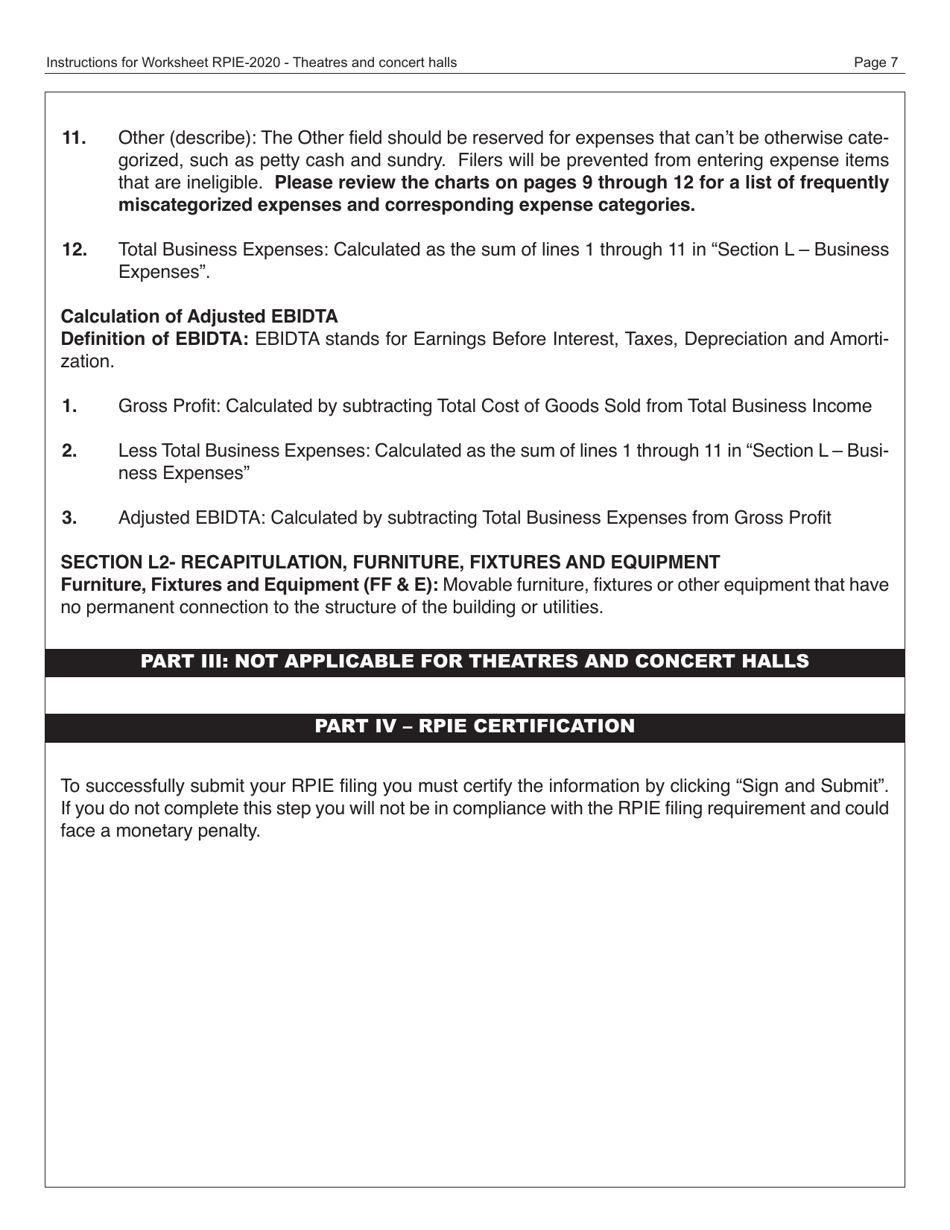

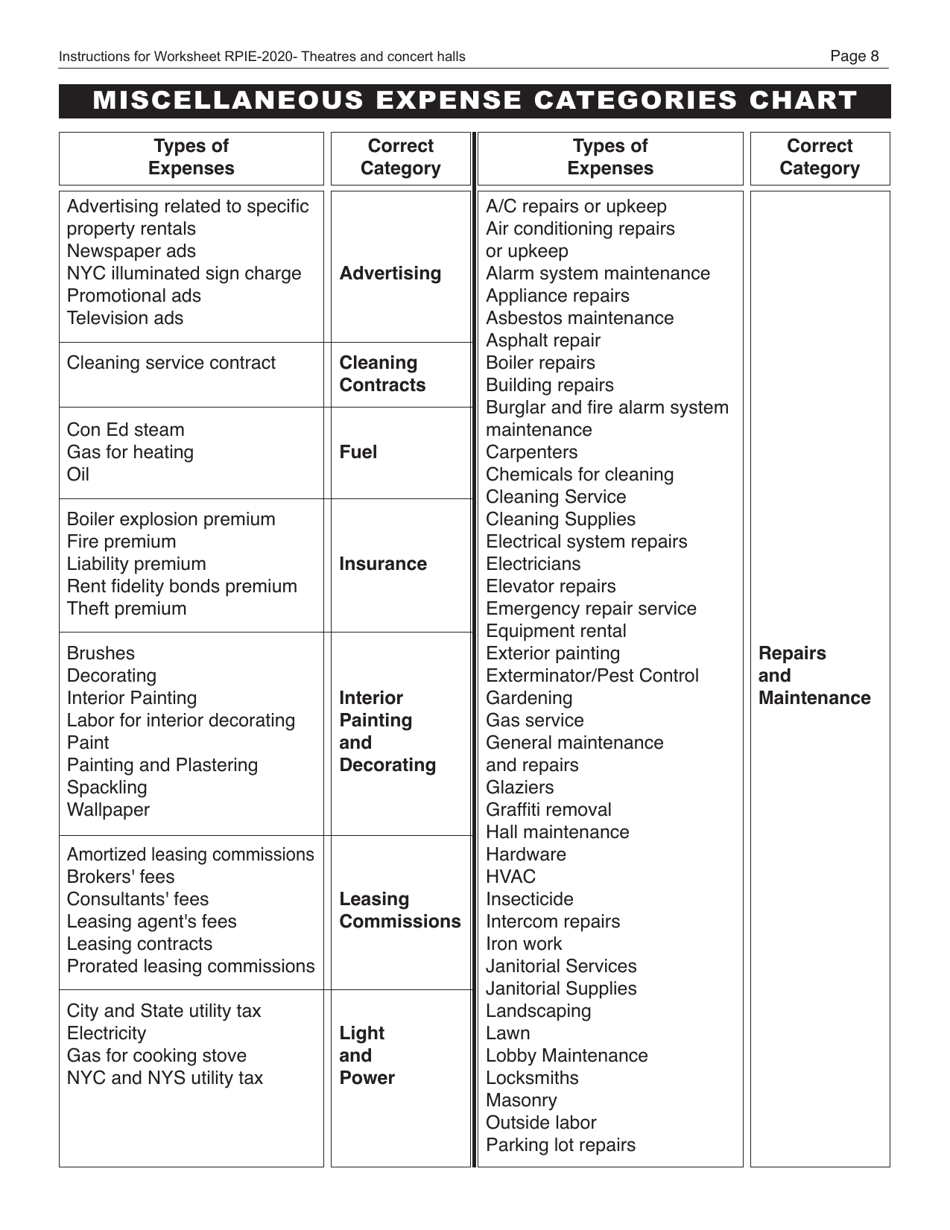

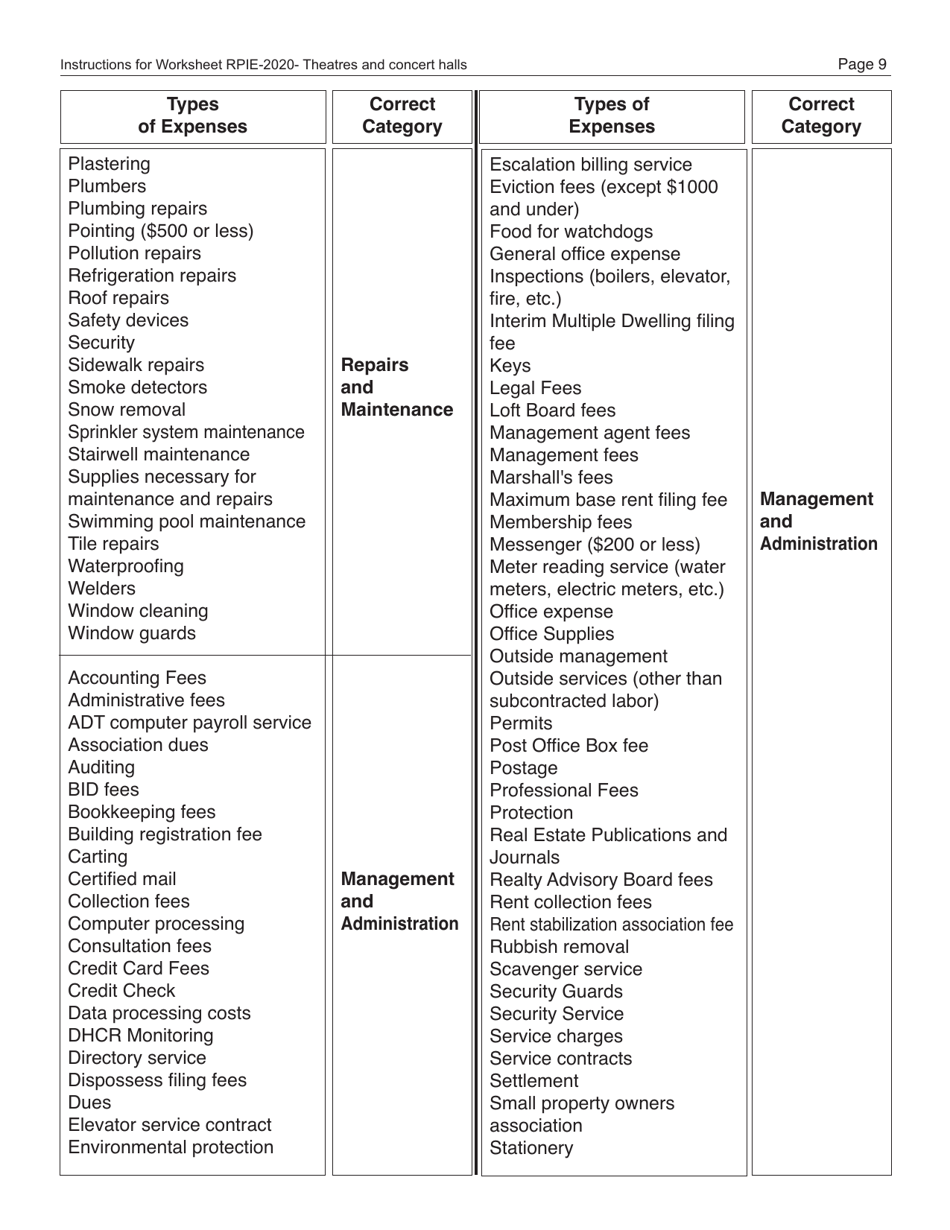

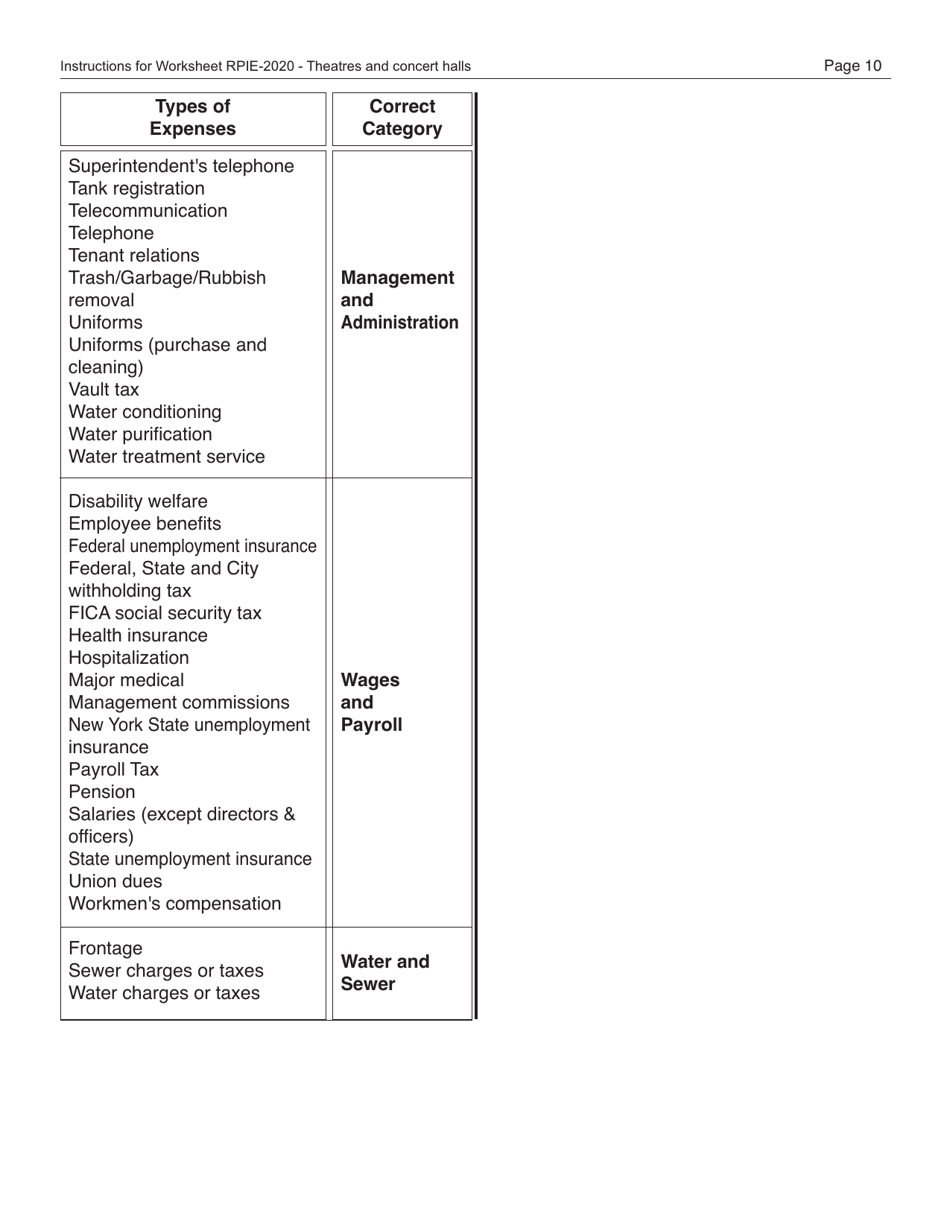

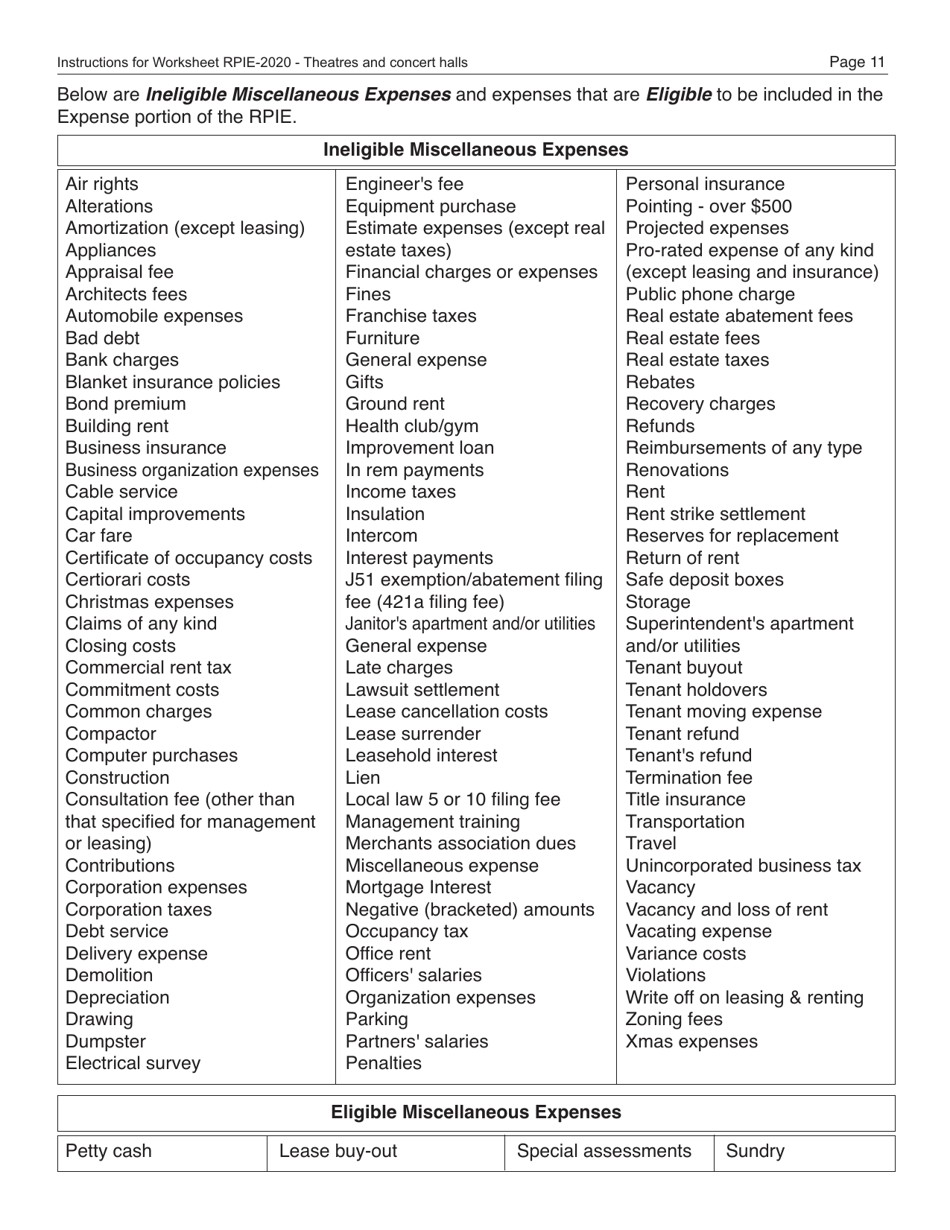

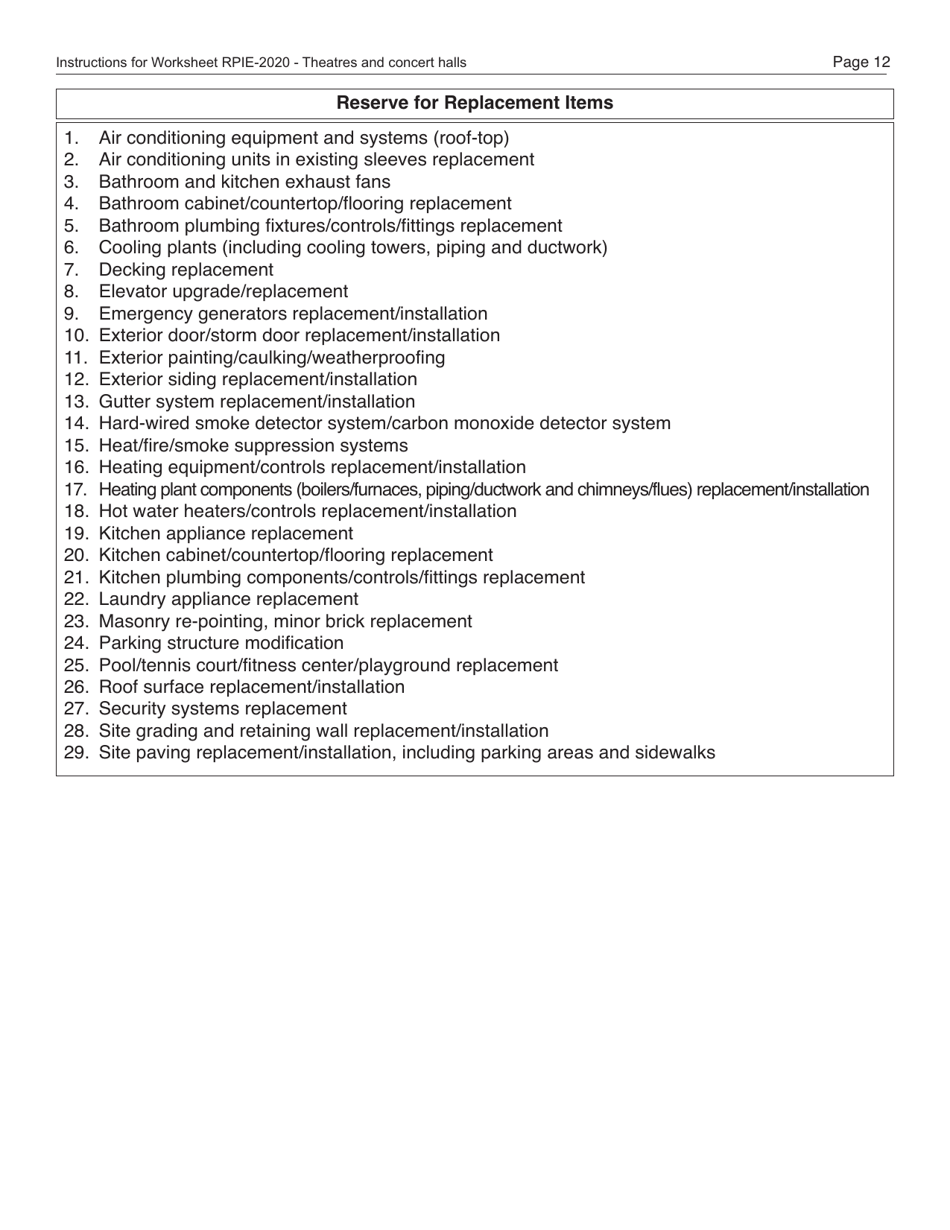

A: The form requires information about the property's income and expenses, including rent, utilities, maintenance costs, and property taxes.

Q: When is the form due?

A: The form is typically due by March 15th each year.

Q: Are there any penalties for not filing the form?

A: Yes, there are penalties for not filing the form, including fines and potential legal action.

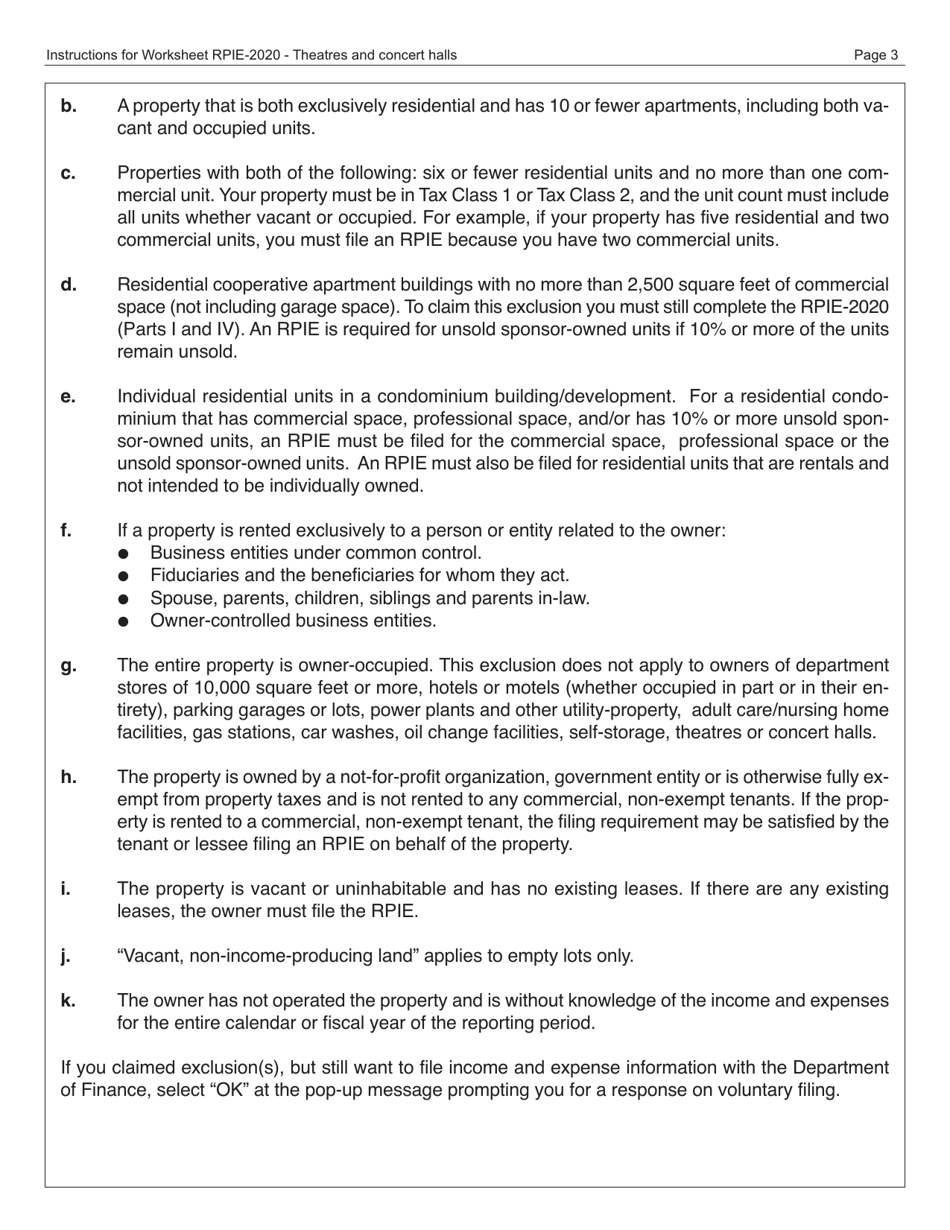

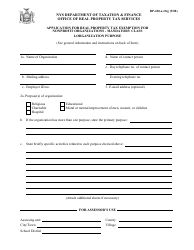

Q: Are there any exemptions to filing the form?

A: There may be exemptions available for certain nonprofit organizations, but it is best to consult the New York City Department of Finance for specific details.

Q: What should I do if I have questions about the form?

A: If you have questions about the form, you can contact the New York City Department of Finance for assistance.

Instruction Details:

- This 17-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the New York City Department of Finance.