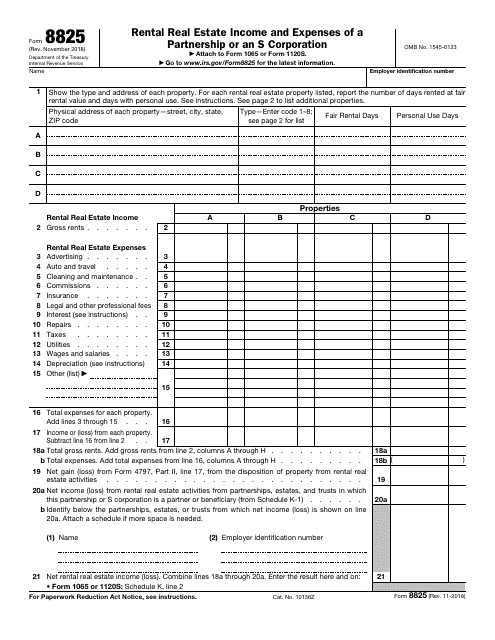

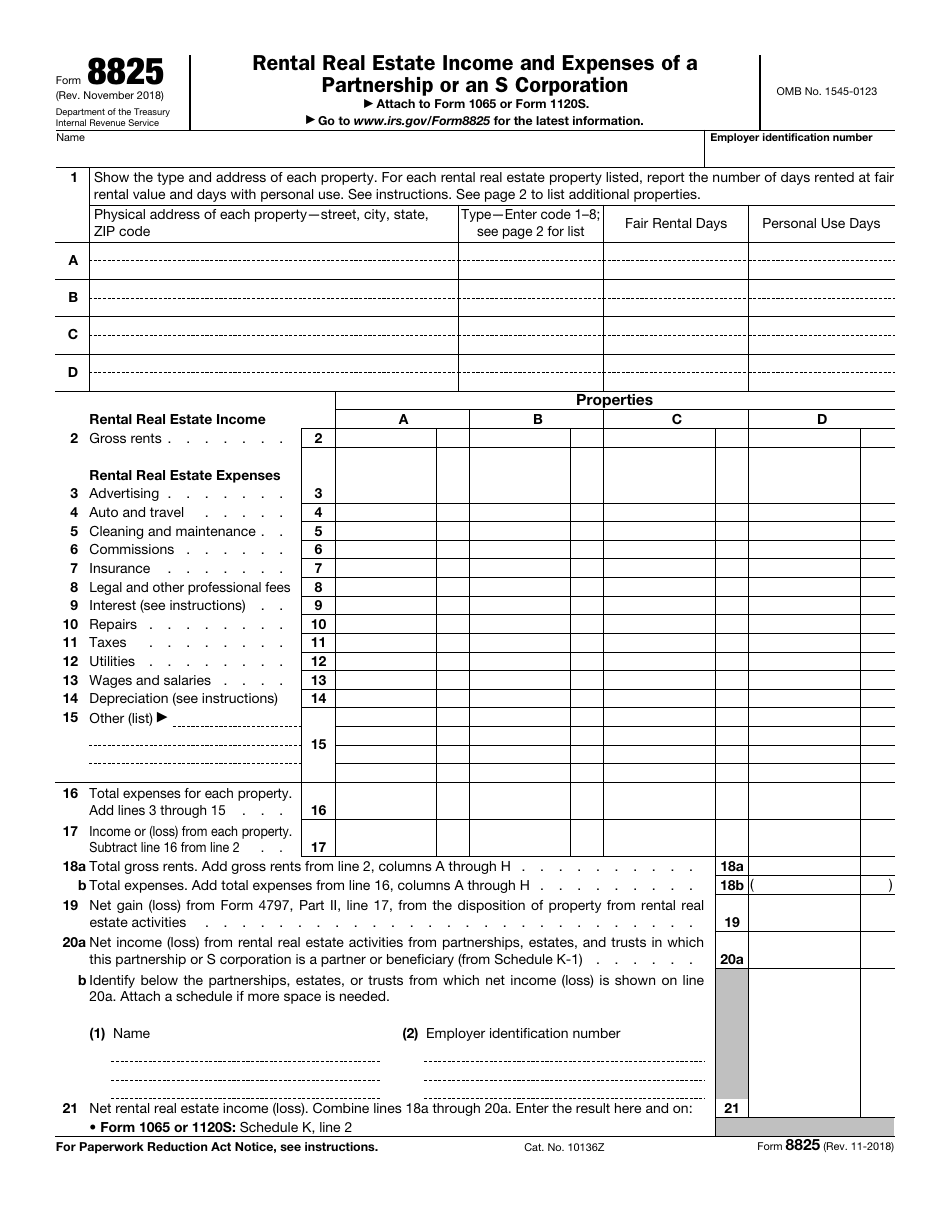

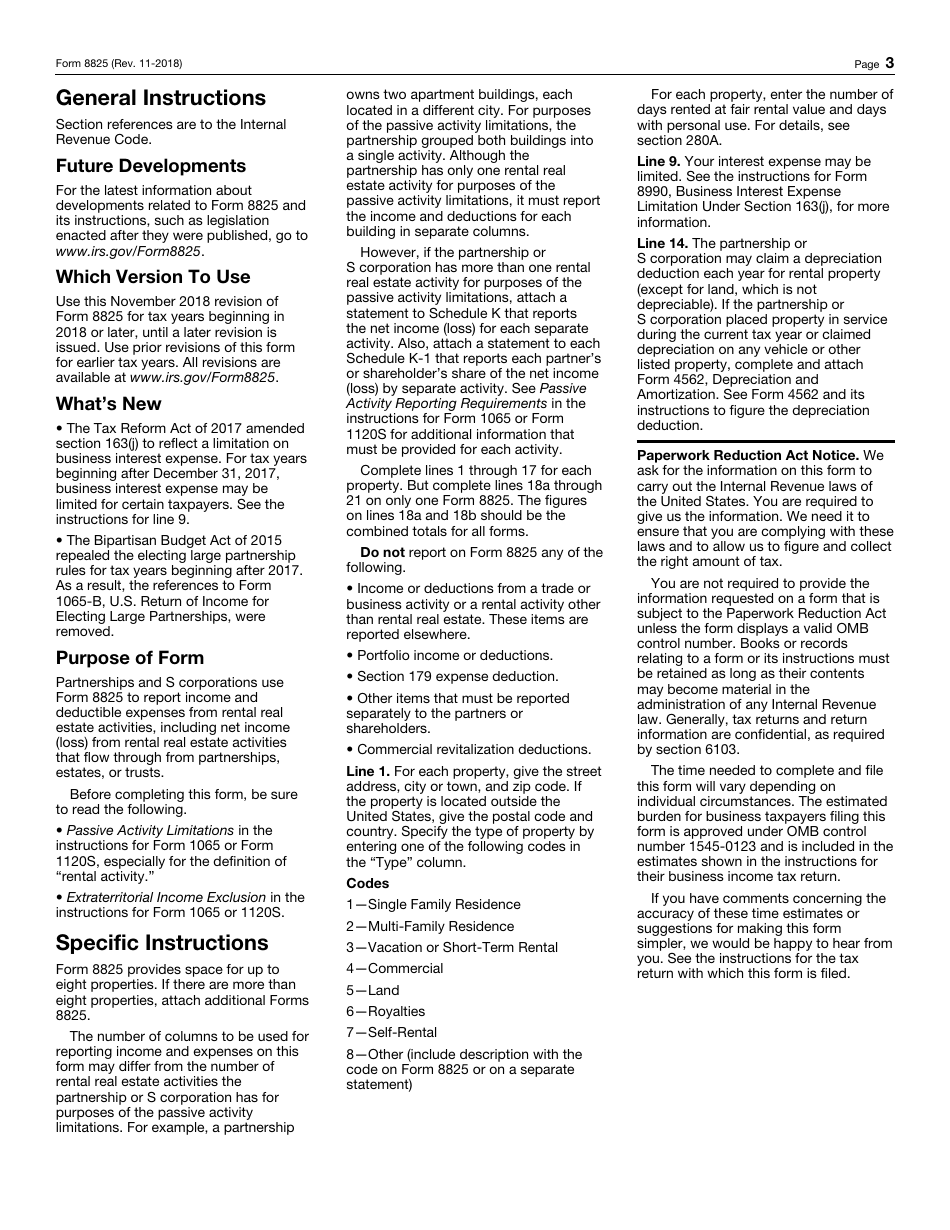

IRS Form 8825 Rental Real Estate Income and Expenses of a Partnership or an S Corporation

What Is IRS Form 8825?

IRS Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation , is a tax statement prepared by S corporations and partnerships to calculate and notify the fiscal authorities about the income they have earned by renting out real estate as well as deductible expenses related to those activities such as maintenance, repairs, advertising, and legal fees.

Alternate Name:

- Tax Form 8825.

This report was released by the Internal Revenue Service (IRS) on November 1, 2018 - all older editions of the instrument are now obsolete. An IRS Form 8825 fillable version is available for download through the link below.

Form 8825 Instructions

Follow these Form 8825 instructions to inform tax authorities about rental income on behalf of your partnership or S corporation:

-

State the name of your entity and add its employer identification number . List the properties you have rented out during the tax period covered in the form - identify them by their addresses, record the code that applies to the property - from family residences to self-rentals, and specify for how many days the real estate in question was rented out and for how long you used it personally.

-

Write down the gross income you managed to generate through renting out every property - make sure you enter the numbers separately for every real estate. Elaborate on the expenses you have dealt with for every property - note that the list is not exhaustive, and you may disclose the expenses that were not mentioned in the form as long as you are able to explain how they relate to the real estate you are describing.

-

Calculate the total expenses incurred by each property. Compute the income (or loss if applicable) from every real estate you have rented out - subtract the expenses from the income. Figure out the total gross rents, net gain or loss the disposition of property led to, and the total amount of income you have earned. Note that it is necessary to include the income or loss from rental activities of entities for whom you act as a beneficiary or partner - identify those estates, trusts, and partnerships as well.

-

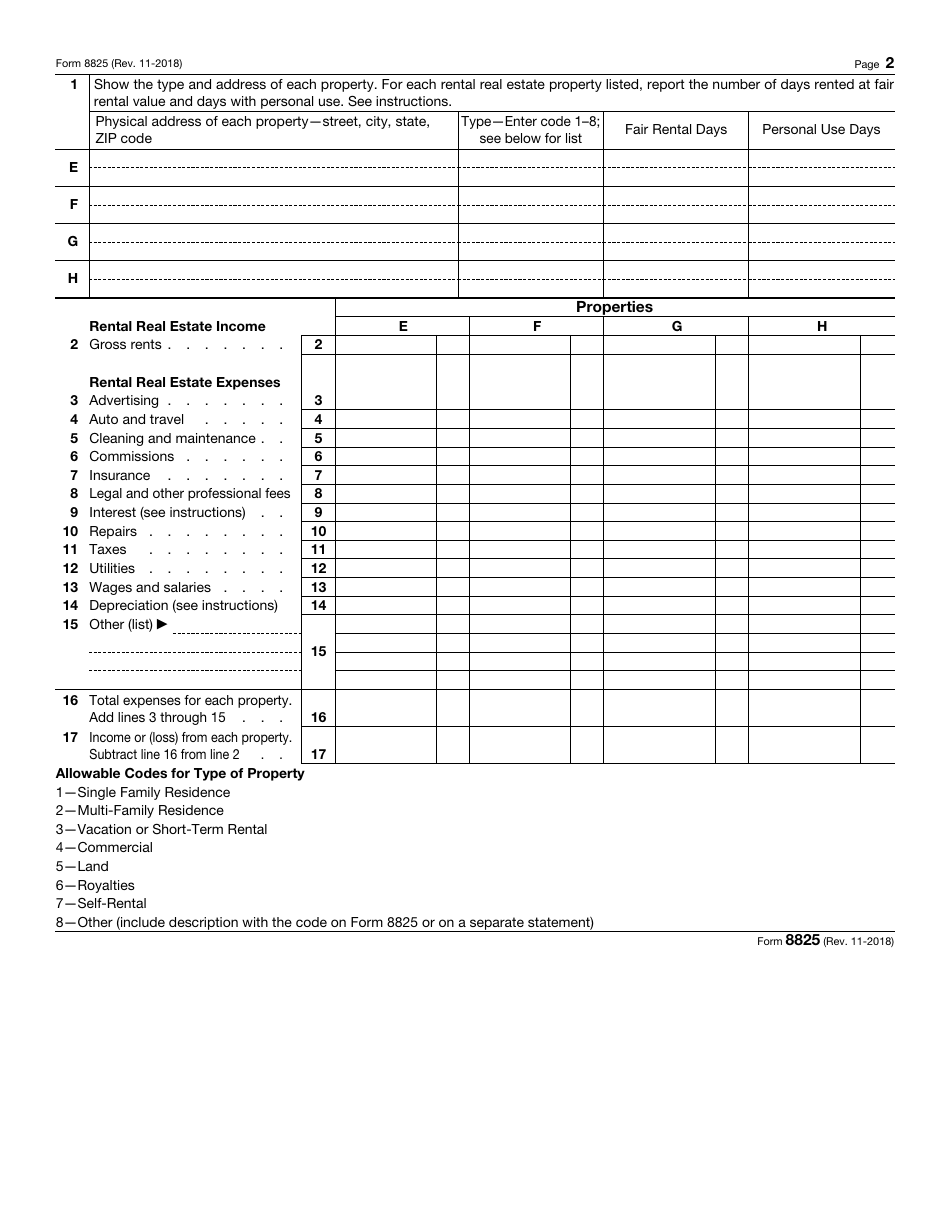

Use the second page of Form 8825 to inform the IRS about additional properties you had no space for previously ; in case you rented out more than eight properties, use an extra form and enclose all the documents together. Ensure you consider them in your calculations - only fill out the total expenses and income fields on one of the forms. Once the report is ready, attach it to the IRS Form 1065, U.S. Return of Partnership Income, or IRS Form 1120-S, Income Tax Return for an S Corporation - depending on the type of business entity you represent - and send the paperwork to the IRS. Remember that you do not need to complete this report if you are a single-member LLC or a sole proprietor.