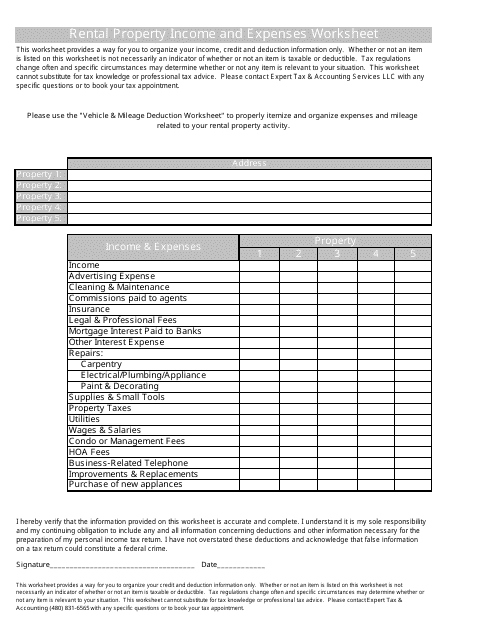

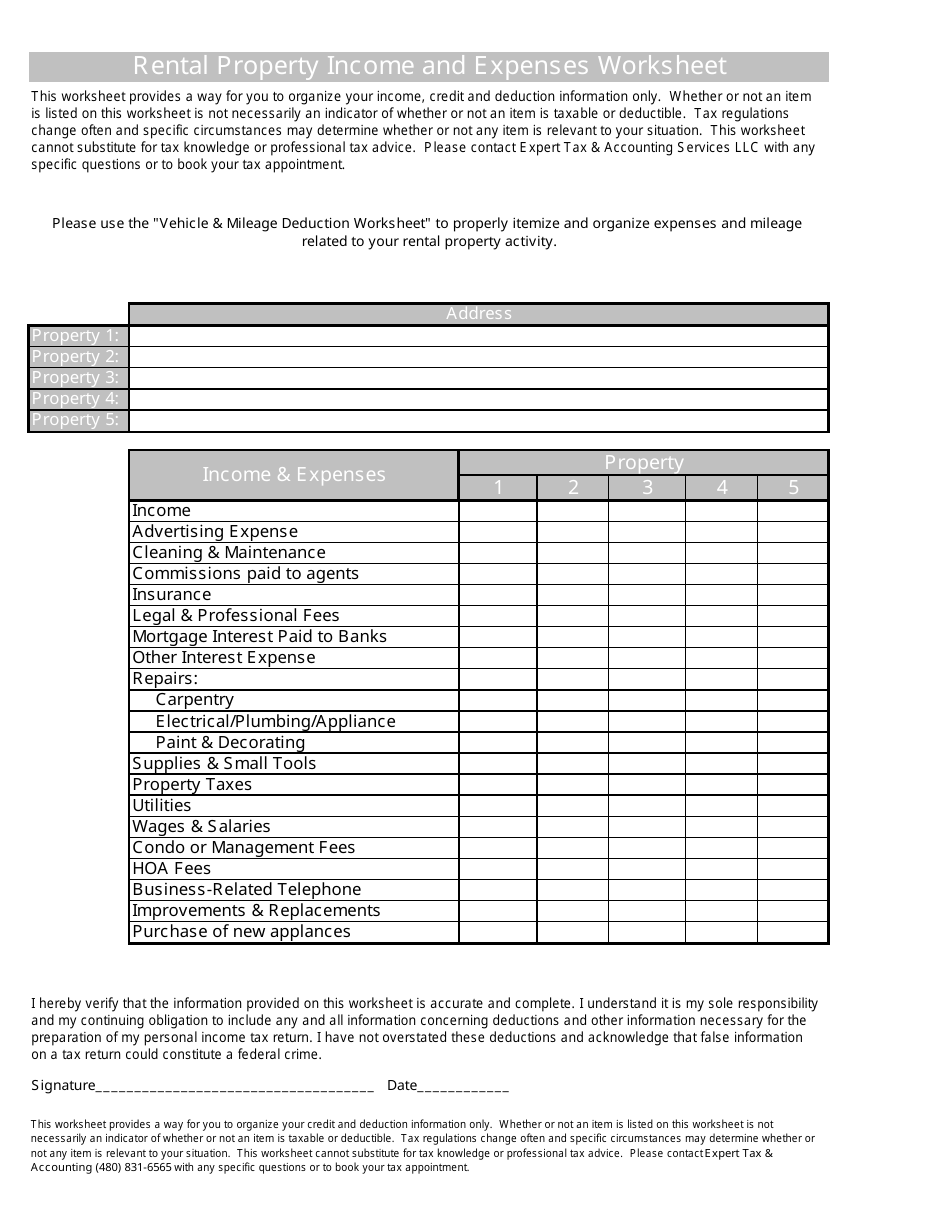

Rental Property Income and Expenses Worksheet - Expert Tax & Accounting Services Llc

The Rental Property Income and Expenses Worksheet is a tool used by Expert Tax & Accounting Services LLC to help individuals and businesses track their rental property income and expenses for tax purposes. It allows users to keep a record of rental income, as well as any expenses incurred related to the rental property, such as maintenance, repairs, and utilities.

FAQ

Q: What is the purpose of a rental property income and expenses worksheet?

A: The purpose of a rental property income and expenses worksheet is to track and organize the income and expenses associated with owning and renting out a property.

Q: Why is it important to keep track of rental property income and expenses?

A: Keeping track of rental property income and expenses is important for accurate tax reporting, managing cash flow, and analyzing the overall profitability of the investment property.

Q: What types of income should be included on a rental property income and expenses worksheet?

A: Types of income that should be included on a rental property income and expenses worksheet include rental income, late fees, and any other money received from the property such as reimbursements for repairs or utility payments.

Q: What types of expenses should be included on a rental property income and expenses worksheet?

A: Types of expenses that should be included on a rental property income and expenses worksheet include mortgage payments, property taxes, insurance premiums, utilities, repairs and maintenance costs, property management fees, advertising expenses, and any other costs directly related to the rental property.

Q: Can I deduct rental property expenses on my tax return?

A: Yes, you can deduct rental property expenses on your tax return. However, there are specific rules and limitations depending on your individual circumstances. It's recommended to consult a tax professional for guidance.

Q: How can a rental property income and expenses worksheet help with tax reporting?

A: A rental property income and expenses worksheet can help with tax reporting by providing a clear breakdown of all income and expenses related to the rental property. This information can be used to complete the necessary tax forms, such as Schedule E, and ensure accurate reporting of rental income and deductions.