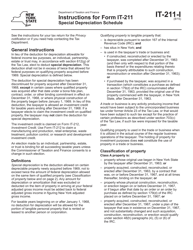

This version of the form is not currently in use and is provided for reference only. Download this version of

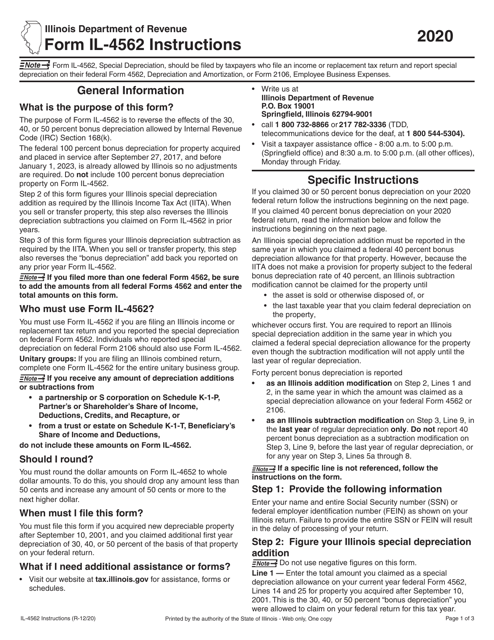

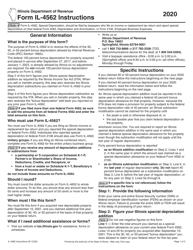

Instructions for Form IL-4562

for the current year.

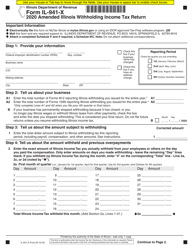

Instructions for Form IL-4562 Special Depreciation - Illinois

This document contains official instructions for Form IL-4562 , Special Depreciation - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form IL-4562 is available for download through this link.

FAQ

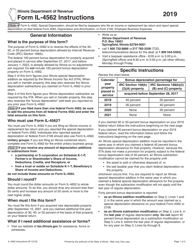

Q: What is Form IL-4562?

A: Form IL-4562 is a tax form used by taxpayers in Illinois to claim special depreciation deductions.

Q: Who can use Form IL-4562?

A: Taxpayers who have made qualifying investments in certain properties in Illinois may use Form IL-4562.

Q: What is special depreciation?

A: Special depreciation is a tax deduction that allows taxpayers to recover the cost of certain qualified property more quickly.

Q: What properties qualify for special depreciation?

A: Properties such as machinery, equipment, and certain building improvements may qualify for special depreciation.

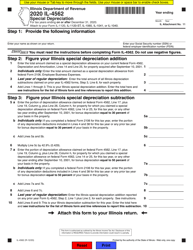

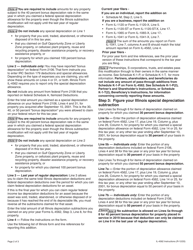

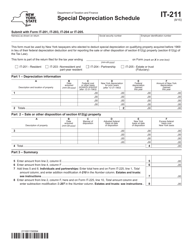

Q: How do I fill out Form IL-4562?

A: You should consult the instructions provided with the form for detailed guidance on how to fill it out.

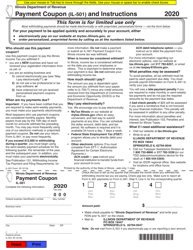

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.