This version of the form is not currently in use and is provided for reference only. Download this version of

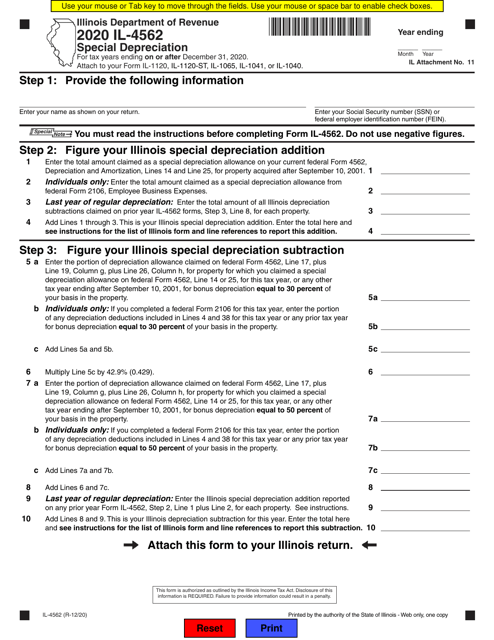

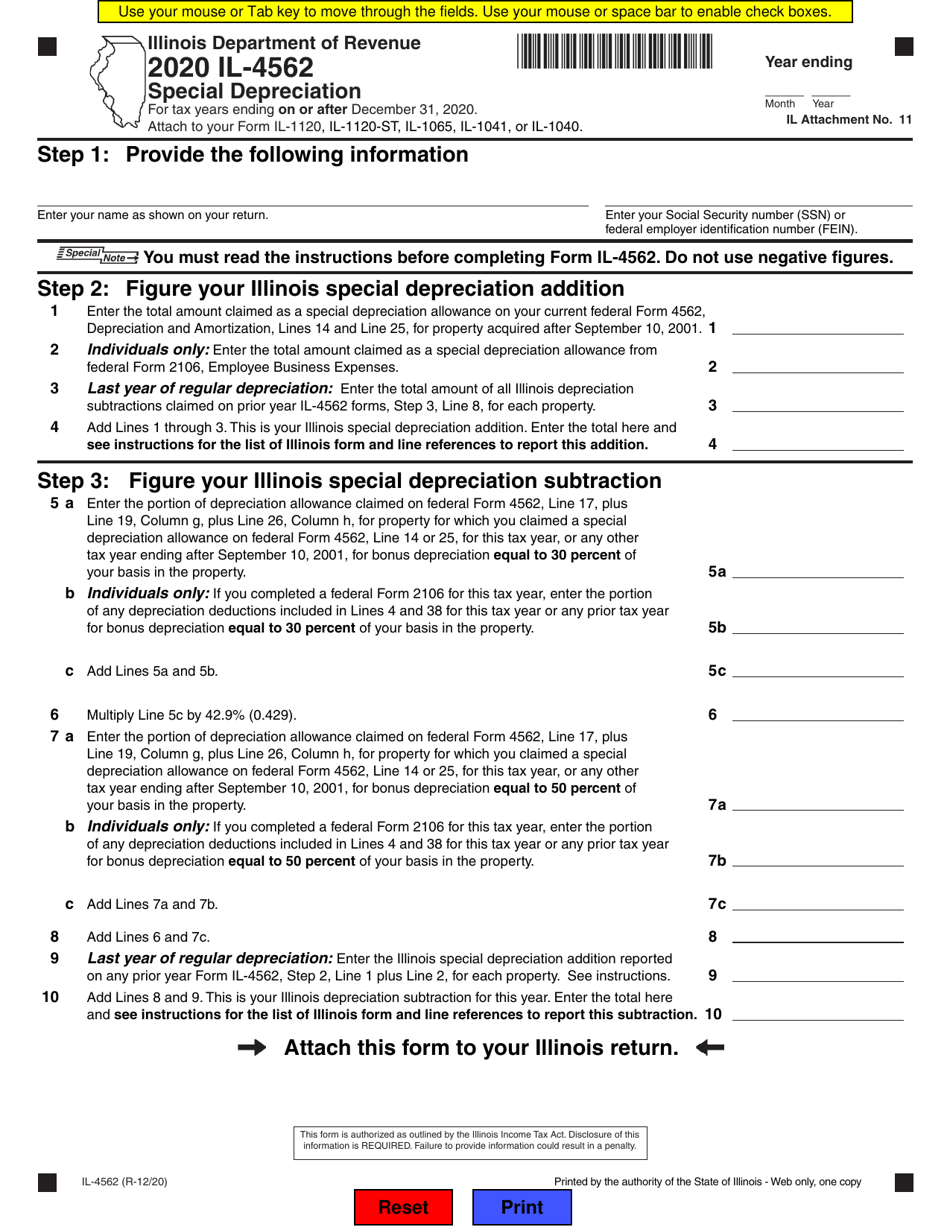

Form IL-4562

for the current year.

Form IL-4562 Special Depreciation - Illinois

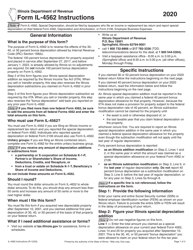

What Is Form IL-4562?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-4562?

A: Form IL-4562 is a tax form used in Illinois to report special depreciation deductions.

Q: What is special depreciation?

A: Special depreciation allows businesses to deduct a larger portion of the cost of certain assets in the year they are acquired.

Q: What assets are eligible for special depreciation?

A: Assets such as new tangible personal property, certain leased property, and qualified improvement property may be eligible for special depreciation.

Q: Why is special depreciation beneficial?

A: Special depreciation can help businesses reduce their taxable income and lower their tax liability.

Q: Do I need to file Form IL-4562 if I am not claiming special depreciation?

A: If you are not claiming any special depreciation deductions, you may not need to file Form IL-4562.

Q: When is Form IL-4562 due?

A: Form IL-4562 is due on or before the same due date as your Illinois income tax return.

Q: Can I e-file Form IL-4562?

A: Yes, you can e-file Form IL-4562 if you are filing your Illinois income tax return electronically.

Q: What if I make a mistake on Form IL-4562?

A: If you make a mistake on Form IL-4562, you may need to file an amended return to correct it.

Q: Who should I contact if I have questions about Form IL-4562?

A: If you have questions about Form IL-4562, you should contact the Illinois Department of Revenue or consult with a tax professional.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-4562 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.